This version of the form is not currently in use and is provided for reference only. Download this version of

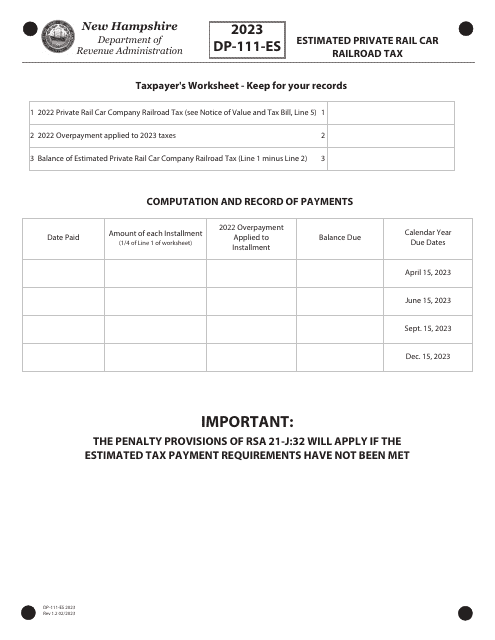

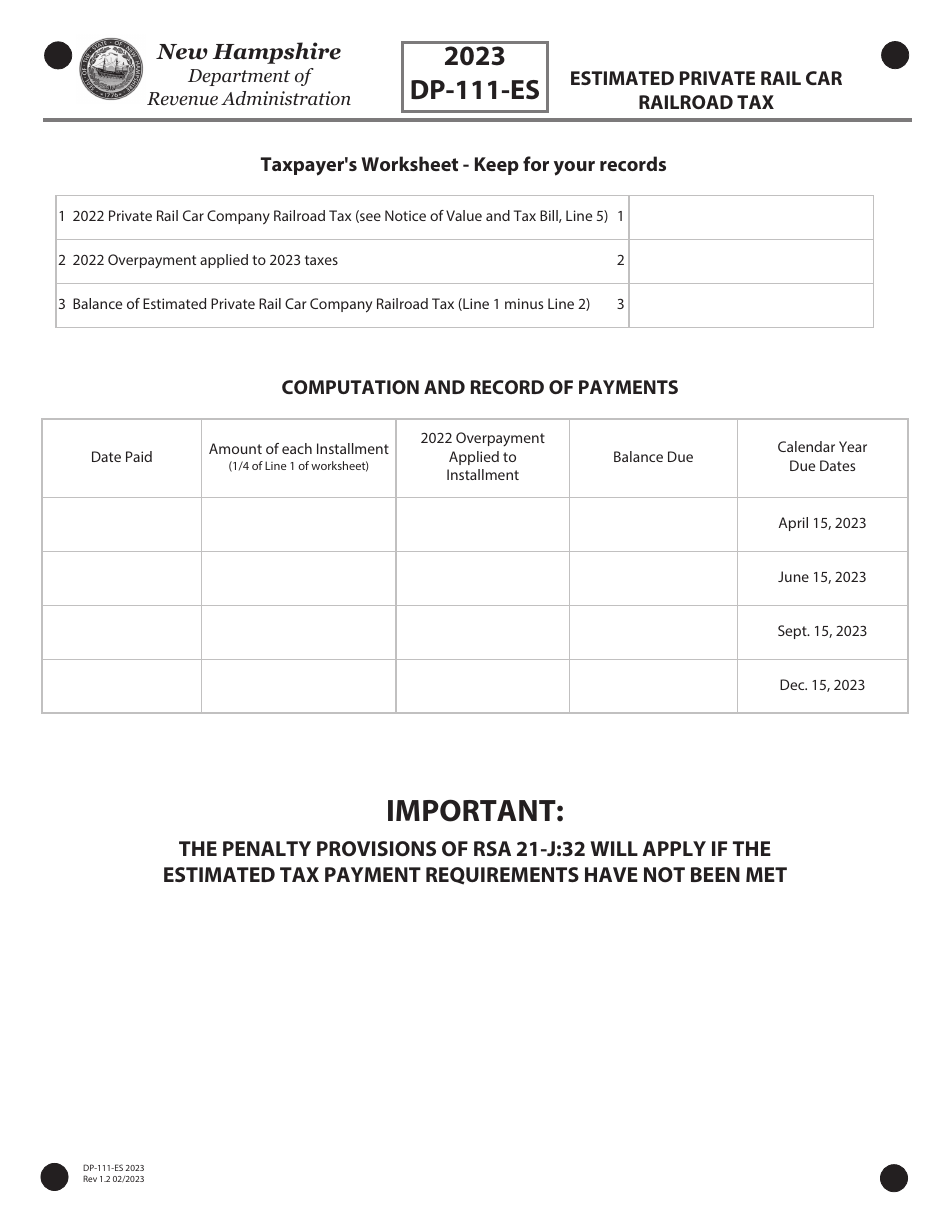

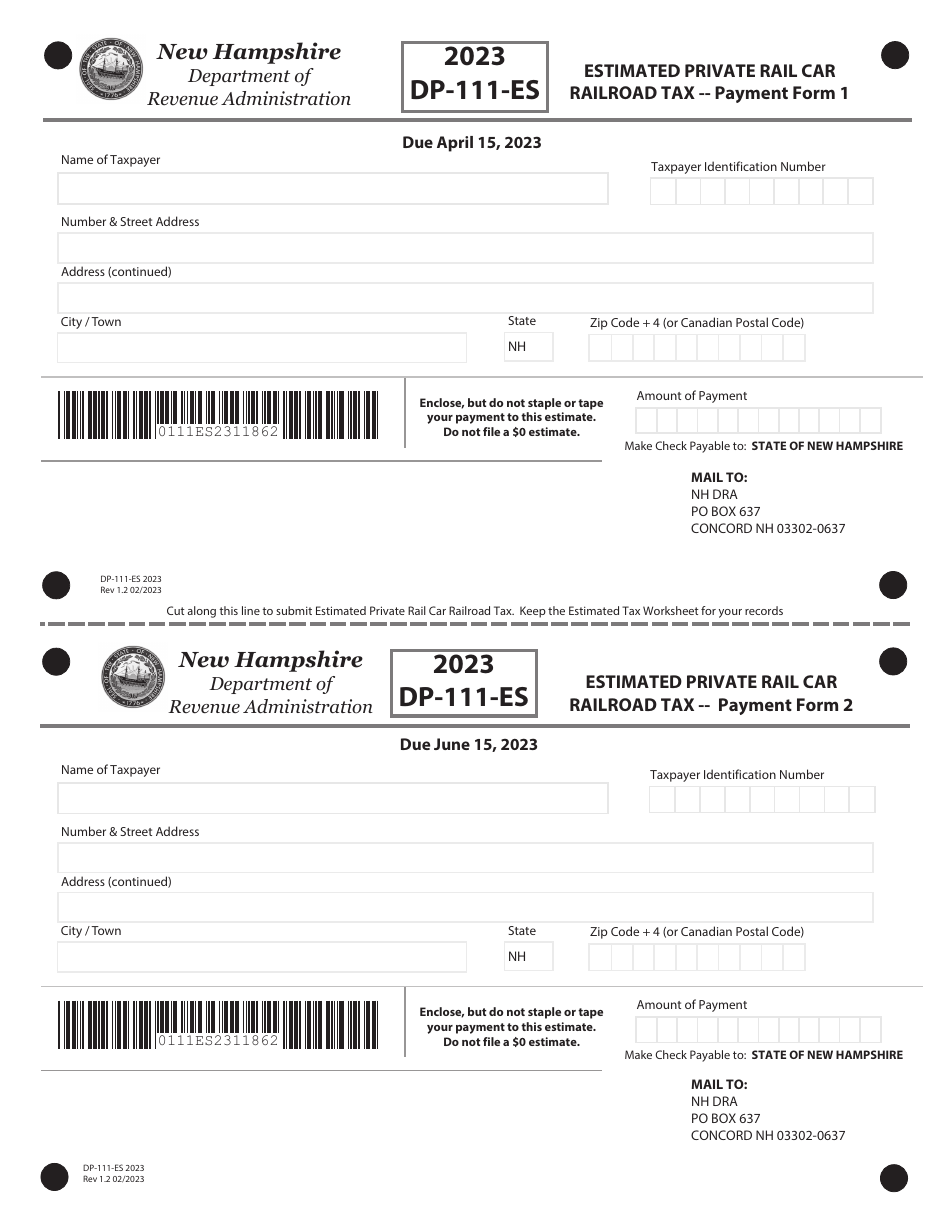

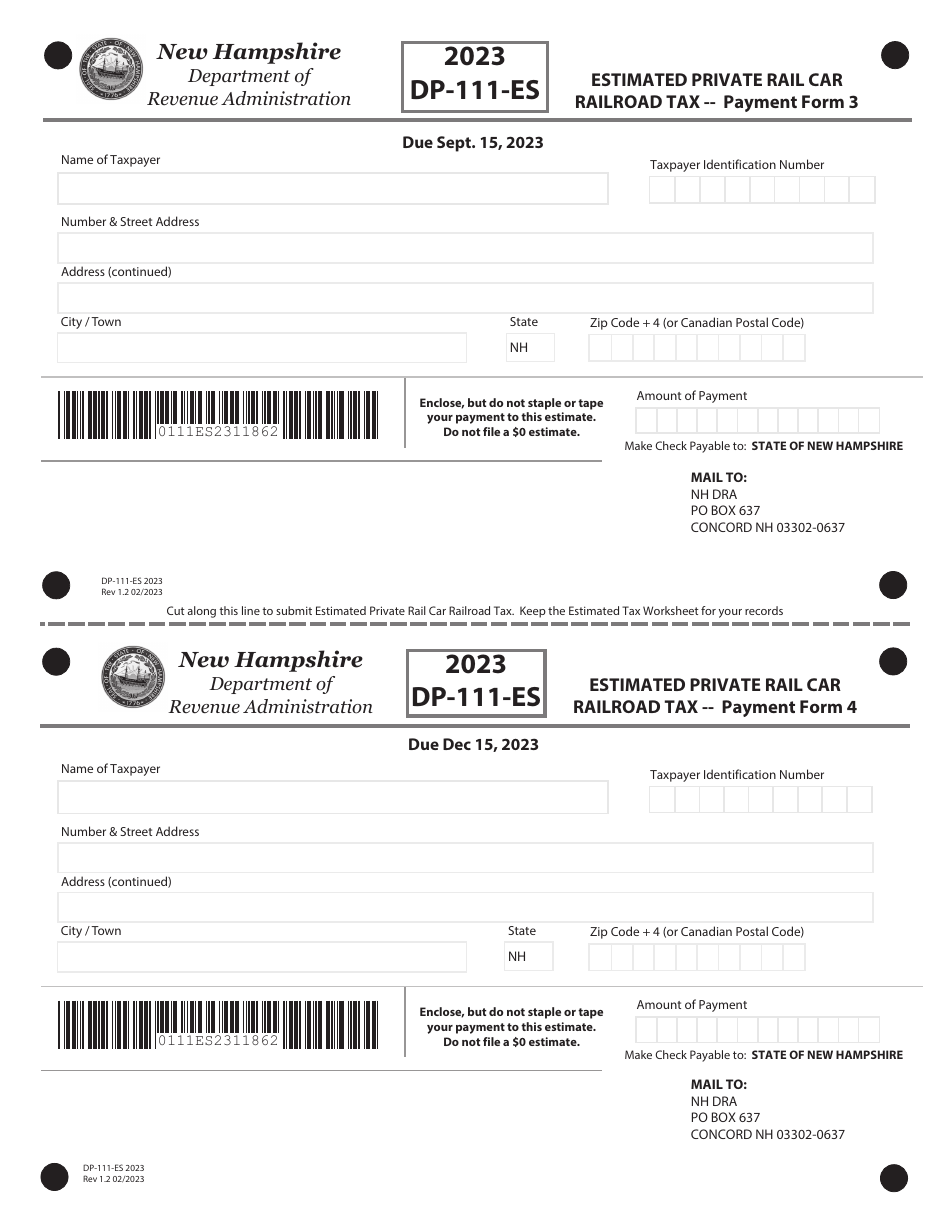

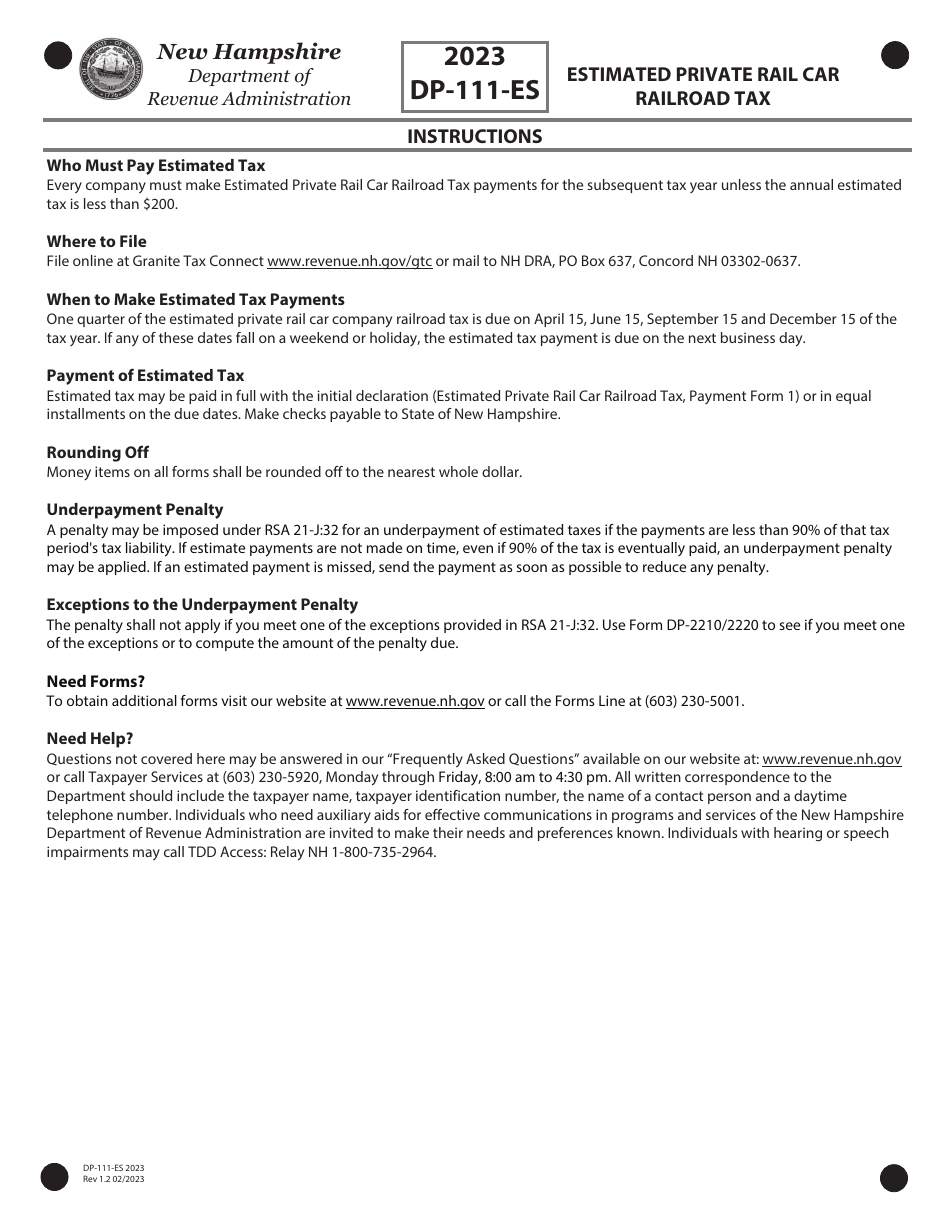

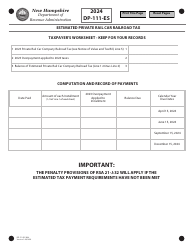

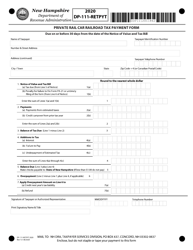

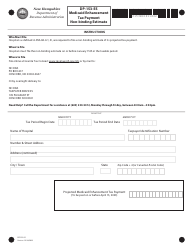

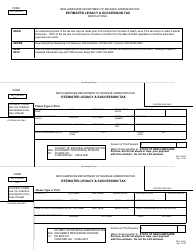

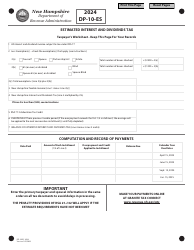

