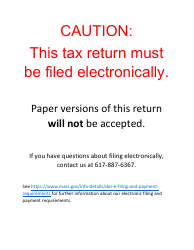

This version of the form is not currently in use and is provided for reference only. Download this version of

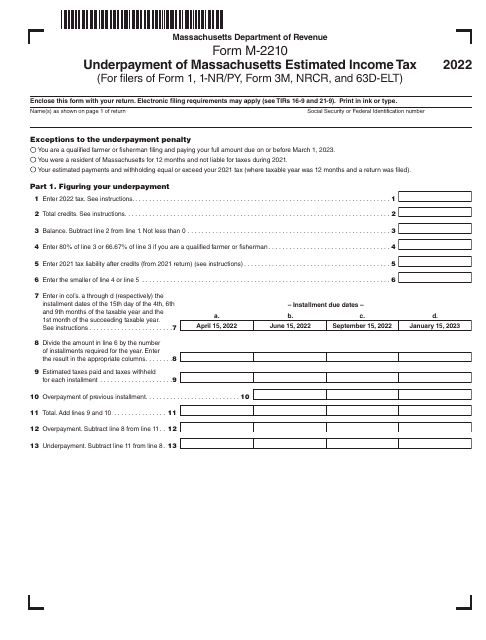

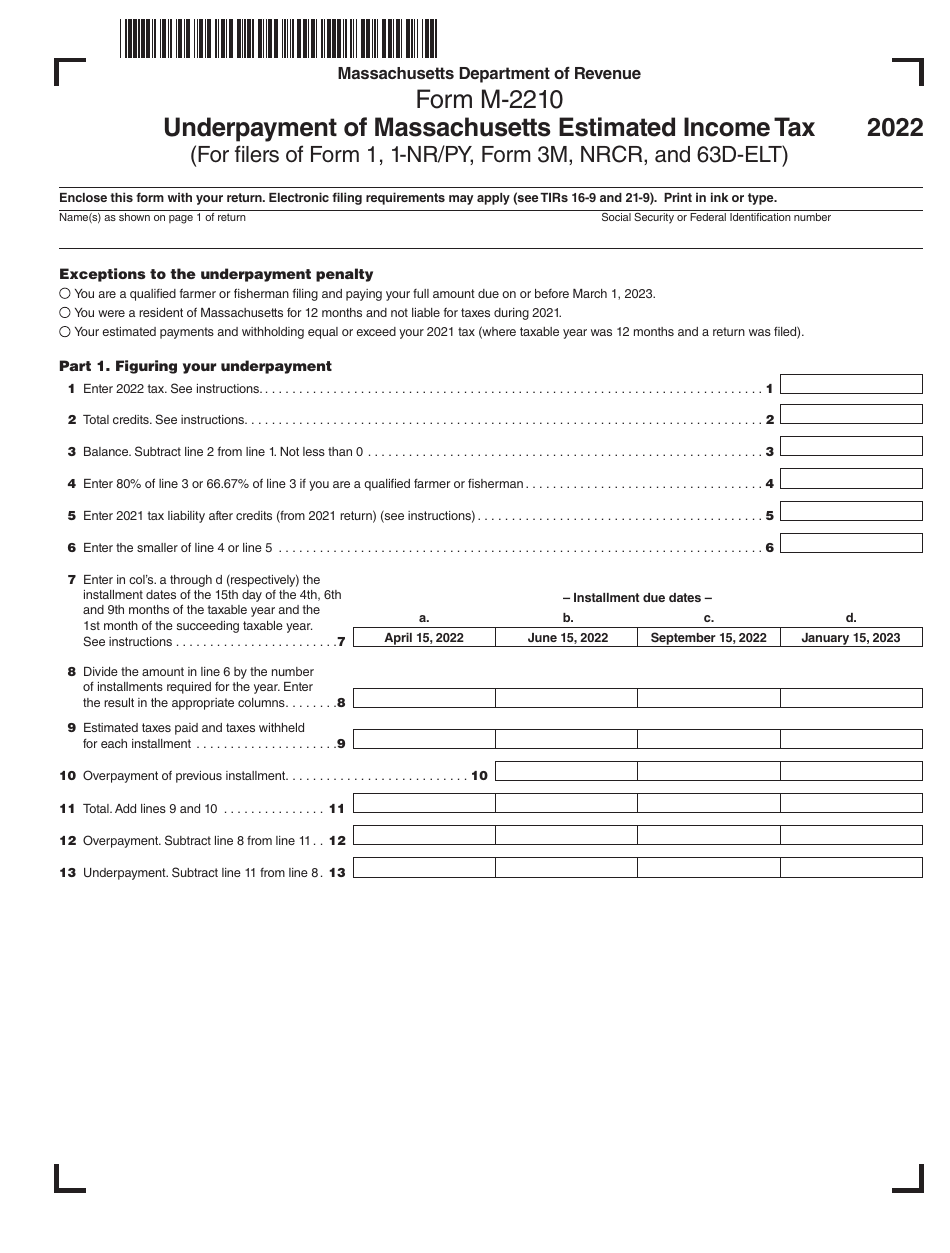

Form M-2210

for the current year.

