This version of the form is not currently in use and is provided for reference only. Download this version of

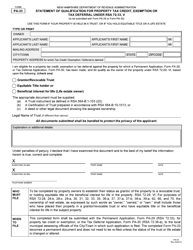

Form PA-22

for the current year.

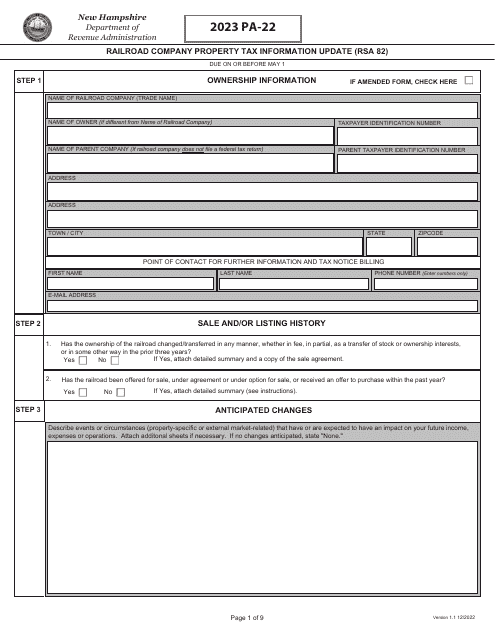

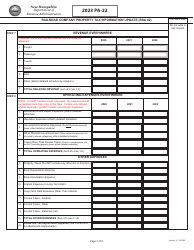

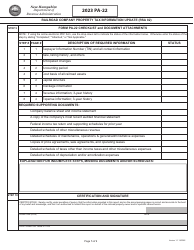

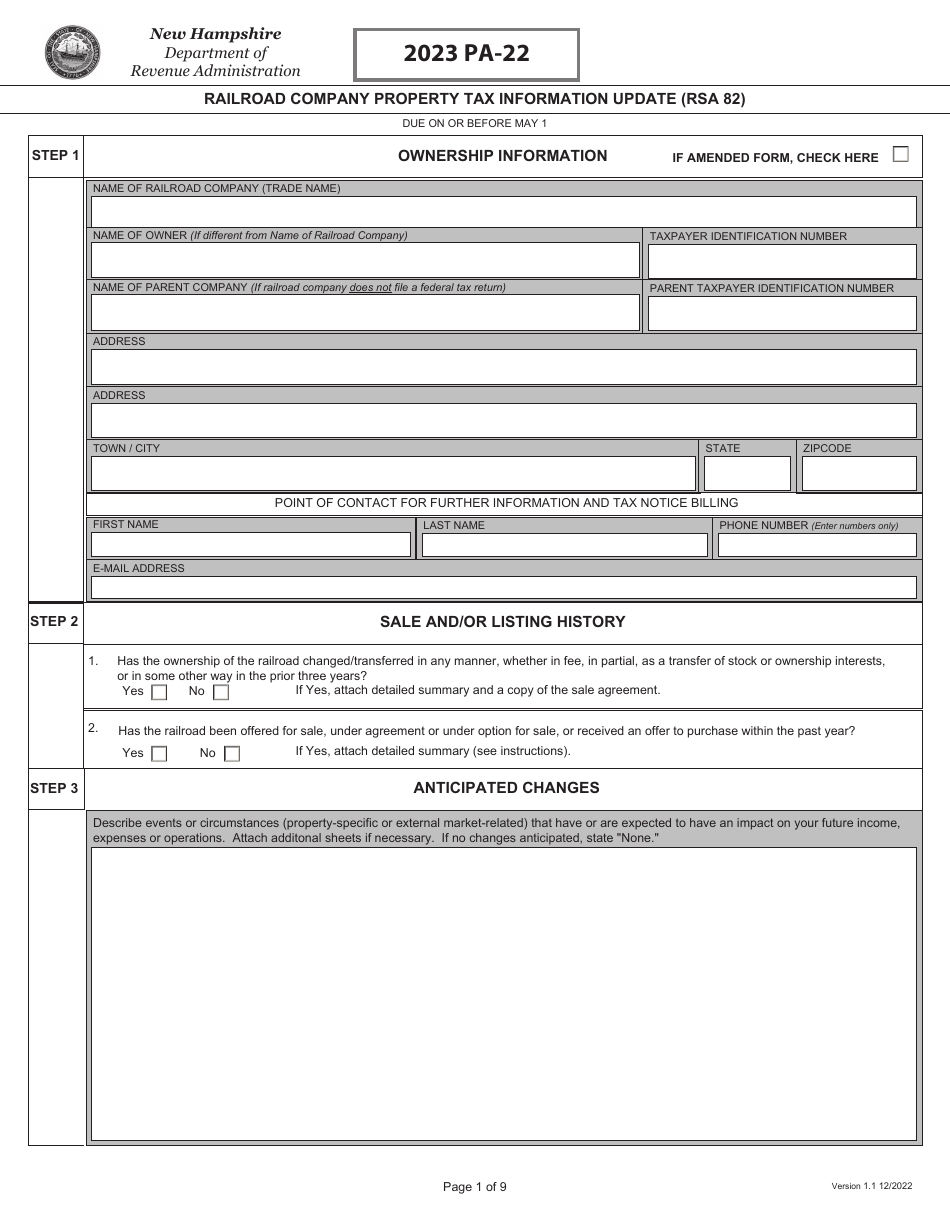

