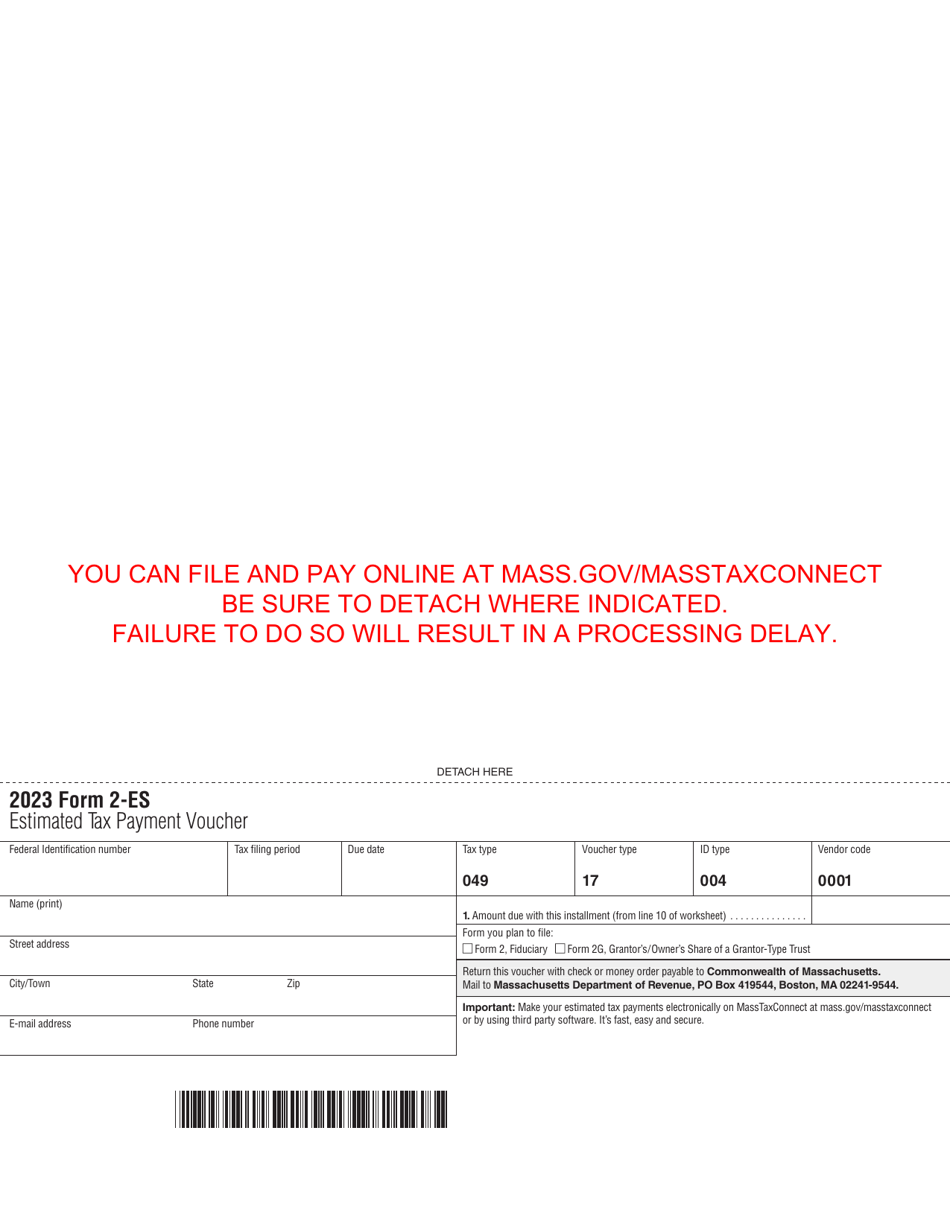

This version of the form is not currently in use and is provided for reference only. Download this version of

