This version of the form is not currently in use and is provided for reference only. Download this version of

Form PA-25

for the current year.

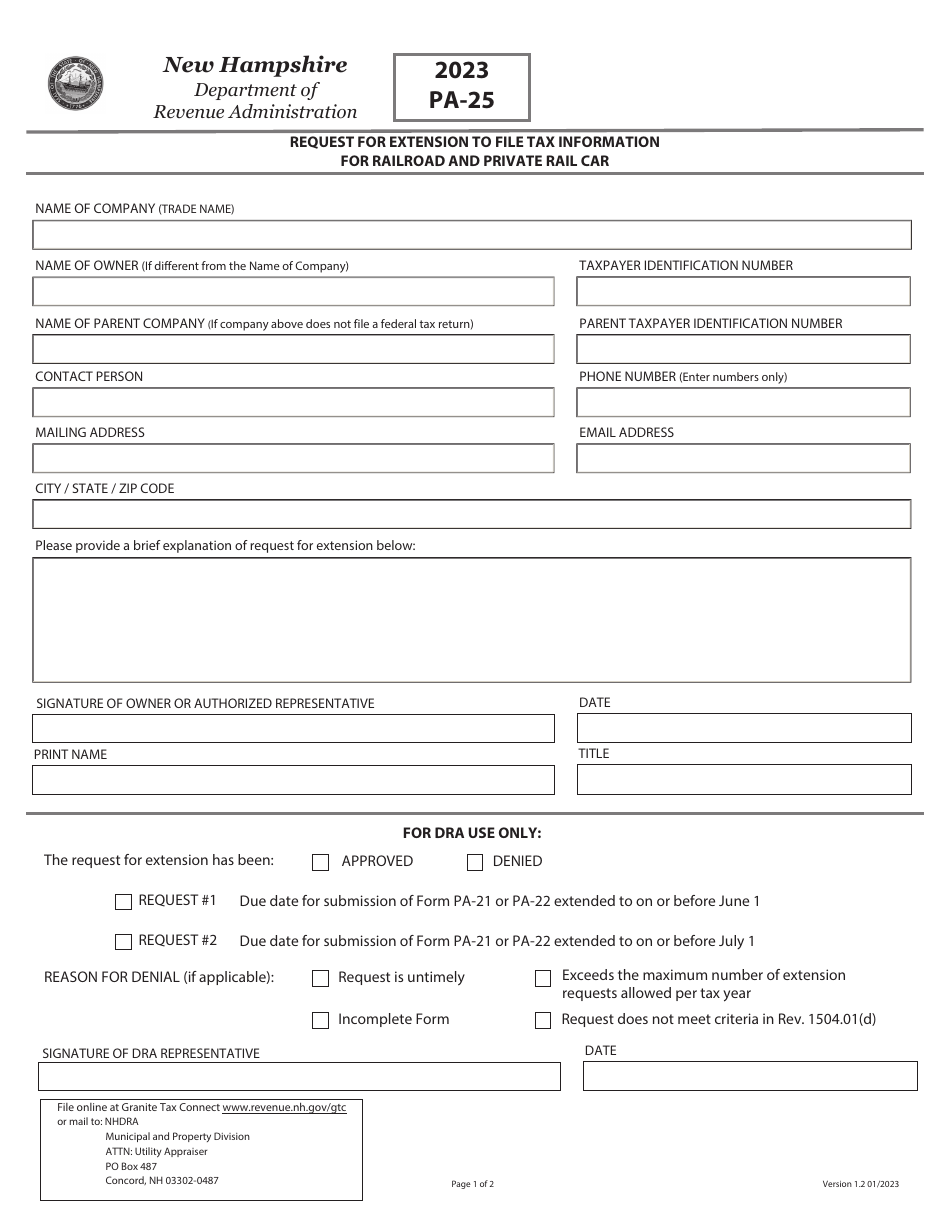

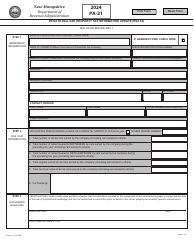

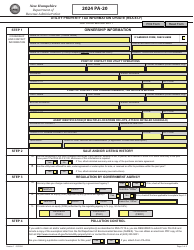

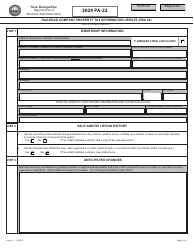

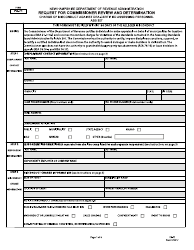

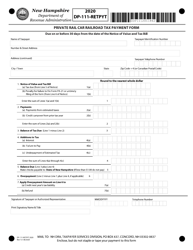

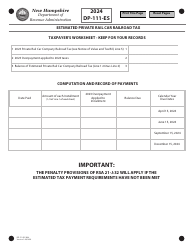

Form PA-25 Request for Extension to File Tax Information for Railroad and Private Rail Car - New Hampshire

What Is Form PA-25?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-25?

