This version of the form is not currently in use and is provided for reference only. Download this version of

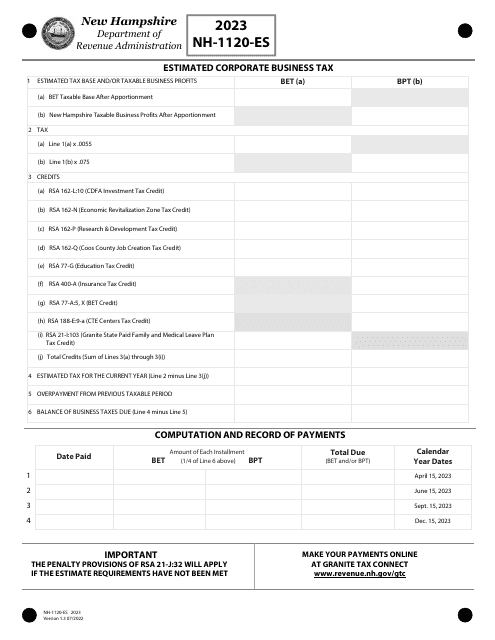

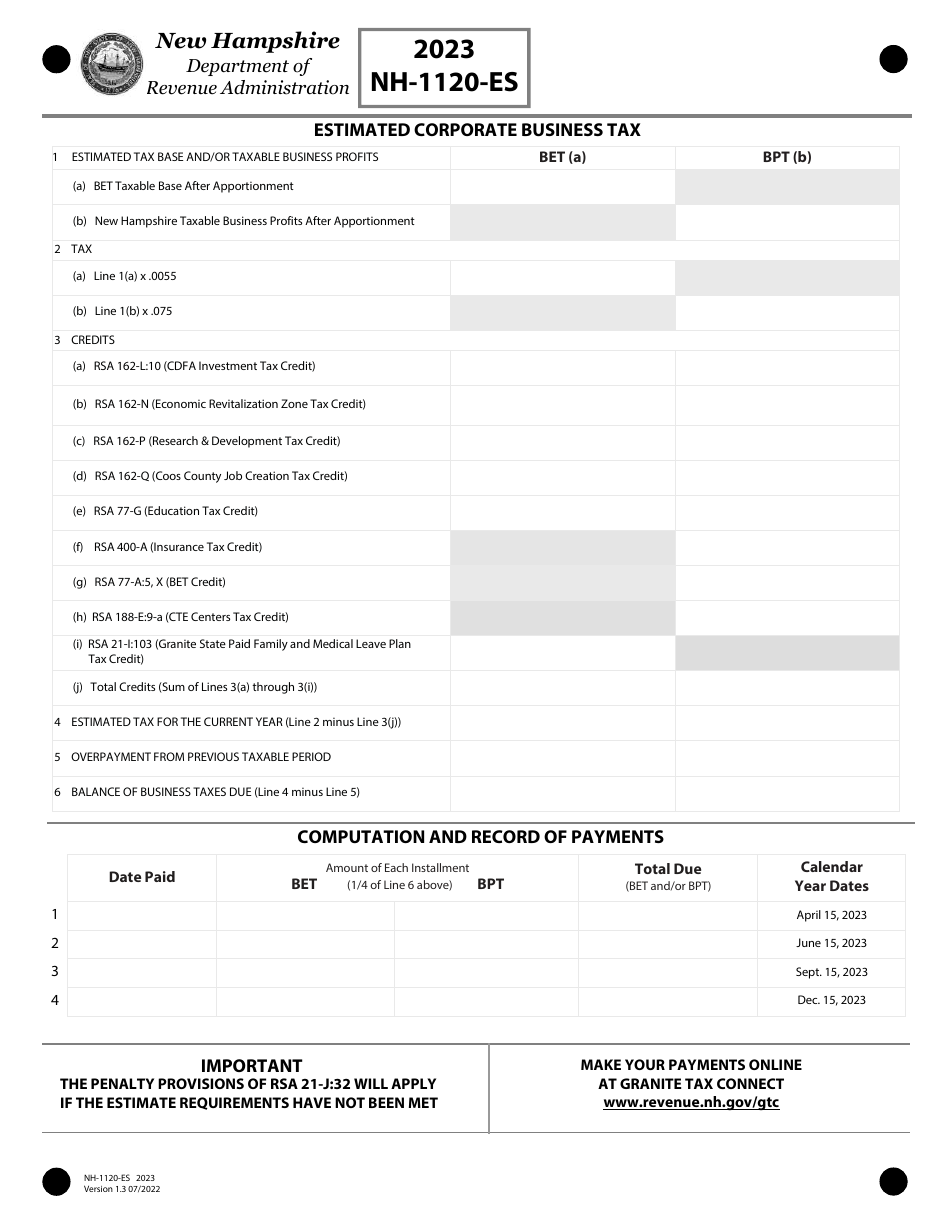

