This version of the form is not currently in use and is provided for reference only. Download this version of

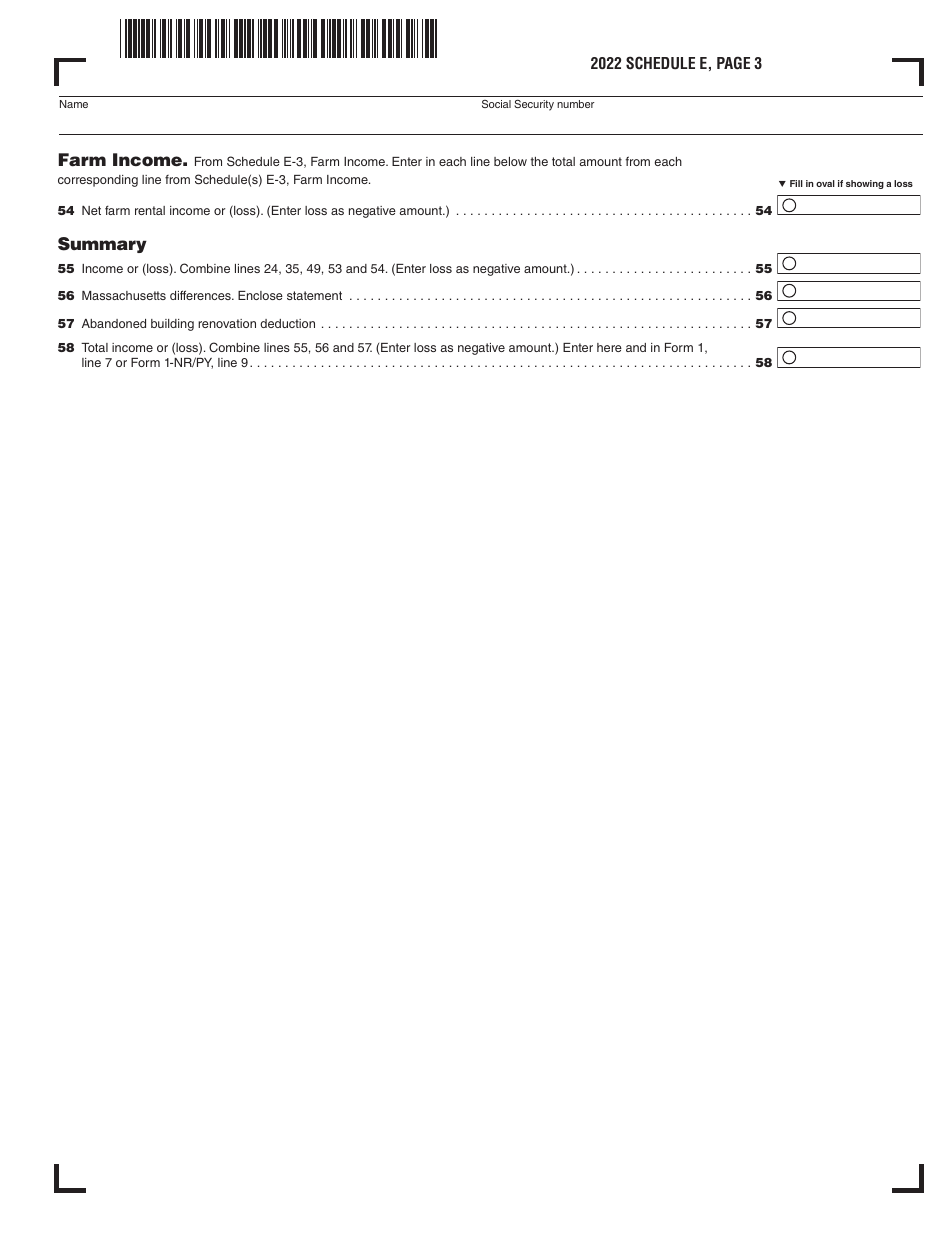

Schedule E RECONCILIATION

for the current year.