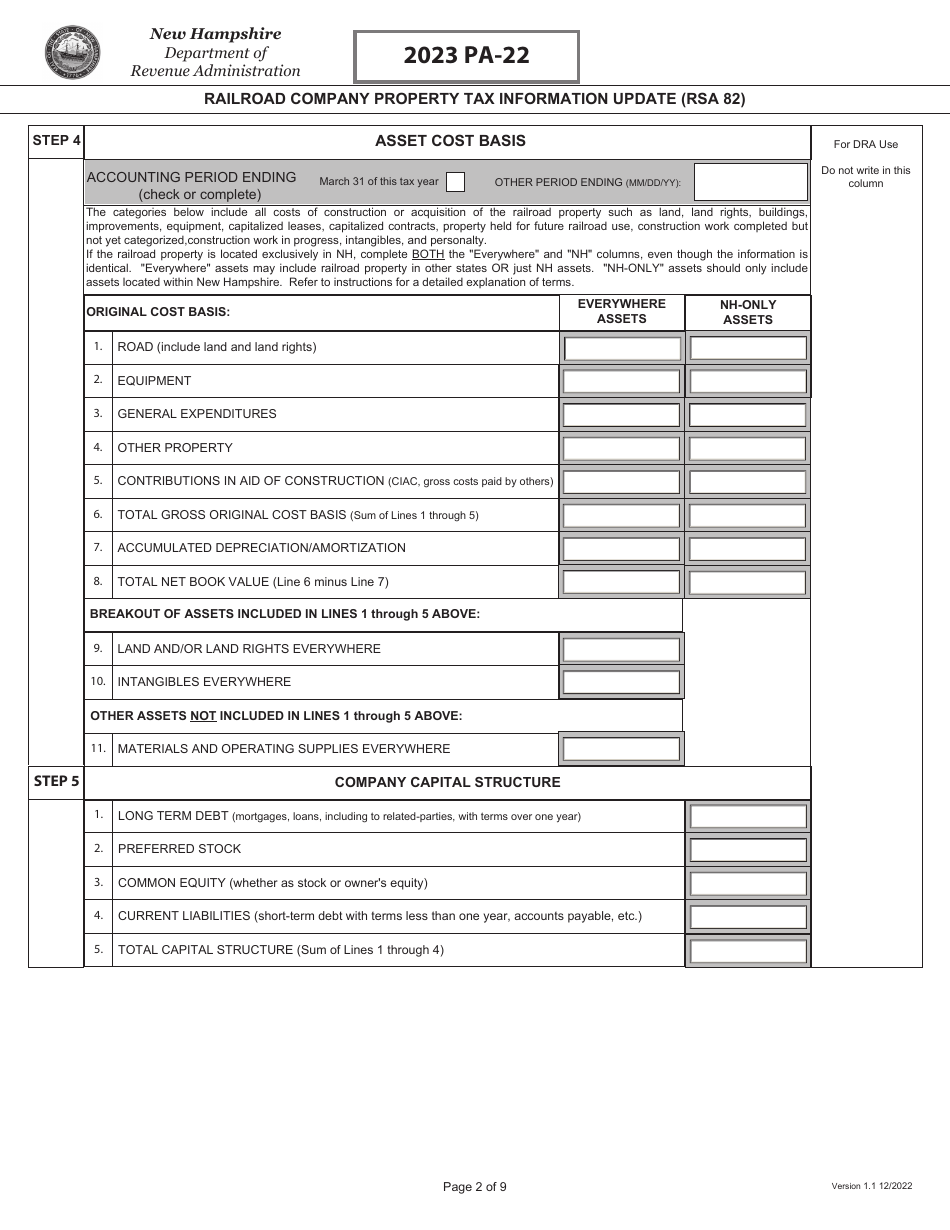

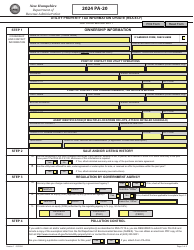

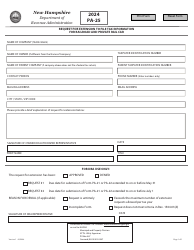

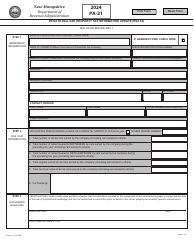

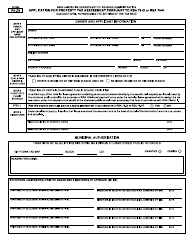

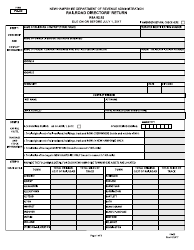

Form PA-22 Railroad Company Property Tax Information Update (Rsa 82) - New Hampshire

