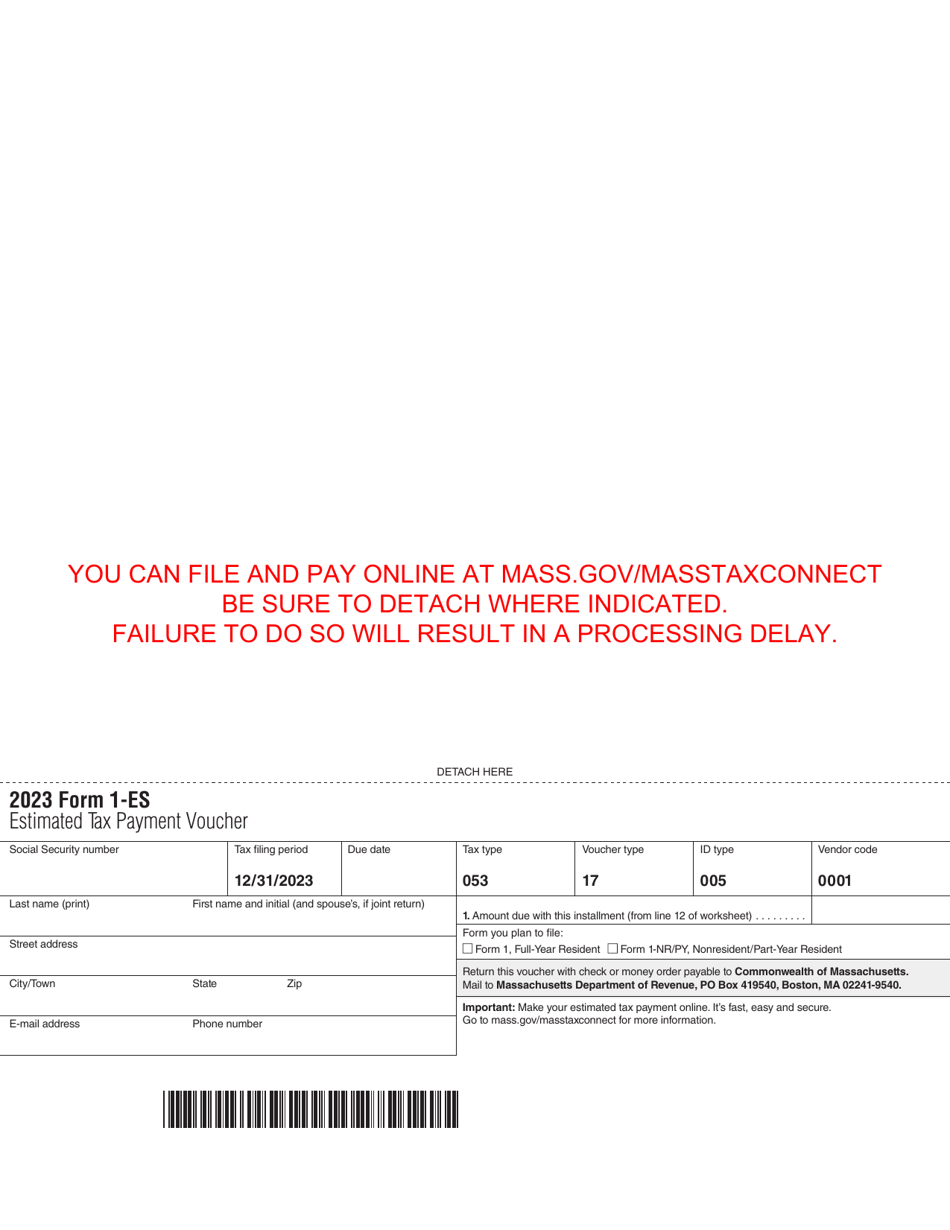

This version of the form is not currently in use and is provided for reference only. Download this version of

