This version of the form is not currently in use and is provided for reference only. Download this version of

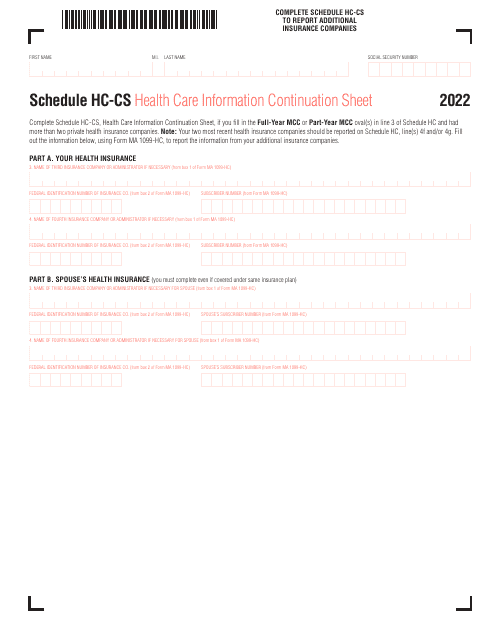

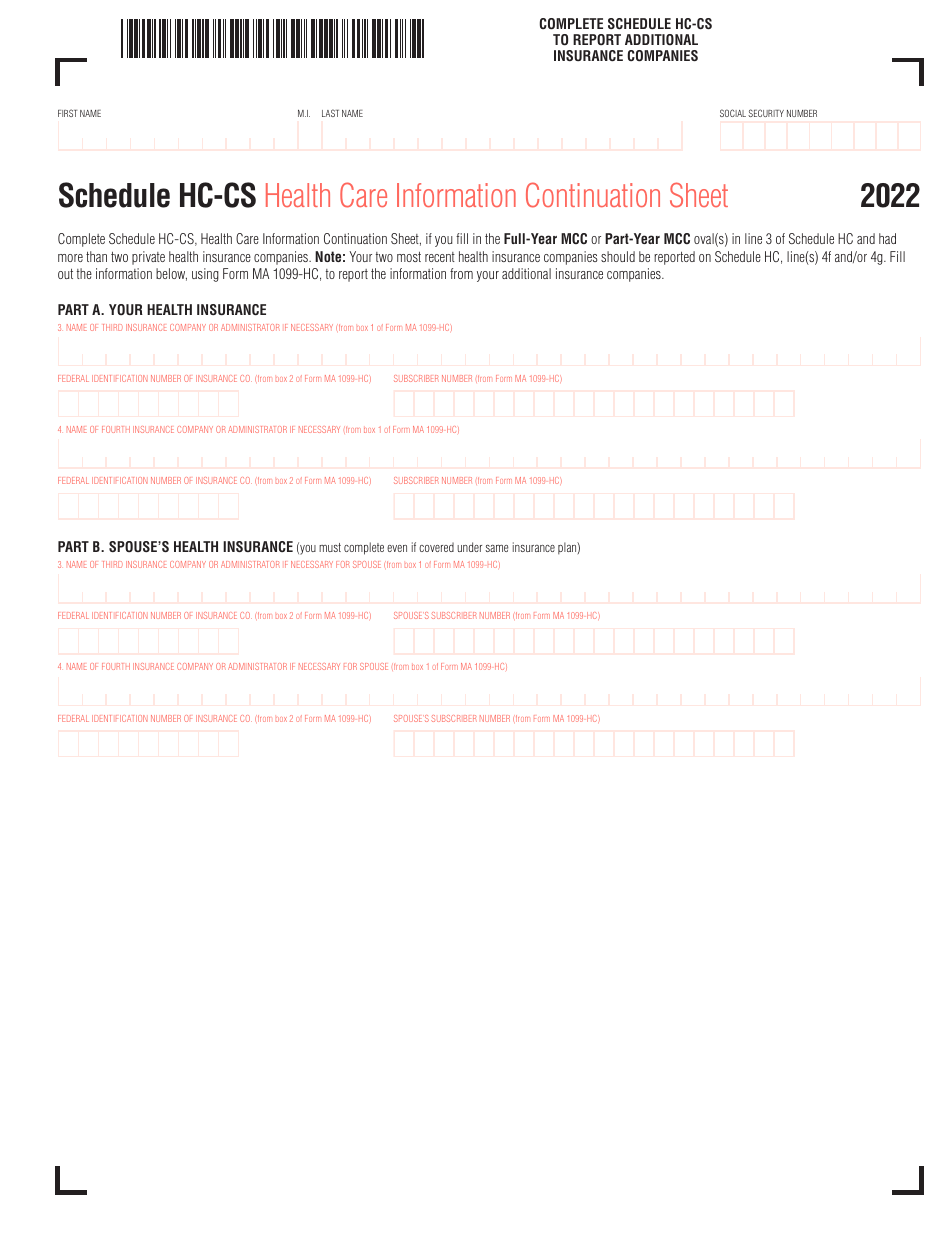

Schedule HC-CS

for the current year.

Schedule HC-CS Health Care Information Continuation Sheet - Massachusetts

What Is Schedule HC-CS?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule HC-CS?

A: Schedule HC-CS is a Health Care Information Continuation Sheet that is specific to Massachusetts.

Q: What is the purpose of Schedule HC-CS?

A: Schedule HC-CS is used to provide additional information about your health care coverage and eligibility in Massachusetts.

Q: Who needs to fill out Schedule HC-CS?

A: Residents of Massachusetts who are required to complete Schedule HC need to fill out Schedule HC-CS if they have additional health care coverage information to report.

Q: What information is required on Schedule HC-CS?

A: Schedule HC-CS requires information about health care coverage, eligibility, and employer-sponsored insurance plans.

Q: When is Schedule HC-CS due?

A: Schedule HC-CS is typically due when you file your annual state tax return in Massachusetts, which is generally on or before April 15th.

Q: Are there any penalties for not filing Schedule HC-CS?

A: Failure to file Schedule HC-CS or providing incomplete or inaccurate information may result in penalties or delays in processing your tax return.

Q: Can I get assistance in filling out Schedule HC-CS?

A: Yes, you can seek assistance from a tax professional or refer to the instructions provided with the form for guidance.

Q: Is Schedule HC-CS only applicable to residents of Massachusetts?

A: Yes, Schedule HC-CS is specific to Massachusetts residents and is not required for residents of other states.

Form Details:

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule HC-CS by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.