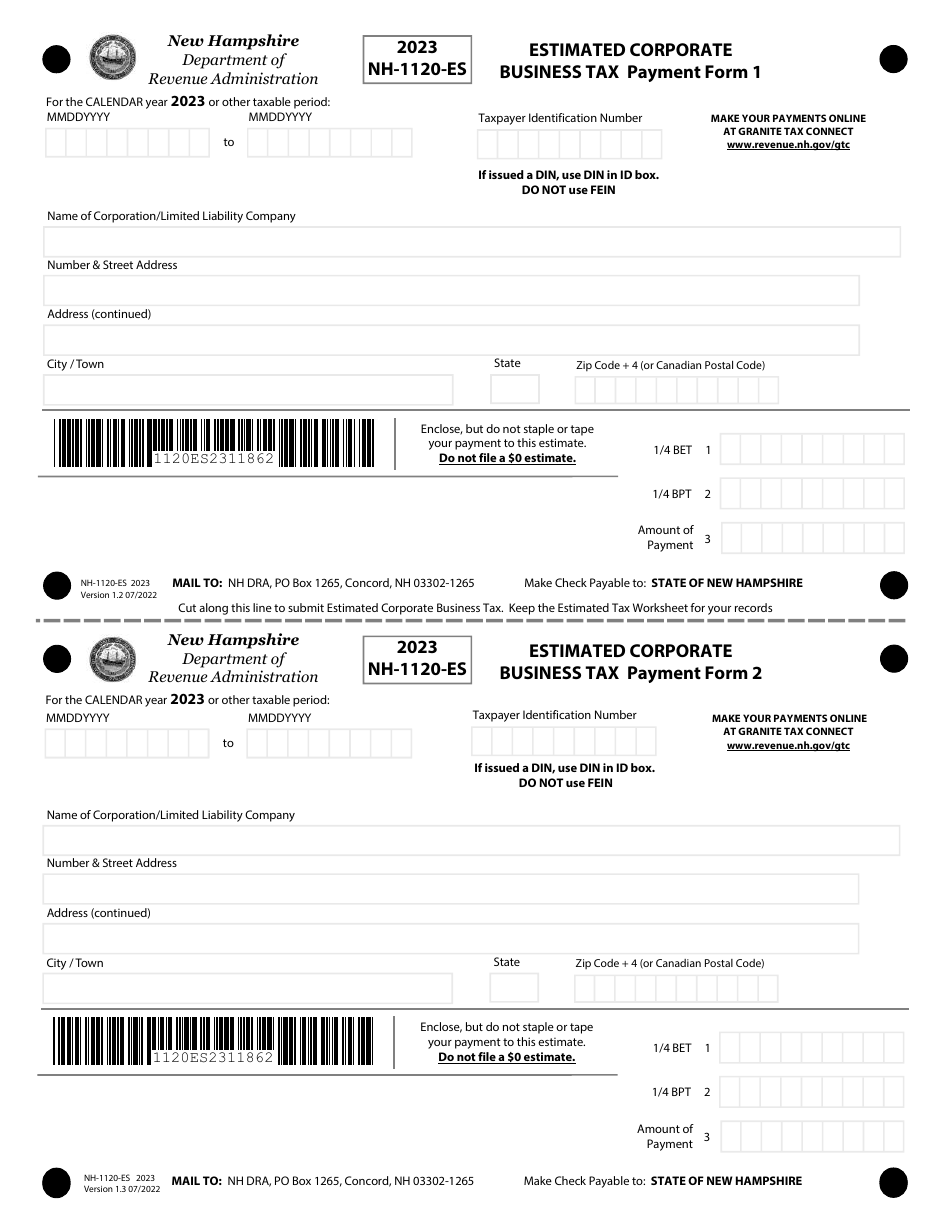

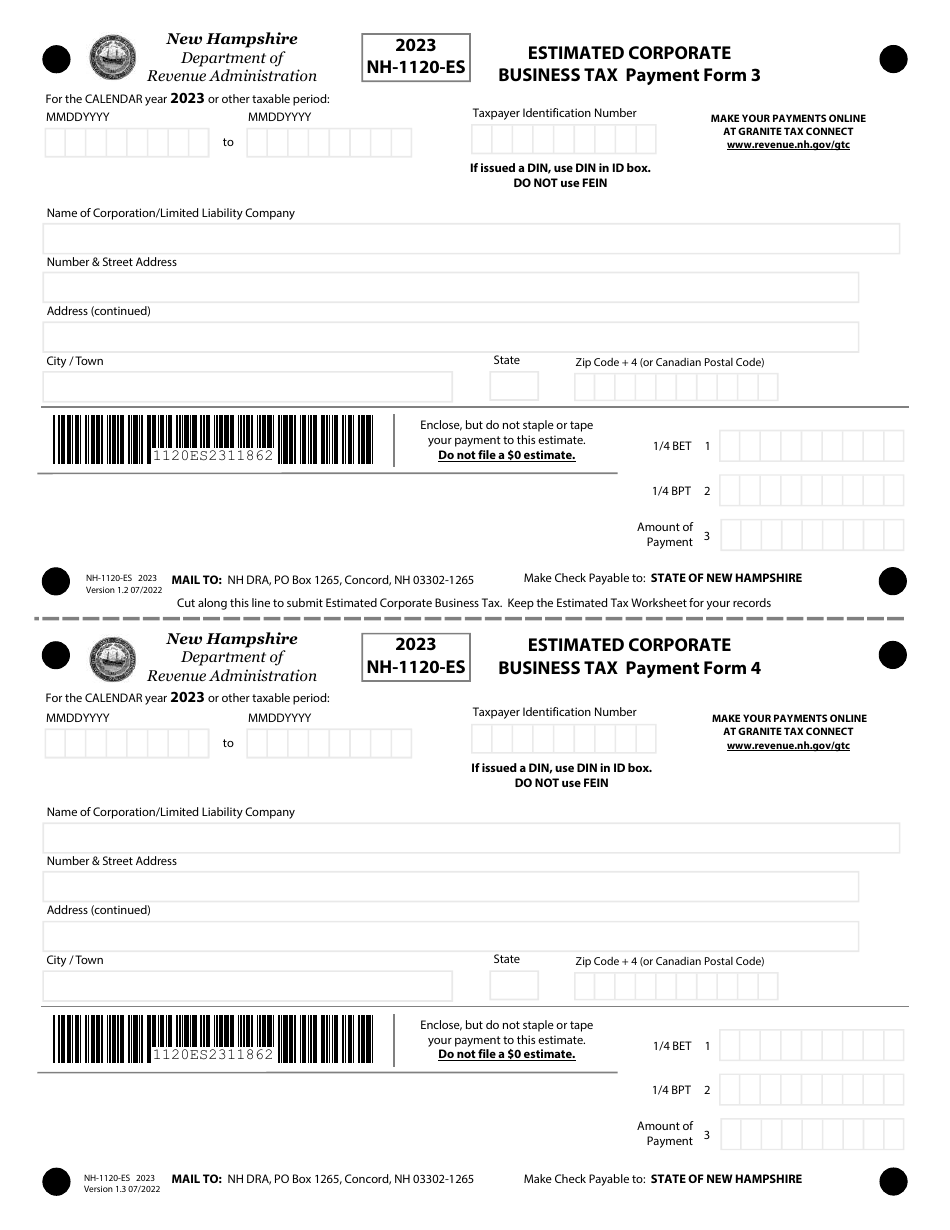

Form NH-1120-ES

for the current year.

