This version of the form is not currently in use and is provided for reference only. Download this version of

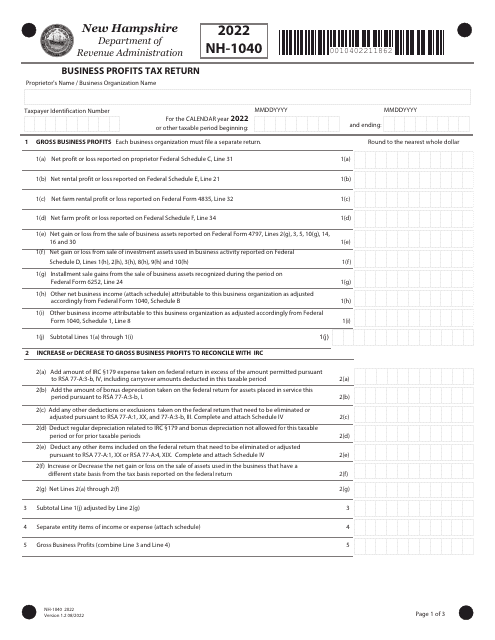

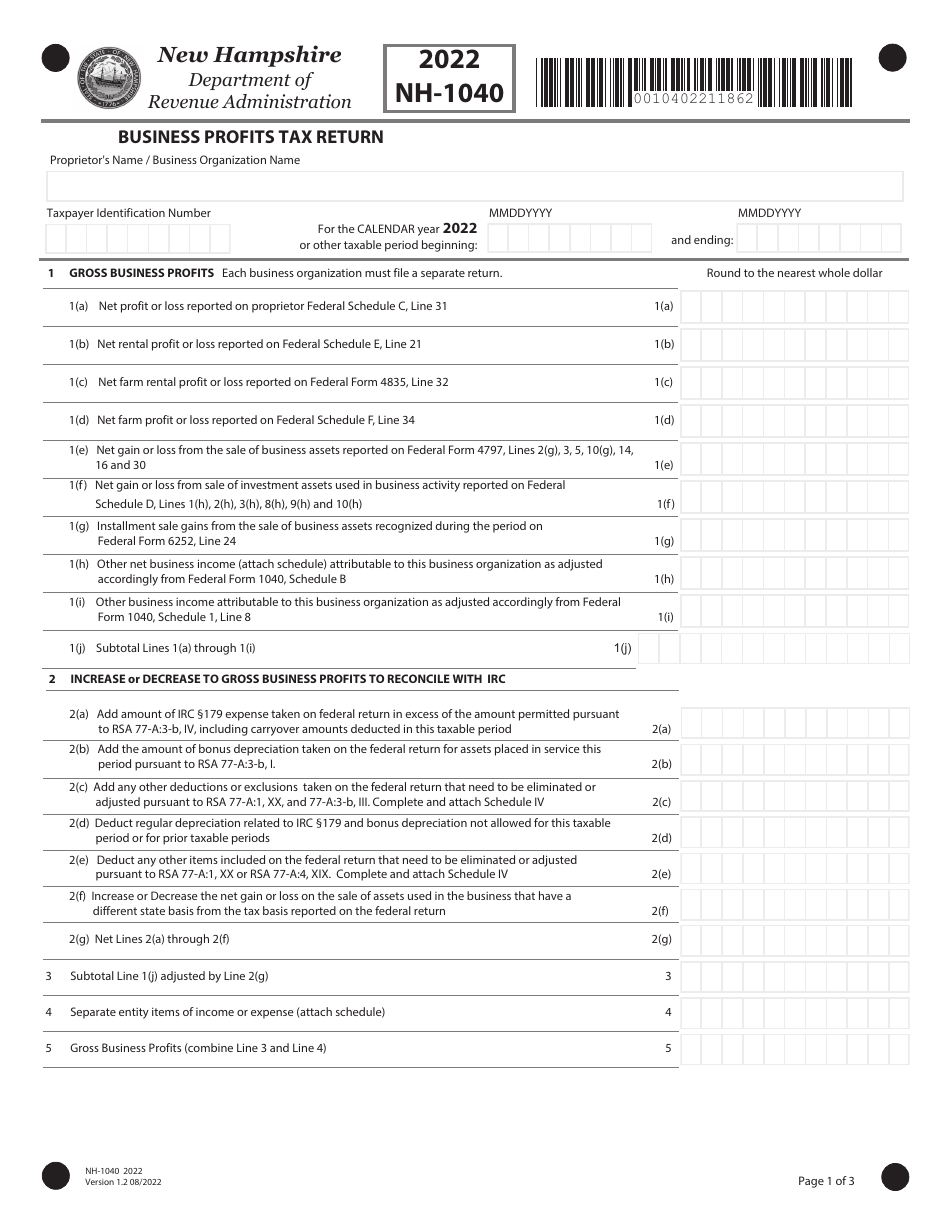

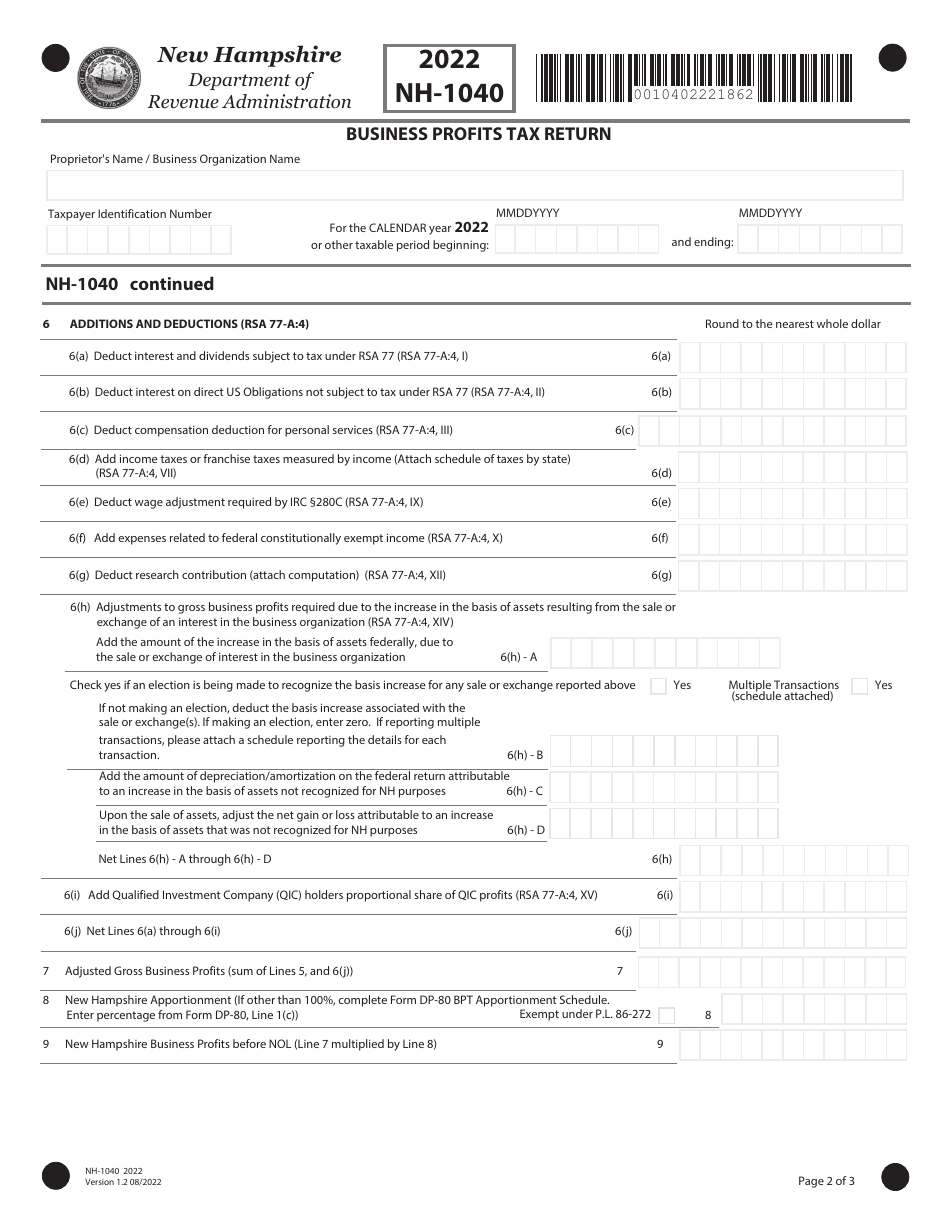

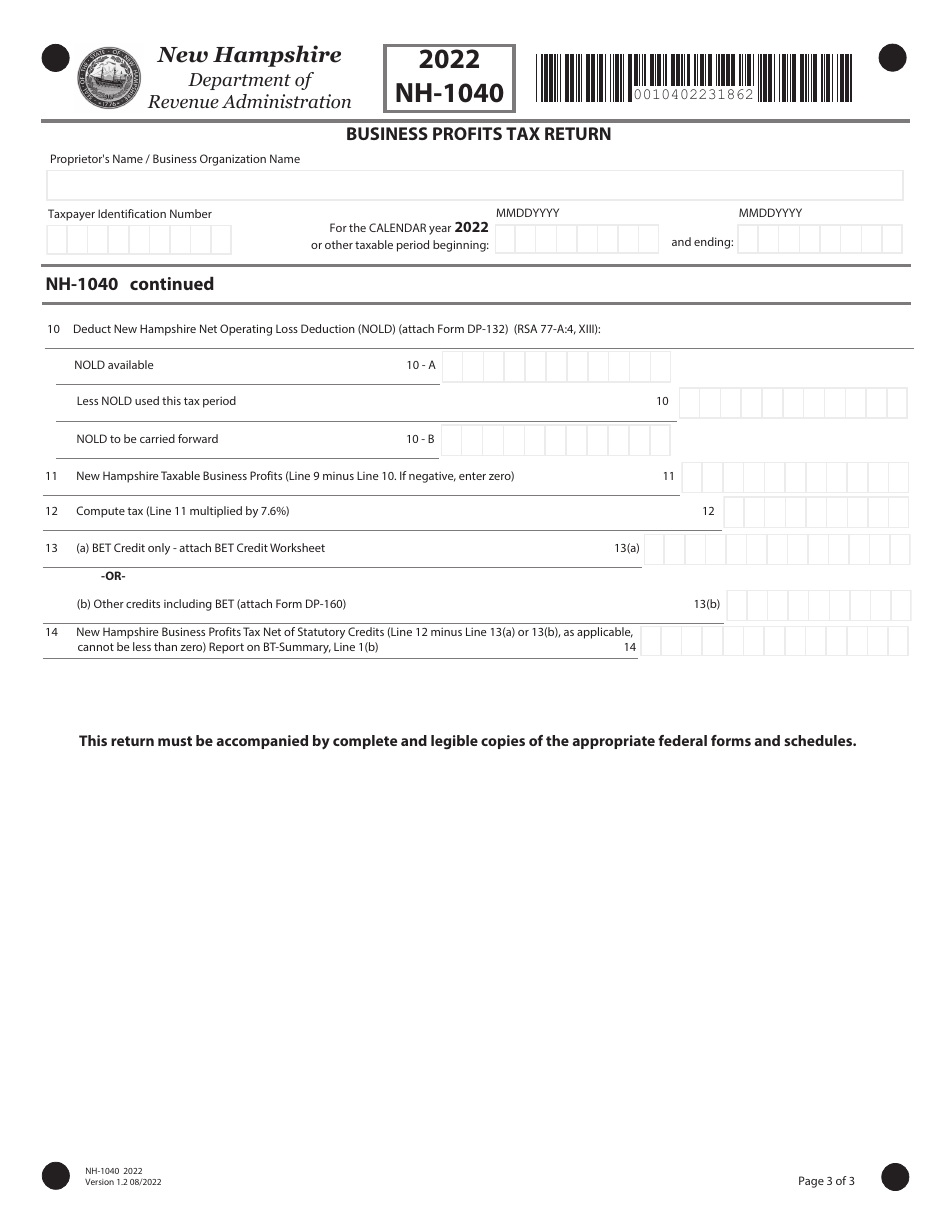

Form NH-1040

for the current year.

Form NH-1040 Proprietorship Business Profits Tax Return - New Hampshire

What Is Form NH-1040?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form NH-1040?

A: Form NH-1040 is the Proprietorship Business Profits Tax Return for businesses in New Hampshire.

Q: Who needs to file Form NH-1040?

A: Any business that operates as a proprietorship and generates profits in New Hampshire needs to file Form NH-1040.

Q: What is the purpose of Form NH-1040?

A: The purpose of Form NH-1040 is to report the profits generated by a business operating as a proprietorship in New Hampshire.

Q: When is Form NH-1040 due?

A: Form NH-1040 is due on or before April 15th of the following tax year.

Q: Are there any filing fees associated with Form NH-1040?

A: No, there are no filing fees associated with Form NH-1040.

Q: What if I need an extension to file Form NH-1040?

A: You can request an extension to file Form NH-1040 by submitting a request with the New Hampshire Department of Revenue Administration.

Q: What happens if I don't file Form NH-1040?

A: If you don't file Form NH-1040, you may be subject to penalties and interest charges imposed by the New Hampshire Department of Revenue Administration.

Q: What supporting documents should I include with Form NH-1040?

A: You should include any necessary schedules and supporting documentation that accurately reflect your business's profits in New Hampshire.

Form Details:

- Released on August 1, 2022;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NH-1040 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.