This version of the form is not currently in use and is provided for reference only. Download this version of

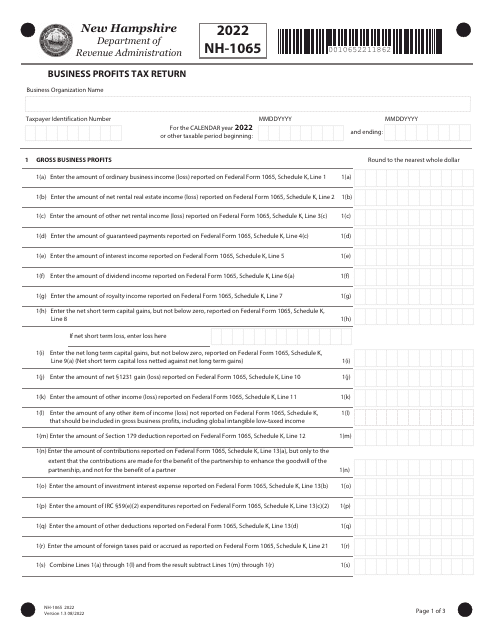

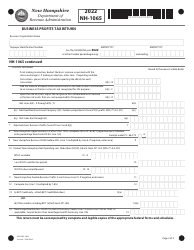

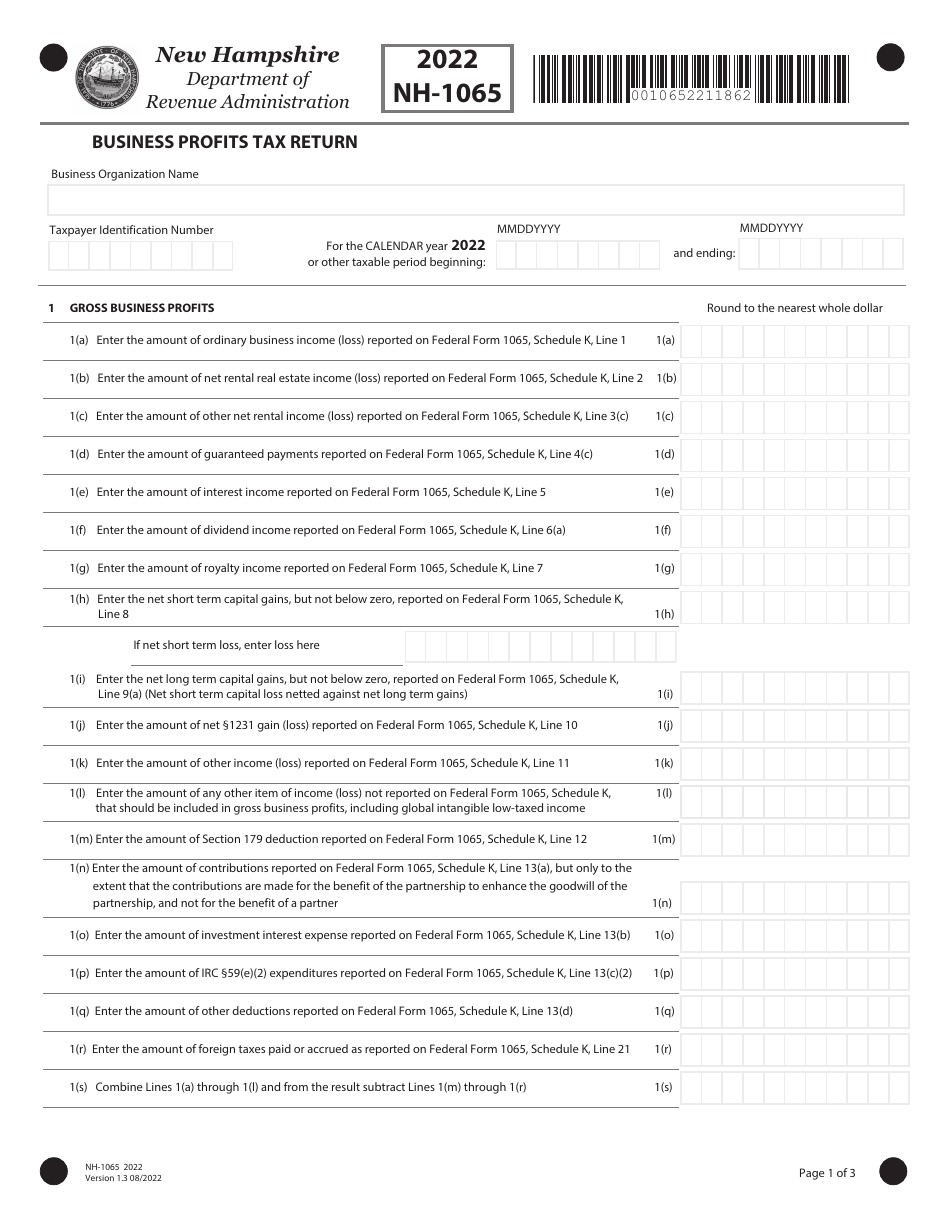

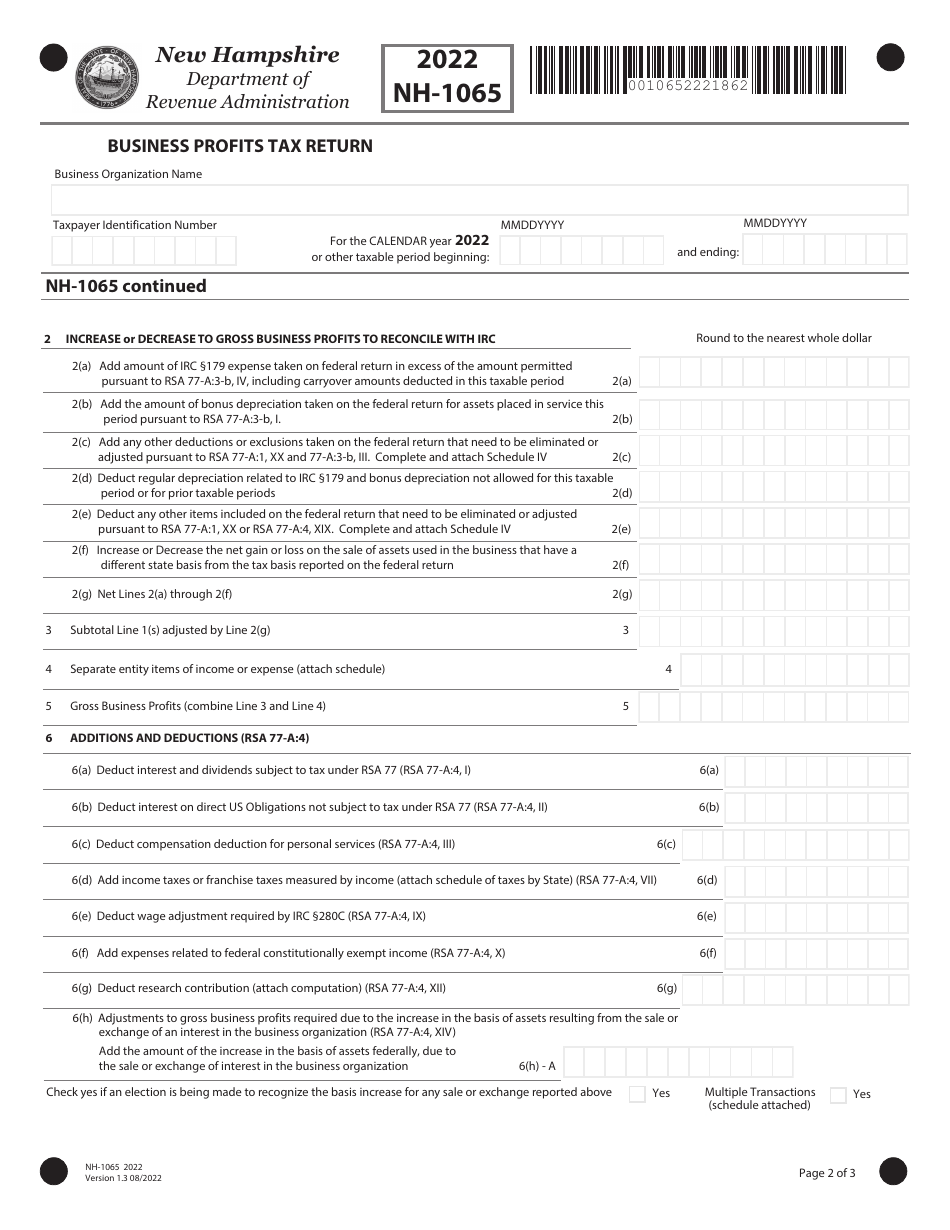

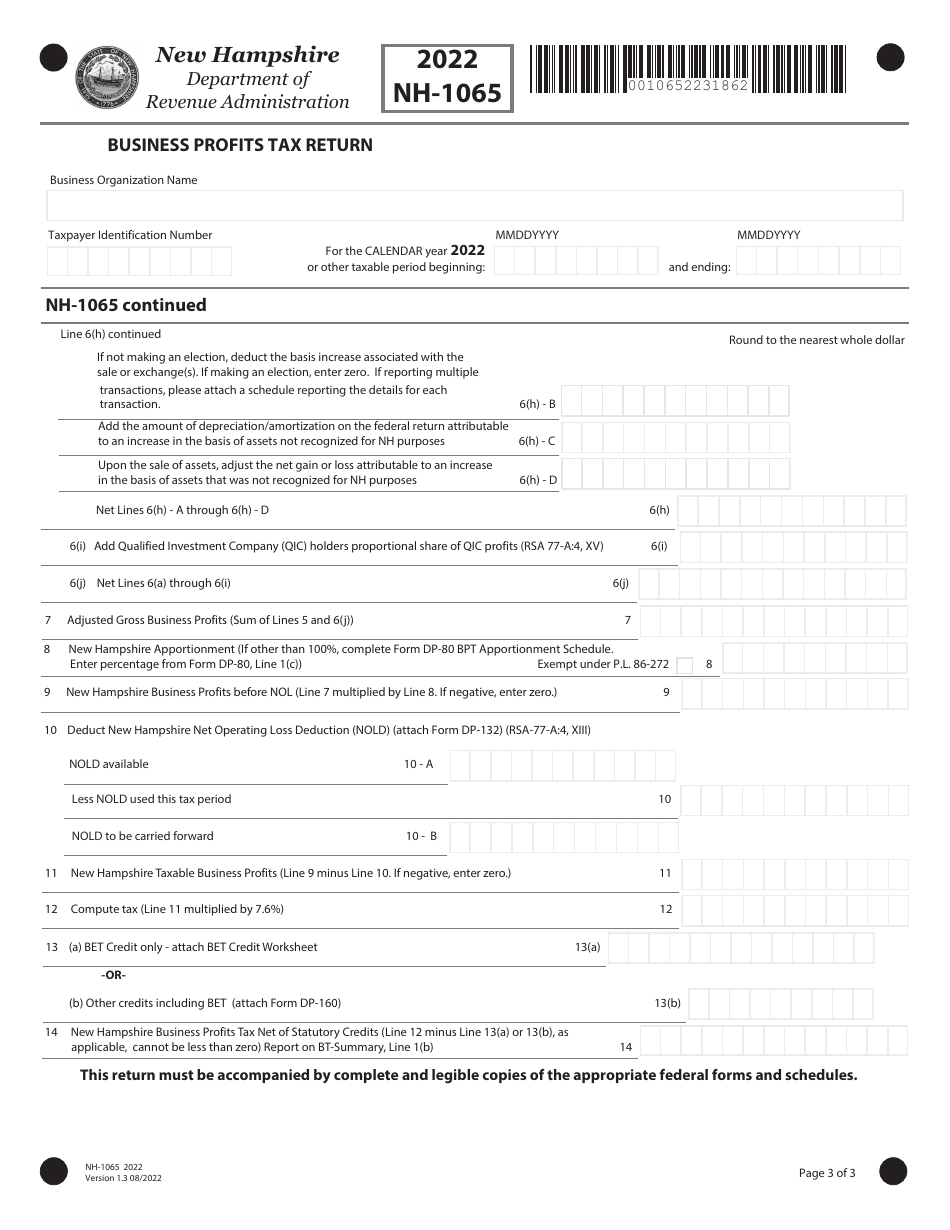

Form NH-1065

for the current year.

Form NH-1065 Partnership Business Profits Tax Return - New Hampshire

What Is Form NH-1065?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. Check the official instructions before completing and submitting the form.

FAQ

Q: What is NH-1065?

A: NH-1065 is a tax form used for Partnership Business Profits Tax Return in the state of New Hampshire.

Q: Who needs to file NH-1065?

A: Partnerships operating in the state of New Hampshire need to file NH-1065.

Q: What is Partnership Business Profits Tax?

A: Partnership Business Profits Tax is a tax imposed on the profits of partnerships in New Hampshire.

Q: What information is required to complete NH-1065?

A: To complete NH-1065, you will need information about the partnership's income, deductions, and credits.

Q: When is the deadline to file NH-1065?

A: The deadline to file NH-1065 is typically April 15th, or the same date as the federal tax filing deadline.

Q: Are there any penalties for late filing or non-filing?

A: Yes, there are penalties for late filing or non-filing of NH-1065. It is important to file the tax return on time to avoid these penalties.

Form Details:

- Released on August 1, 2022;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NH-1065 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.