This version of the form is not currently in use and is provided for reference only. Download this version of

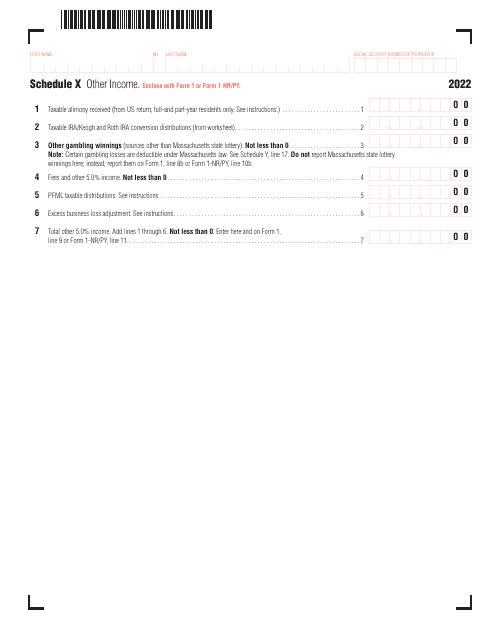

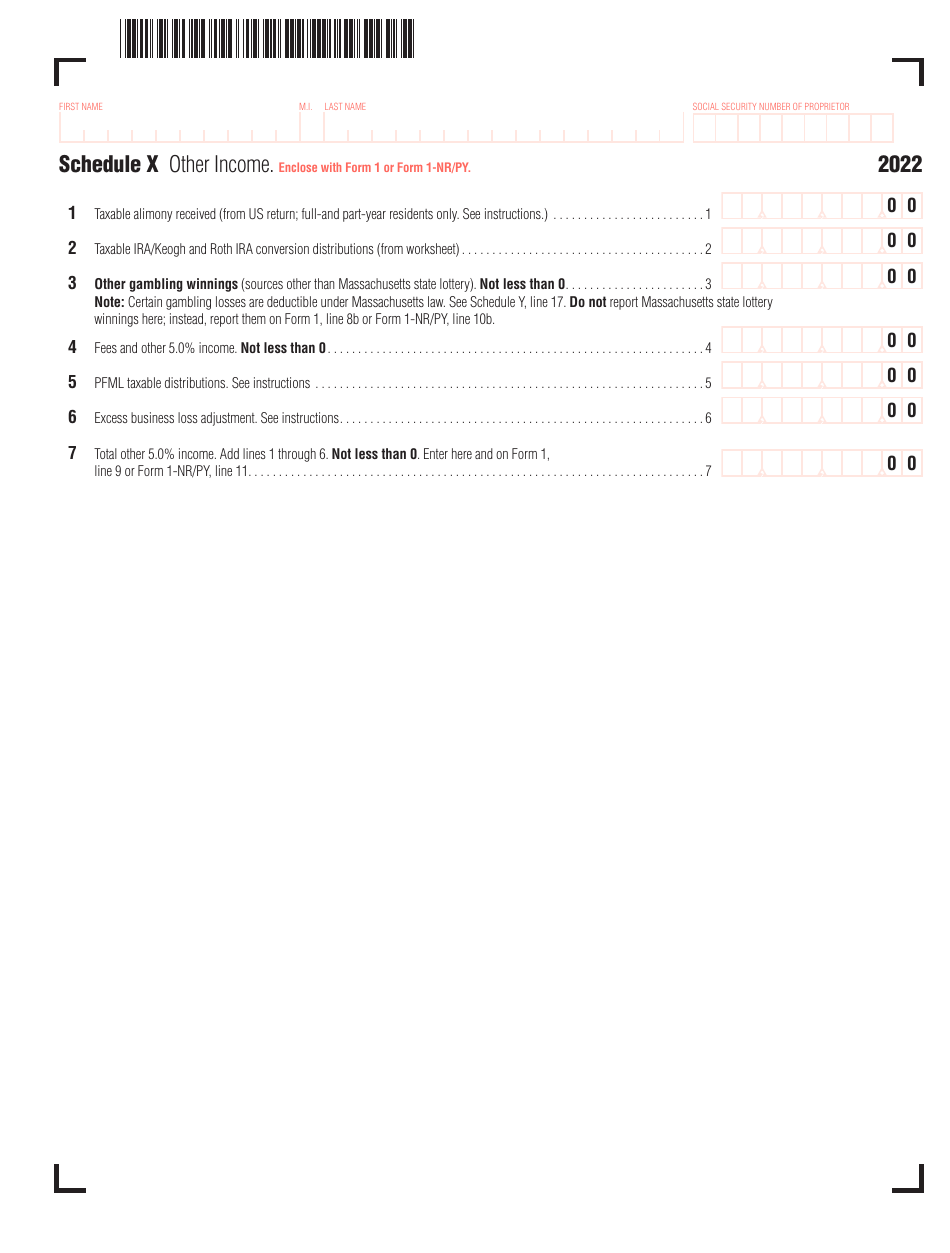

Schedule X

for the current year.

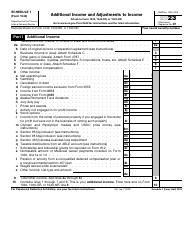

Schedule X Other Income - Massachusetts

What Is Schedule X?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule X Other Income?

A: Schedule X Other Income is a form used in Massachusetts to report income that is not reported on other tax schedules.

Q: What types of income should be reported on Schedule X Other Income?

A: Examples of income that should be reported on Schedule X Other Income include rental income, gambling winnings, and income from out-of-state sources.

Q: Do I need to file Schedule X Other Income if I don't have any other income?

A: No, you only need to file Schedule X Other Income if you have income that is not reported on other tax schedules.

Q: When is the deadline to file Schedule X Other Income?

A: The deadline to file Schedule X Other Income is the same as the deadline to file your Massachusetts tax return, which is typically April 15th.

Form Details:

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule X by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.