This version of the form is not currently in use and is provided for reference only. Download this version of

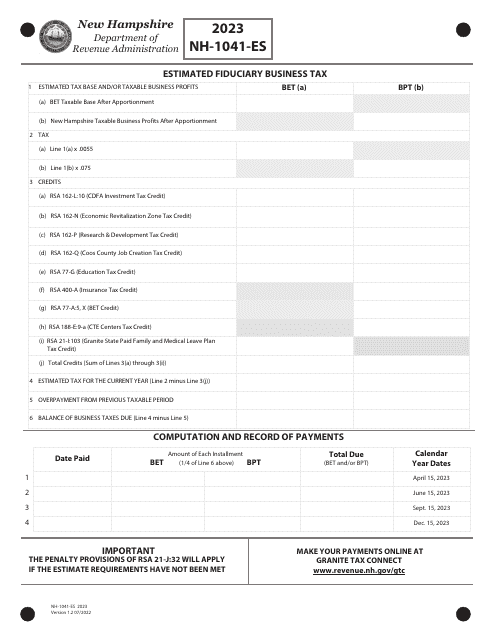

Form NH-1041-ES

for the current year.

Form NH-1041-ES Estimated Fiduciary Business Tax - New Hampshire

What Is Form NH-1041-ES?

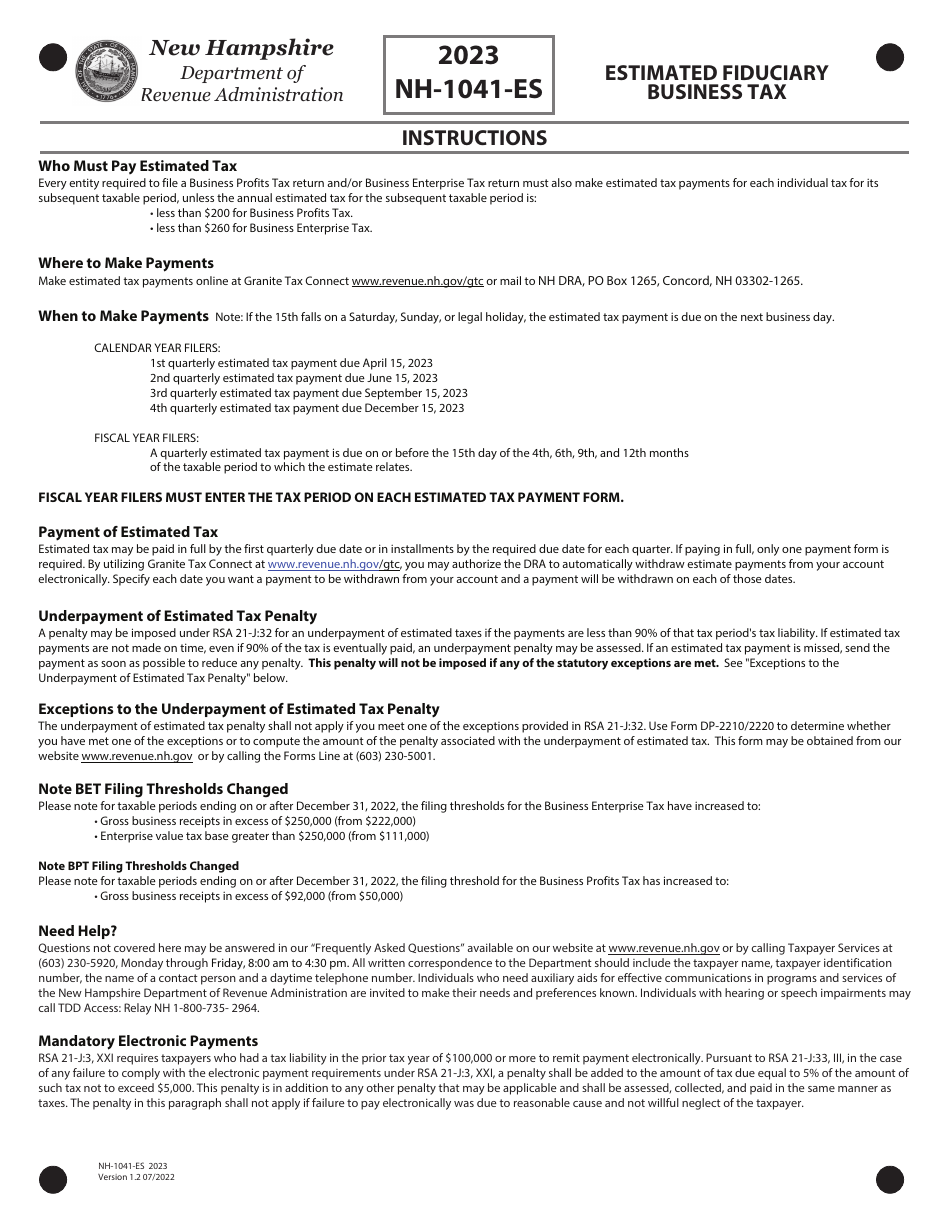

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

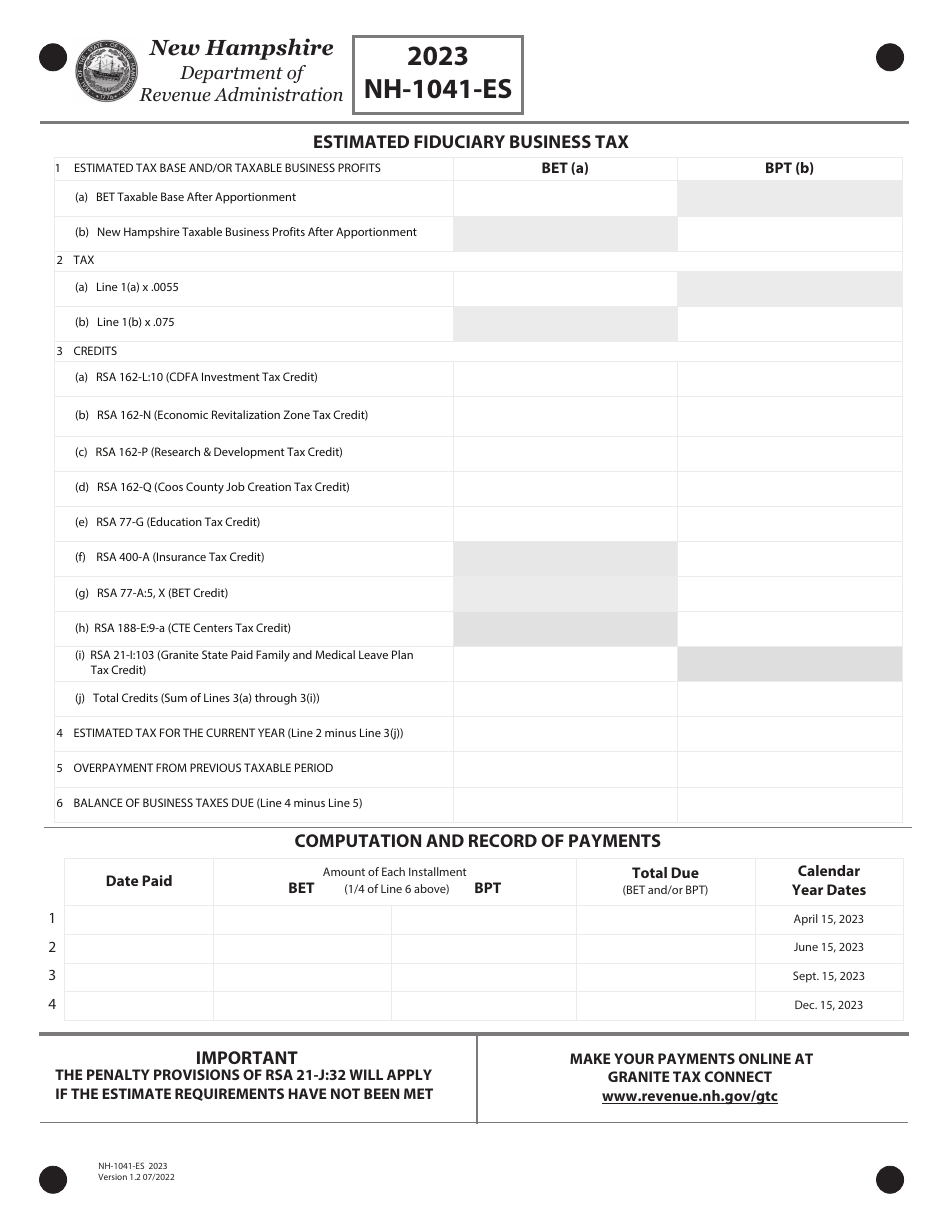

Q: What is Form NH-1041-ES?

