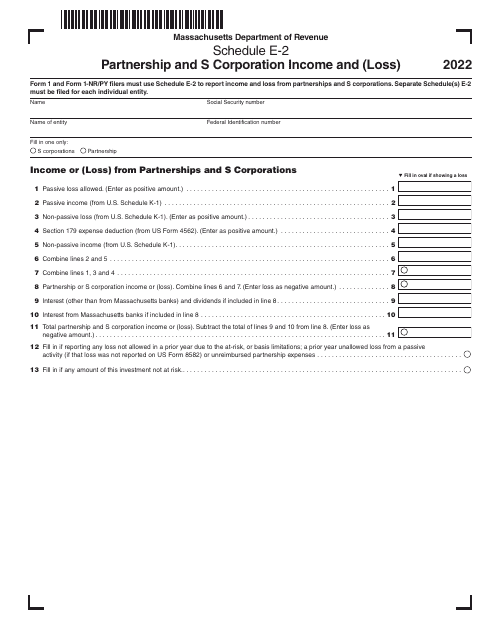

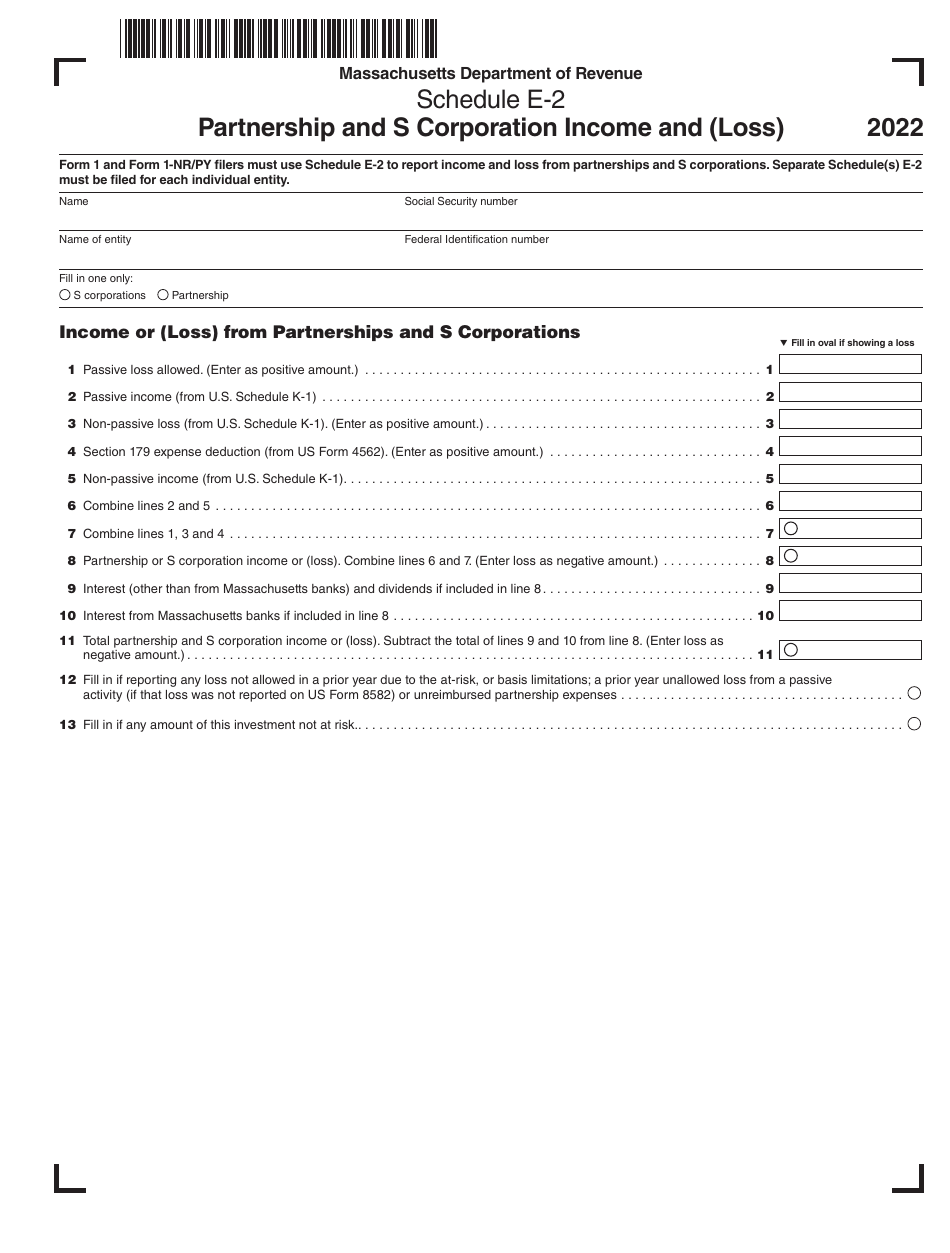

This version of the form is not currently in use and is provided for reference only. Download this version of

Schedule E-2

for the current year.

Schedule E-2 Partnership and S Corporation Income and (Loss) - Massachusetts

What Is Schedule E-2?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule E-2?

A: Schedule E-2 is a tax form used to report partnership and S corporation income and losses.

Q: What is a partnership?

A: A partnership is a business entity where two or more individuals work together and share the profits and losses.

Q: What is an S corporation?

A: An S corporation is a type of corporation that elects to pass corporate income, losses, deductions, and credits through to their shareholders.

Q: Who needs to file Schedule E-2?

A: Partnerships and S corporations in Massachusetts need to file Schedule E-2.

Q: What information is required on Schedule E-2?

A: Schedule E-2 requires information about the partnership or S corporation's income, deductions, and tax credits.

Q: When is Schedule E-2 due?

A: Schedule E-2 is typically due on the same date as the partnership or S corporation tax return, which is usually on or around April 15th.

Q: Is there a penalty for not filing Schedule E-2?

A: Yes, there may be penalties for not filing Schedule E-2 or filing it late. It's important to file all required tax forms on time.

Q: Can I e-file Schedule E-2?

A: Yes, you can e-file Schedule E-2 if you are using tax software that supports electronic filing.

Q: Do I need to include a copy of Schedule E-2 with my tax return?

A: No, you do not need to include a copy of Schedule E-2 with your tax return. However, you should keep it for your records.

Form Details:

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule E-2 by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.