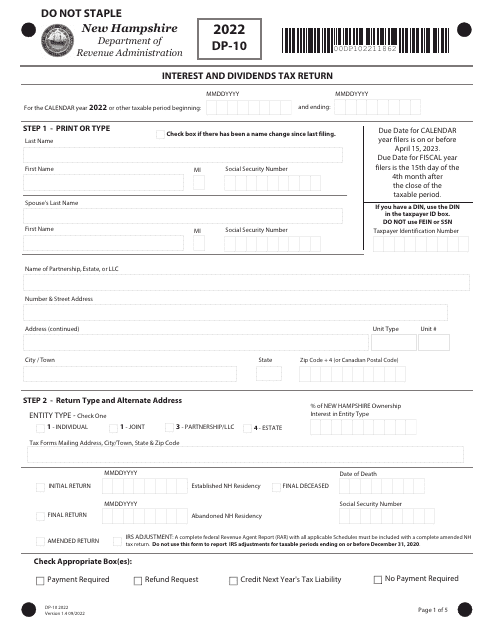

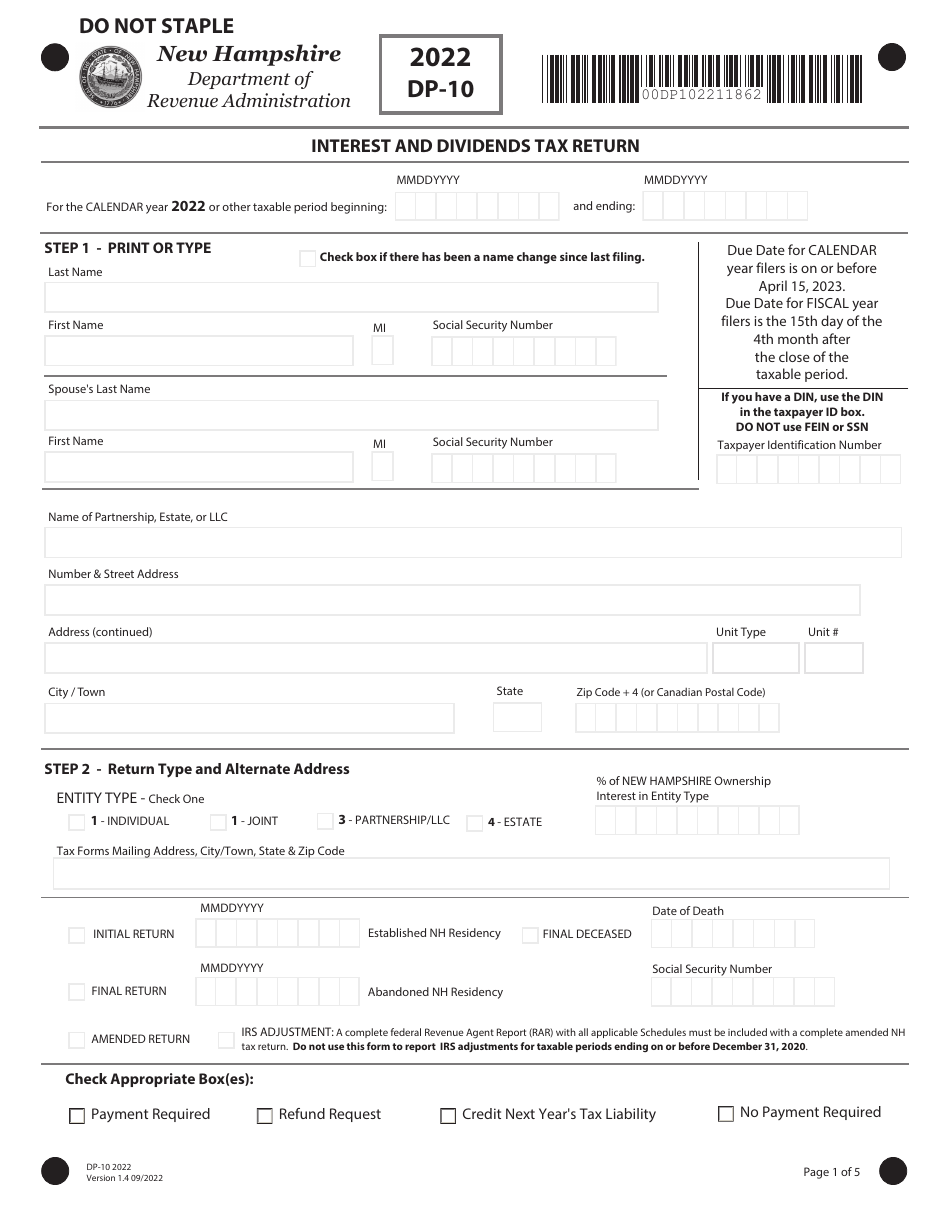

This version of the form is not currently in use and is provided for reference only. Download this version of