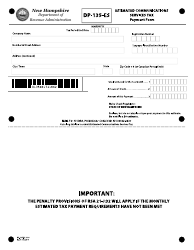

Form DP-111-ES

for the current year.

Form DP-111-ES Estimated Private Rail Car Railroad Tax - New Hampshire

What Is Form DP-111-ES?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DP-111-ES?

A: Form DP-111-ES is the form used to estimate and report private rail carrailroad tax in New Hampshire.

Q: Who needs to file Form DP-111-ES?

A: Owners or operators of private rail cars in New Hampshire need to file Form DP-111-ES.

Q: What is the purpose of Form DP-111-ES?

A: The purpose of Form DP-111-ES is to estimate and report the amount of private rail car railroad tax owed in New Hampshire.

Q: When is Form DP-111-ES due?

A: Form DP-111-ES is due on or before the last day of February.

Q: Are there any penalties for filing Form DP-111-ES late?

A: Yes, there may be penalties for filing Form DP-111-ES late. It is important to file the form by the due date to avoid penalties.

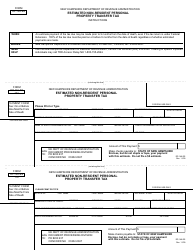

Q: What other documentation do I need to include with Form DP-111-ES?

A: You may need to include additional documentation such as the schedule of car days and any supporting documentation to calculate the tax.

Q: What happens after I file Form DP-111-ES?

A: After you file Form DP-111-ES, you will receive a notice of assessment from the New Hampshire Department of Revenue Administration indicating the amount of tax owed.

Form Details:

- Released on February 1, 2023;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DP-111-ES by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.