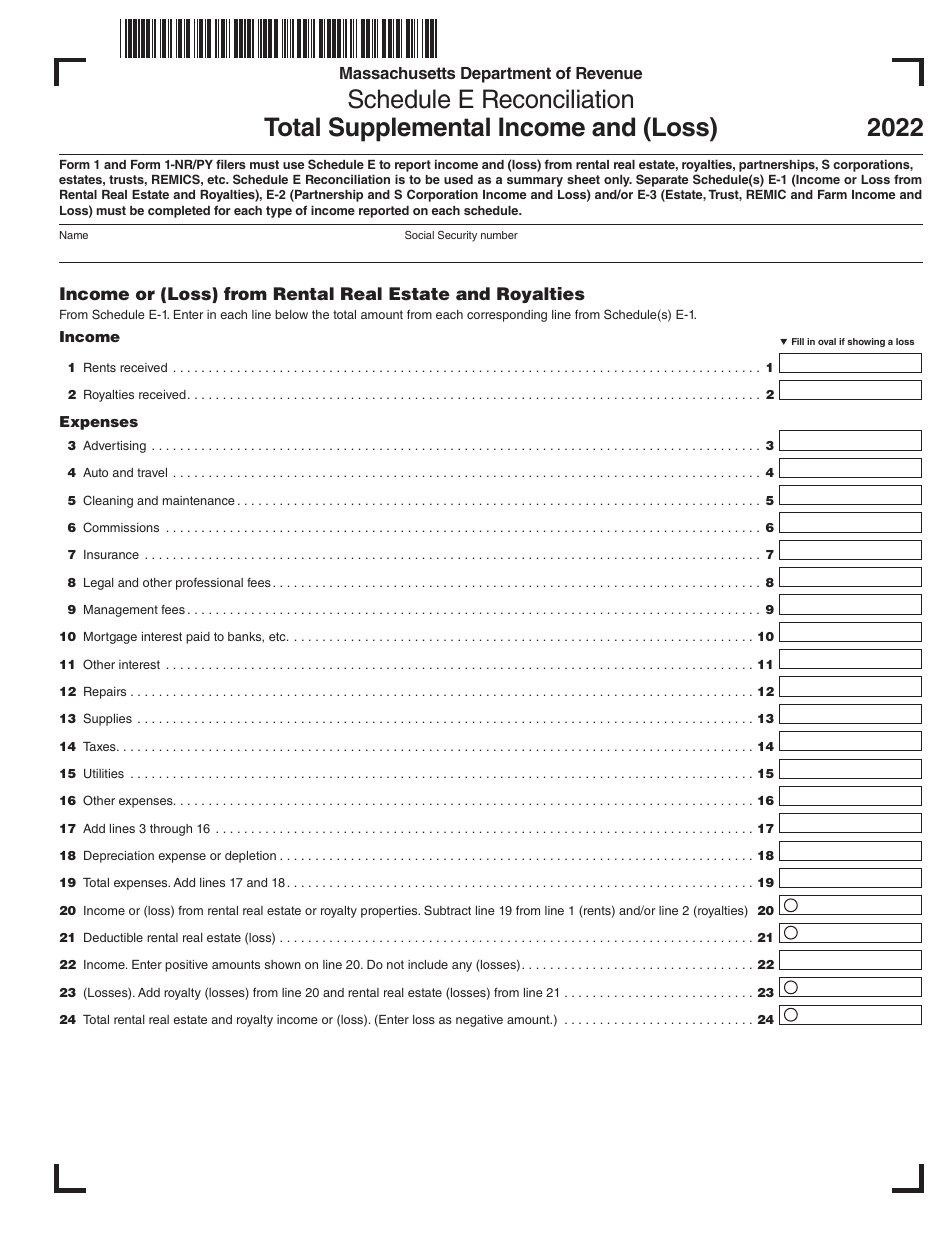

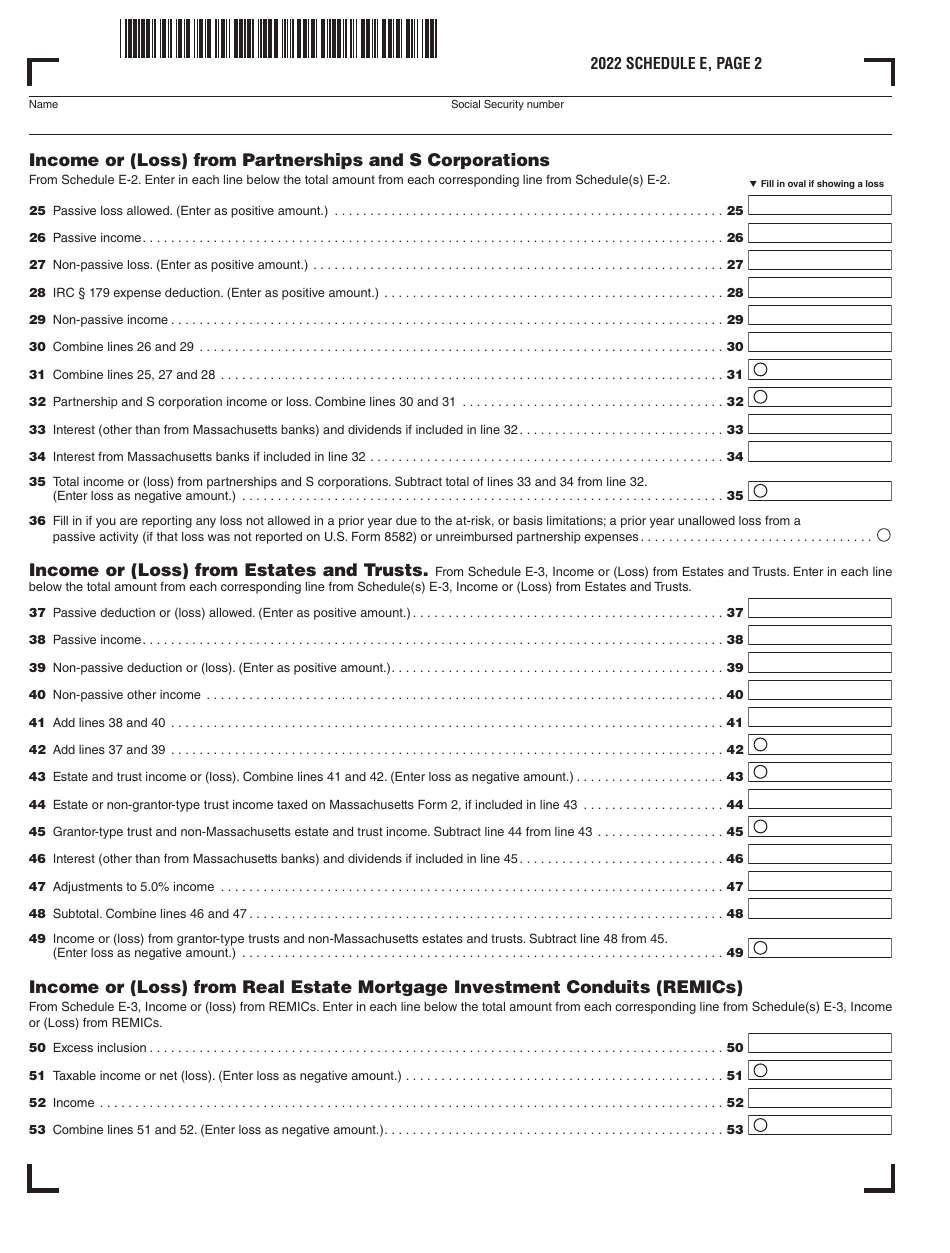

Schedule E RECONCILIATION Total Supplemental Income and (Loss) - Massachusetts

What Is Schedule E RECONCILIATION?

