This version of the form is not currently in use and is provided for reference only. Download this version of

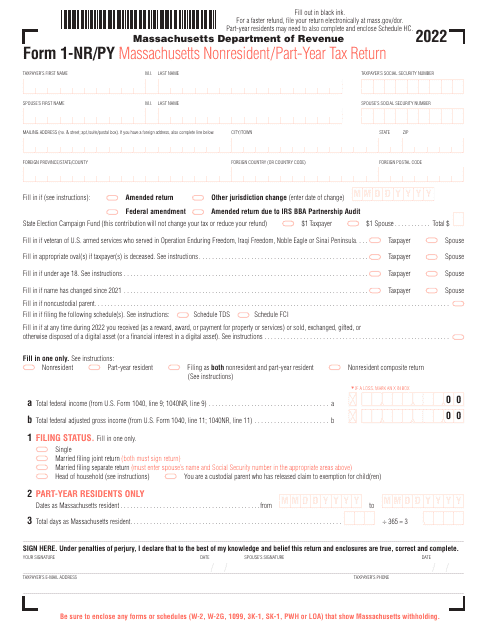

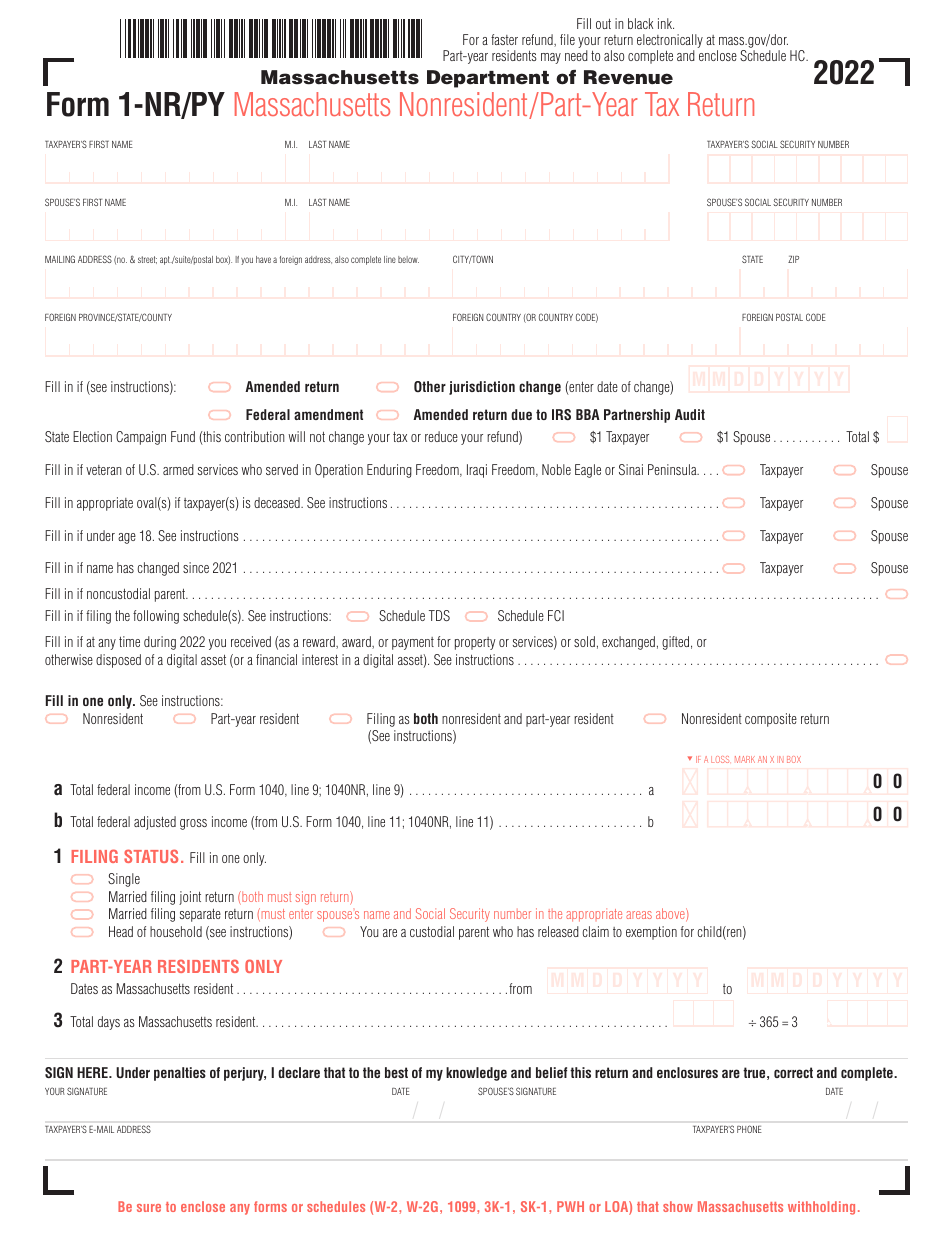

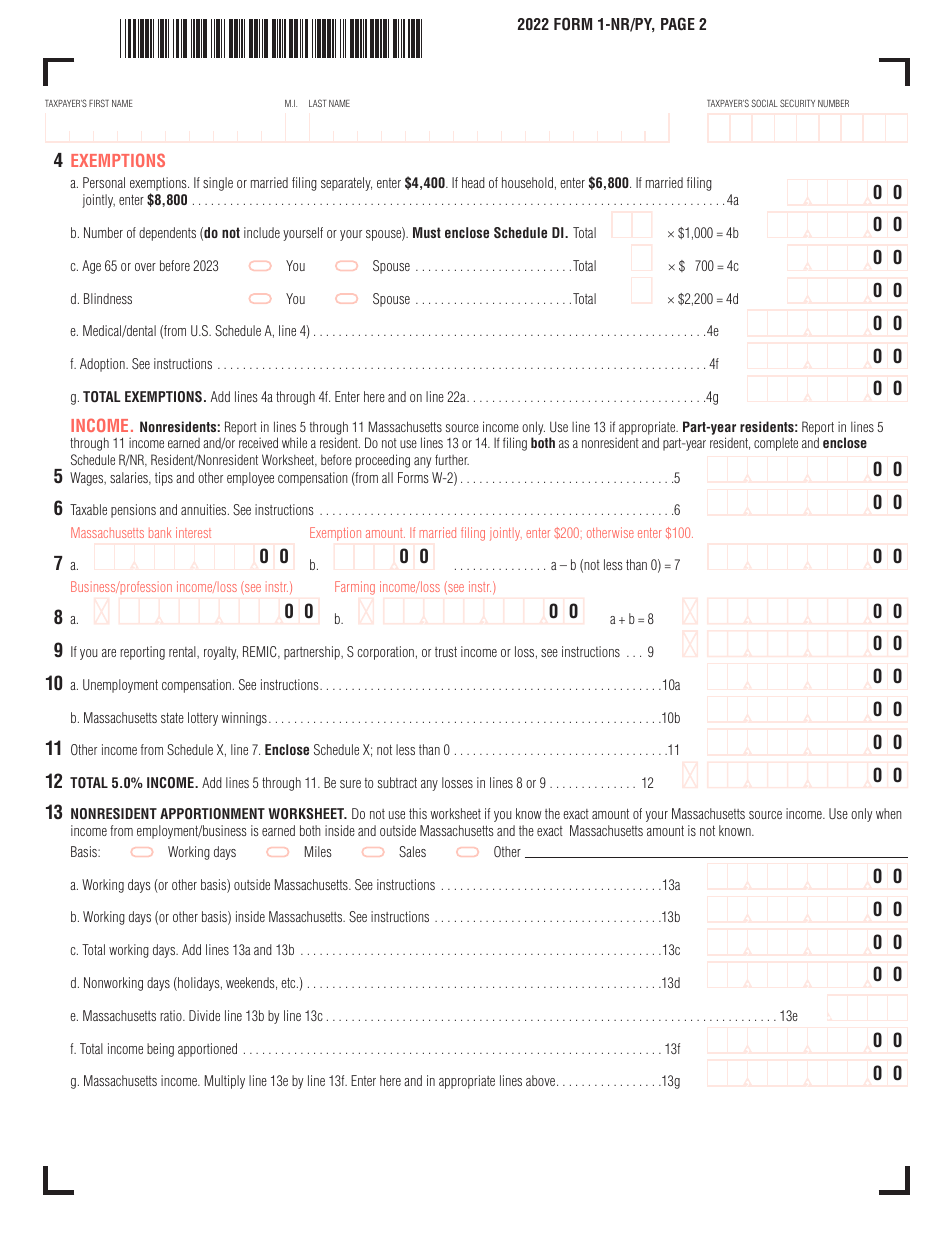

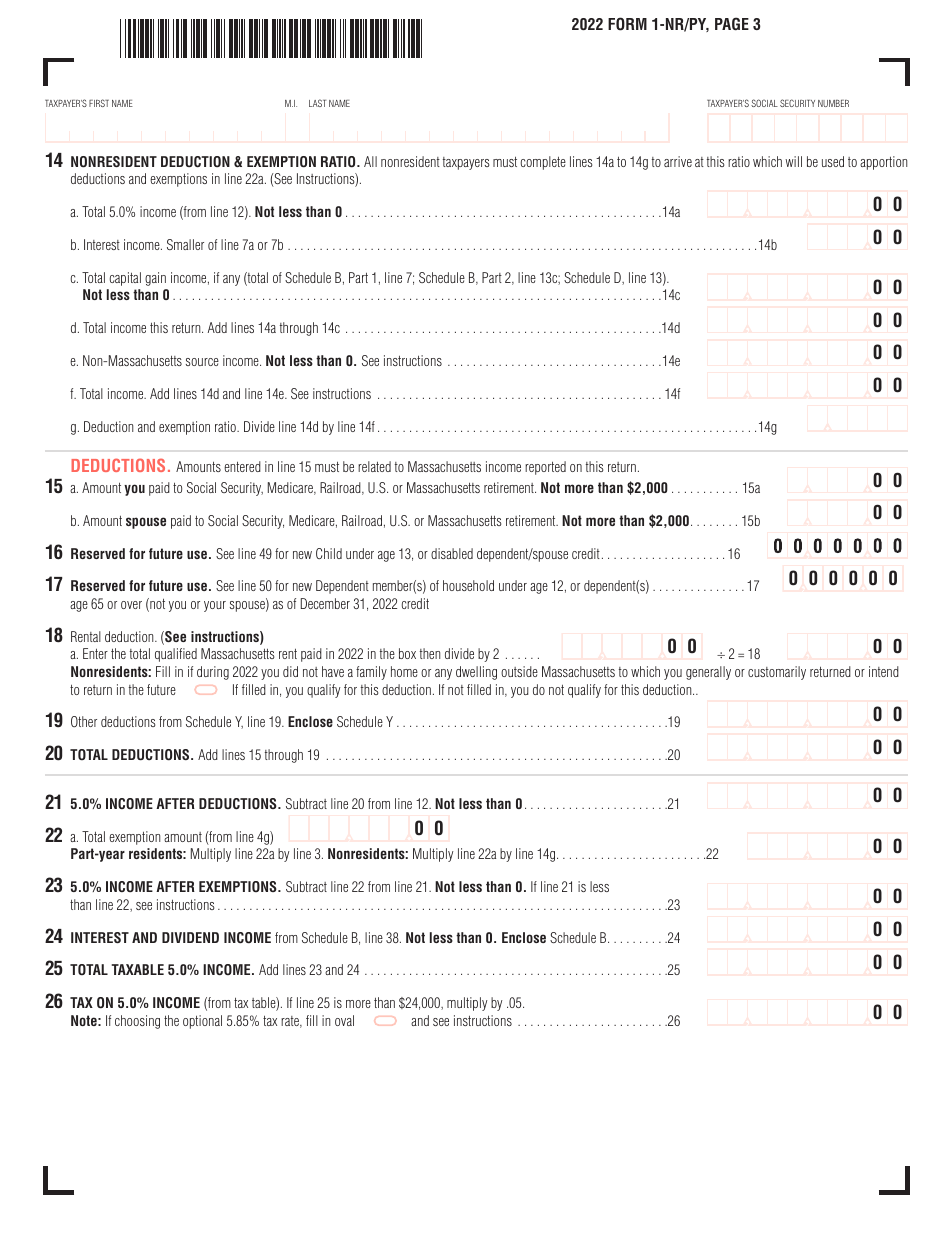

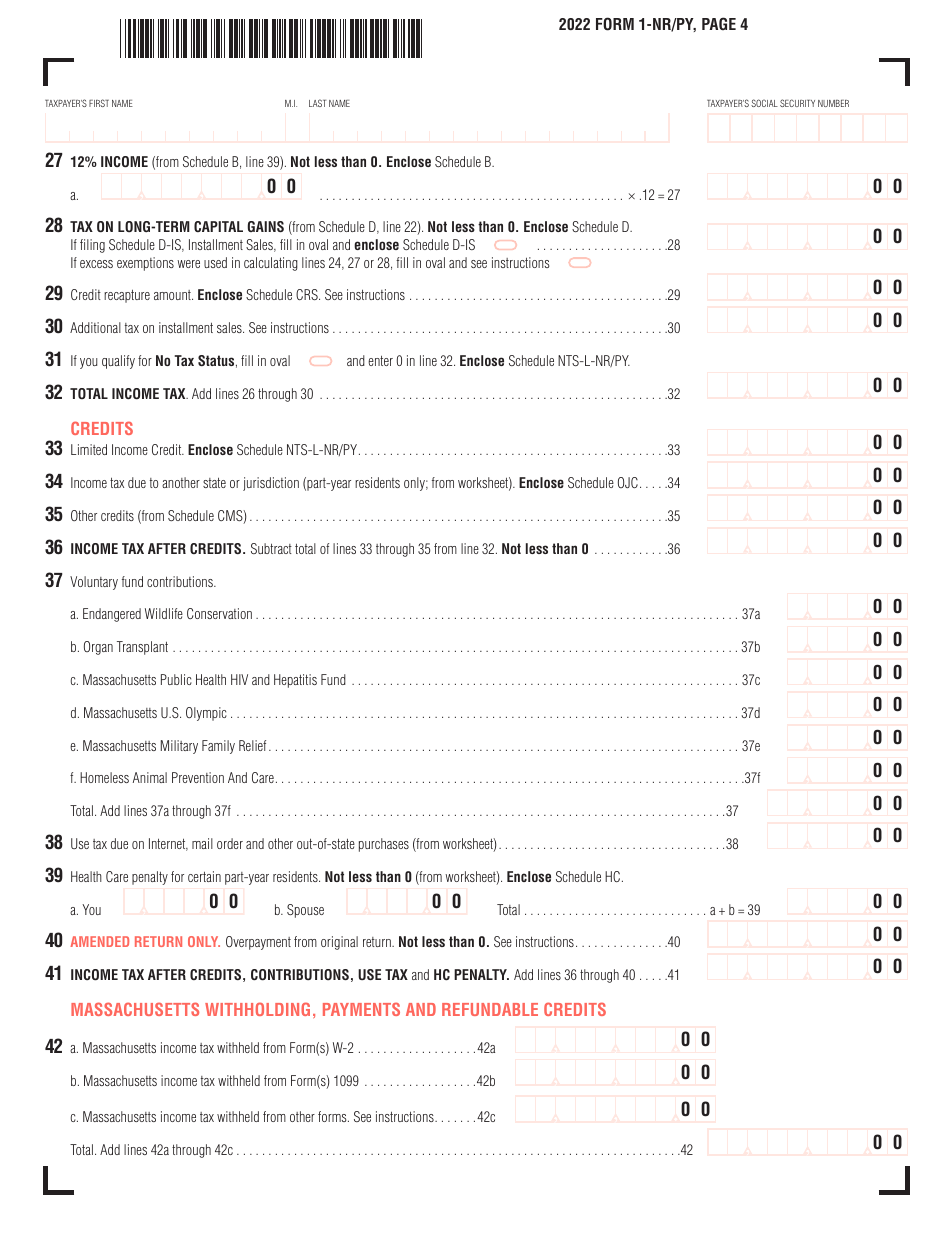

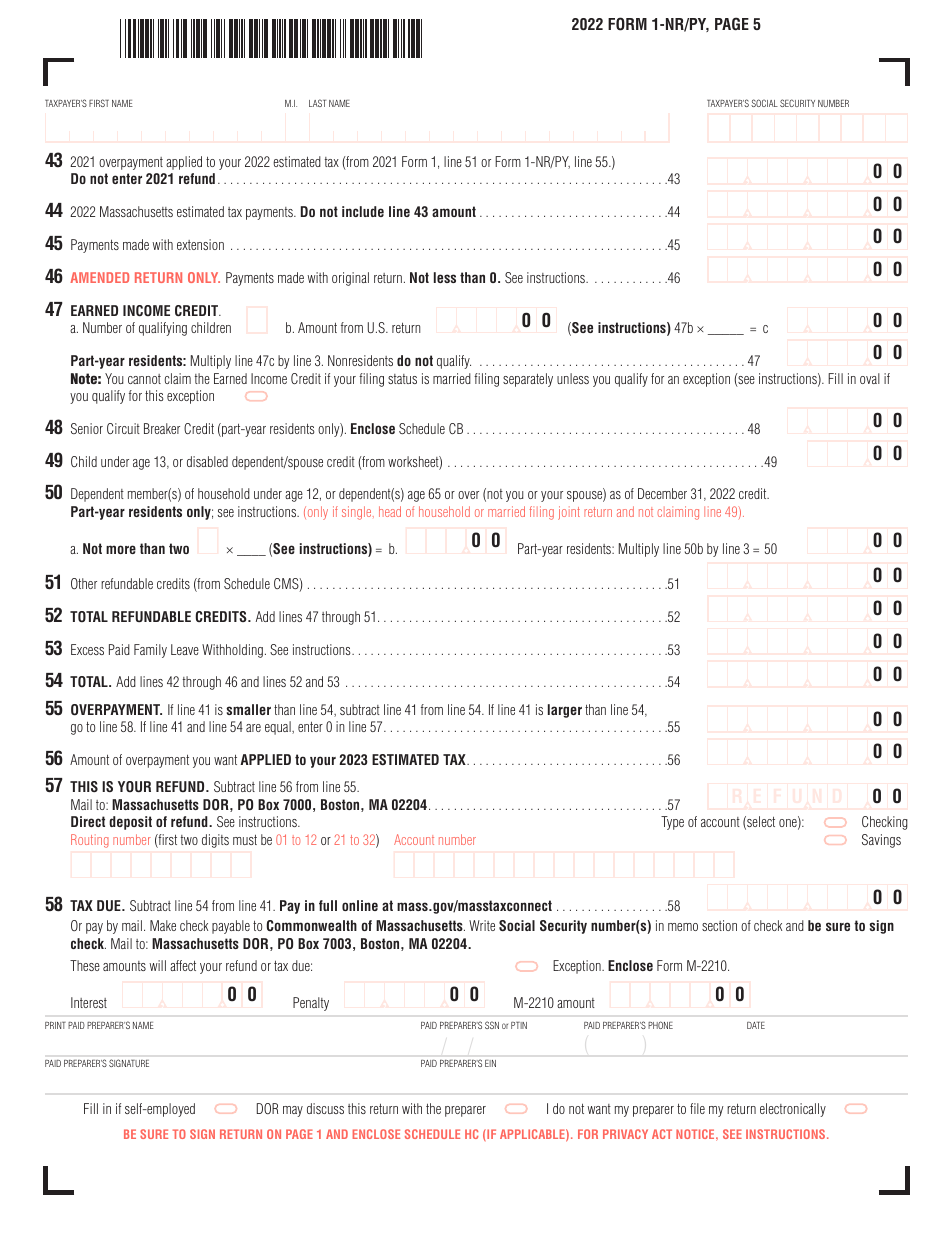

Form 1-NR/PY

for the current year.