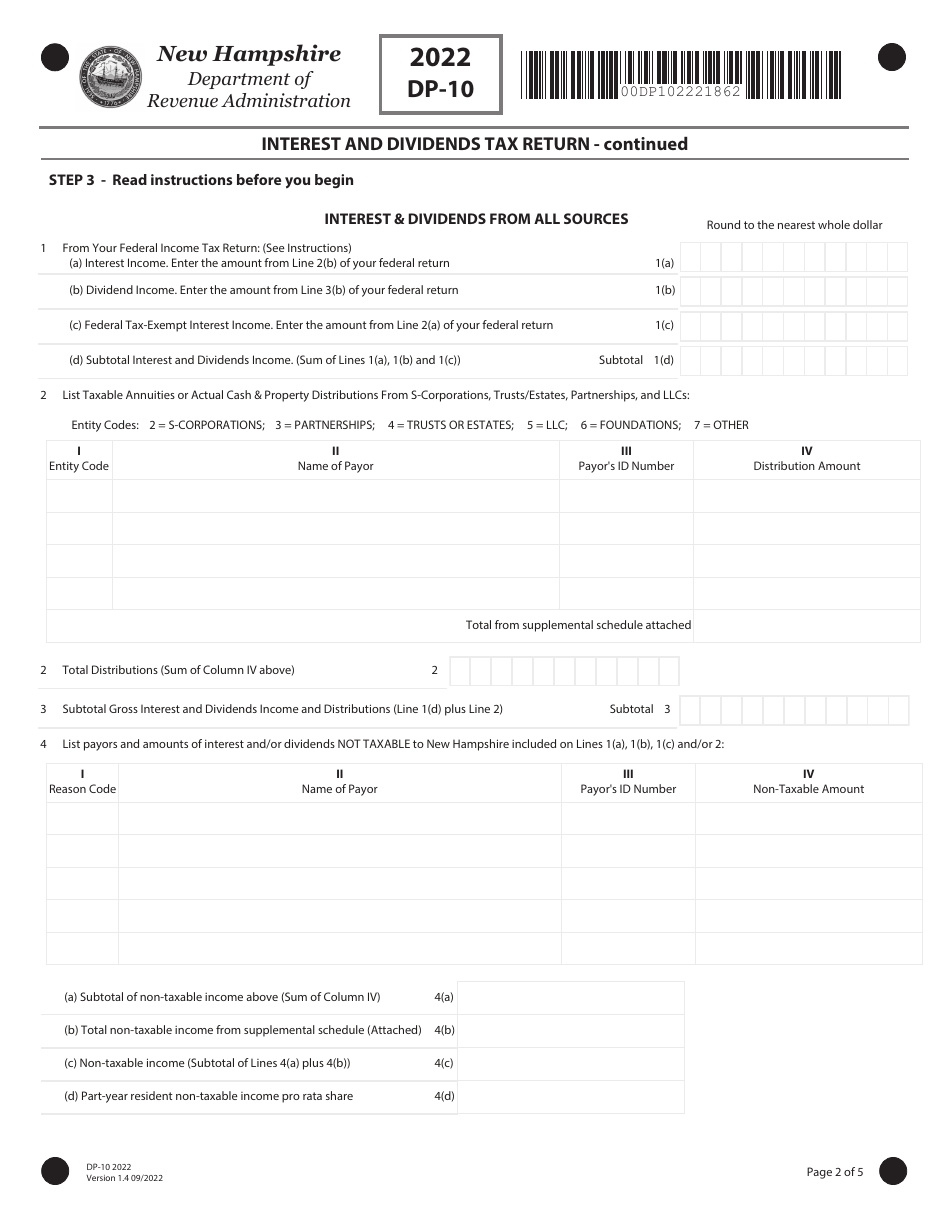

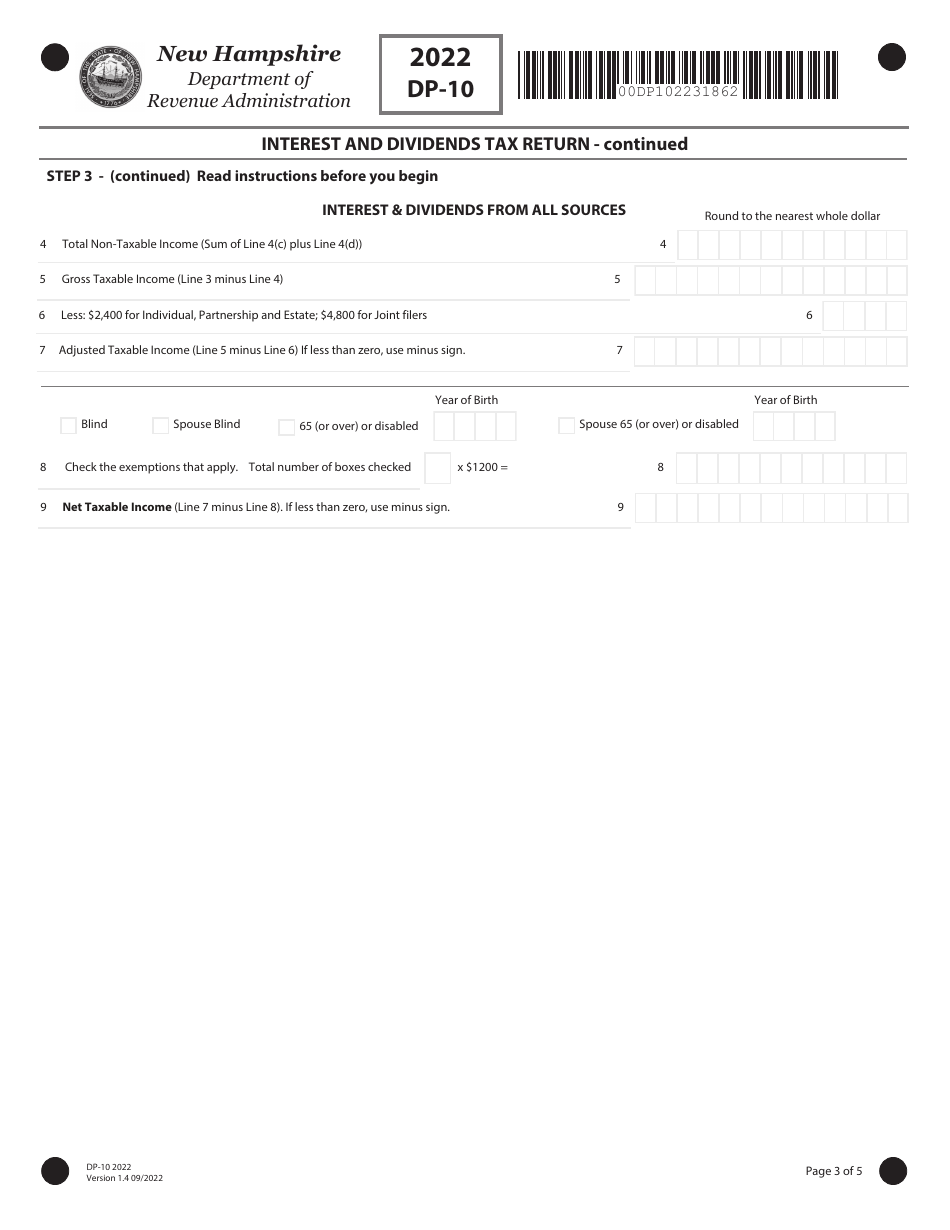

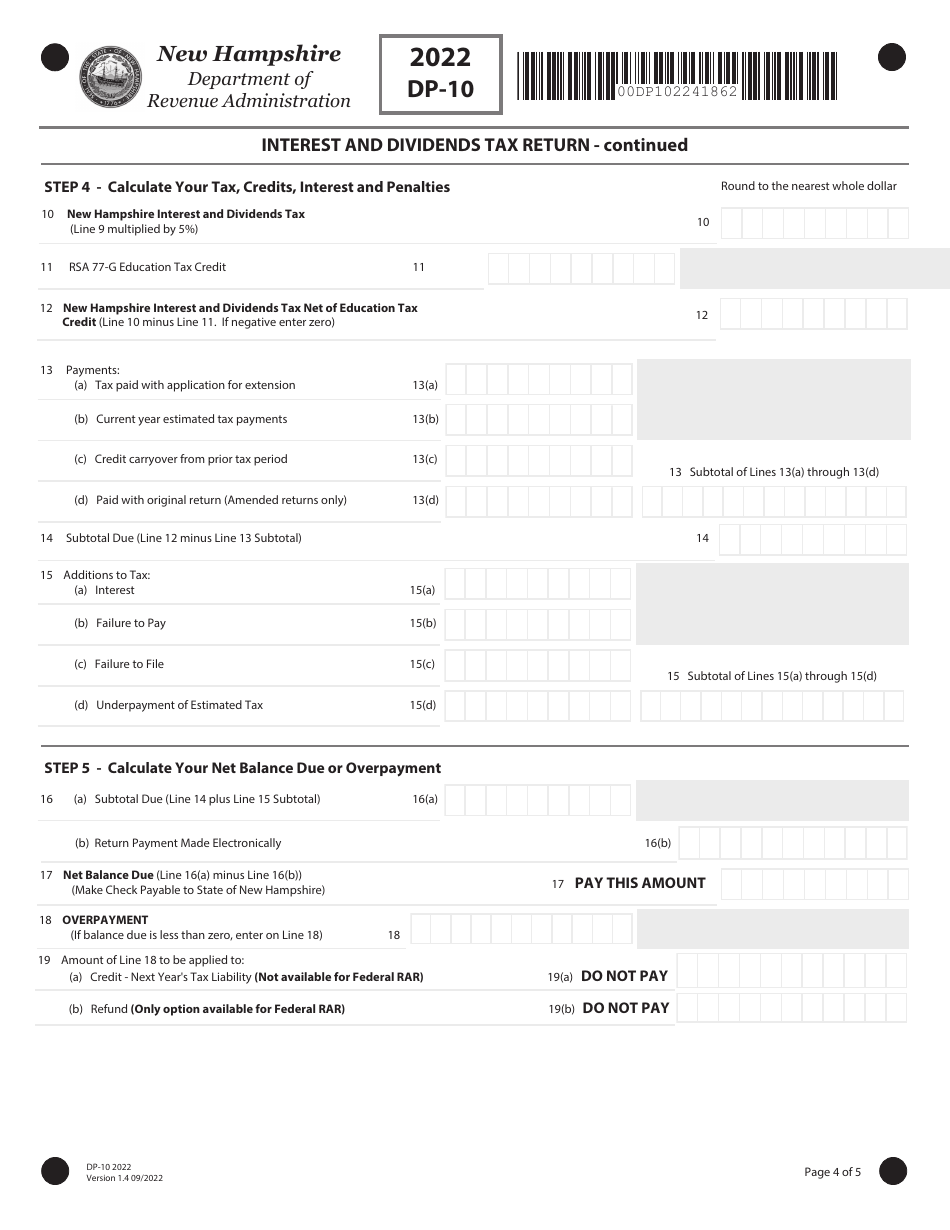

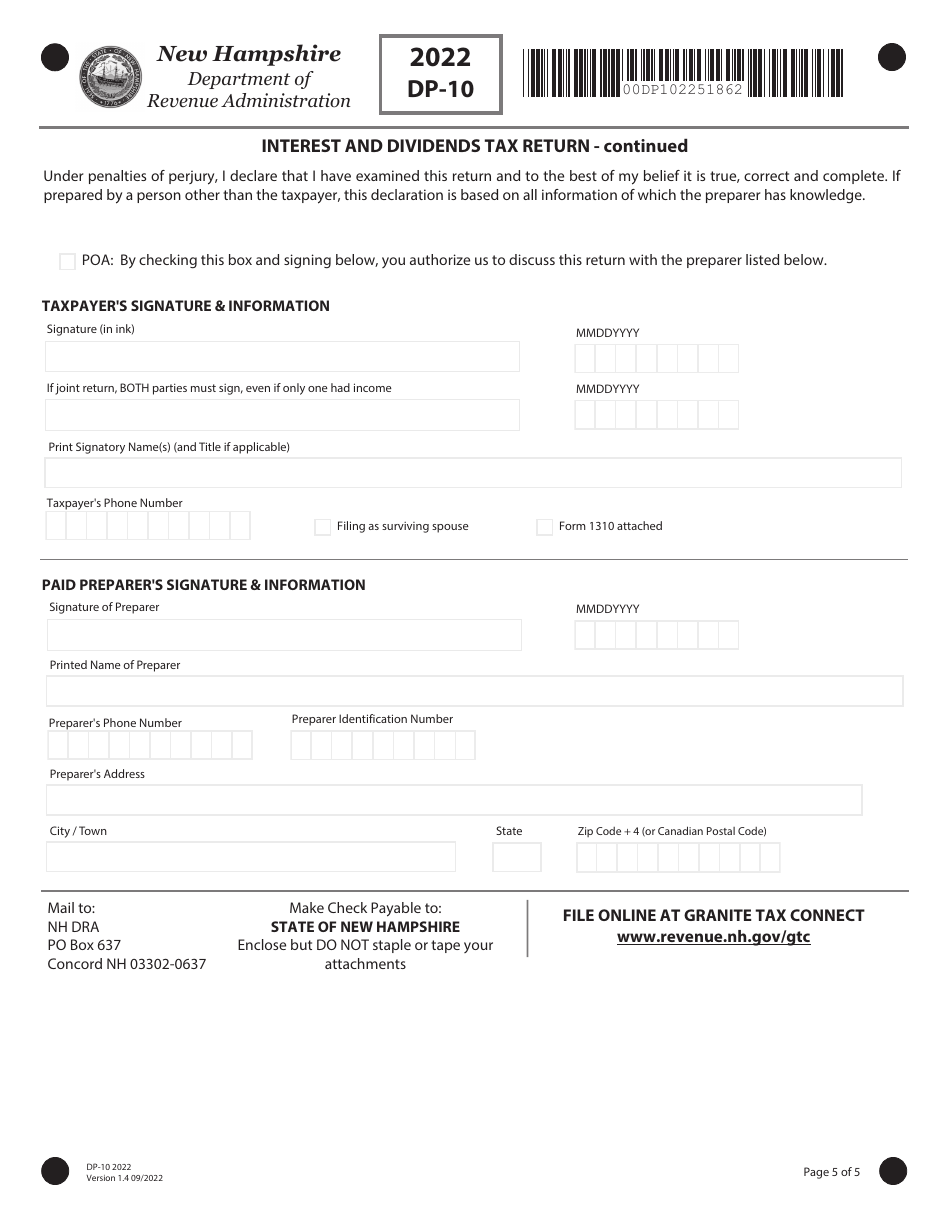

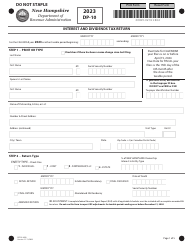

Form DP-10

for the current year.

Form DP-10 Interest and Dividends Tax Return - New Hampshire

What Is Form DP-10?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form DP-10?

A: Form DP-10 is the Interest and Dividends Tax Return form used in the state of New Hampshire.

Q: What is the purpose of Form DP-10?

A: The purpose of Form DP-10 is to report interest and/or dividend income earned by individuals or trustees in the state of New Hampshire.

