This version of the form is not currently in use and is provided for reference only. Download this version of

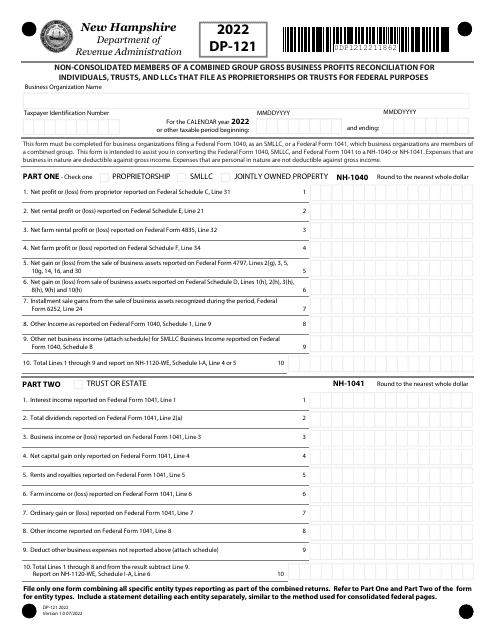

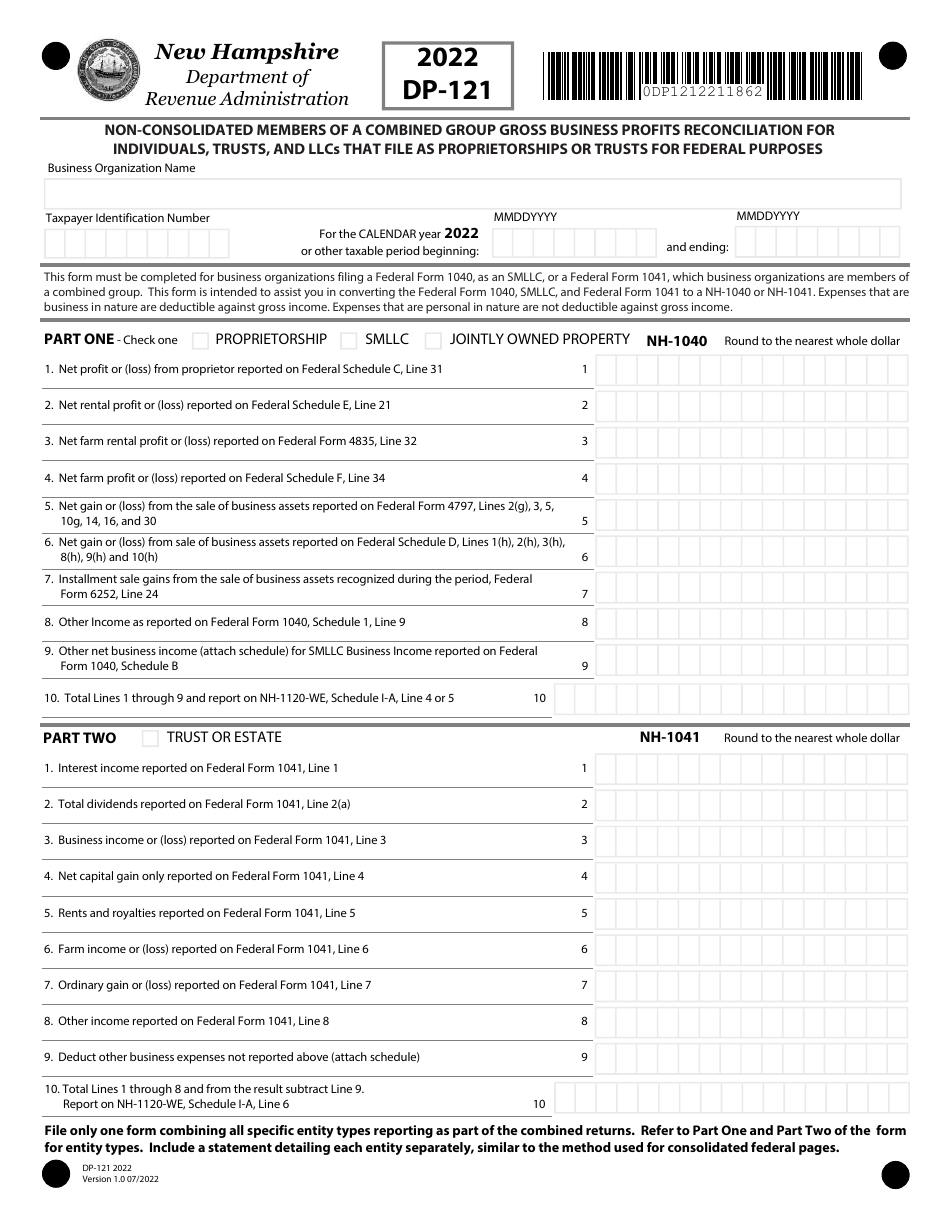

Form DP-121

for the current year.

Form DP-121 Non-consolidated Members of a Combined Group Gross Business Profits Reconciliation for Individuals, Trusts, and Llcs That File as Proprietorships or Trusts for Federal Purposes - New Hampshire

What Is Form DP-121?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DP-121?

A: Form DP-121 is a reconciliation form used by individuals, trusts, and LLCs that file as proprietorships or trusts in New Hampshire to report their gross business profits for non-consolidated members of a combined group.

Q: Who needs to file Form DP-121?

A: Individuals, trusts, and LLCs that file as proprietorships or trusts in New Hampshire and have non-consolidated members in a combined group need to file Form DP-121.

Q: What is the purpose of Form DP-121?

A: The purpose of Form DP-121 is to reconcile the gross business profits of non-consolidated members of a combined group for individuals, trusts, and LLCs that file as proprietorships or trusts in New Hampshire.

Q: Is Form DP-121 for federal purposes or state purposes?

A: Form DP-121 is for state purposes. It is used to report gross business profits in New Hampshire.

Q: Are there any specific instructions for filling out Form DP-121?

A: Yes, there are instructions provided with the form. It is important to carefully read and follow the instructions to accurately complete Form DP-121.

Form Details:

- Released on July 1, 2022;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DP-121 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.