This version of the form is not currently in use and is provided for reference only. Download this version of

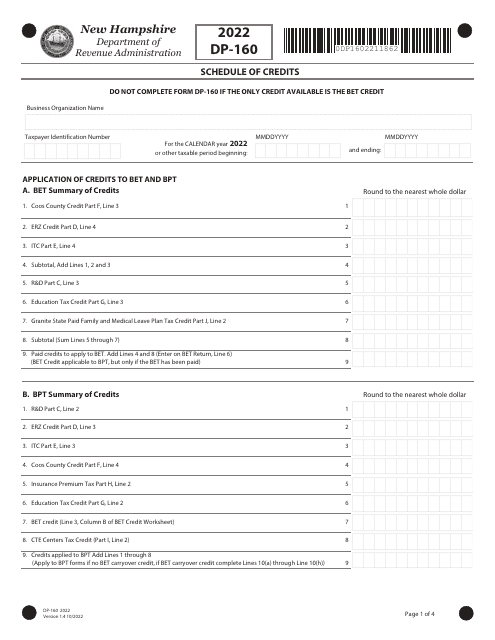

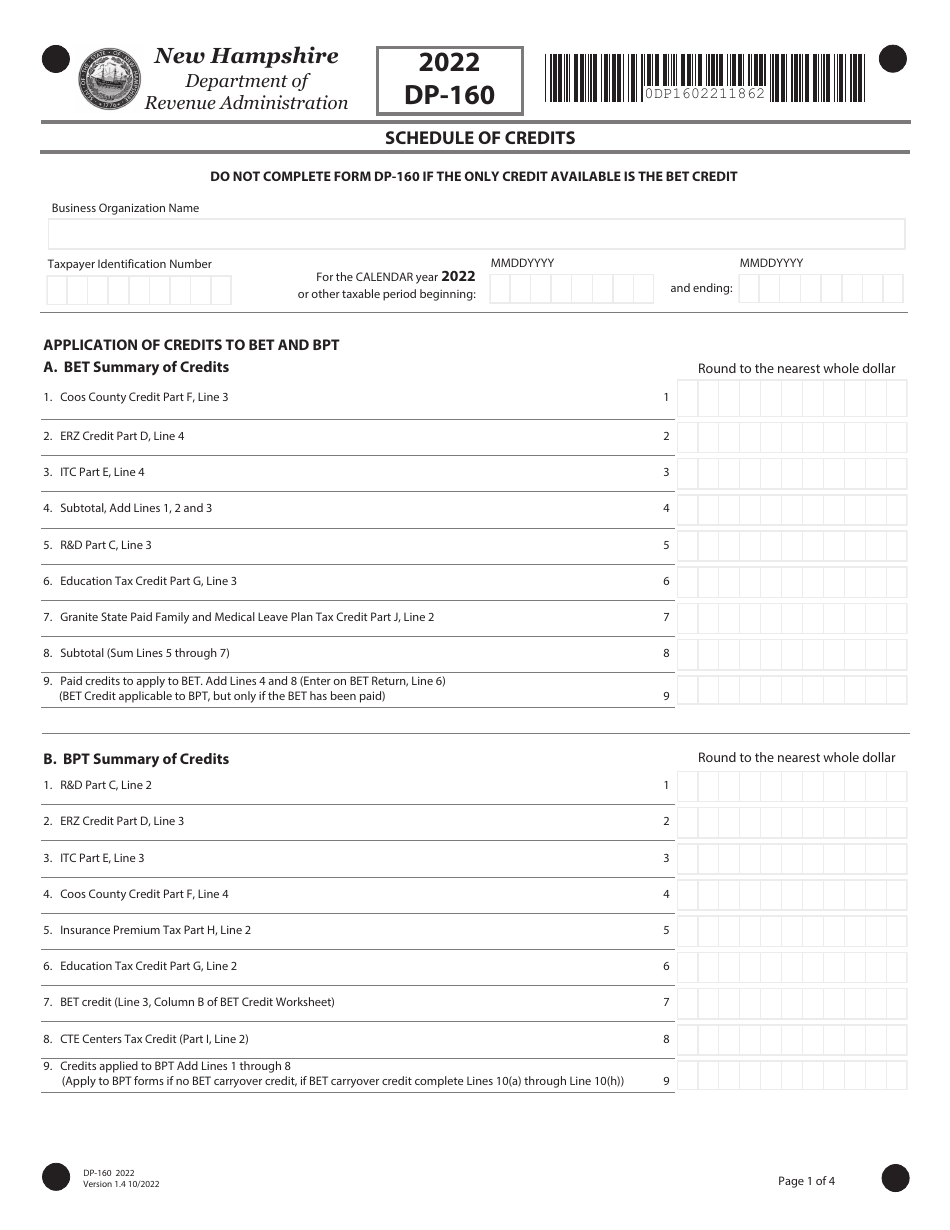

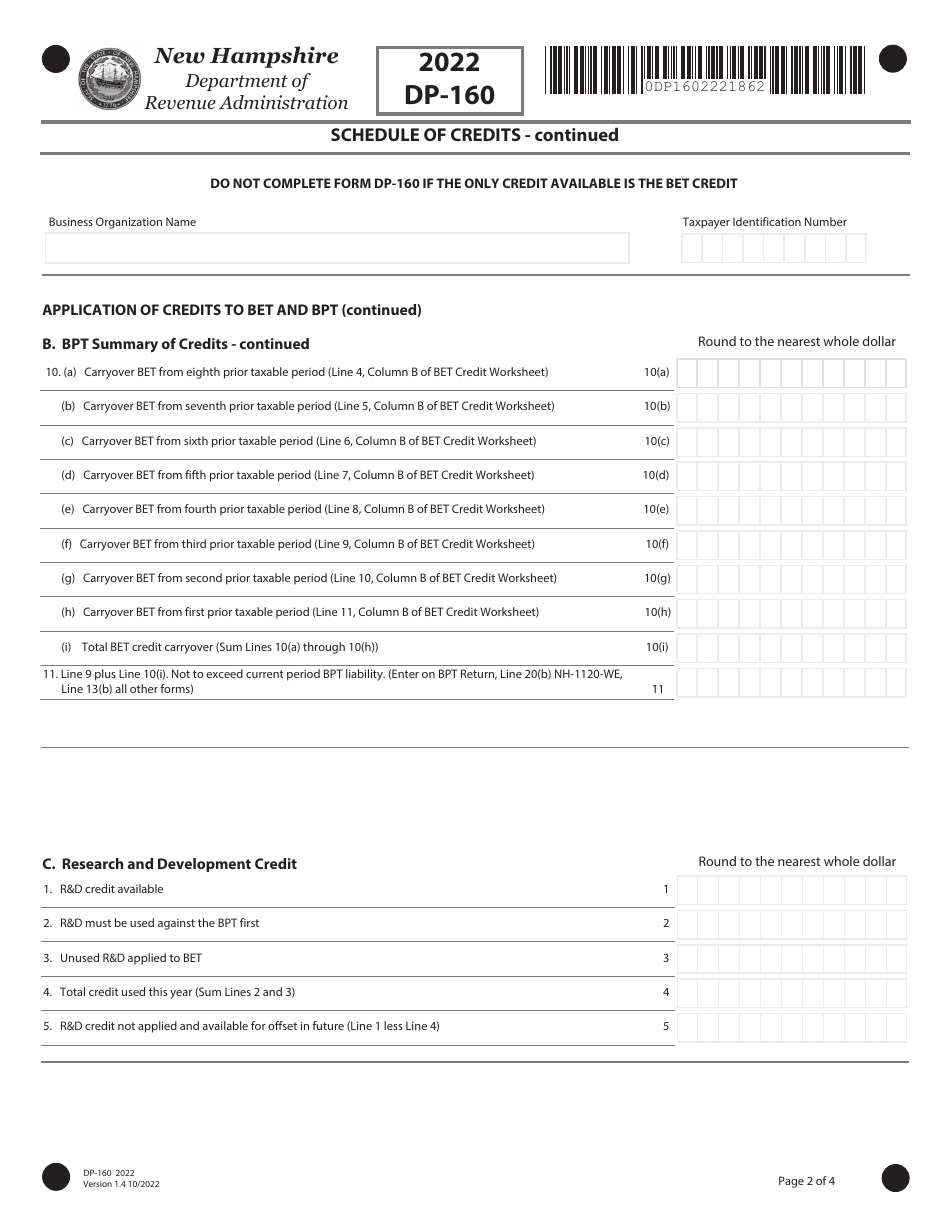

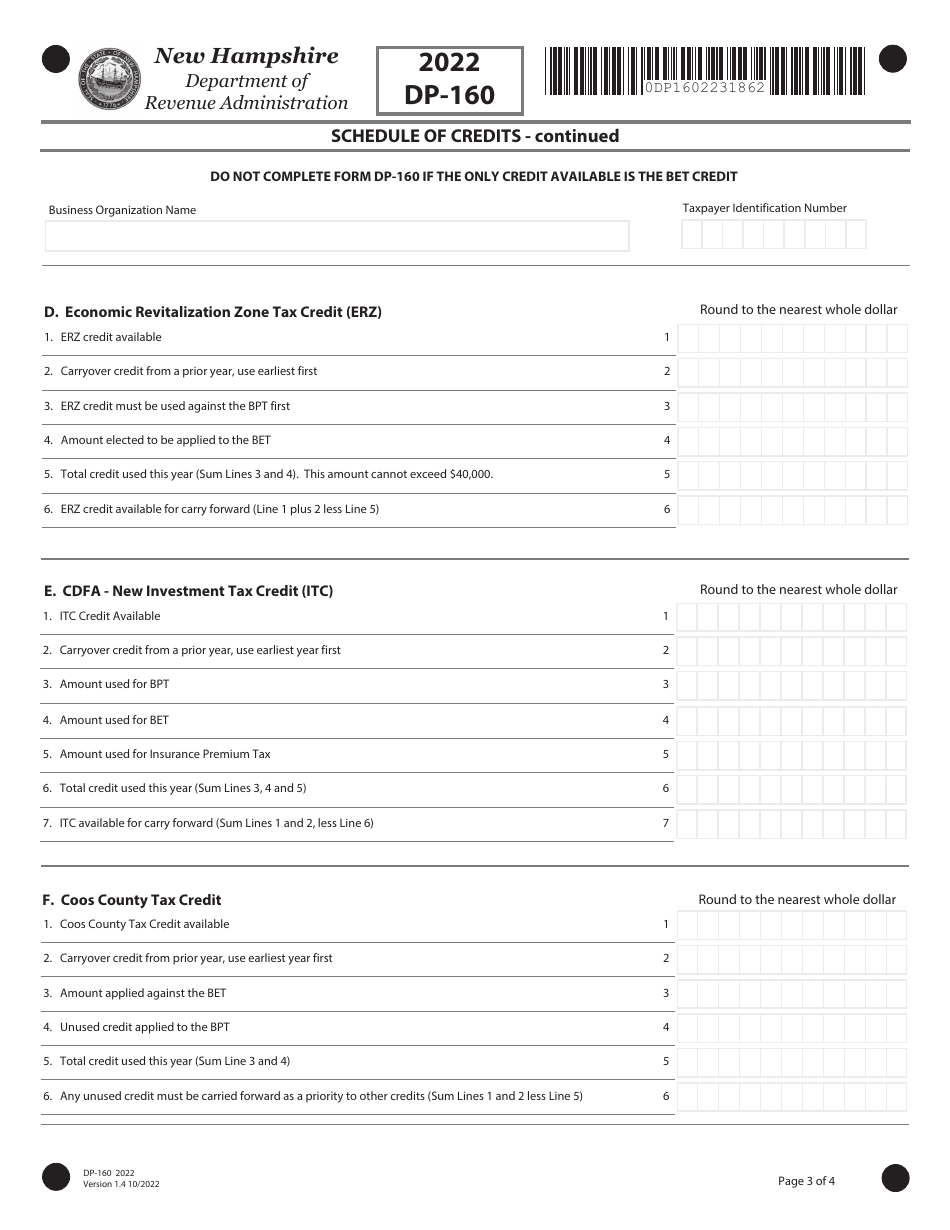

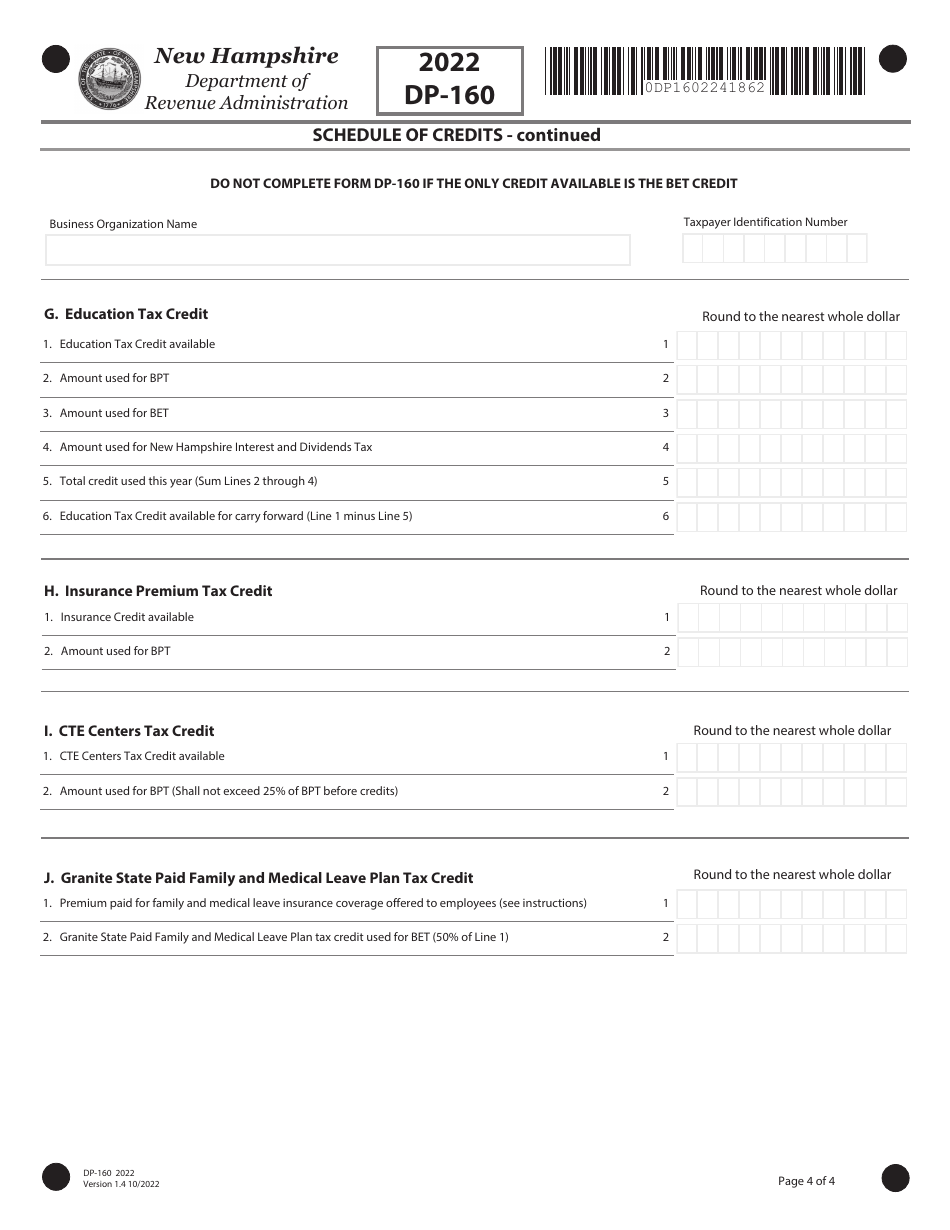

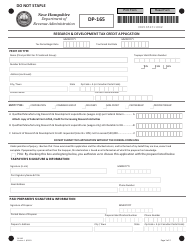

Form DP-160

for the current year.

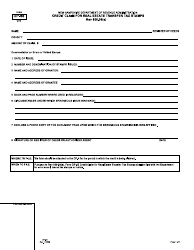

Form DP-160 Schedule of Credits - New Hampshire

What Is Form DP-160?

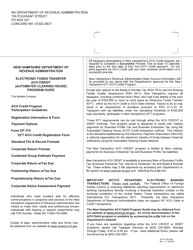

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form DP-160?

A: Form DP-160 is the Schedule of Credits for individuals filing their taxes in New Hampshire.

Q: Who needs to file Form DP-160?

A: Individuals who are residents of New Hampshire and have applicable tax credits to claim.

Q: When is Form DP-160 due?

A: Form DP-160 is typically due on the same date as the taxpayer's New Hampshire income tax return, which is April 15th.

Q: What credits can be claimed on Form DP-160?

A: Form DP-160 allows taxpayers to claim various credits, such as the Business EnterpriseTax Credit, Research and Development Tax Credit, and Renewable Energy Tax Credit, among others.

Form Details:

- Released on October 1, 2022;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DP-160 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.