A: Form PA-25 is a request for extension to file tax information for railroad and private rail car in New Hampshire.

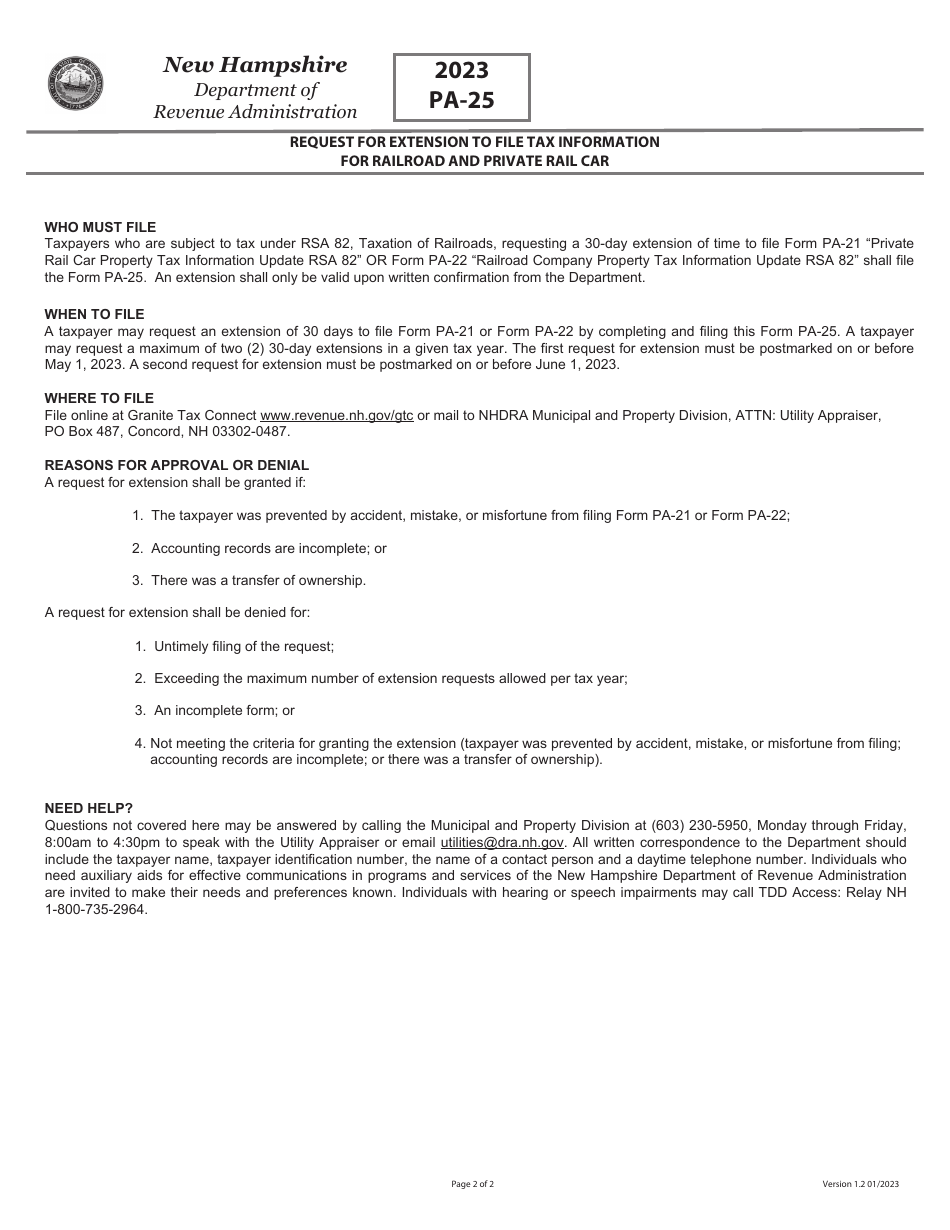

Q: Who needs to file Form PA-25?

A: Railroad companies and owners of private rail cars in New Hampshire who need an extension to file their tax information.

Q: What is the purpose of Form PA-25?

A: The purpose of Form PA-25 is to request additional time to file tax information for railroad and private rail car purposes.

Q: How do I file Form PA-25?

A: Form PA-25 can be filed by mail to the New Hampshire Department of Revenue Administration.

Q: Is there a deadline for filing Form PA-25?

A: Yes, Form PA-25 must be filed on or before the original due date of the return.

Q: Are there any penalties for late filing?

A: Yes, late filing may result in penalties and interest charges.

Form Details:

- Released on January 1, 2023;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-25 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.