This version of the form is not currently in use and is provided for reference only. Download this version of

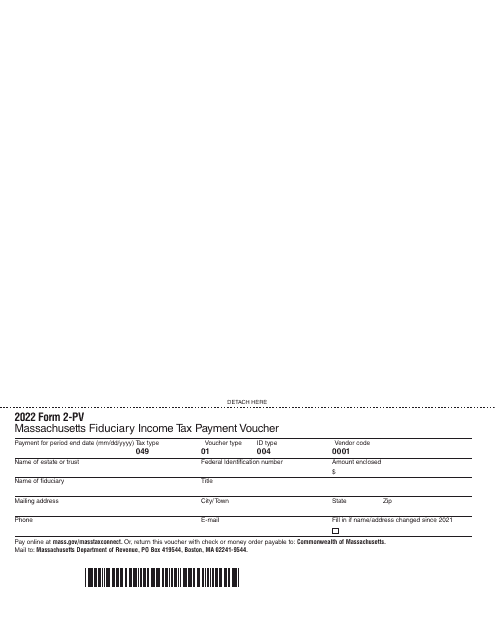

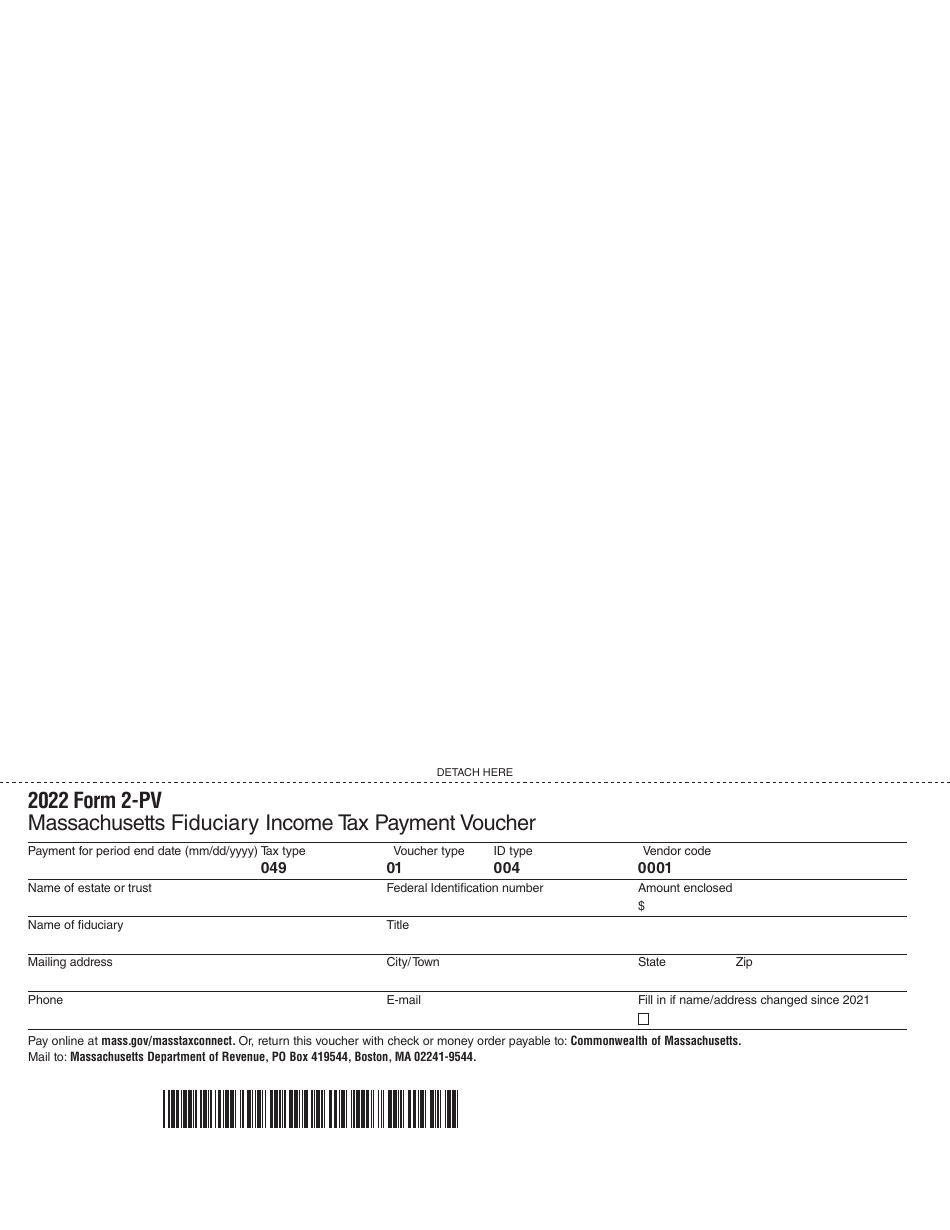

Form 2-PV

for the current year.

Form 2-PV Fiduciary Income Tax Payment Voucher - Massachusetts

What Is Form 2-PV?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 2-PV?

A: Form 2-PV is the Fiduciary Income Tax Payment Voucher for Massachusetts.

Q: Who needs to file Form 2-PV?

A: Individuals or estates that are required to file a Massachusetts fiduciary income tax return must also file Form 2-PV to submit their payment.

Q: What is the purpose of Form 2-PV?

A: Form 2-PV is used to make a payment for Massachusetts fiduciary income tax.

Q: When is Form 2-PV due?

A: The due date for Form 2-PV corresponds with the due date of the Massachusetts fiduciary income tax return, which is generally April 15th.

Q: What should I do if I can't pay the full amount on Form 2-PV?

A: If you are unable to pay the full amount indicated on Form 2-PV, you should still file the form and pay as much as you can. You may be eligible for a payment plan or other options.

Q: Is there a penalty for late payment?

A: Yes, there may be penalties for late payment of Massachusetts fiduciary income tax. It is important to file and pay on time to avoid penalties.

Form Details:

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 2-PV by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.