Form M-2210 Underpayment of Massachusetts Estimated Income Tax (For Filers of Form 1, 1-nr / Py, Form 3m, Nrcr, and 63d-Elt) - Massachusetts

What Is Form M-2210?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form M-2210?

A: Form M-2210 is used to calculate and report any underpayment of estimated income tax in Massachusetts.

Q: Who needs to file Form M-2210?

A: Form M-2210 should be filed by individuals who are required to file Form 1, 1-NR/Py, Form 3M, NRCR, or 63D-ELT in Massachusetts.

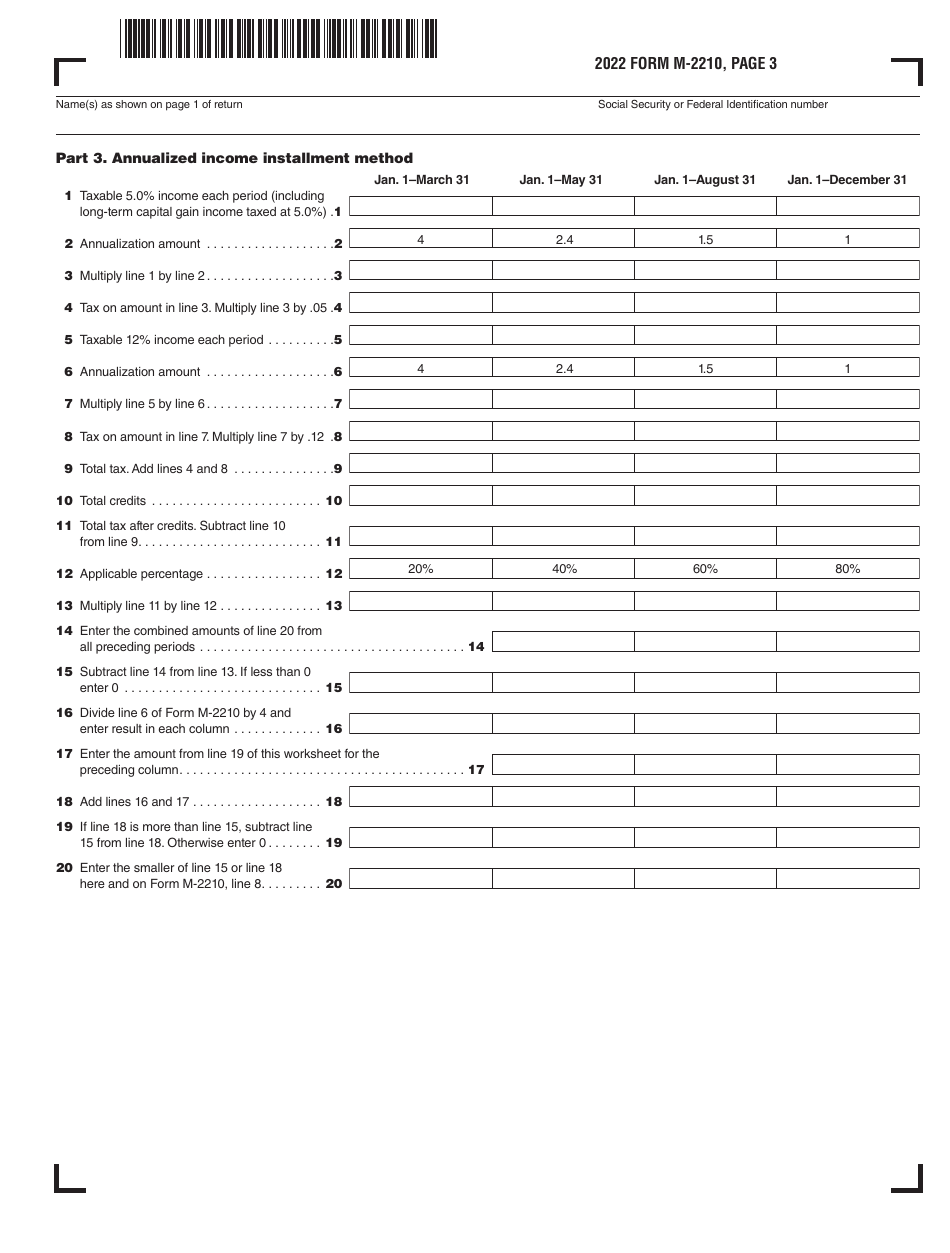

Q: What does Form M-2210 calculate?