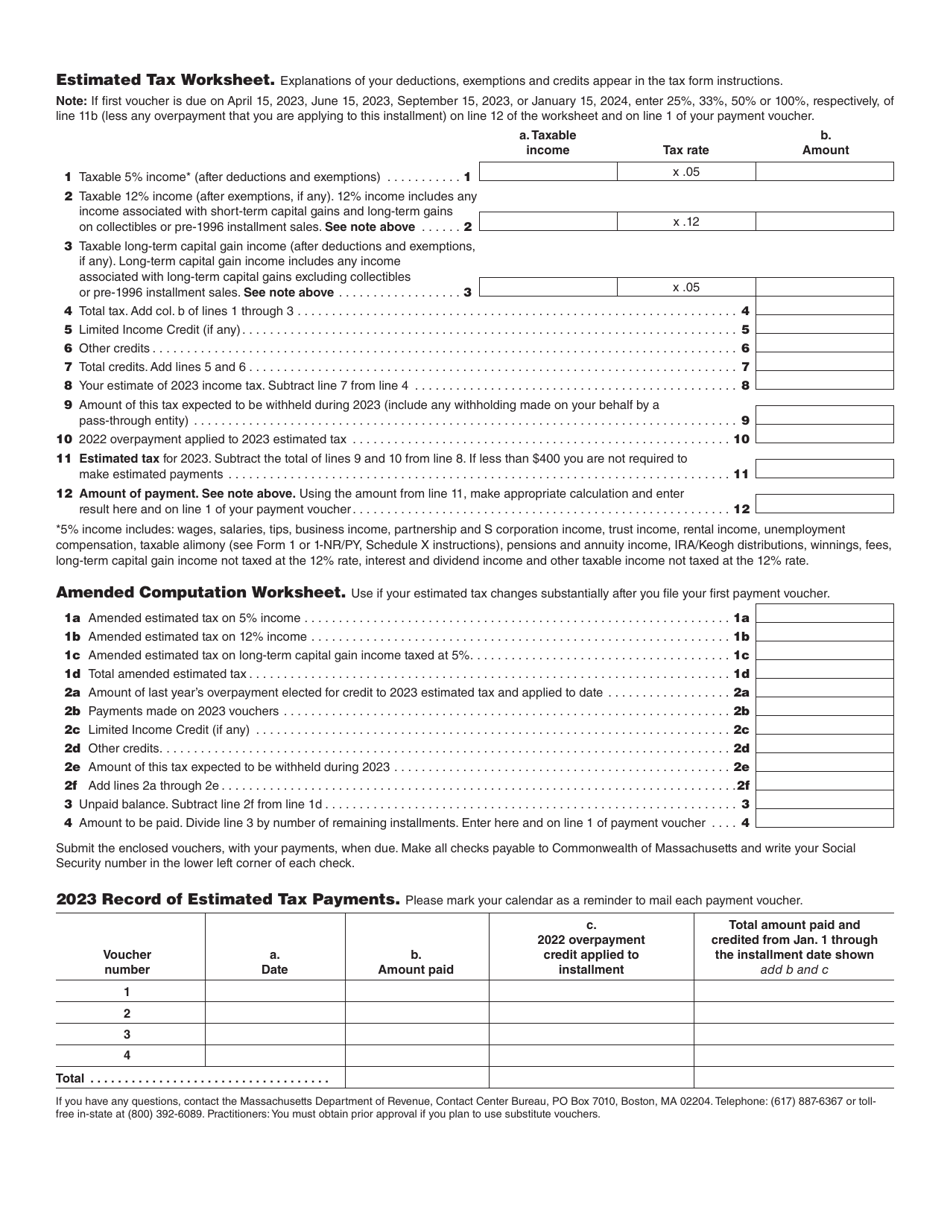

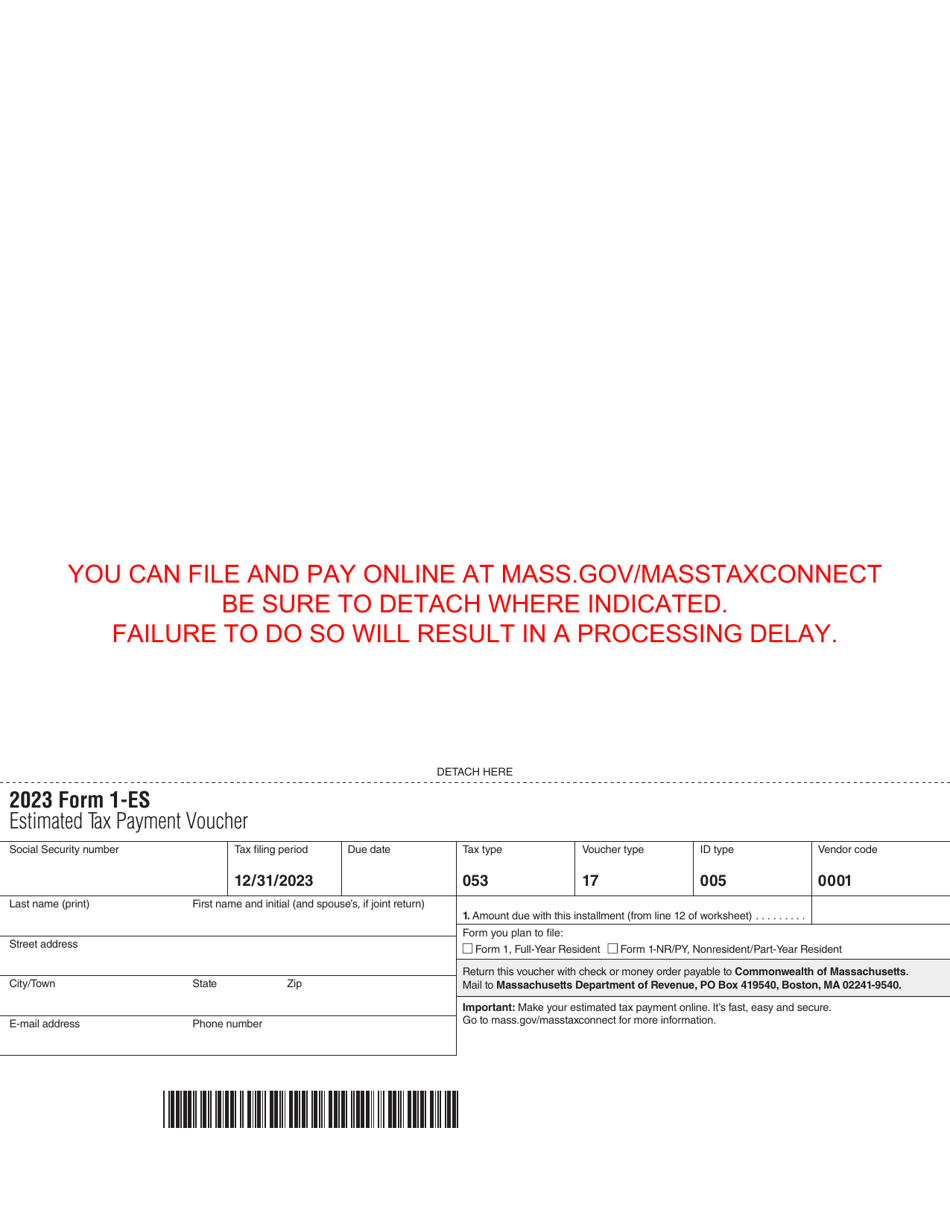

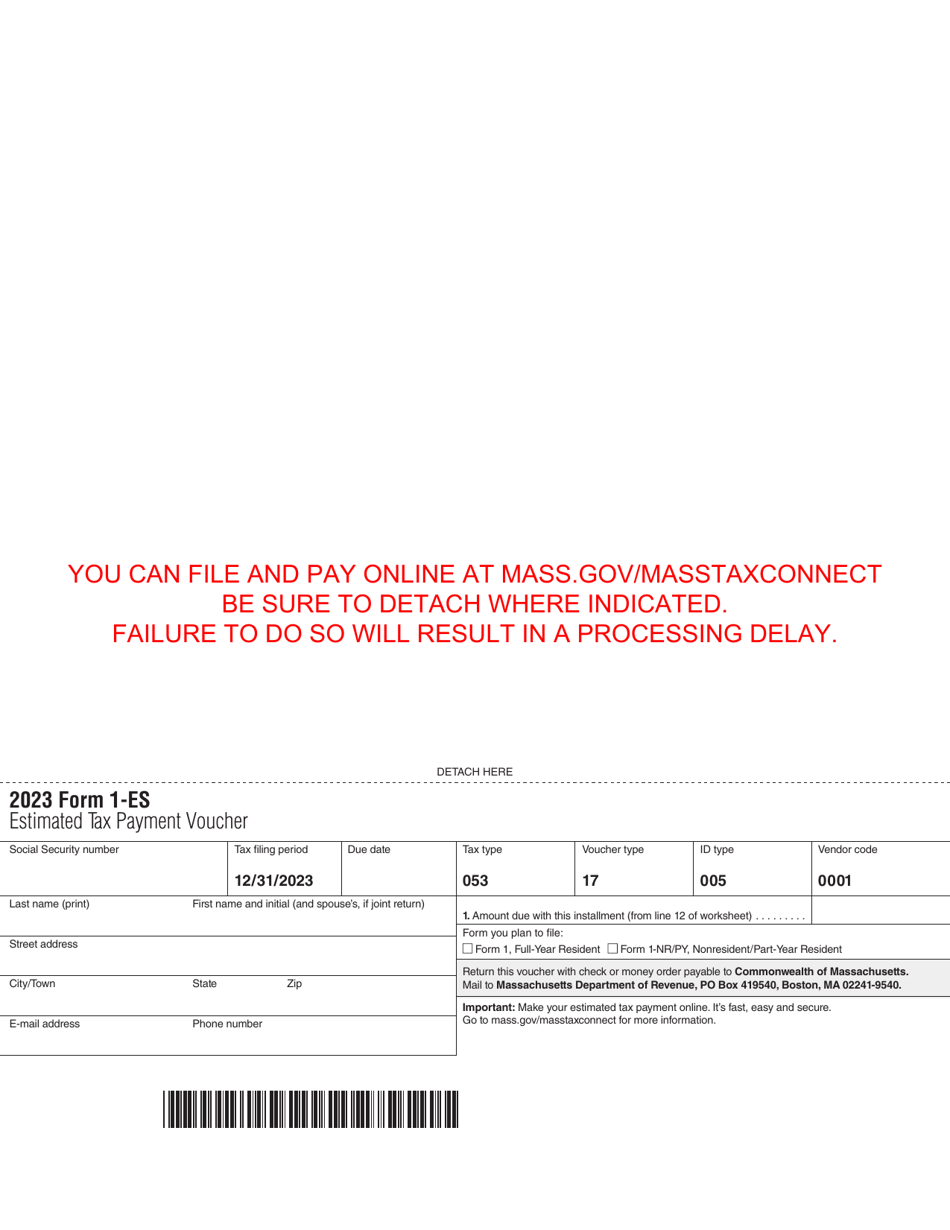

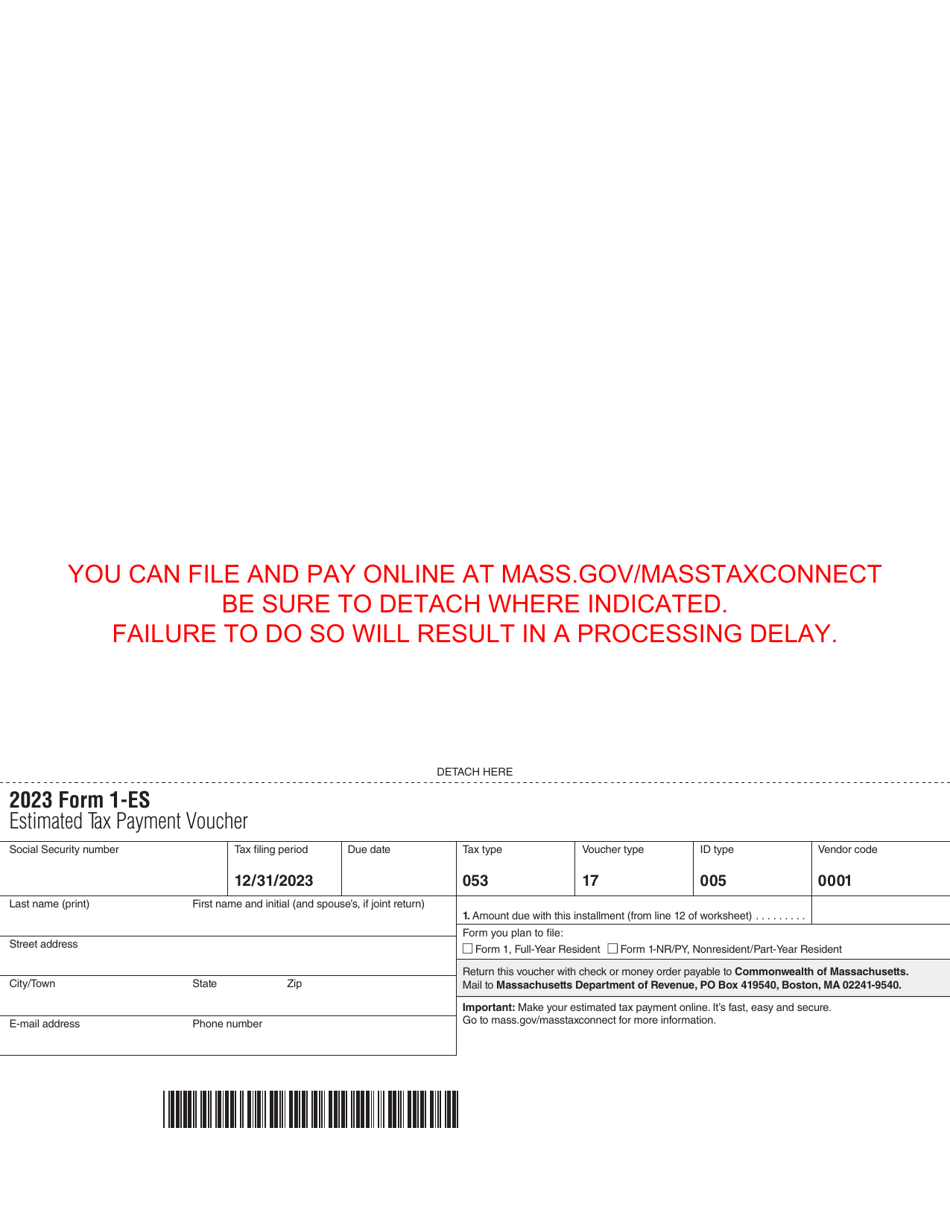

Form 1-ES

for the current year.

Form 1-ES Estimated Tax Payment Voucher - Massachusetts

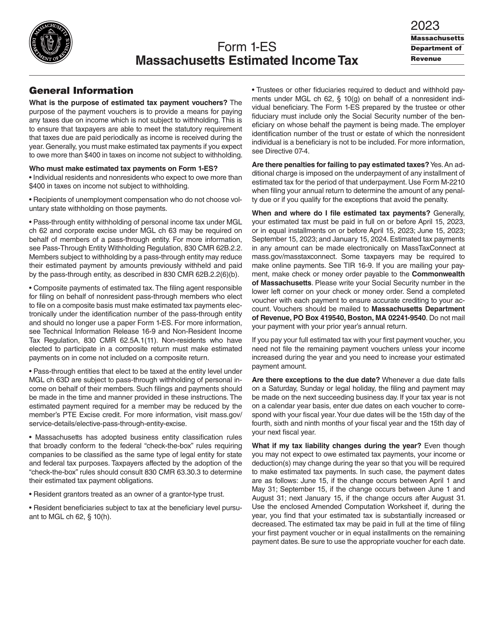

What Is Form 1-ES?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1-ES?

A: Form 1-ES is an estimated tax payment voucher used in Massachusetts.

Q: What is the purpose of Form 1-ES?

A: The purpose of Form 1-ES is to make estimated tax payments to the Massachusetts Department of Revenue.

Q: Who needs to use Form 1-ES?

A: Individuals and businesses with income that is not subject to withholding must use Form 1-ES to make estimated tax payments in Massachusetts.

Q: How often do I need to file Form 1-ES?

A: Form 1-ES must be filed quarterly, with estimated payments due on April 15, June 15, September 15, and January 15.

Q: What do I include with Form 1-ES?

A: You need to include your estimated tax payment, which can be paid by check or electronically.

Q: What happens if I don't file Form 1-ES?

A: If you don't file Form 1-ES or fail to make the required estimated tax payments, you may owe penalties and interest.

Q: Can I get an extension to file Form 1-ES?

A: No, there is no extension available for filing Form 1-ES. The quarterly deadlines must be met.

Q: What if my income changes during the year?

A: If your income changes during the year, you may need to adjust your estimated tax payments by filing an updated Form 1-ES.

Form Details:

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 1-ES by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.