This version of the form is not currently in use and is provided for reference only. Download this version of

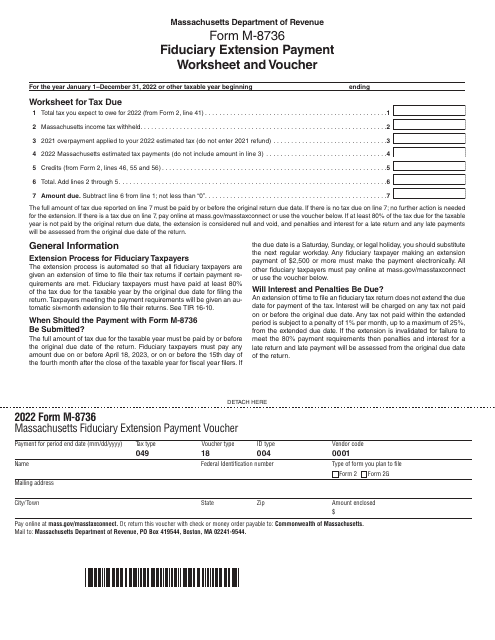

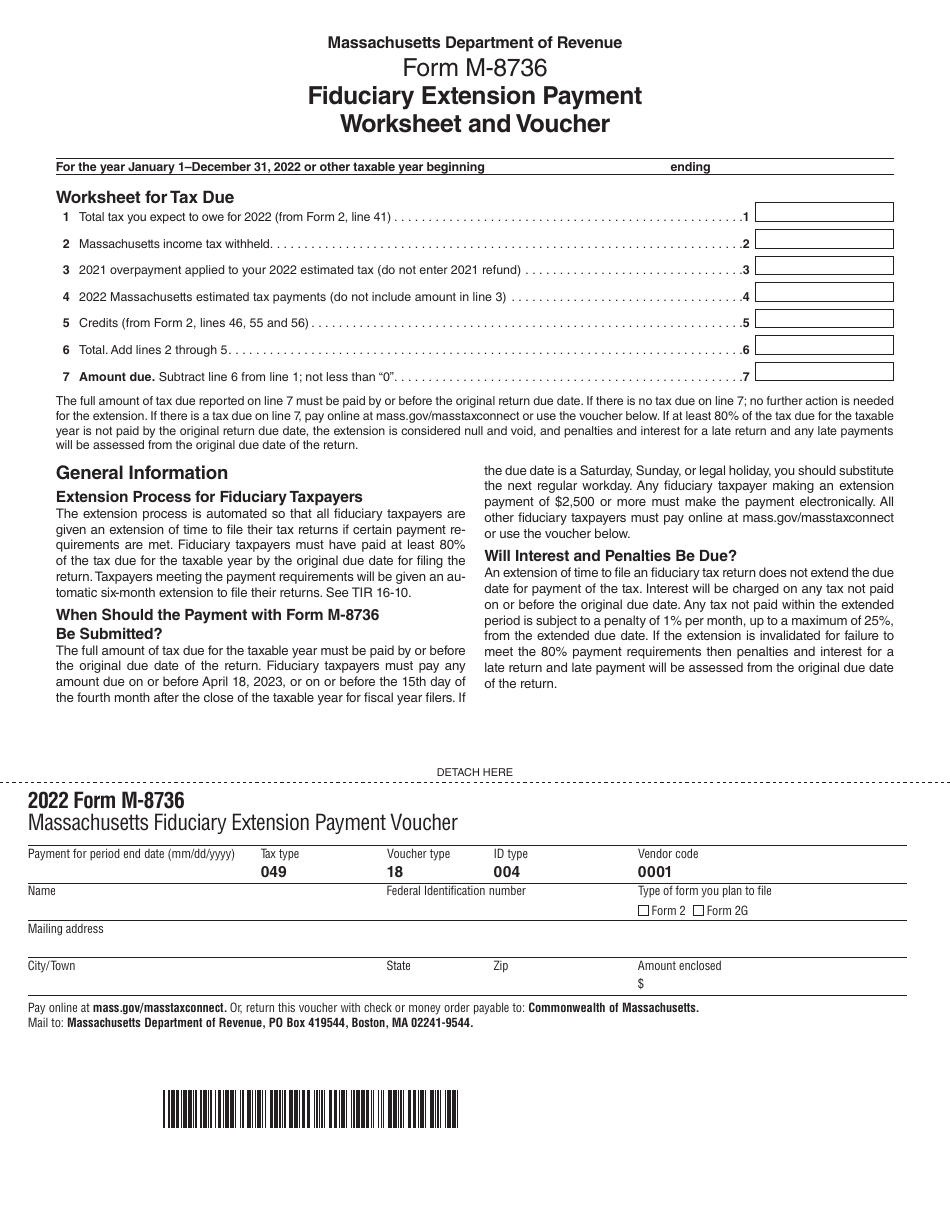

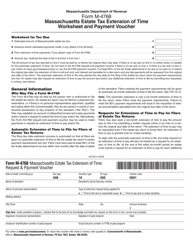

Form M-8736

for the current year.

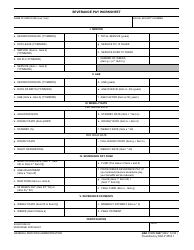

Form M-8736 Fiduciary Extension Payment Worksheet and Voucher - Massachusetts

What Is Form M-8736?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form M-8736?

A: Form M-8736 is the Fiduciary Extension Payment Worksheet and Voucher for Massachusetts.

Q: What is the purpose of Form M-8736?

A: The purpose of Form M-8736 is to calculate the estimated tax payment and extension payment for fiduciaries in Massachusetts.

Q: Who needs to file Form M-8736?

A: Fiduciaries in Massachusetts who need to make an estimated tax payment and request an extension of time to file their tax return.

Q: How do I fill out Form M-8736?

A: You need to calculate your estimated tax payment and extension payment, provide your taxpayer information, and include any required attachments.

Q: When is the due date for Form M-8736?

A: The due date for Form M-8736 is the same as the due date for your Massachusetts fiduciary tax return, usually April 15th.

Q: Are there any penalties for not filing Form M-8736?

A: Yes, there may be penalties for failing to make the estimated tax payment or request an extension by the due date.

Form Details:

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form M-8736 by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.