A: Form NH-1041-ES is a form used to estimate and pay fiduciary business tax in New Hampshire.

Q: Who should file Form NH-1041-ES?

A: Form NH-1041-ES should be filed by individuals or entities that have fiduciary business tax obligations in New Hampshire.

Q: What is fiduciary business tax?

A: Fiduciary business tax is a tax imposed on income earned by a fiduciary, such as a trust or estate, in New Hampshire.

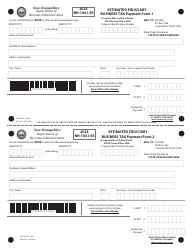

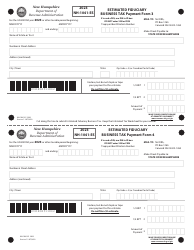

Q: When is Form NH-1041-ES due?

A: Form NH-1041-ES is due on the 15th day of the 4th, 6th, and 9th months of the taxable year.

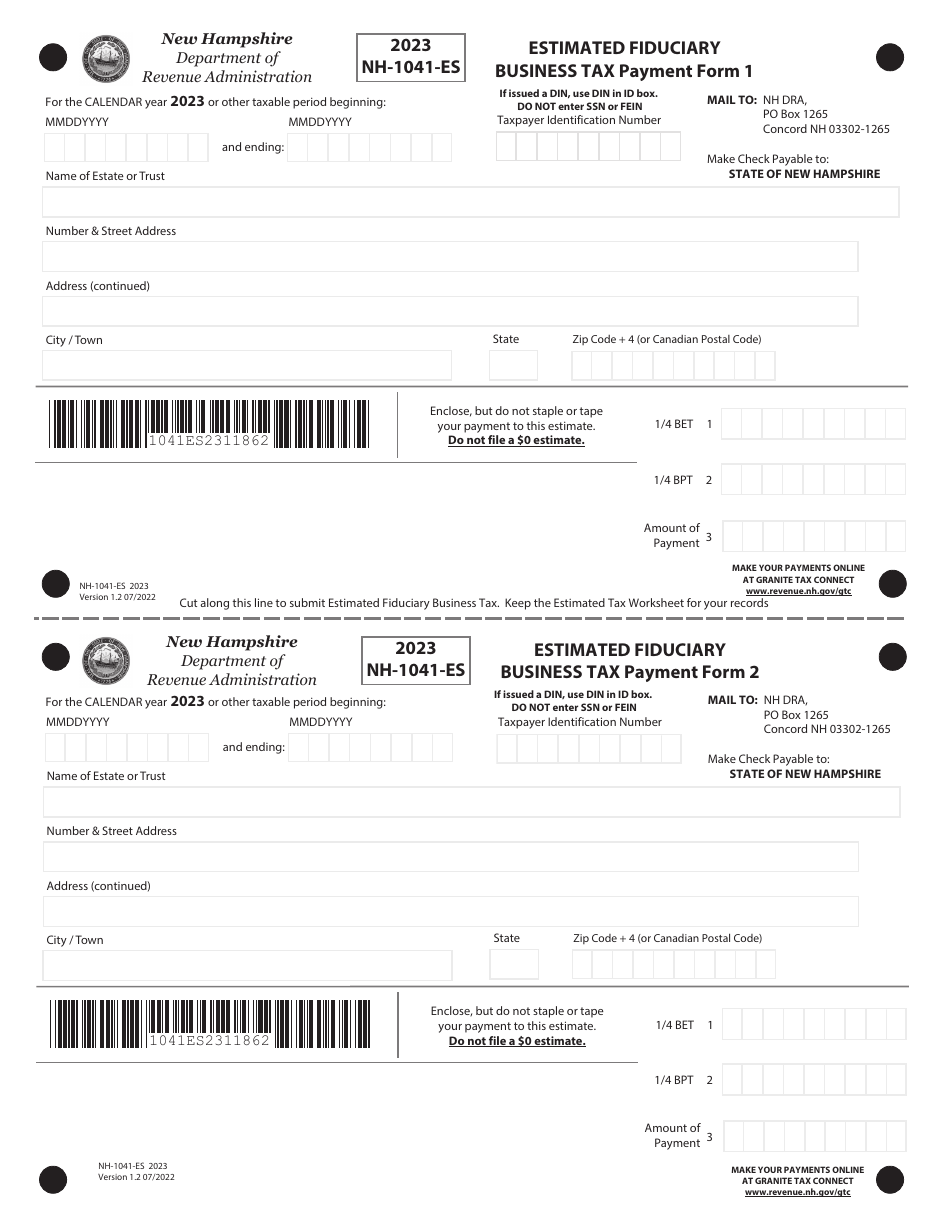

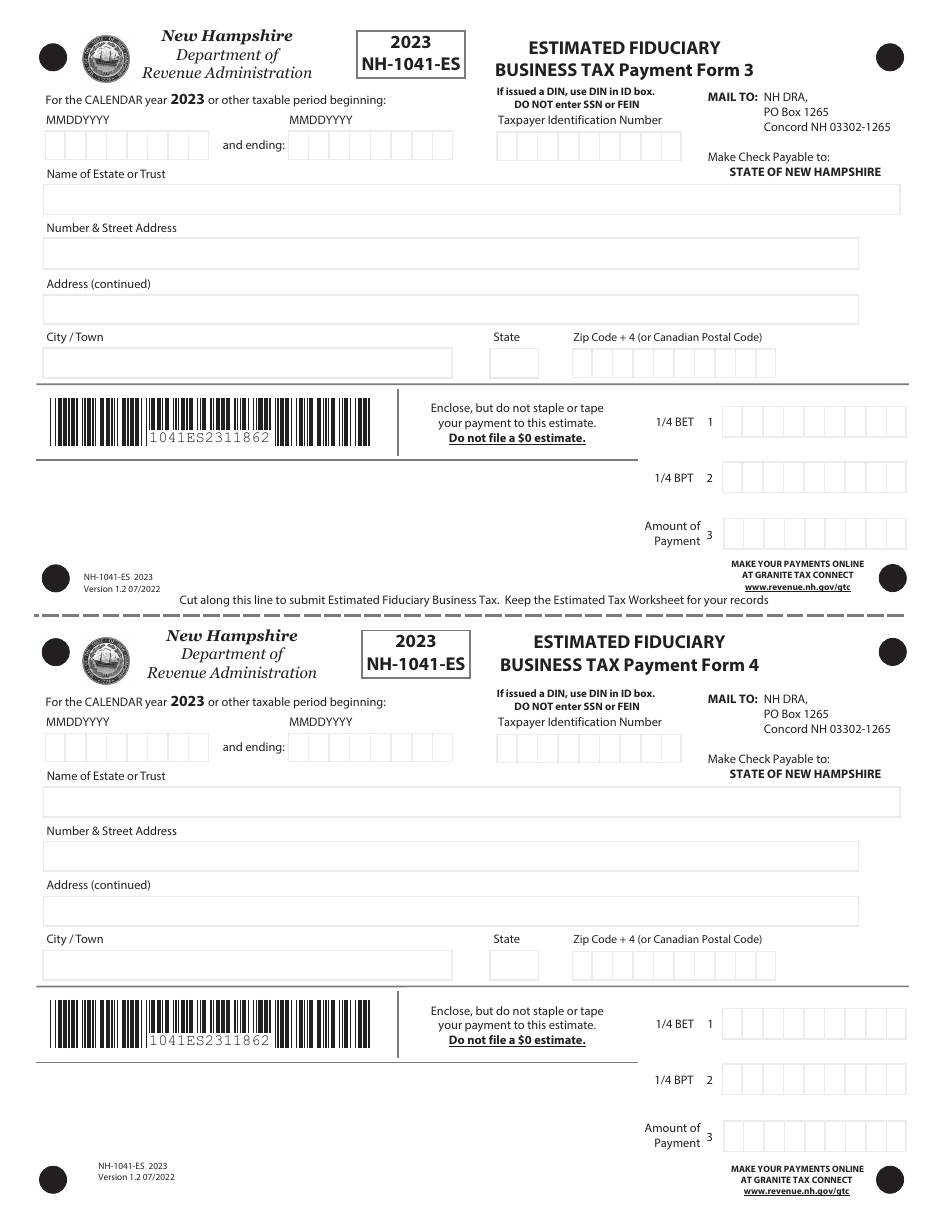

Q: What information is required on Form NH-1041-ES?

A: Form NH-1041-ES requires information such as the taxpayer's identification number, estimated tax liability, and payment details.

Form Details:

- Released on July 1, 2022;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NH-1041-ES by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.