This version of the form is not currently in use and is provided for reference only. Download this version of

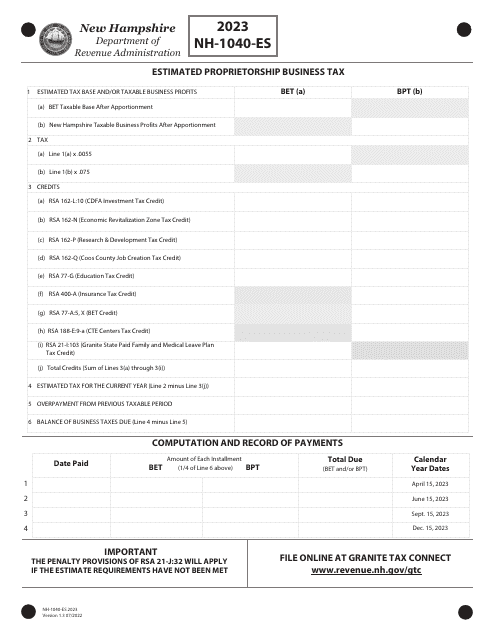

Form NH-1040-ES

for the current year.

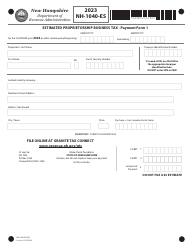

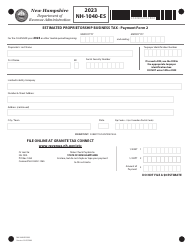

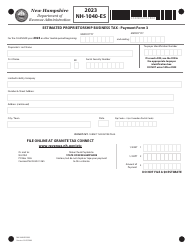

Form NH-1040-ES Estimated Proprietorship Business Tax - New Hampshire

What Is Form NH-1040-ES?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

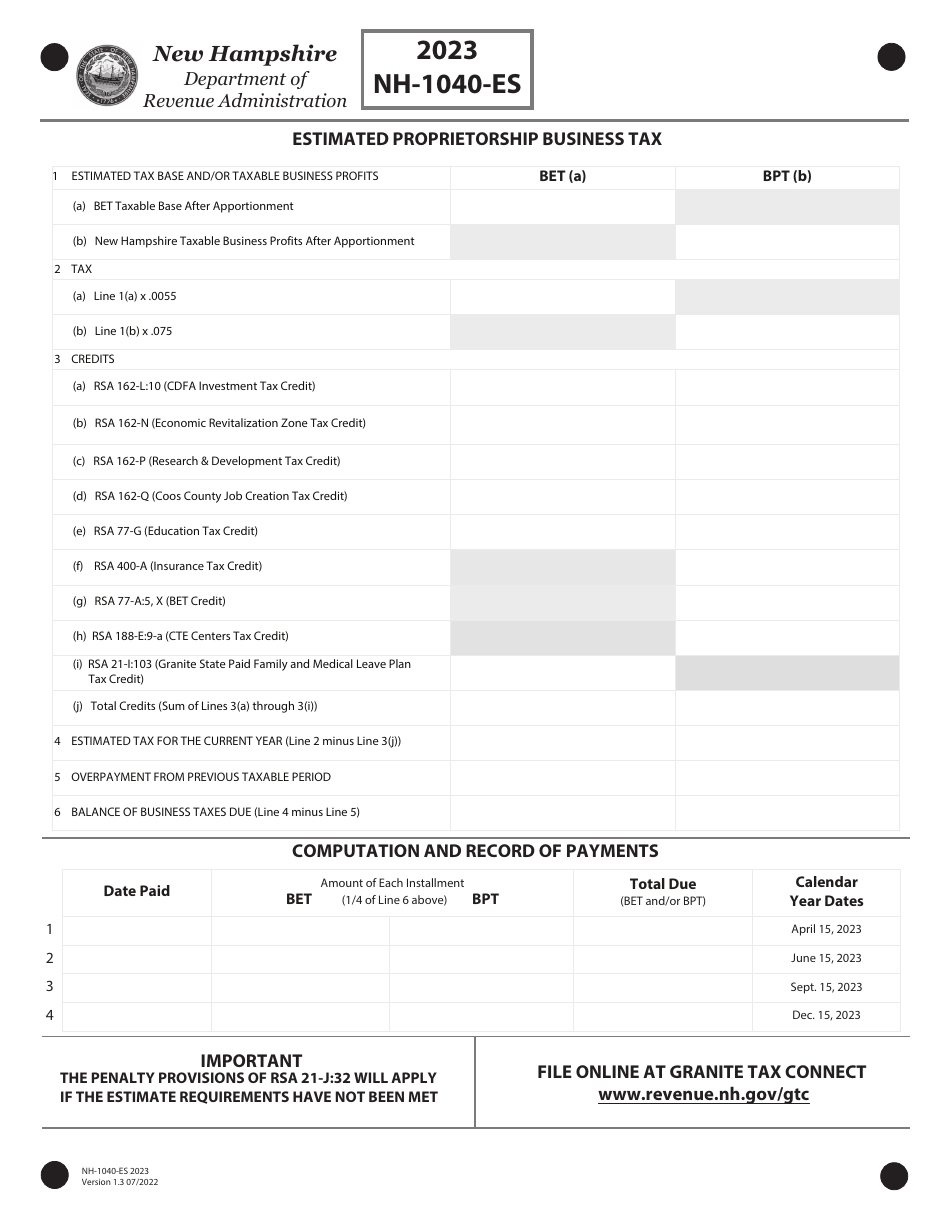

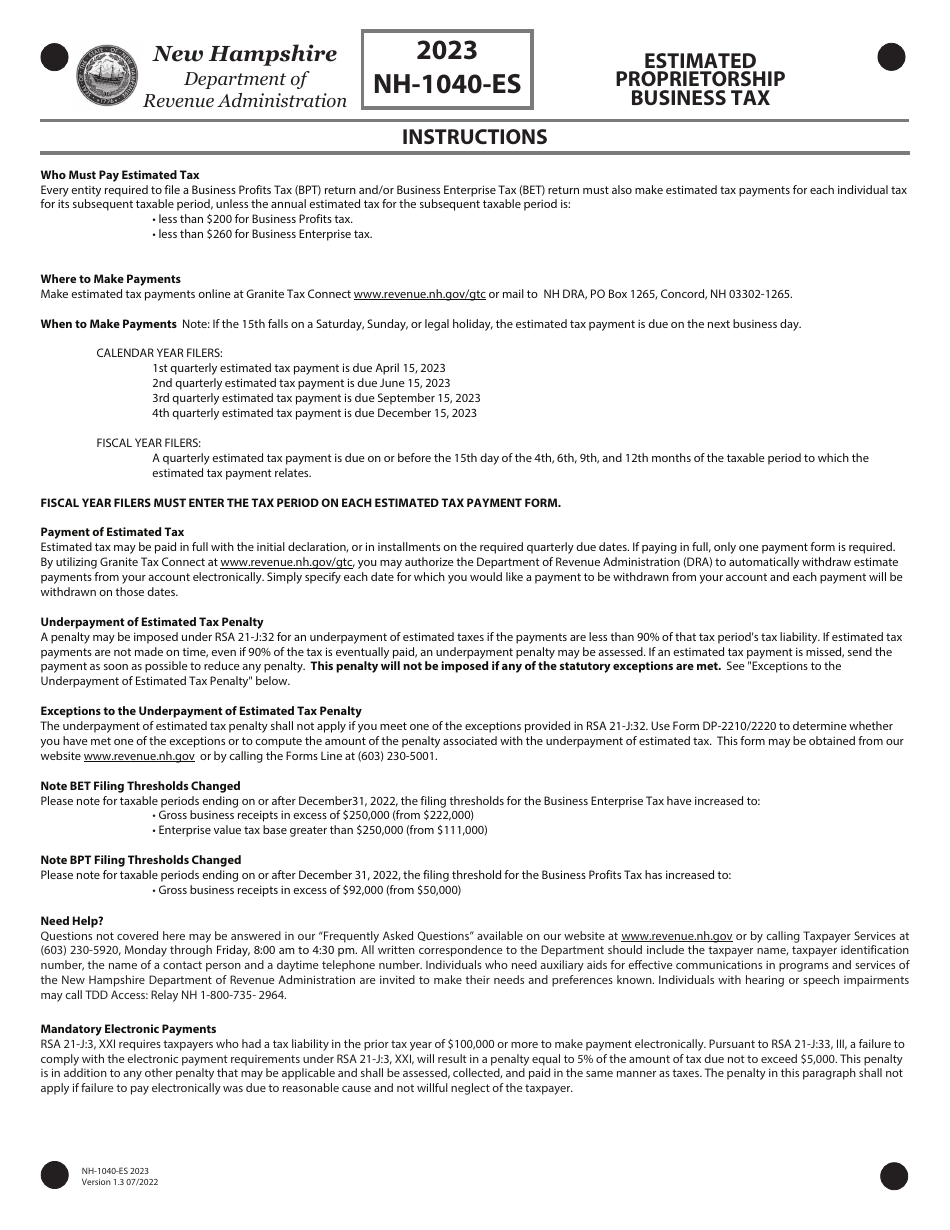

Q: What is form NH-1040-ES?

A: Form NH-1040-ES is a tax form used for estimating and paying business taxes in the state of New Hampshire.

Q: Who uses form NH-1040-ES?

A: Form NH-1040-ES is used by individuals who operate a sole proprietorship business in New Hampshire and need to make estimated tax payments.

Q: What is the purpose of form NH-1040-ES?

A: The purpose of form NH-1040-ES is to calculate and pay estimated business taxes on a quarterly basis, ensuring that the appropriate amount of taxes is paid throughout the year.

Q: When should form NH-1040-ES be filed?

A: Form NH-1040-ES should be filed quarterly, with payments due on April 15th, June 15th, September 15th, and January 15th of the following year.

Q: What information is needed to complete form NH-1040-ES?

A: To complete form NH-1040-ES, you will need information on your business income, deductions, and any credits or adjustments that apply to your tax situation.

Form Details:

- Released on July 1, 2022;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NH-1040-ES by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.