Q: Who needs to file Form DP-10?

A: Any individual or trustee who has earned interest and/or dividend income in the state of New Hampshire needs to file Form DP-10.

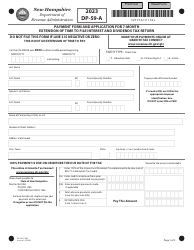

Q: When is Form DP-10 due?

A: Form DP-10 is due on April 15th of each year, unless that date falls on a weekend or holiday, in which case the deadline is extended to the following business day.

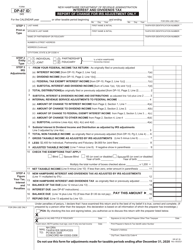

Q: Are there any penalties for filing Form DP-10 late?

A: Yes, there are penalties for filing Form DP-10 late. The penalty is 5% of the tax due per month (or portion of a month) that the return is late, up to a maximum of 25% of the tax due.

Q: Do I need to include any supporting documents with Form DP-10?

A: No, you do not need to include any supporting documents with Form DP-10. However, you should keep all relevant records and documents in case of an audit.

Q: Can I file Form DP-10 if I have no interest or dividend income?

A: No, you do not need to file Form DP-10 if you have no interest or dividend income. However, it is always a good idea to consult with a tax professional to ensure compliance with state tax laws.

Q: Can I file Form DP-10 if I am not a resident of New Hampshire?

A: Yes, non-residents who have earned interest and/or dividend income in the state of New Hampshire are required to file Form DP-10.

Q: Can I file Form DP-10 if I am a part-year resident of New Hampshire?

A: Yes, part-year residents of New Hampshire who have earned interest and/or dividend income during their residency are required to file Form DP-10.

Form Details:

- Released on September 1, 2022;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DP-10 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.