Form 1-NR / PY Massachusetts Nonresident / Part-Year Tax Return - Massachusetts

What Is Form 1-NR/PY?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1-NR/PY?

A: Form 1-NR/PY is the Massachusetts Nonresident/Part-Year Tax Return.

Q: Who should file Form 1-NR/PY?

A: You should file Form 1-NR/PY if you were a nonresident or part-year resident of Massachusetts during the tax year and need to report your income and claim any applicable deductions or credits.

Q: What is the purpose of Form 1-NR/PY?

A: The purpose of Form 1-NR/PY is to determine your Massachusetts tax liability for the tax year based on your nonresident or part-year resident status.

Q: Do I need to file Form 1-NR/PY if I only earned income in Massachusetts?

A: Yes, if you were a nonresident or part-year resident of Massachusetts and earned income in the state, you must file Form 1-NR/PY to report that income.

Q: Can I file Form 1-NR/PY electronically?

A: Yes, you can file Form 1-NR/PY electronically using the Massachusetts Department of Revenue's e-file system.

Q: When is the deadline to file Form 1-NR/PY?

A: The deadline to file Form 1-NR/PY is generally the same as the federal income tax deadline, which is April 15th.

Q: Are there any extensions available for filing Form 1-NR/PY?

A: Yes, you can request an extension to file Form 1-NR/PY, but you must still pay any taxes owed by the original due date of April 15th.

Q: What attachments or supporting documents do I need to include with Form 1-NR/PY?

A: You may need to include copies of your federal tax return, as well as any schedules or forms required to report your income or claim deductions or credits.

Form Details:

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 1-NR/PY by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.