This version of the form is not currently in use and is provided for reference only. Download this version of

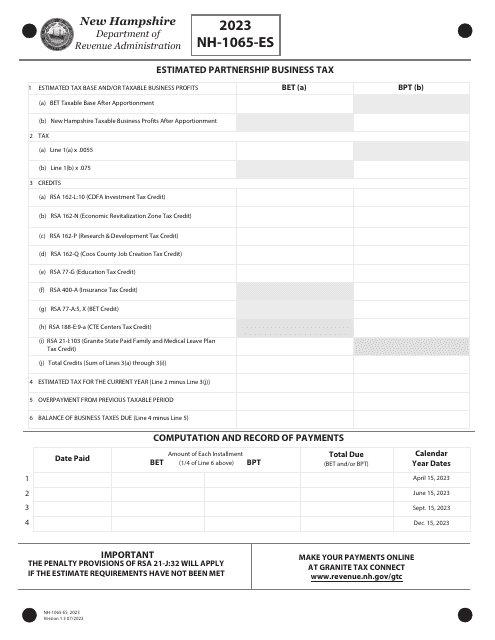

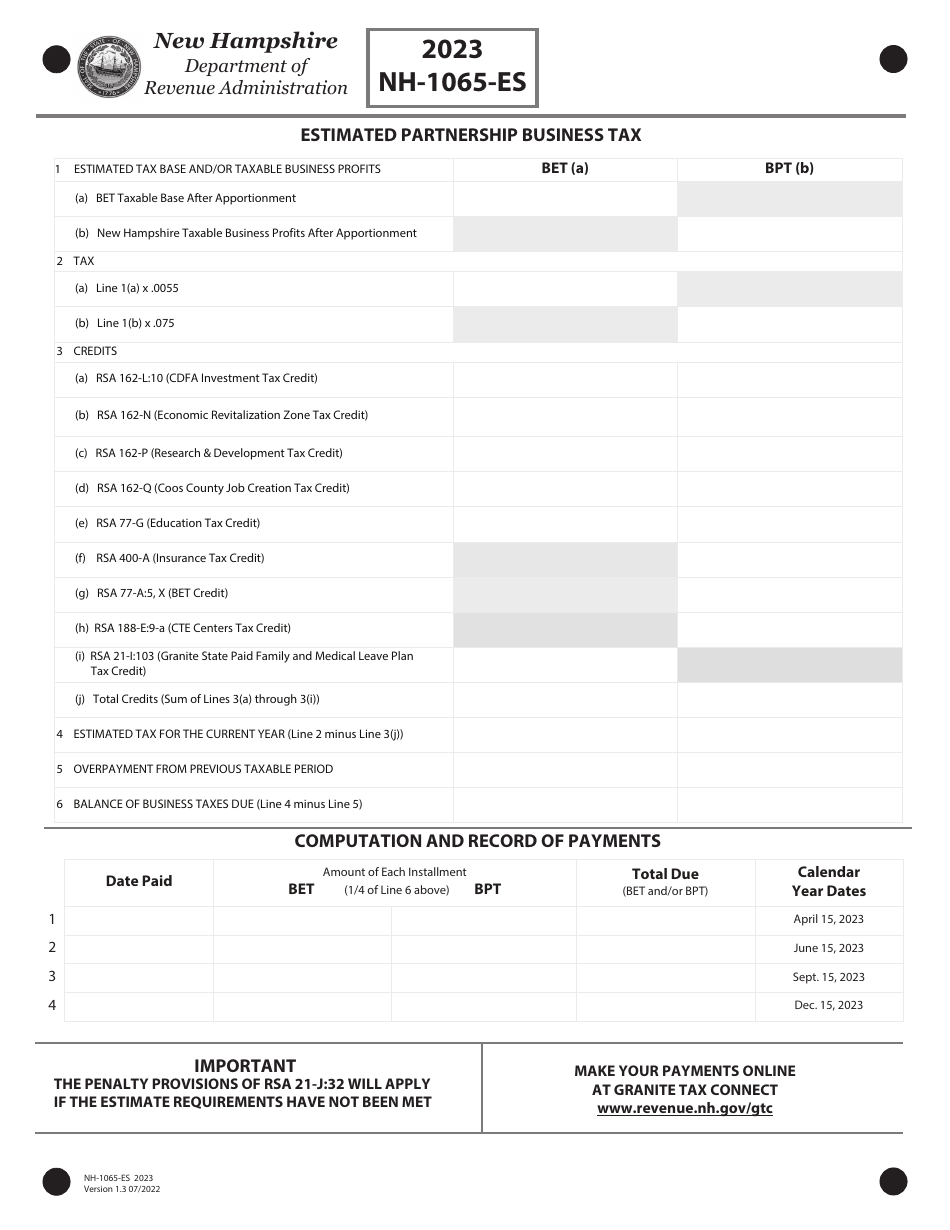

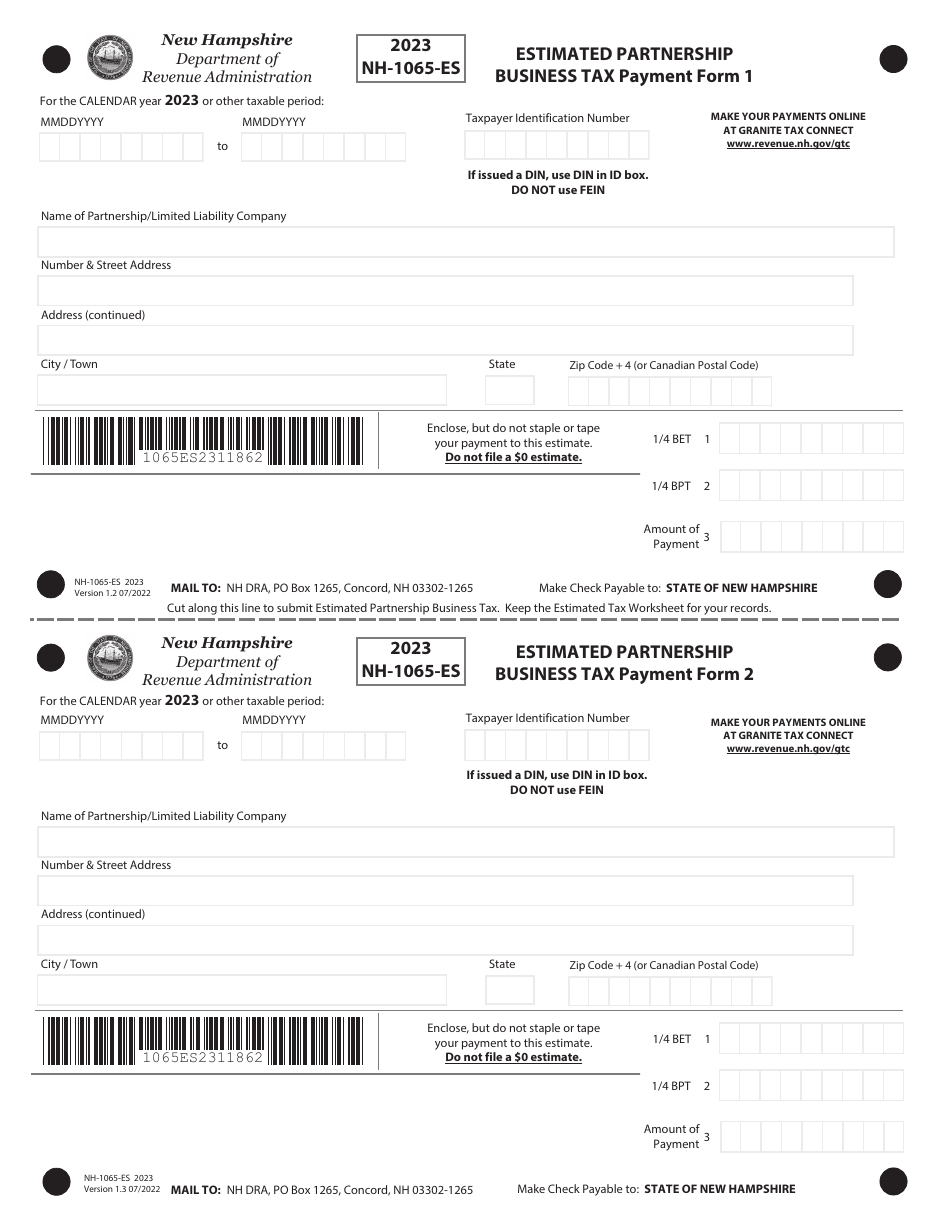

