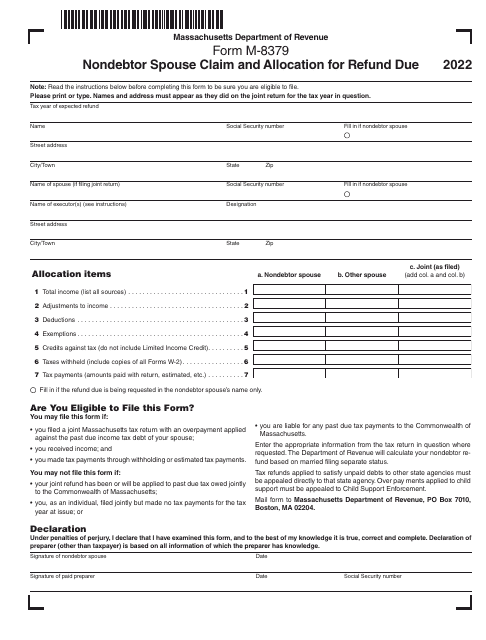

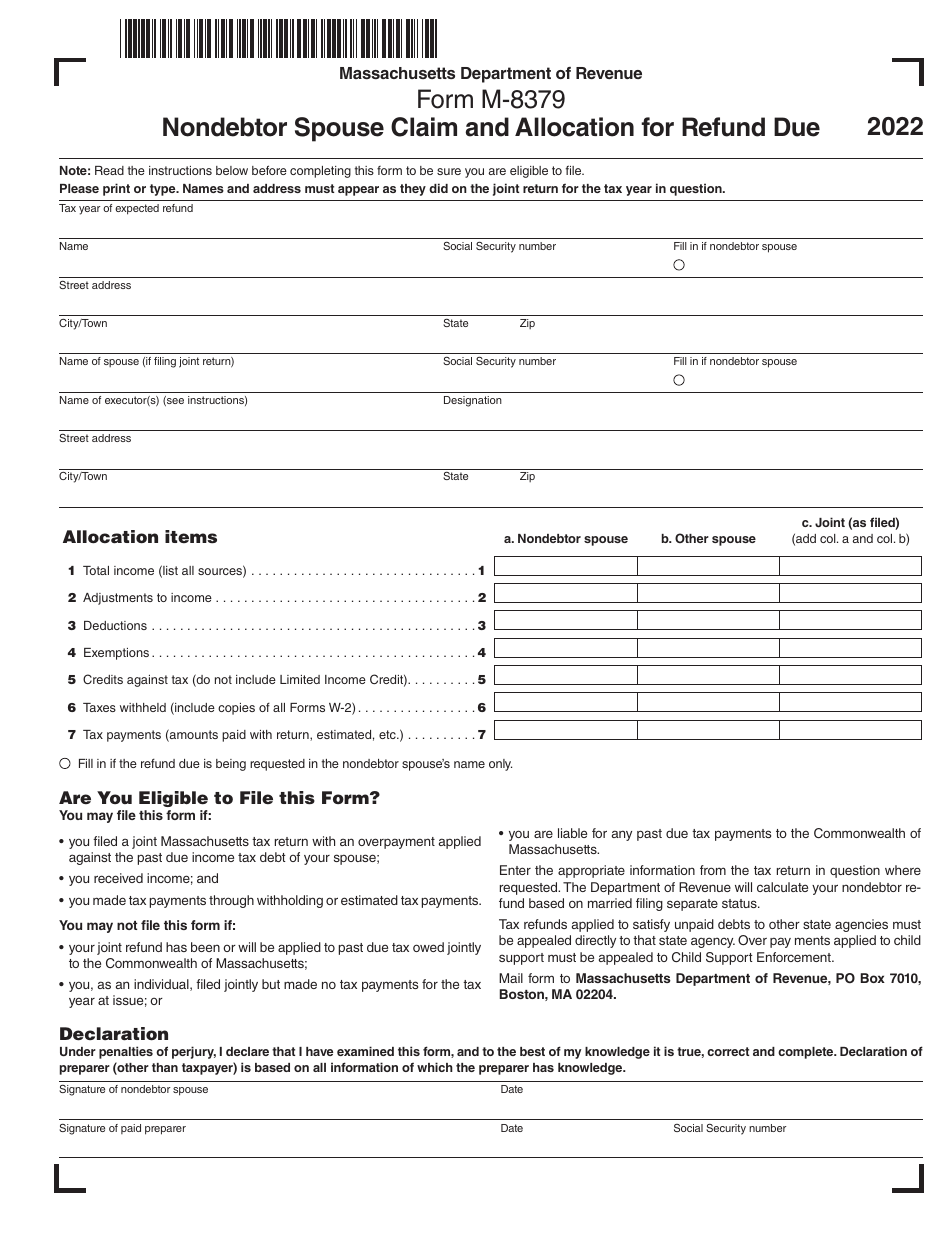

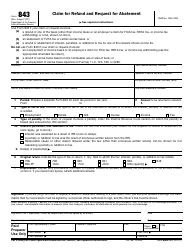

Form M-8379 Nondebtor Spouse Claim and Allocation for Refund Due - Massachusetts

What Is Form M-8379?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form M-8379?

A: Form M-8379 is a tax form used in Massachusetts for a nondebtor spouse to claim and allocate a refund that is due.

Q: Who should use Form M-8379?

A: Form M-8379 should be used by married taxpayers who are filing a joint return and want to allocate the refund to the nondebtor spouse.

Q: What is a nondebtor spouse?

A: A nondebtor spouse is the spouse who does not owe any debts that could offset the joint refund.

Q: What is the purpose of Form M-8379?

A: The purpose of Form M-8379 is to protect the nondebtor spouse's share of a joint refund from being applied to any past-due debts of the other spouse.

Q: When should I file Form M-8379?

A: Form M-8379 should be filed at the same time as your Massachusetts tax return, or as soon as possible if you become aware of any debts owed by the debtor spouse after filing your return.

Q: Is there a fee to file Form M-8379?

A: No, there is no fee to file Form M-8379.

Q: Can Form M-8379 be filed electronically?

A: No, Form M-8379 cannot be filed electronically. It must be filed by mail or in person.

Q: Are there any other requirements for filing Form M-8379?

A: Yes, both spouses must sign the form and provide any required supporting documentation.

Q: What happens after I file Form M-8379?

A: After you file Form M-8379, the Massachusetts Department of Revenue will review your claim and allocate the refund according to the information provided.

Form Details:

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form M-8379 by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.