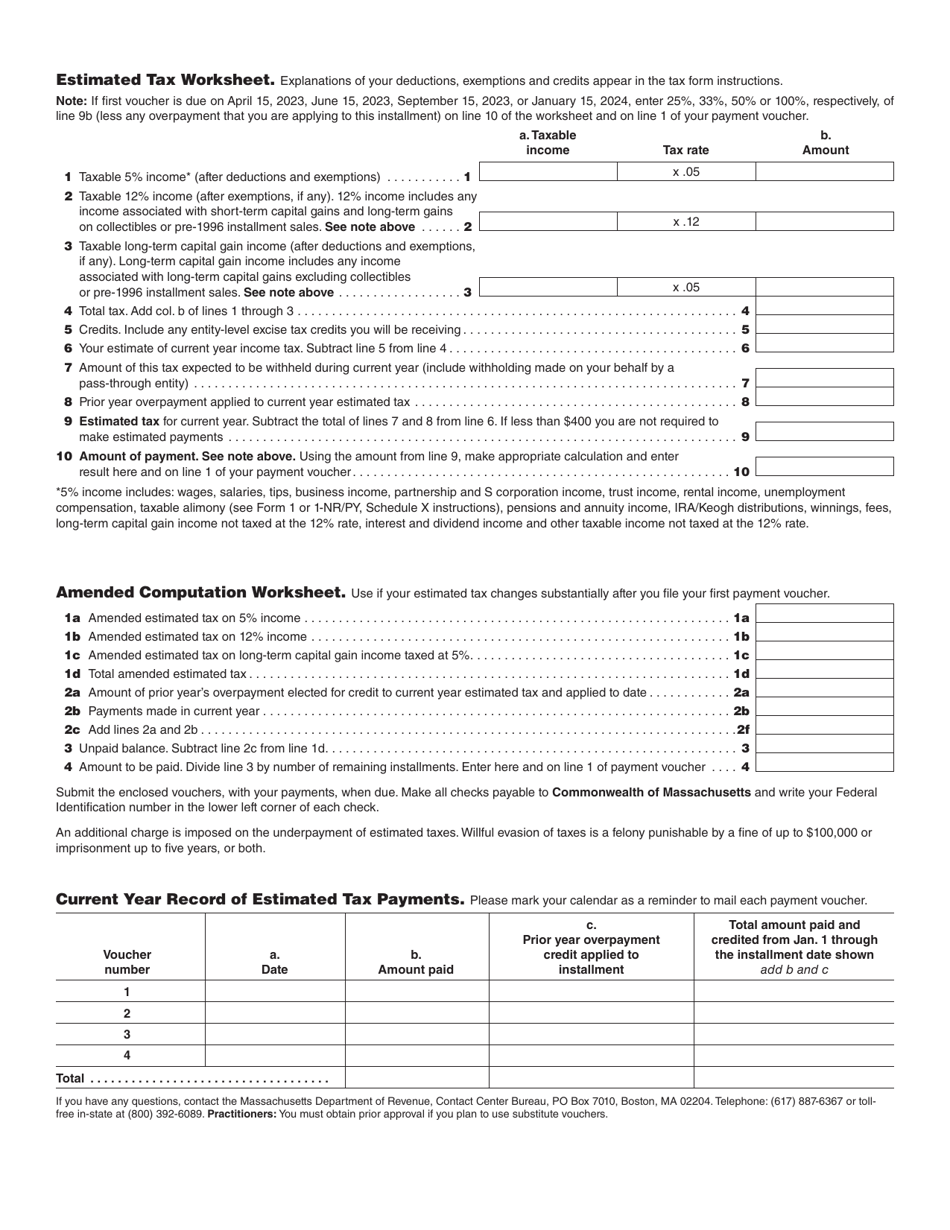

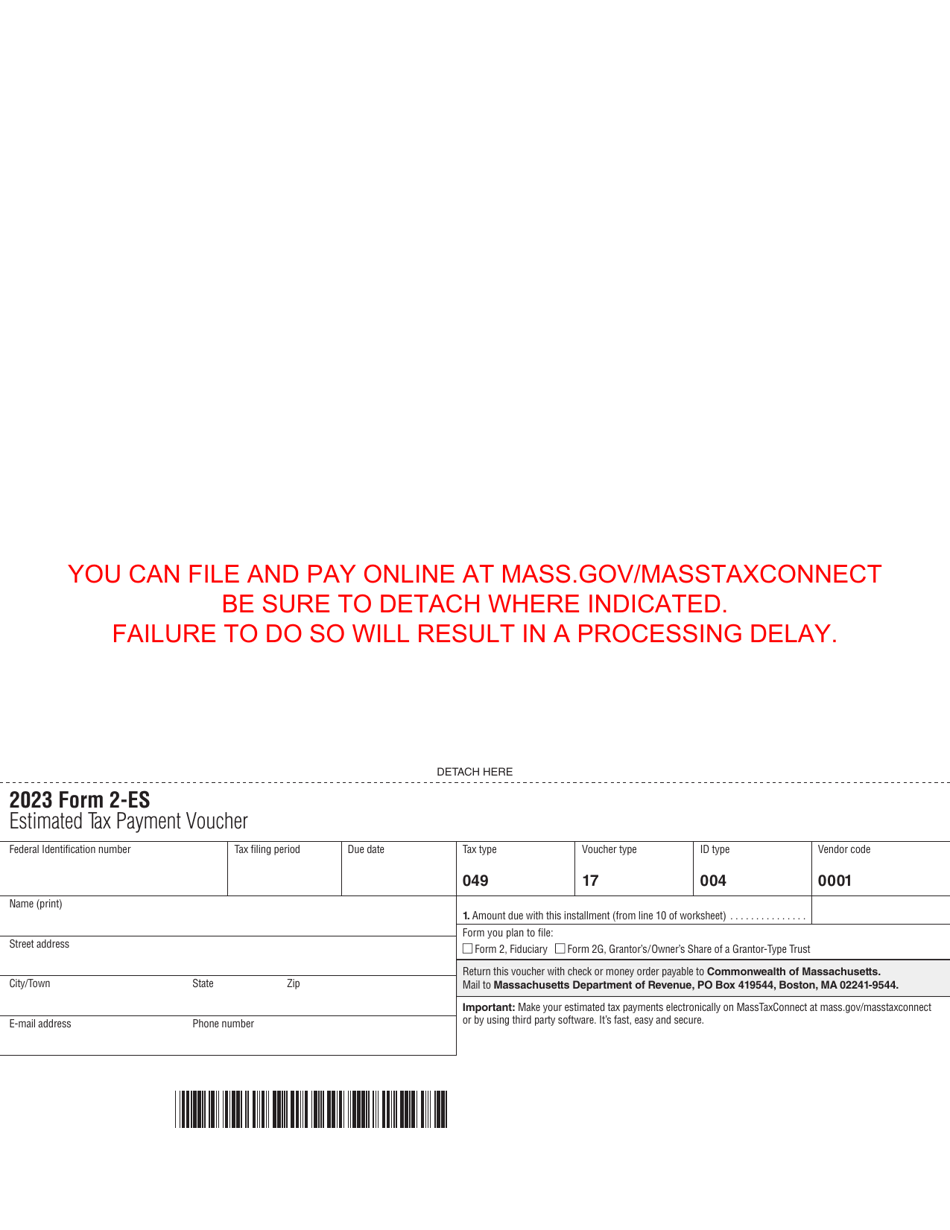

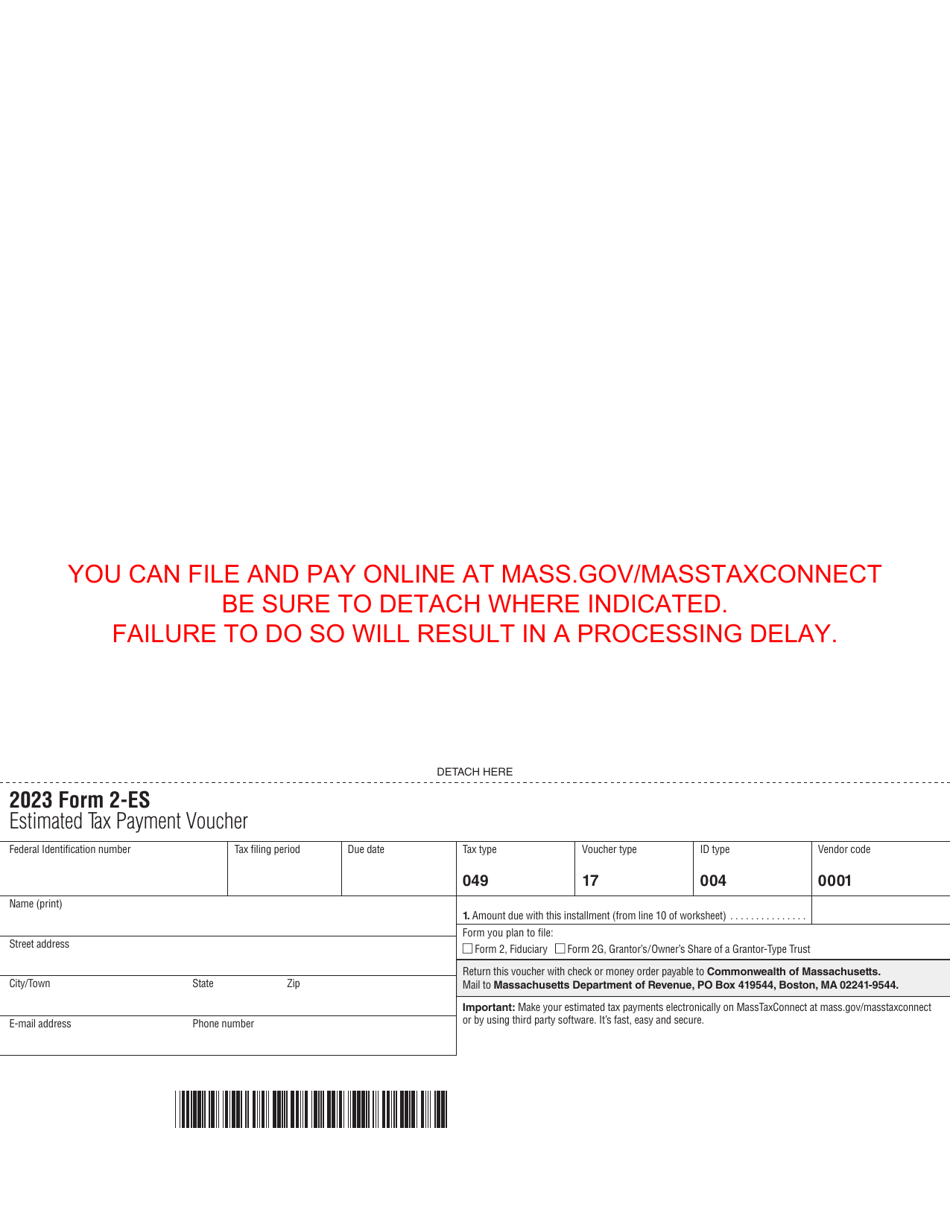

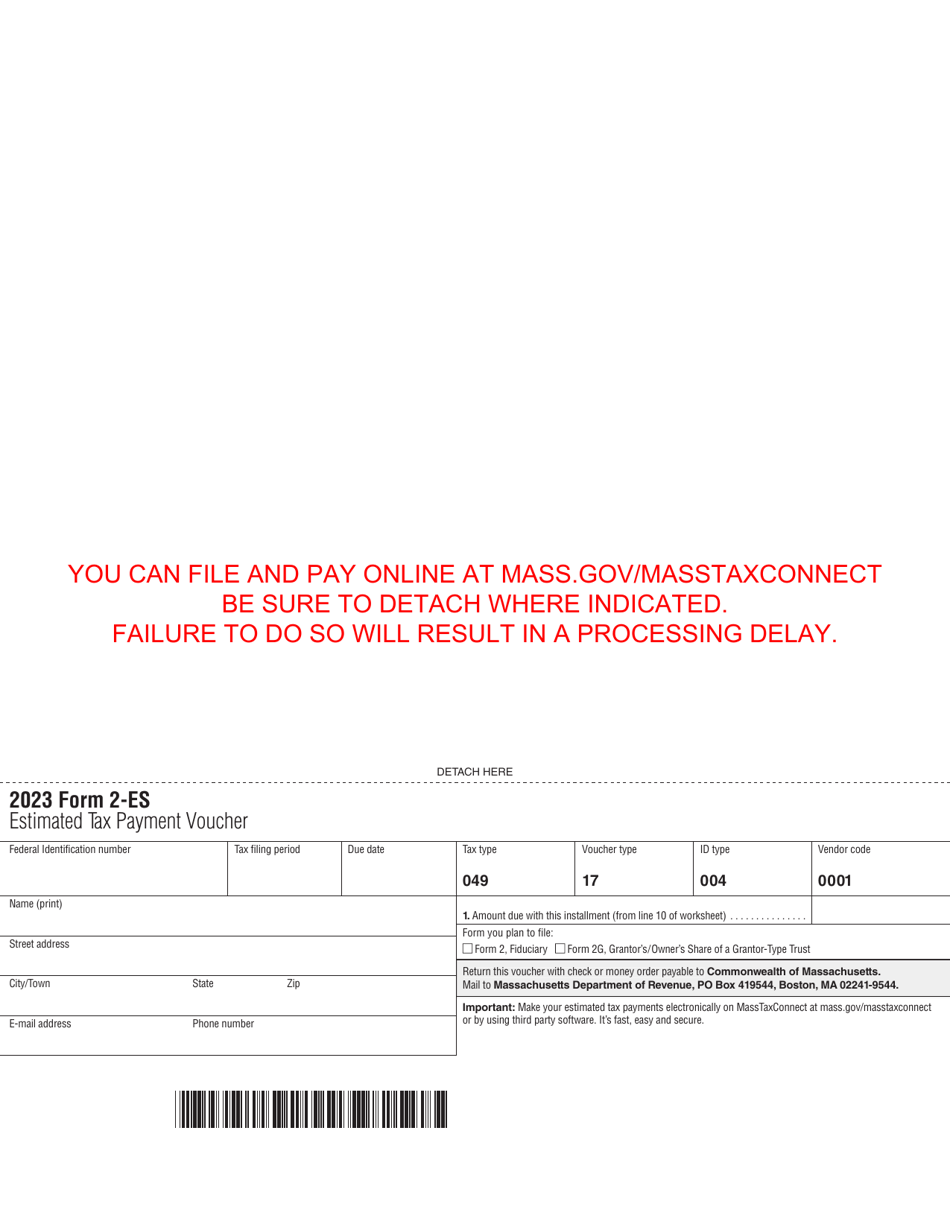

Form 2-ES

for the current year.

Form 2-ES Estimated Tax Payment Voucher - Massachusetts

What Is Form 2-ES?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

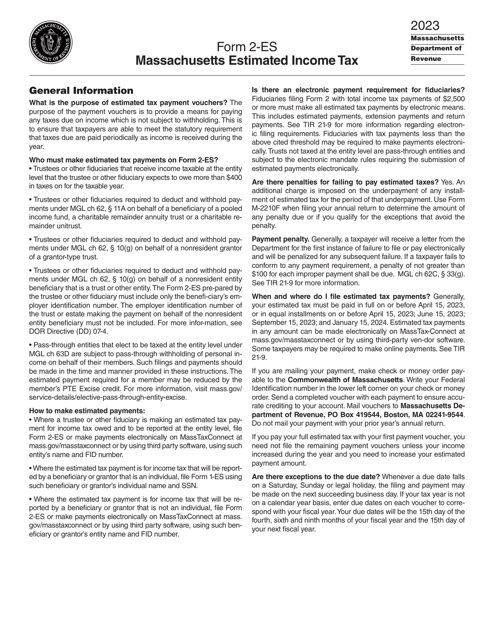

Q: What is the Form 2-ES?