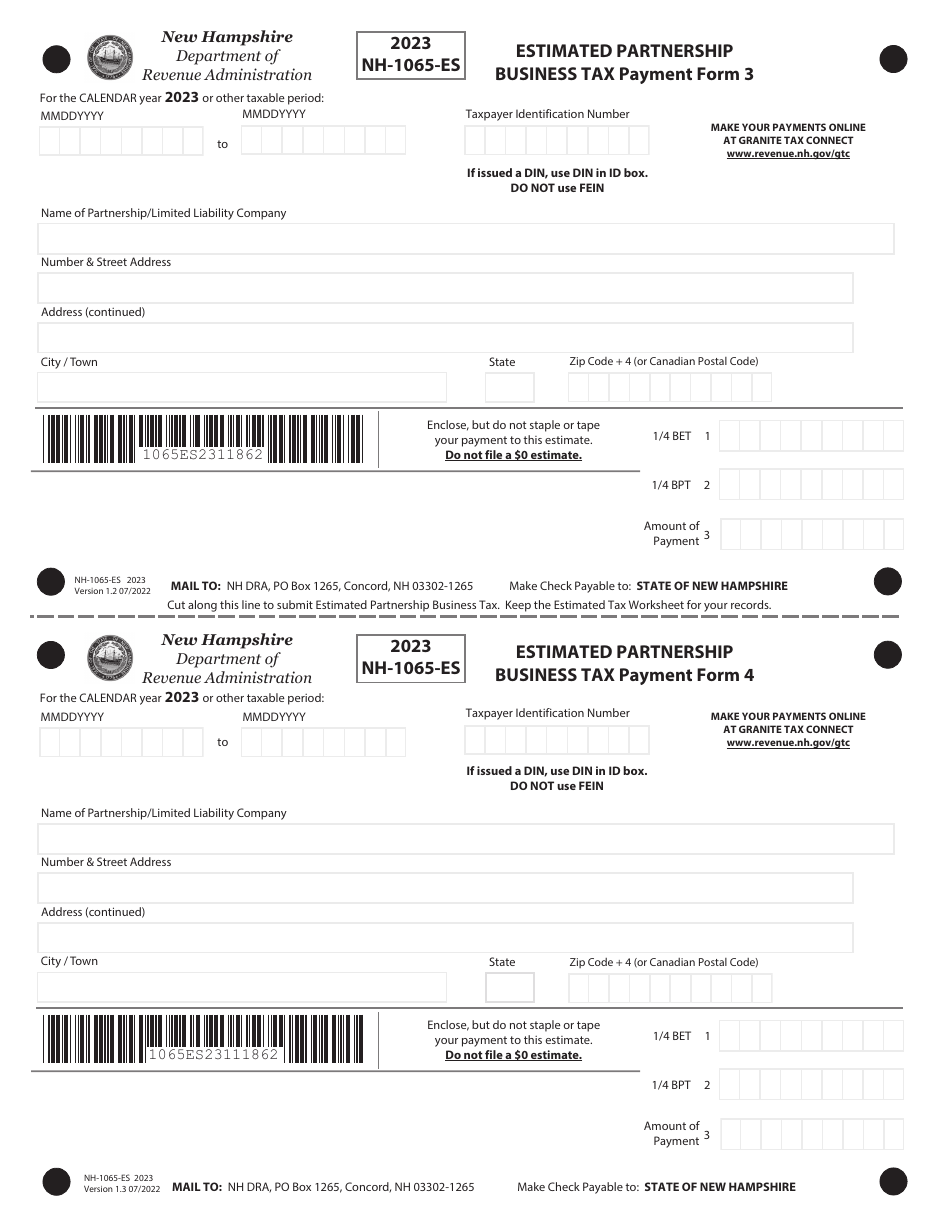

Form NH-1065-ES

for the current year.

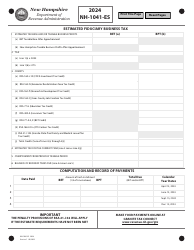

Form NH-1065-ES Estimated Partnership Business Tax - New Hampshire

What Is Form NH-1065-ES?

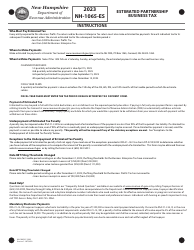

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NH-1065-ES?

A: Form NH-1065-ES is an estimated tax payment form for partnership businesses in the state of New Hampshire.