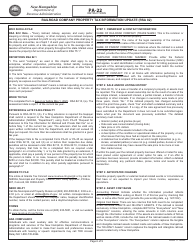

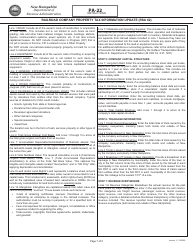

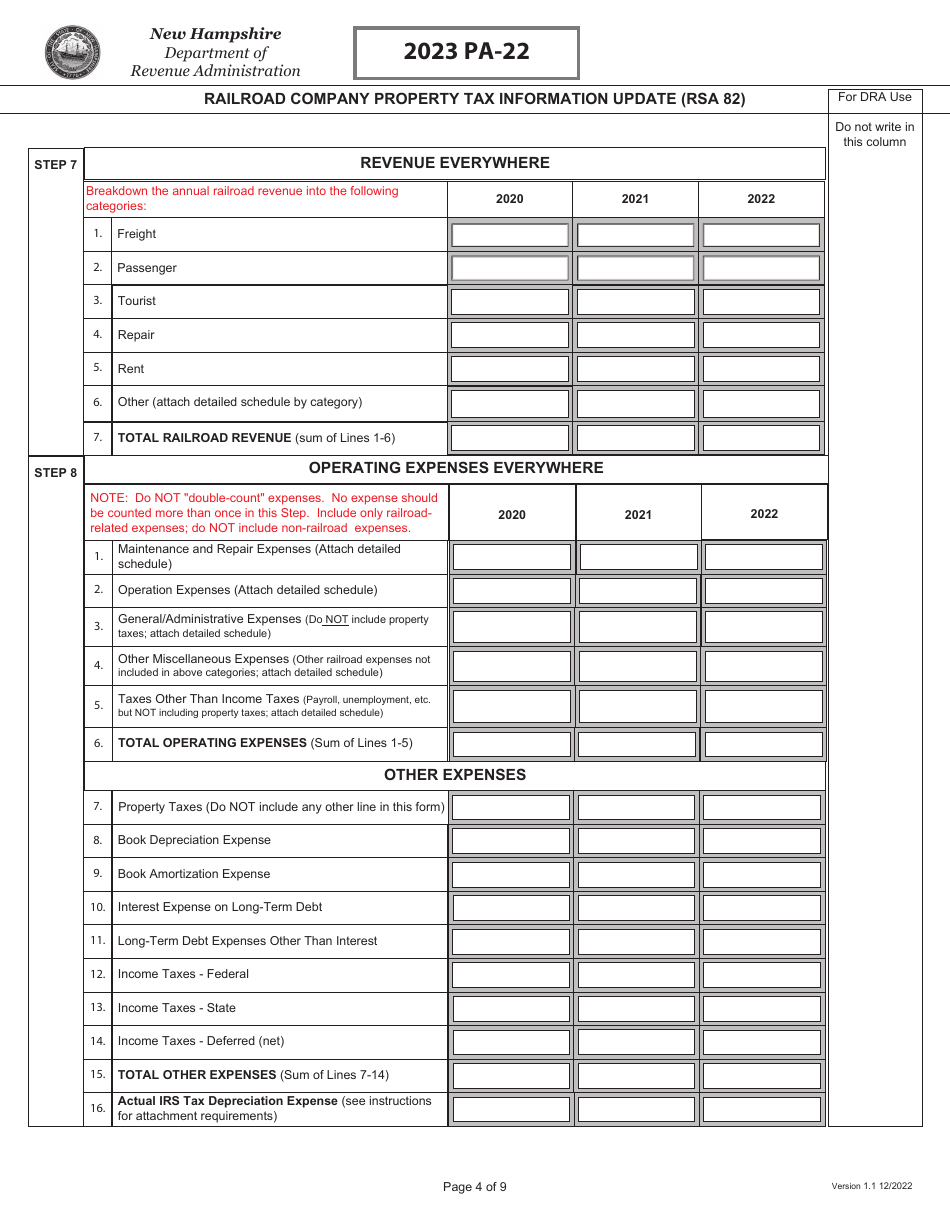

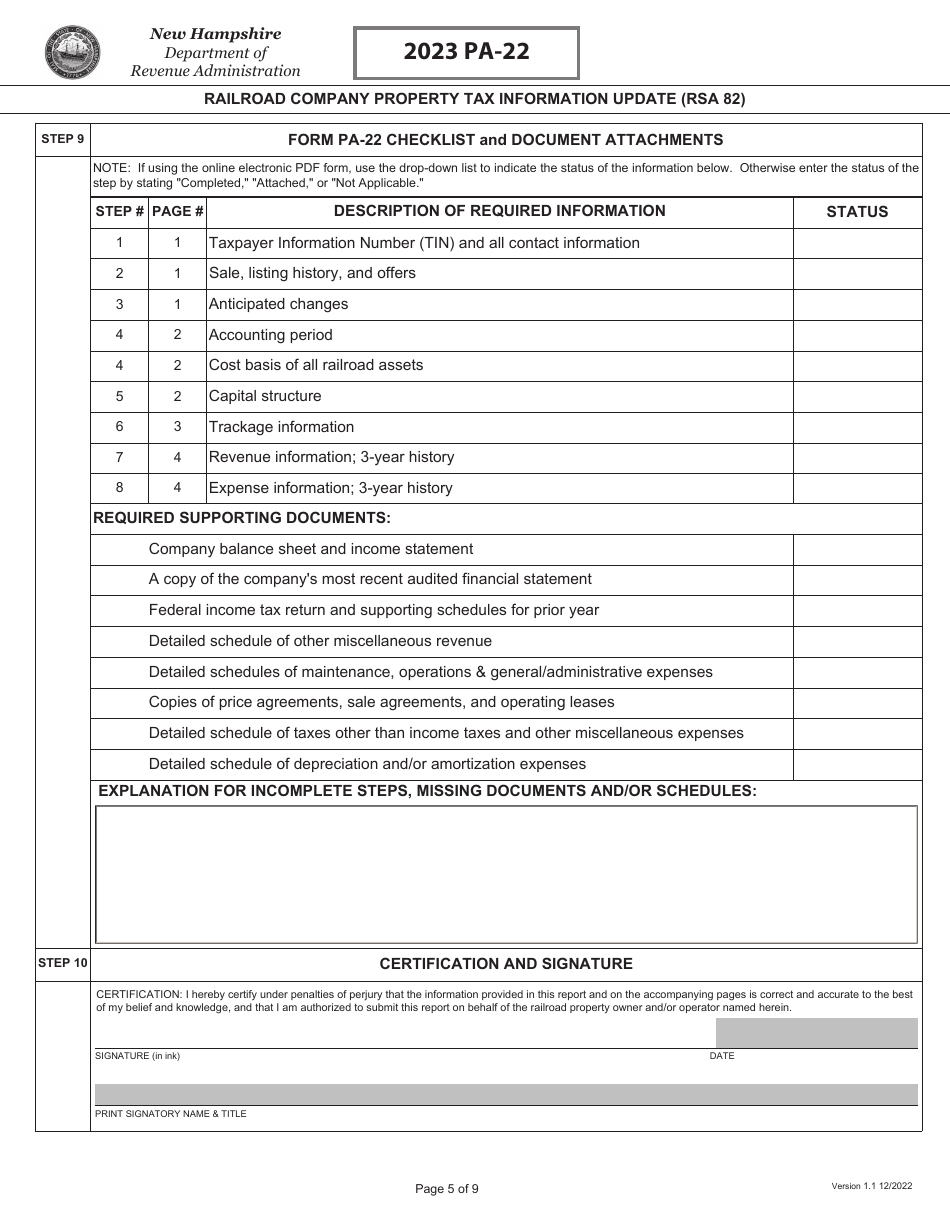

What Is Form PA-22?