Form NH-1120-ES Estimated Corporate Business Tax - New Hampshire

What Is Form NH-1120-ES?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

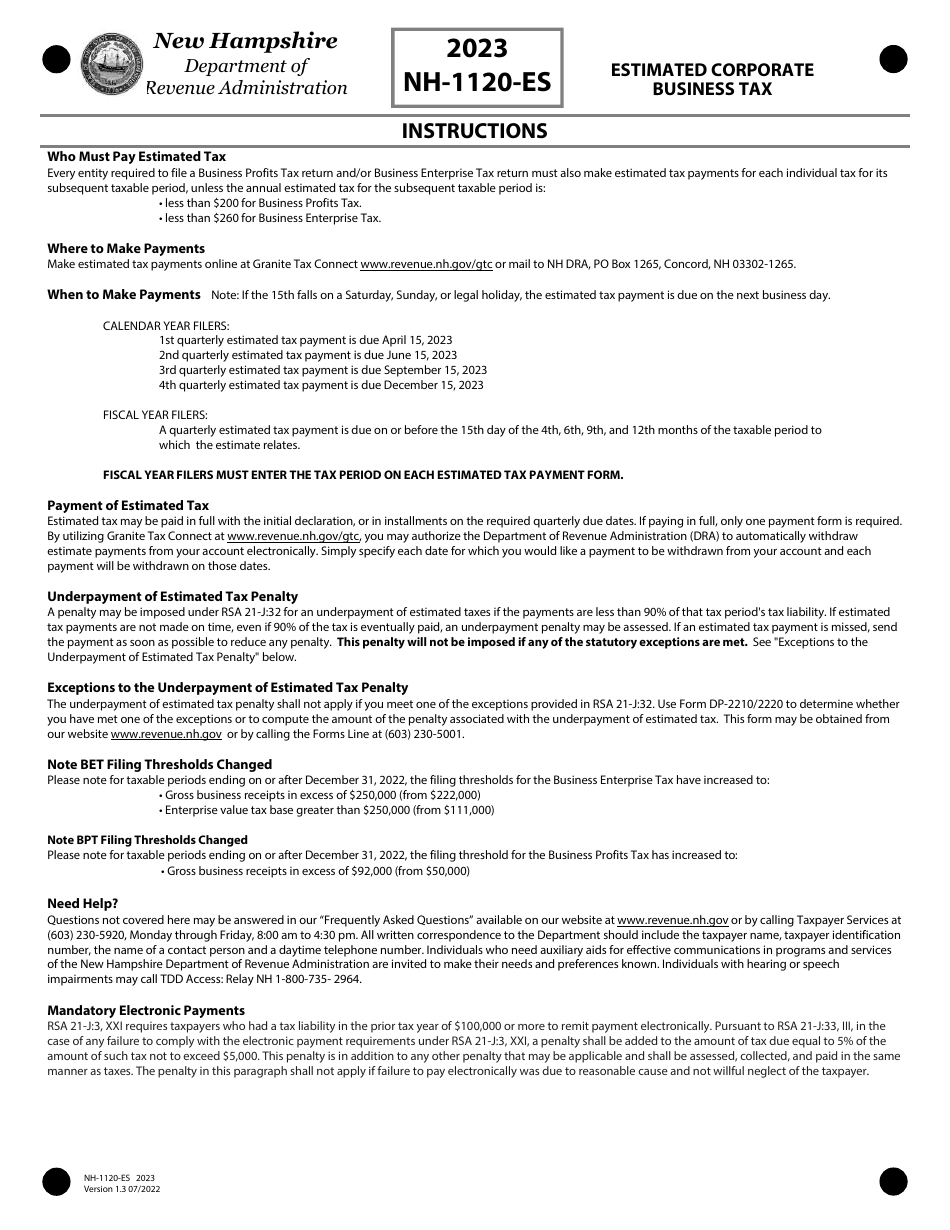

Q: What is the NH-1120-ES form?

A: The NH-1120-ES form is the Estimated Corporate Business Tax form used by businesses in New Hampshire to estimate and pay their corporate business tax in advance.

Q: Who needs to file the NH-1120-ES form?

A: Businesses that are subject to New Hampshire's corporate business tax and expect to owe more than $500 in tax for the year are generally required to file the NH-1120-ES form.

Q: When is the NH-1120-ES form due?

A: The NH-1120-ES form is generally due quarterly, with due dates falling on the 15th day of the 4th, 6th, 9th, and 12th months of the taxable year.

Q: How do I calculate the estimated tax on the NH-1120-ES form?

A: The estimated tax on the NH-1120-ES form is generally calculated based on the business's expected taxable income for the year, applying the applicable tax rate for New Hampshire's corporate business tax.

Form Details:

- Released on July 1, 2022;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NH-1120-ES by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.