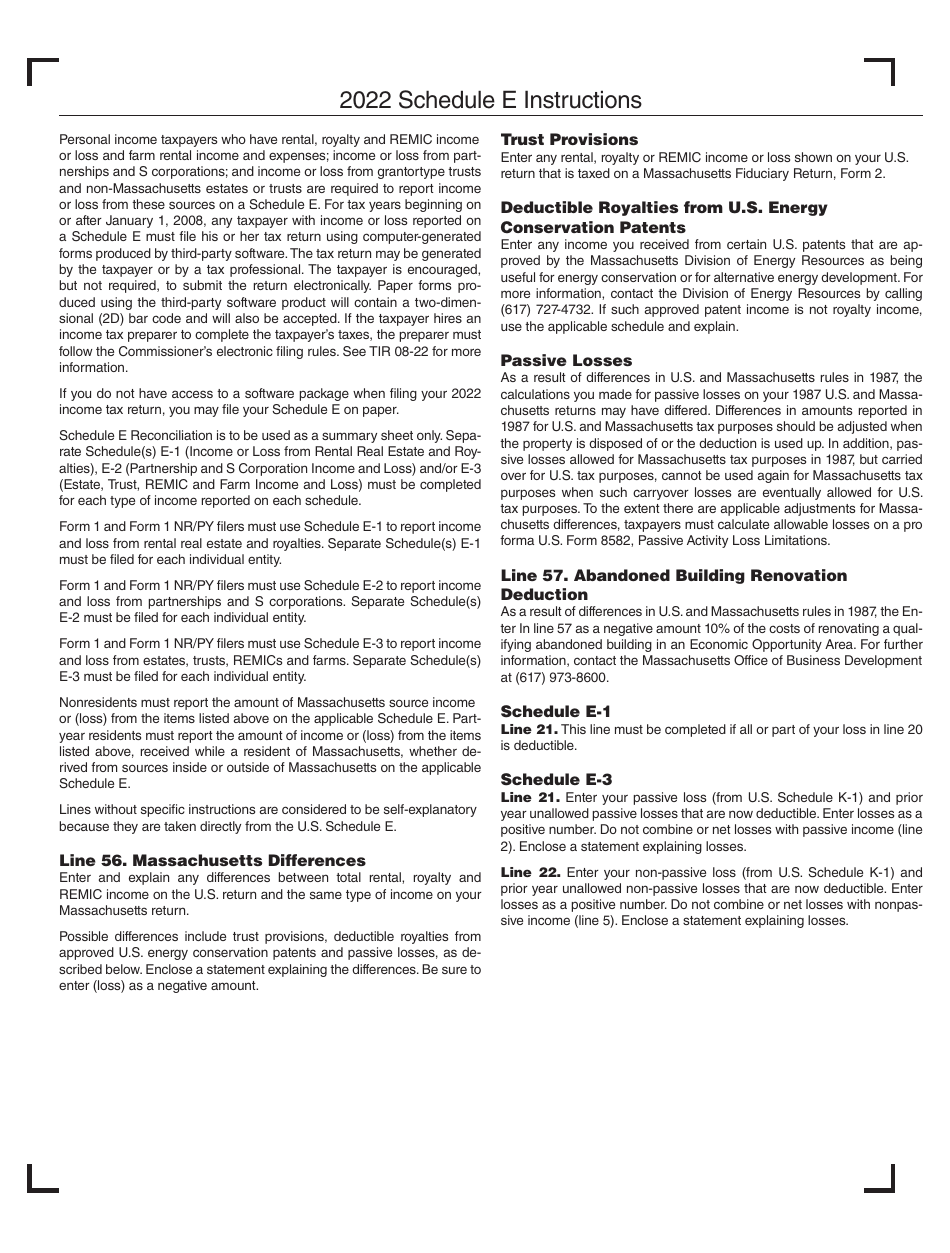

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule E?

A: Schedule E is a tax form used to report supplemental income and loss.

Q: What does the term 'reconciliation' mean?

A: Reconciliation refers to the process of comparing and matching different financial records or statements to ensure accuracy.

Q: What is 'Total Supplemental Income and (Loss)'?

A: 'Total Supplemental Income and (Loss)' refers to the total amount of additional income or loss reported on Schedule E.

Q: Why is Massachusetts mentioned in relation to Schedule E?

A: Massachusetts is mentioned because it likely pertains to specific tax rules or regulations within the state.

Q: Is Schedule E applicable only for Massachusetts residents?

A: No, Schedule E is used by residents of any state to report supplemental income and loss, but the mention of Massachusetts suggests specific guidelines apply in that state.

Q: What should I do if I have supplemental income or loss to report?

A: If you have supplemental income or loss, you should consult with a tax professional or refer to the IRS guidelines on how to properly report it on Schedule E.

Form Details:

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule E RECONCILIATION by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.