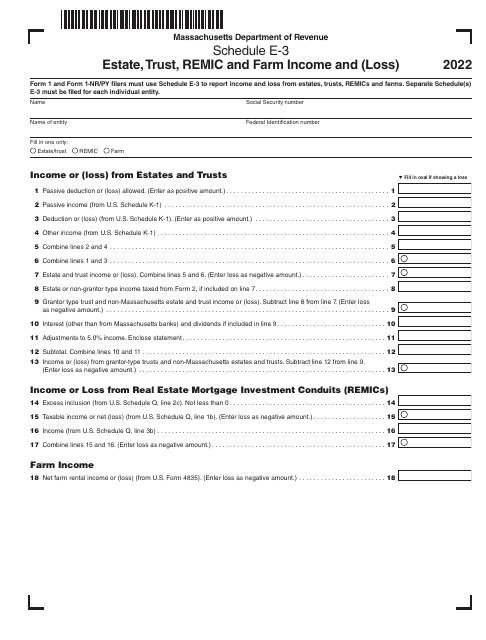

This version of the form is not currently in use and is provided for reference only. Download this version of

Schedule E-3

for the current year.

Schedule E-3 Estate, Trust, REMIC and Farm Income and (Loss) - Massachusetts

What Is Schedule E-3?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule E-3?

A: Schedule E-3 is a tax form used to report income and losses from estates, trusts, REMICs (Real Estate Mortgage Investment Conduits), and farm activities.

Q: Who needs to file Schedule E-3?

A: Individuals or entities that have income and losses from estates, trusts, REMICs, or farm activities in Massachusetts need to file Schedule E-3.

Q: What types of income and losses are reported on Schedule E-3?

A: Income and losses from rental properties, royalties, partnerships, S corporations, and other sources related to estates, trusts, REMICs, and farm activities are reported on Schedule E-3.

Q: When is the deadline to file Schedule E-3?

A: The deadline to file Schedule E-3 in Massachusetts is usually the same as the federal tax deadline, which is April 15th.

Form Details:

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule E-3 by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.