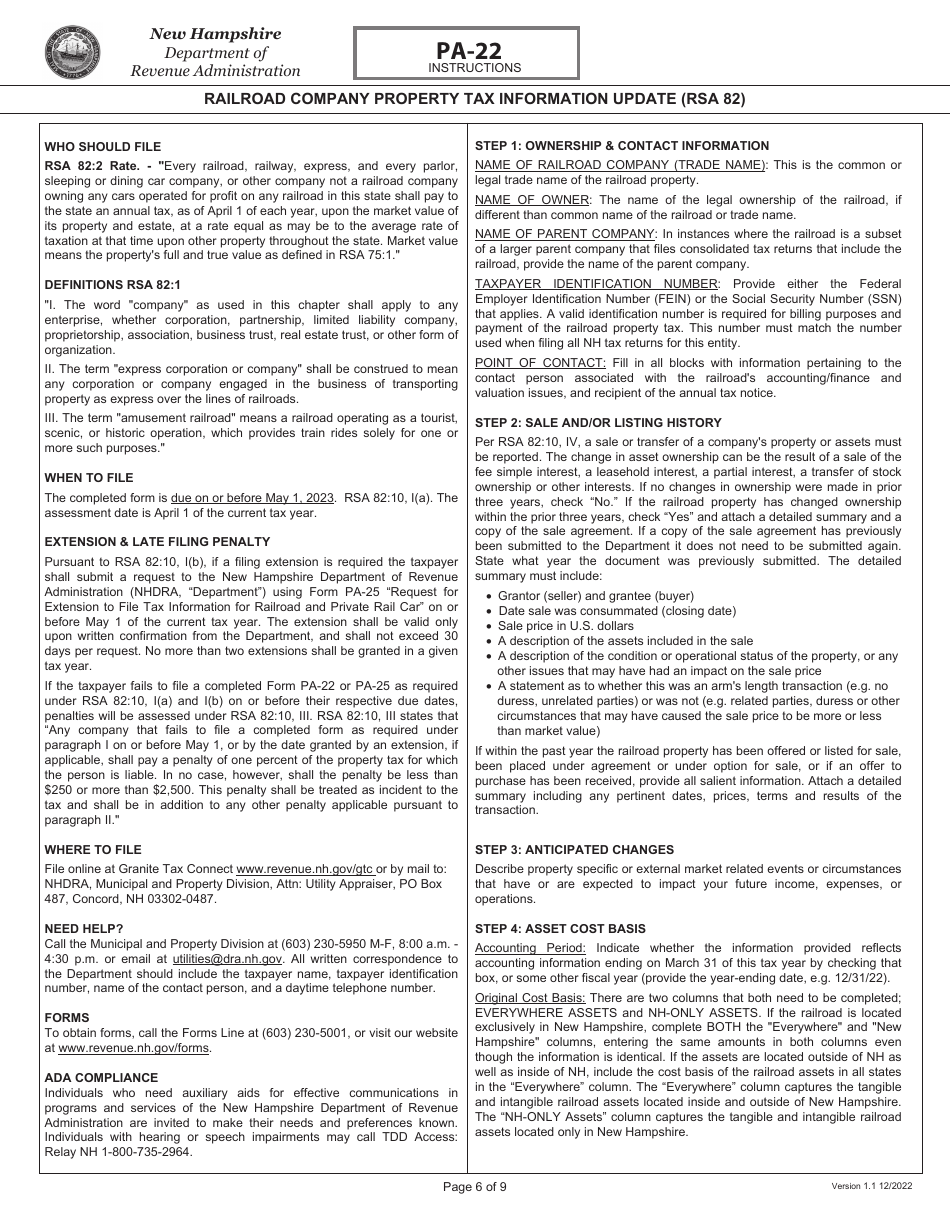

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is PA-22?

A: PA-22 is a form used to update property tax information for railroad companies in New Hampshire.

Q: Who needs to file form PA-22?

A: Railroad companies in New Hampshire need to file form PA-22.

Q: What is the purpose of form PA-22?

A: Form PA-22 is used to update property tax information for railroad companies in New Hampshire.

Q: Is form PA-22 specific to railroad companies?

A: Yes, form PA-22 is specific to railroad companies in New Hampshire.

Q: What is RSA 82?

A: RSA 82 refers to the section of the New Hampshire state law that relates to property tax for railroad companies.

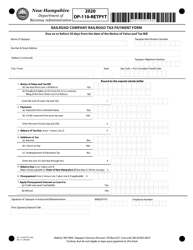

Q: Are there any deadlines for filing form PA-22?

A: Yes, the deadlines for filing form PA-22 are determined by the New Hampshire Department of Revenue Administration.

Q: Is form PA-22 mandatory?

A: Yes, railroad companies in New Hampshire are required to file form PA-22 to update their property tax information.

Form Details:

- Released on December 1, 2022;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-22 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.