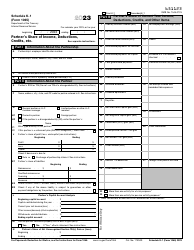

This version of the form is not currently in use and is provided for reference only. Download this version of

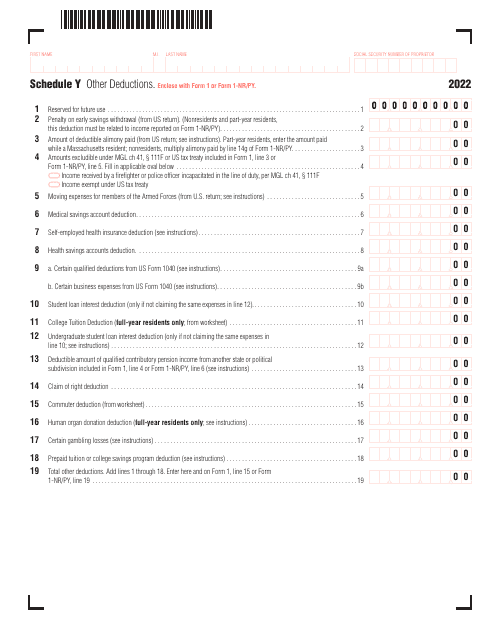

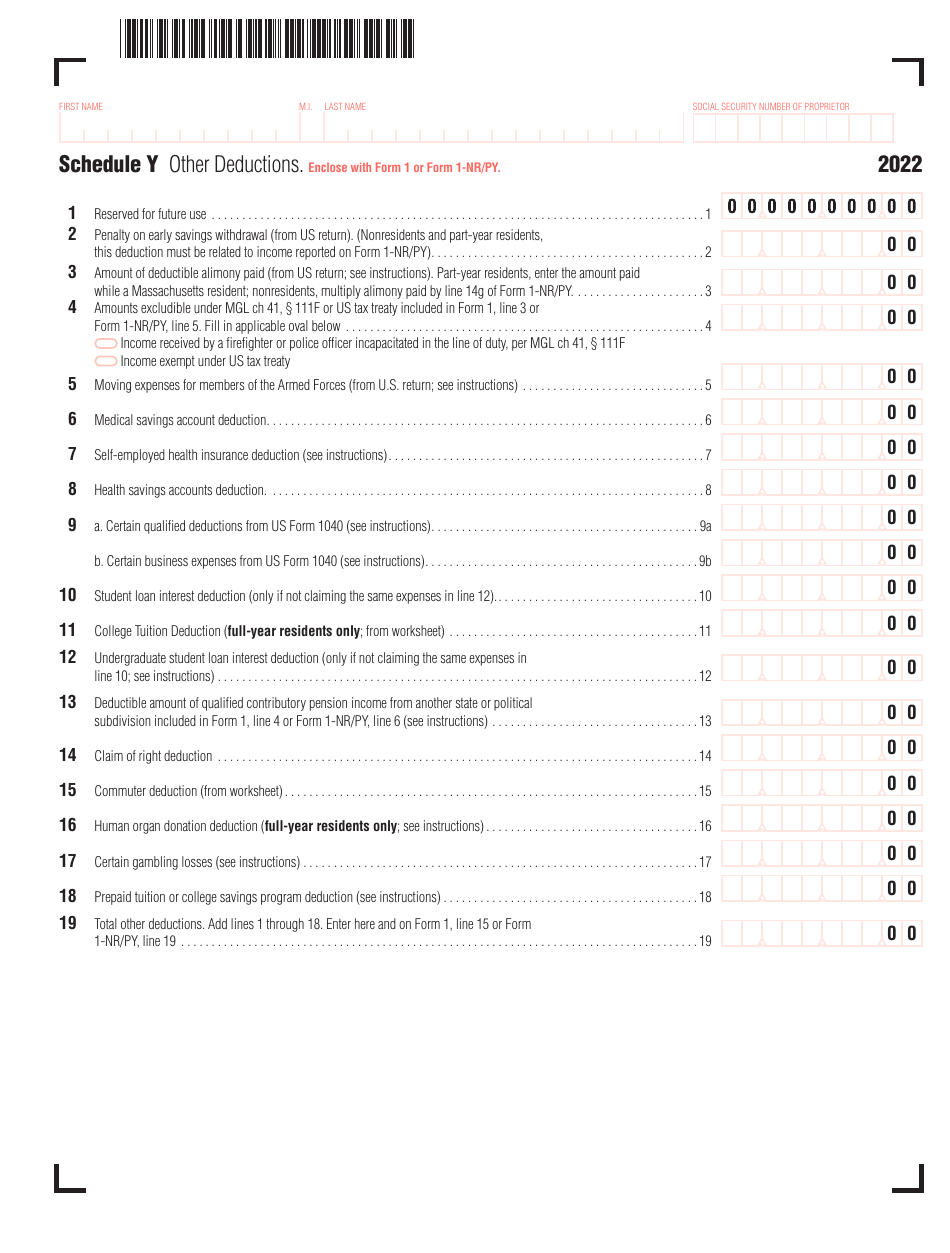

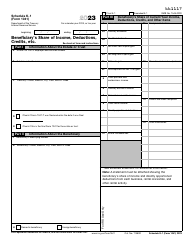

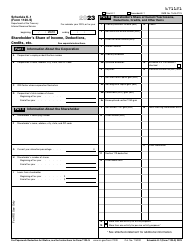

Schedule Y

for the current year.

Schedule Y Other Deductions - Massachusetts

What Is Schedule Y?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule Y Other Deductions?

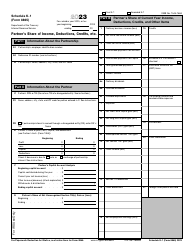

A: Schedule Y Other Deductions is a form used by Massachusetts taxpayers to report various deductions that cannot be claimed on other tax forms.

Q: What types of deductions can be claimed on Schedule Y?

A: Some common deductions that can be claimed on Schedule Y include medical and dental expenses, casualty and theft losses, contributions to certain retirement plans, and certain moving expenses.

Q: Do I need to complete Schedule Y if I don't have any other deductions?

A: No, if you don't have any other deductions to report, you do not need to complete Schedule Y. You can simply skip this form.

Q: When is the deadline to file Schedule Y?

A: The deadline to file Schedule Y is usually the same as the deadline to file your Massachusetts state tax return, which is typically April 15th.

Form Details:

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule Y by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.