A: Form 2-ES is the Estimated Tax Payment Voucher for Massachusetts.

Q: What is an Estimated Tax Payment Voucher?

A: An Estimated Tax Payment Voucher is a form used to make estimated tax payments to the state.

Q: Who needs to use Form 2-ES?

A: Massachusetts taxpayers who are required to make estimated tax payments need to use Form 2-ES.

Q: When do I need to use Form 2-ES?

A: You need to use Form 2-ES if you expect to owe $400 or more in Massachusetts income tax for the year.

Q: How often do I need to make estimated tax payments?

A: Estimated tax payments are typically made on a quarterly basis, four times a year.

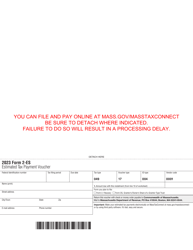

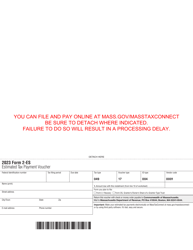

Q: What information do I need to fill out Form 2-ES?

A: You will need your Social Security number, name, address, and estimated tax amount.

Q: What happens if I don't make estimated tax payments?

A: If you are required to make estimated tax payments and fail to do so, you may be subject to penalties and interest.

Q: When is the deadline for filing Form 2-ES?

A: The deadlines for filing Form 2-ES are April 15, June 15, September 15, and January 15 of the following year.

Form Details:

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 2-ES by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.