A: Form M-2210 calculates any underpayment of estimated income tax in Massachusetts.

Q: When do I need to file Form M-2210?

A: Form M-2210 should be filed with your Massachusetts tax return.

Q: Do I need to file Form M-2210 if I have no underpayment?

A: If you did not underpay your estimated income tax in Massachusetts, you do not need to file Form M-2210.

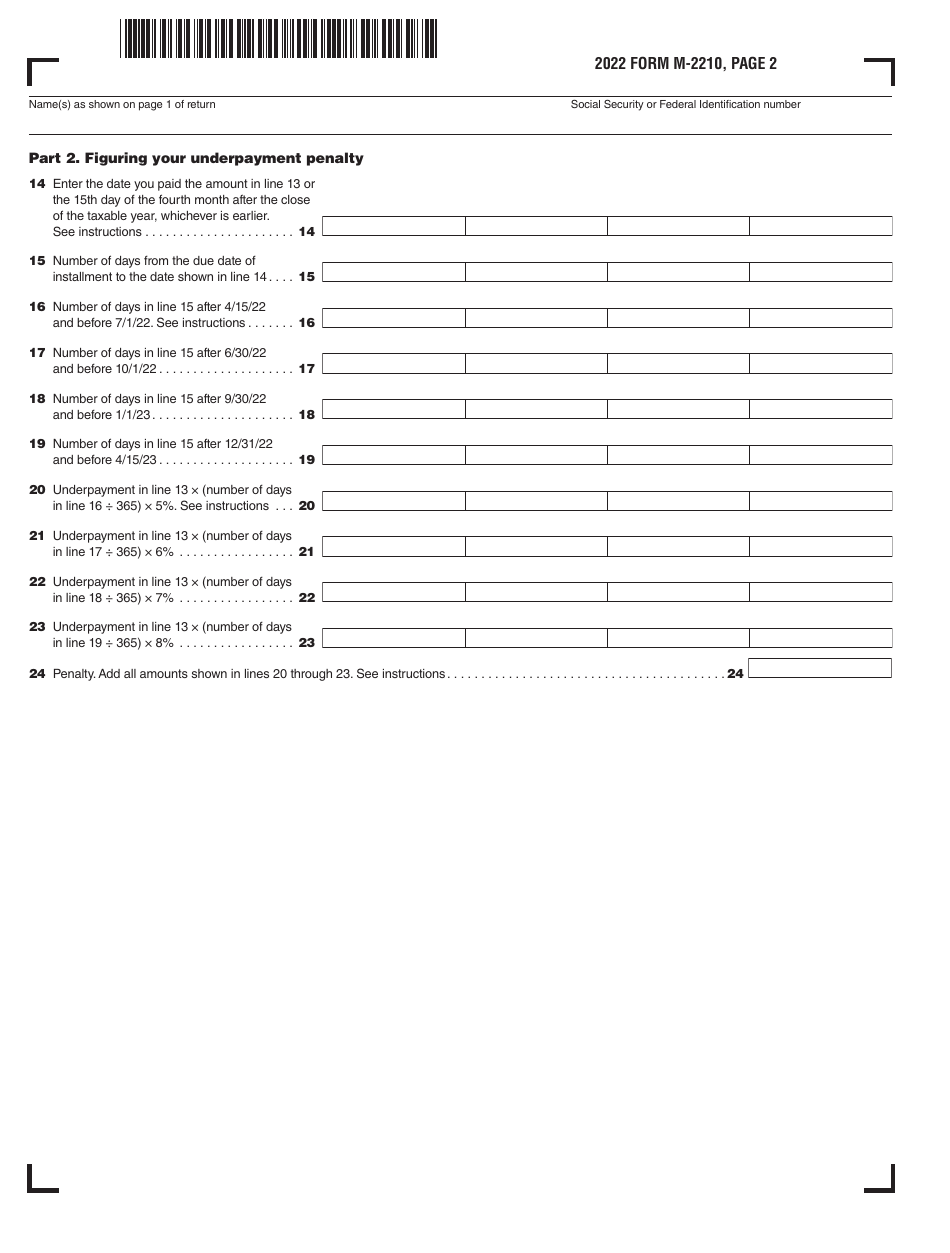

Q: Are there any penalties for underpayment of estimated income tax?

A: Yes, there may be penalties and interest for underpayment of estimated income tax in Massachusetts. Form M-2210 helps calculate any penalties owed.

Q: Can I request an extension to file Form M-2210?

A: Yes, you can request an extension to file Form M-2210. The extension request must be made by the original due date of your Massachusetts tax return.

Form Details:

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form M-2210 by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.