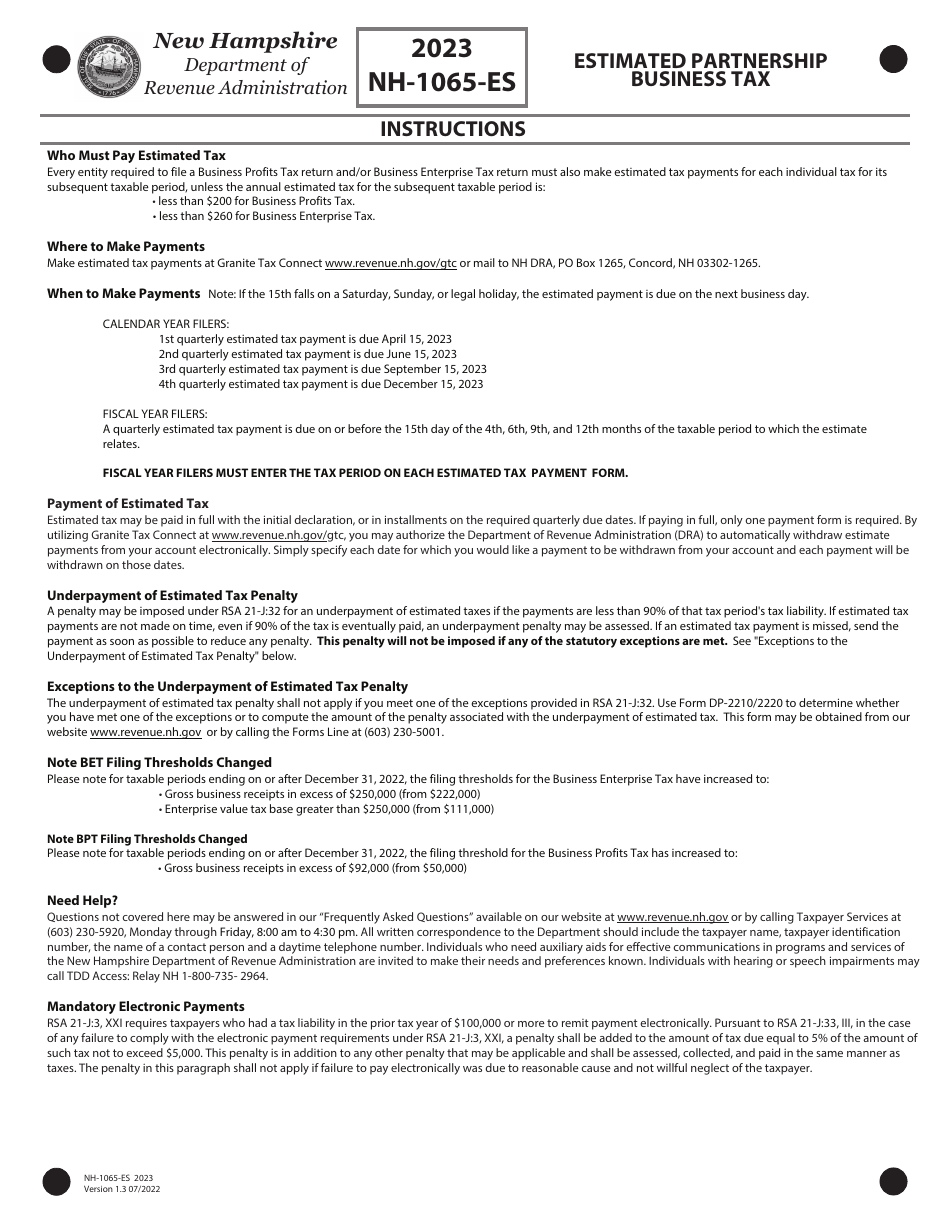

Q: Who needs to file Form NH-1065-ES?

A: Partnership businesses in New Hampshire that expect to owe $200 or more in business taxes for the year must file Form NH-1065-ES.

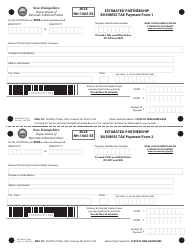

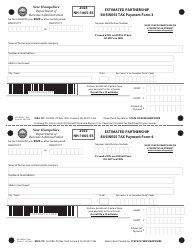

Q: When is Form NH-1065-ES due?

A: Form NH-1065-ES is due on the 15th day of the 4th, 6th, 9th, and 12th months of the tax year.

Q: What is an estimated tax payment?

A: An estimated tax payment is a pre-payment of taxes that businesses make to the tax authority based on their projected income for the year.

Q: How do I calculate my estimated tax payment?

A: To calculate your estimated tax payment, you need to estimate your partnership's taxable income and apply the current tax rate for businesses in New Hampshire.

Q: Can I e-file Form NH-1065-ES?

A: Currently, electronic filing of Form NH-1065-ES is not available. You must file a paper copy of the form.

Q: What happens if I don't file Form NH-1065-ES?

A: If you fail to file Form NH-1065-ES or underpay your estimated taxes, you may be subject to penalties and interest on the unpaid amount.

Form Details:

- Released on July 1, 2022;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NH-1065-ES by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.