This version of the form is not currently in use and is provided for reference only. Download this version of

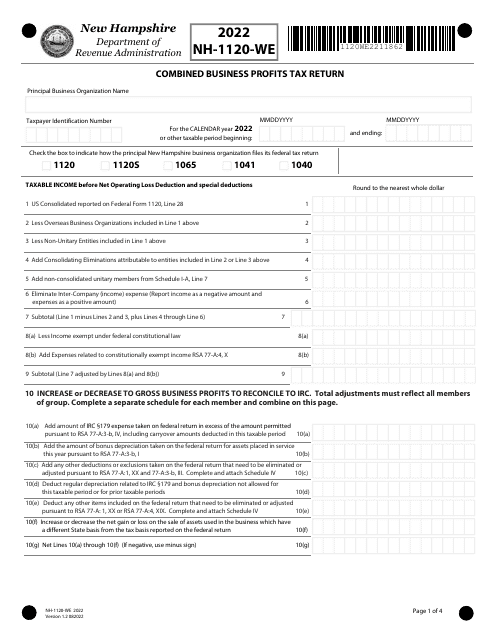

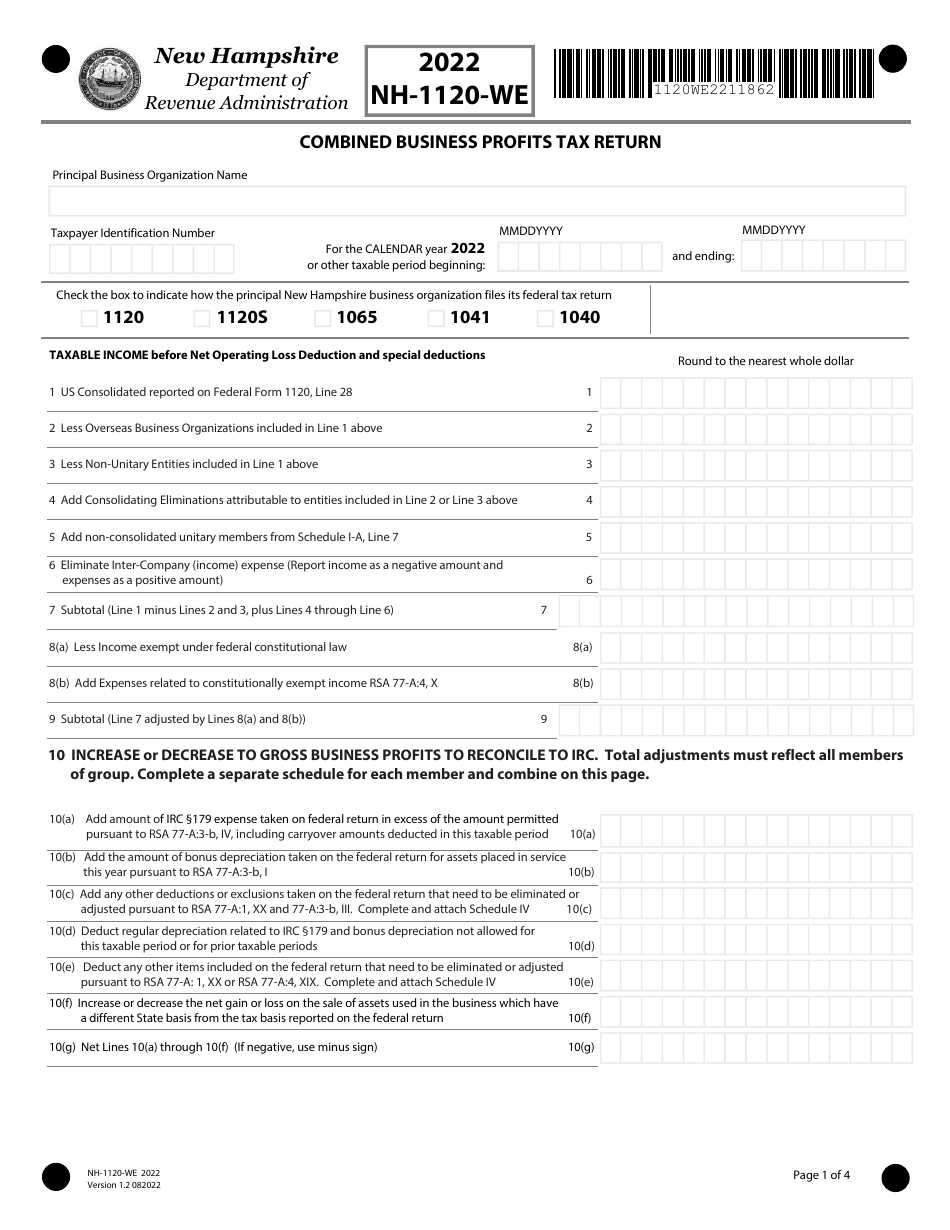

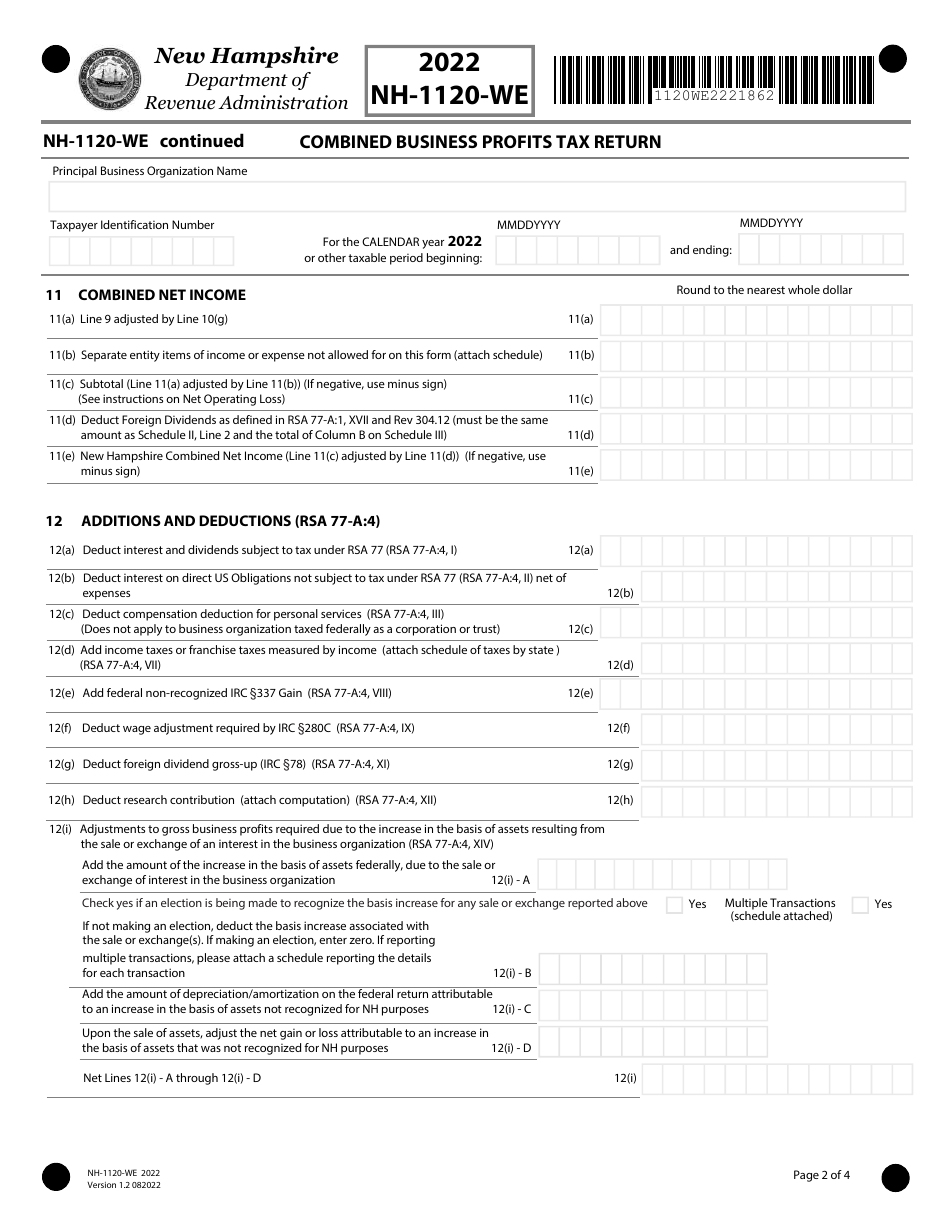

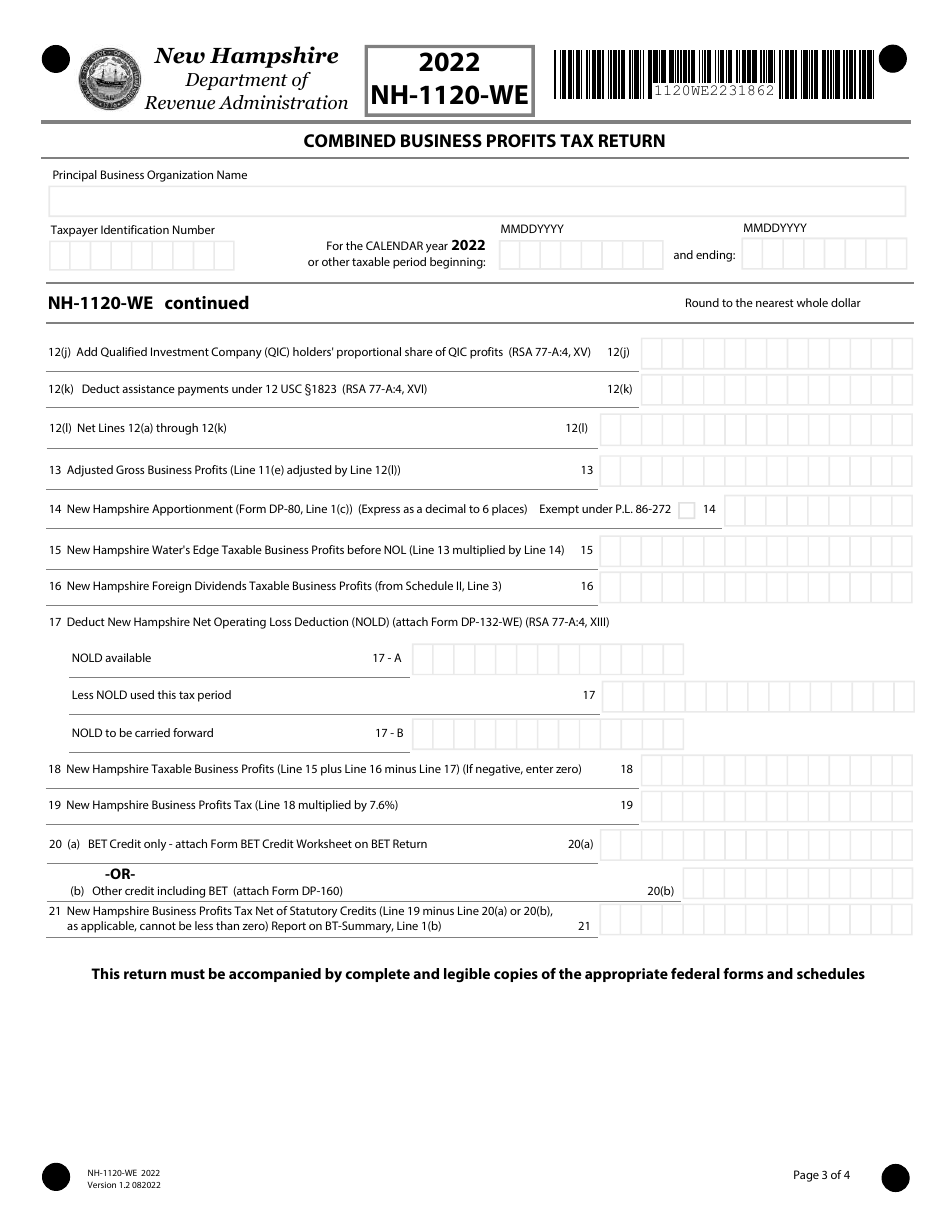

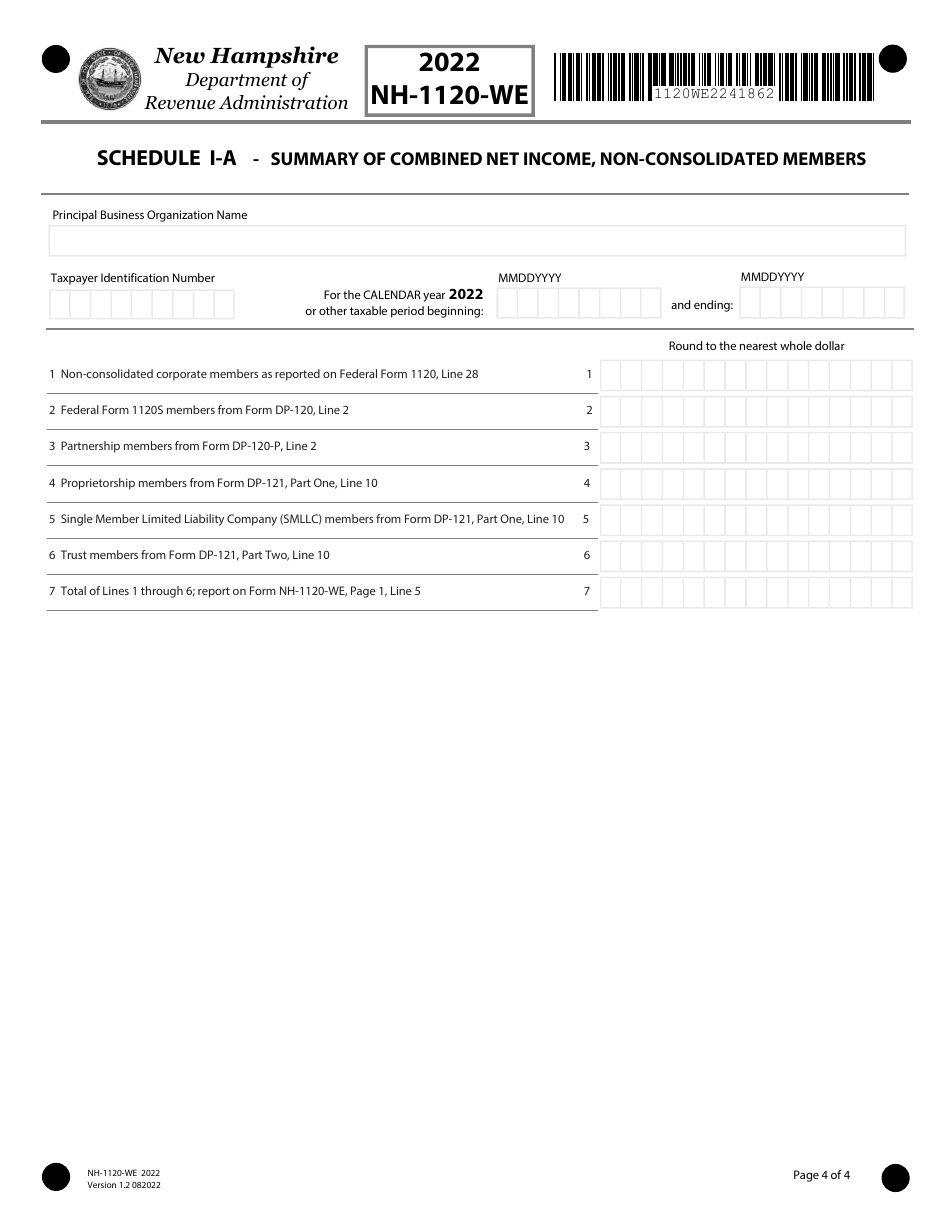

Form NH-1120-WE

for the current year.

Form NH-1120-WE Combined Business Profits Tax Return - New Hampshire

What Is Form NH-1120-WE?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form NH-1120-WE?

A: Form NH-1120-WE is the Combined Business Profits Tax Return for businesses in New Hampshire.

Q: Who needs to file form NH-1120-WE?

A: Businesses that operate in New Hampshire and make a profit need to file form NH-1120-WE.

Q: What is the purpose of form NH-1120-WE?

A: The purpose of form NH-1120-WE is for businesses to report and pay their income taxes to the state of New Hampshire.

Q: When is the deadline to file form NH-1120-WE?

A: The deadline to file form NH-1120-WE is usually on or before the 15th day of the fourth month following the end of the tax year.

Q: Are there any penalties for late filing of form NH-1120-WE?

A: Yes, there may be penalties for late filing of form NH-1120-WE. It is important to file the return on time to avoid any penalties or interest charges.

Form Details:

- Released on August 1, 2022;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NH-1120-WE by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.