This version of the form is not currently in use and is provided for reference only. Download this version of

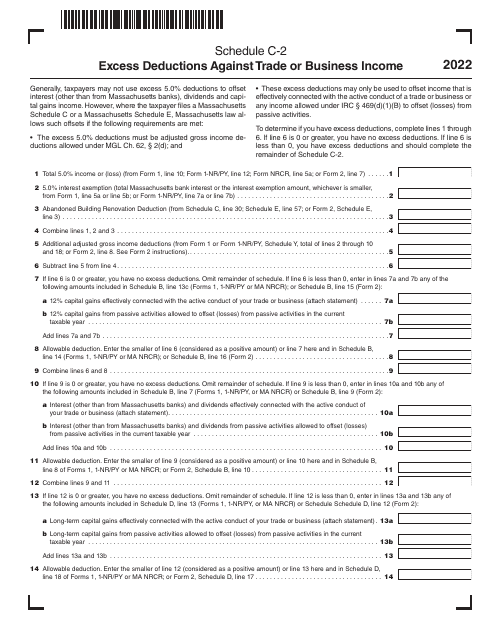

Schedule C-2

for the current year.

Schedule C-2 Excess Deductions Against Trade or Business Income - Massachusetts

What Is Schedule C-2?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule C-2?

A: Schedule C-2 is a form used to calculate excess deductions against trade or business income in Massachusetts.

Q: What are excess deductions against trade or business income?

A: Excess deductions against trade or business income are deductions that exceed the taxpayer's total income.

Q: How do I calculate excess deductions against trade or business income in Massachusetts?

A: You can calculate excess deductions against trade or business income in Massachusetts using Schedule C-2.

Q: Who needs to file Schedule C-2?

A: Taxpayers in Massachusetts who have excess deductions against trade or business income need to file Schedule C-2.

Q: Are there any specific requirements for filing Schedule C-2?

A: Yes, you must meet certain criteria to be eligible to file Schedule C-2. Consult the instructions provided with the form for more information.

Q: What should I do if I have questions about filling out Schedule C-2?

A: If you have questions about filling out Schedule C-2, it is recommended to consult a tax professional or contact the Massachusetts Department of Revenue for assistance.

Form Details:

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule C-2 by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.