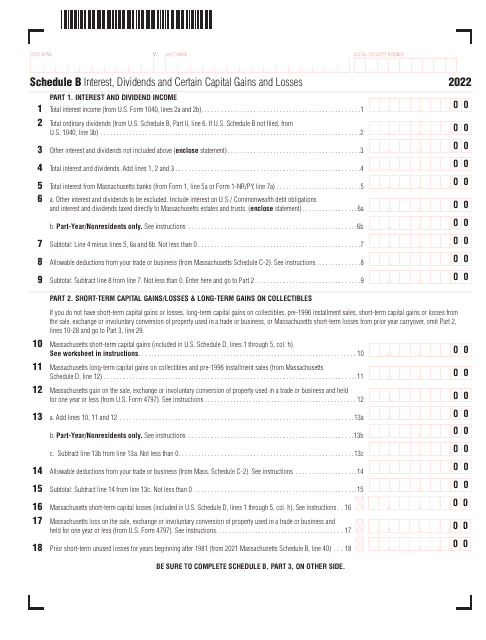

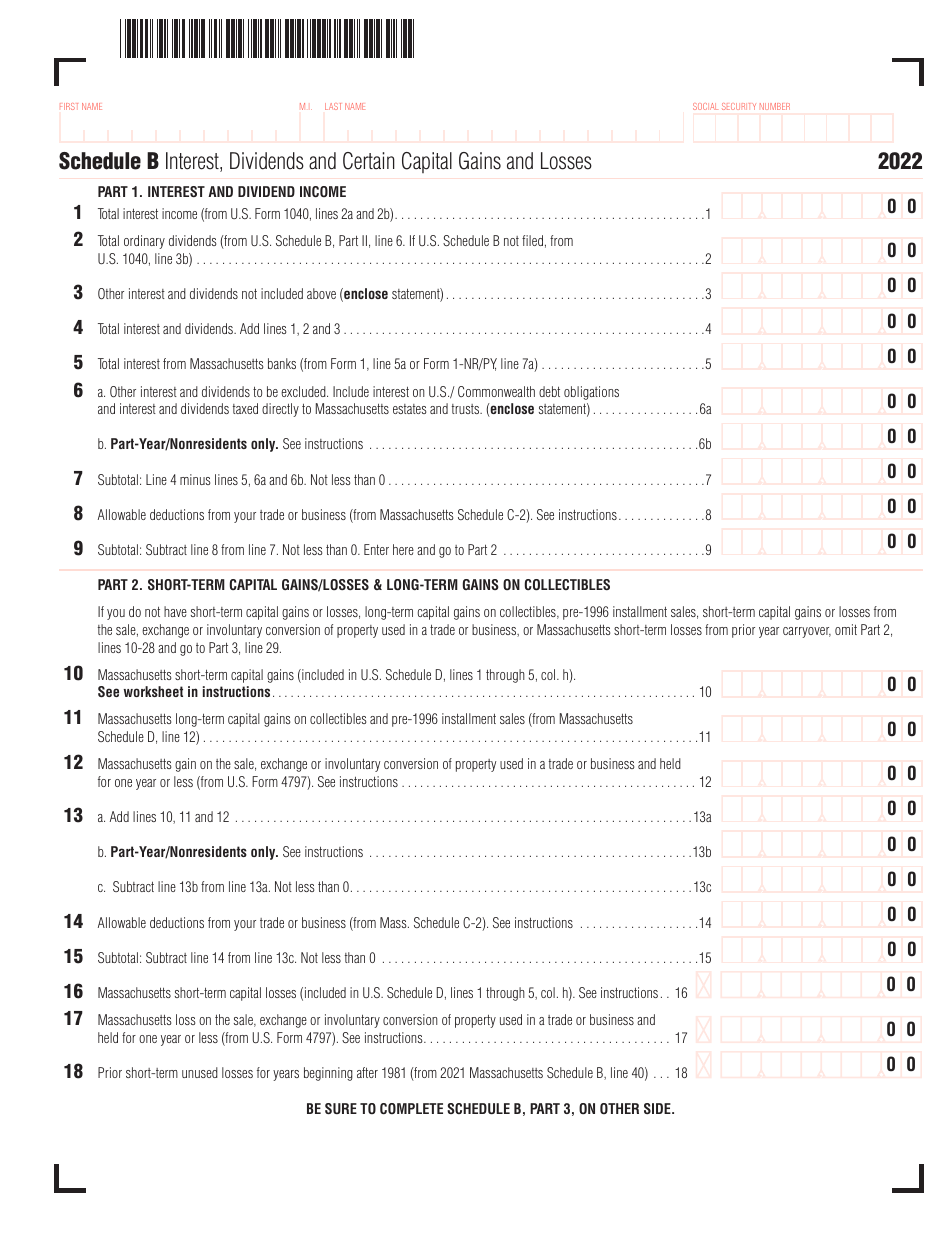

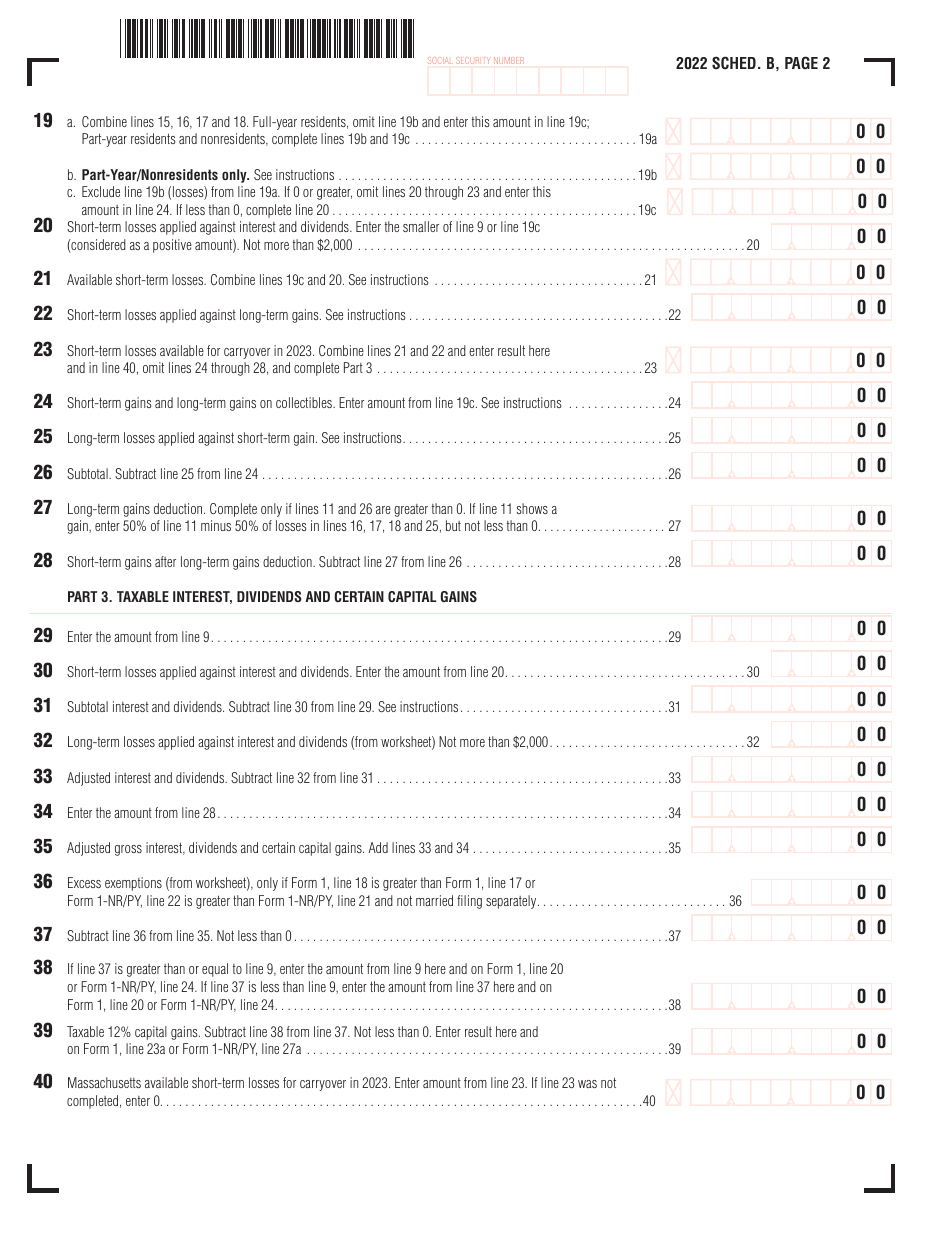

Schedule B Interest, Dividends and Certain Capital Gains and Losses - Massachusetts

What Is Schedule B?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule B?

A: Schedule B is a tax form used in Massachusetts to report interest, dividends, and certain capital gains and losses.

Q: Who needs to file Schedule B?

A: You need to file Schedule B if you earned interest, dividends, or had certain capital gains or losses in Massachusetts.

Q: What types of income should be reported on Schedule B?

A: You should report income from interest, dividends, and certain capital gains or losses on Schedule B.

Q: Is Schedule B the same for federal and state taxes?

A: No, Schedule B is specific to Massachusetts state taxes and may have different requirements than the federal form.

Q: What are the deadlines for filing Schedule B?

A: The deadlines for filing Schedule B vary each year, but generally coincide with the federal income tax deadline.

Q: Do I need to attach any additional documents with Schedule B?

A: If you are reporting certain capital gains or losses, you may need to include additional supporting documents with Schedule B.

Q: What happens if I don't file Schedule B?

A: If you are required to file Schedule B and fail to do so, you may face penalties and interest on any unpaid taxes.

Form Details:

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule B by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.