This version of the form is not currently in use and is provided for reference only. Download this version of

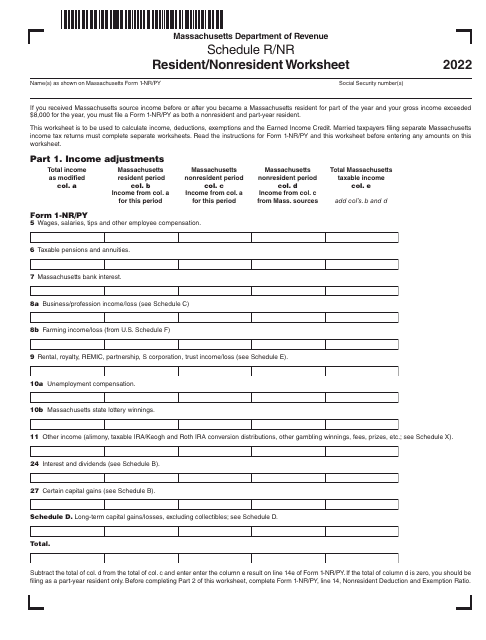

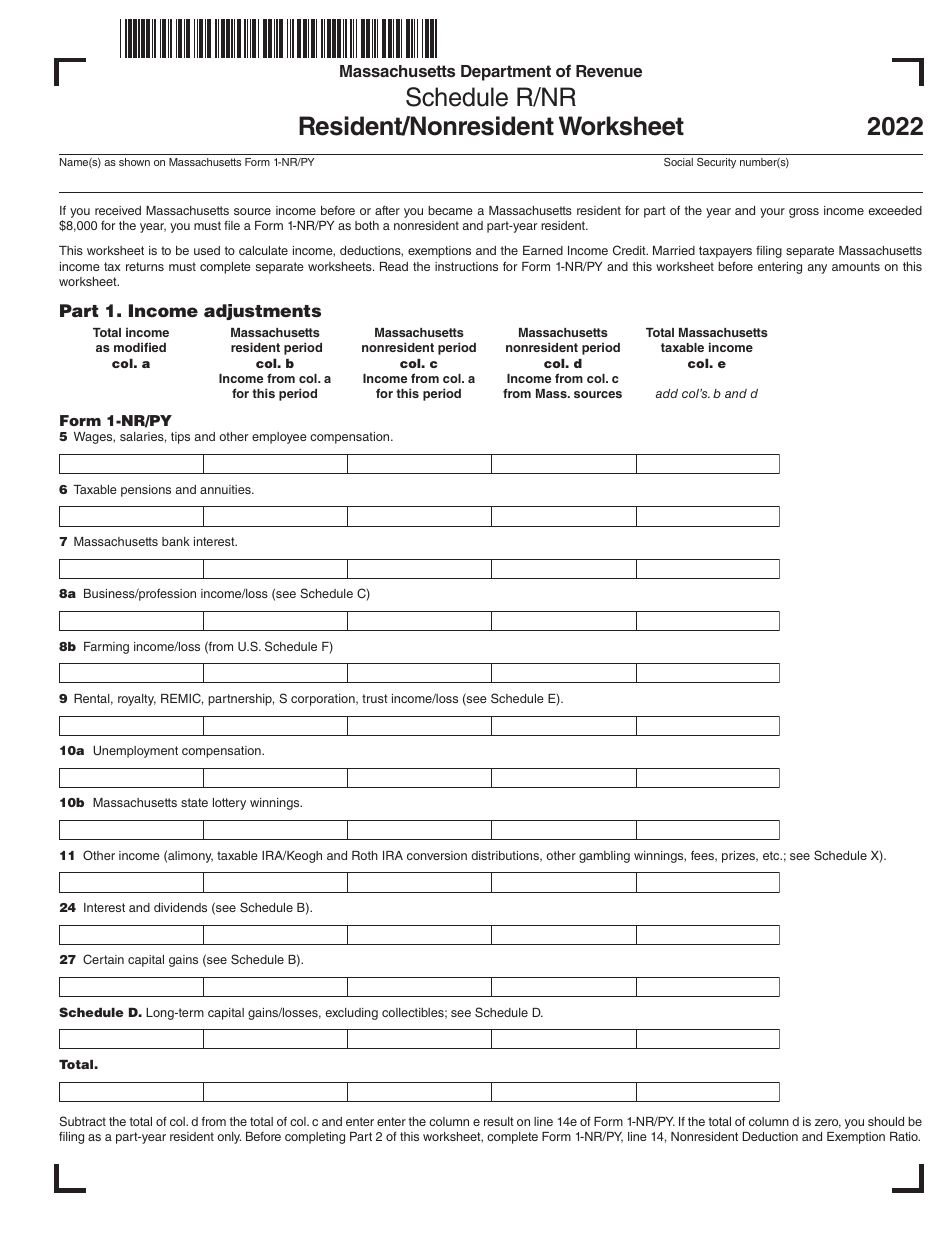

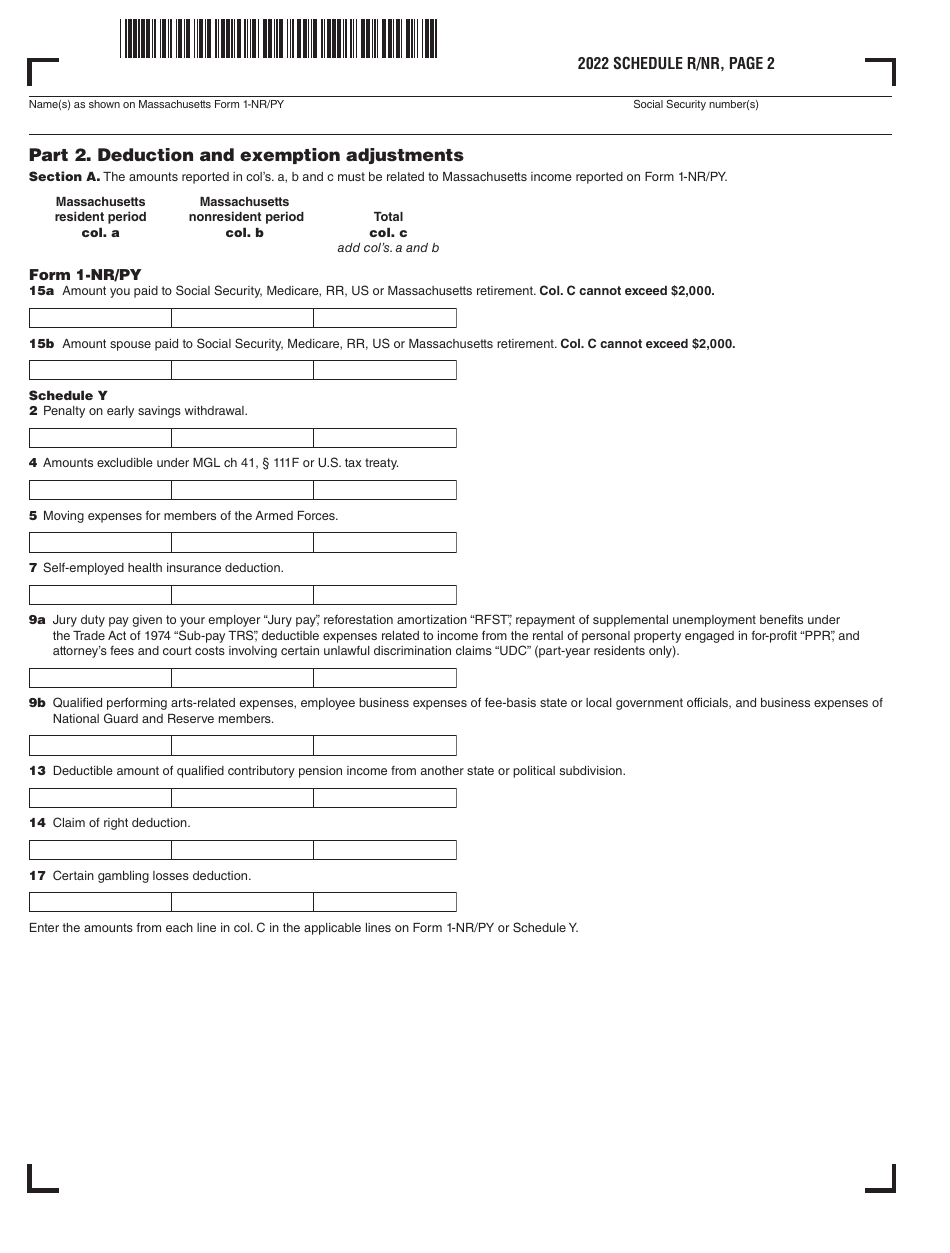

Schedule R/NR

for the current year.

Schedule R / NR Resident / Nonresident Worksheet - Massachusetts

What Is Schedule R/NR?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule R/NR?

A: Schedule R/NR is a worksheet used in Massachusetts to determine your residency status for tax purposes.

Q: Why is residency status important for taxes?

A: Residency status determines the tax rates and deductions that apply to you.

Q: What does R/NR stand for in Schedule R/NR?

A: R/NR stands for Resident/Nonresident.

Q: Who needs to fill out Schedule R/NR?

A: You need to fill out Schedule R/NR if you lived in Massachusetts during the tax year and are required to file a state tax return.

Q: How do I determine my residency status?

A: Your residency status is determined based on factors such as where you maintain your permanent home, where you spend the most time, and where you earn income.

Q: What information is required on Schedule R/NR?

A: You will need to provide details about your residency status, such as the number of days you spent in Massachusetts and the reason for your presence in the state.

Q: Do I need to file Schedule R/NR if I am a full-year resident of Massachusetts?

A: No, if you are a full-year resident of Massachusetts, you do not need to file Schedule R/NR.

Q: Do I need to file Schedule R/NR if I am a nonresident of Massachusetts?

A: No, if you are a nonresident of Massachusetts and did not earn any Massachusetts-source income, you do not need to file Schedule R/NR.

Form Details:

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule R/NR by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.