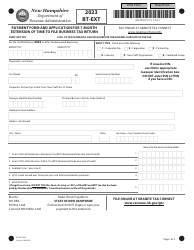

This version of the form is not currently in use and is provided for reference only. Download this version of

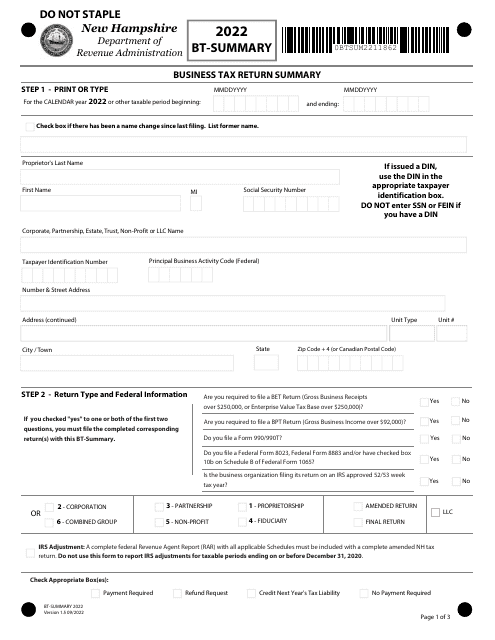

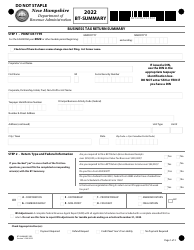

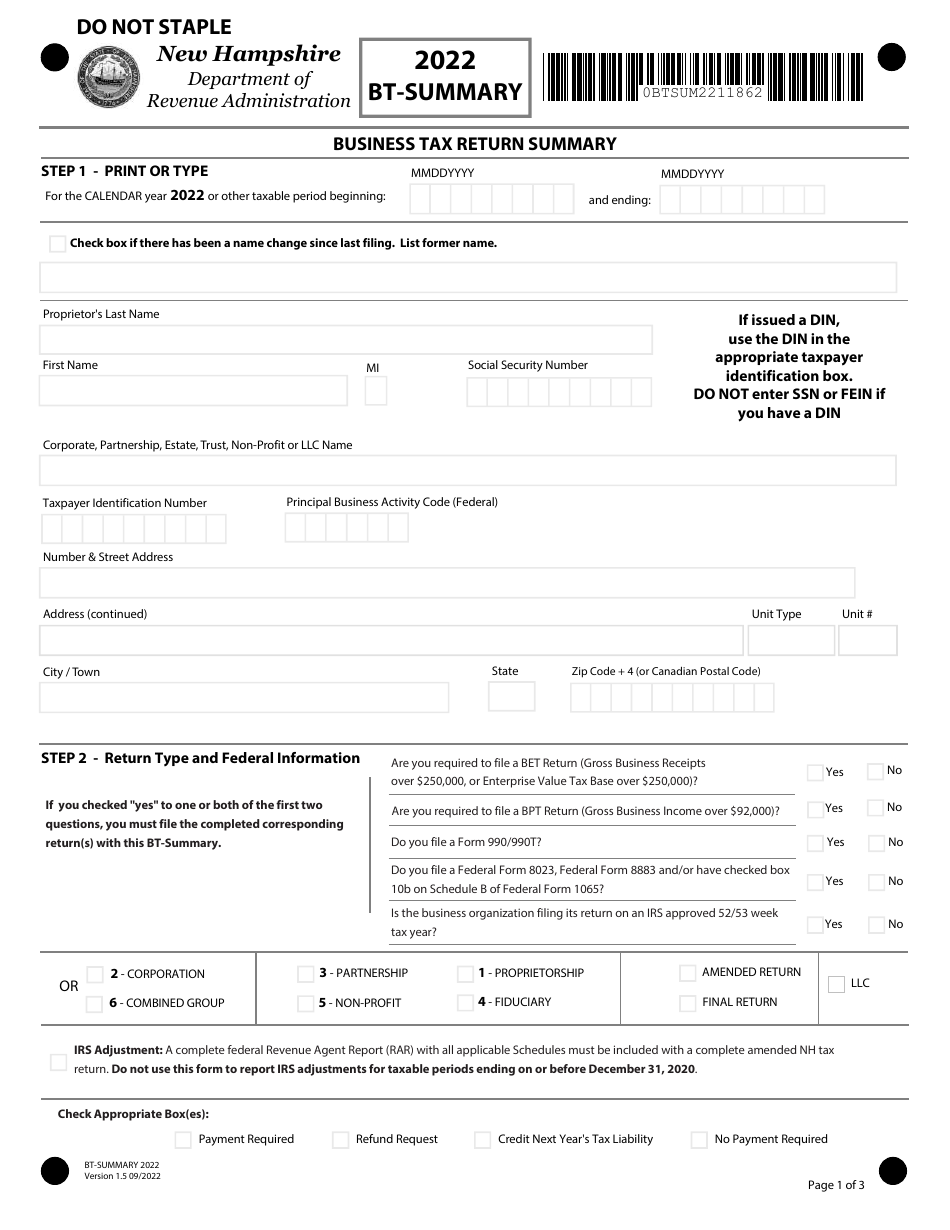

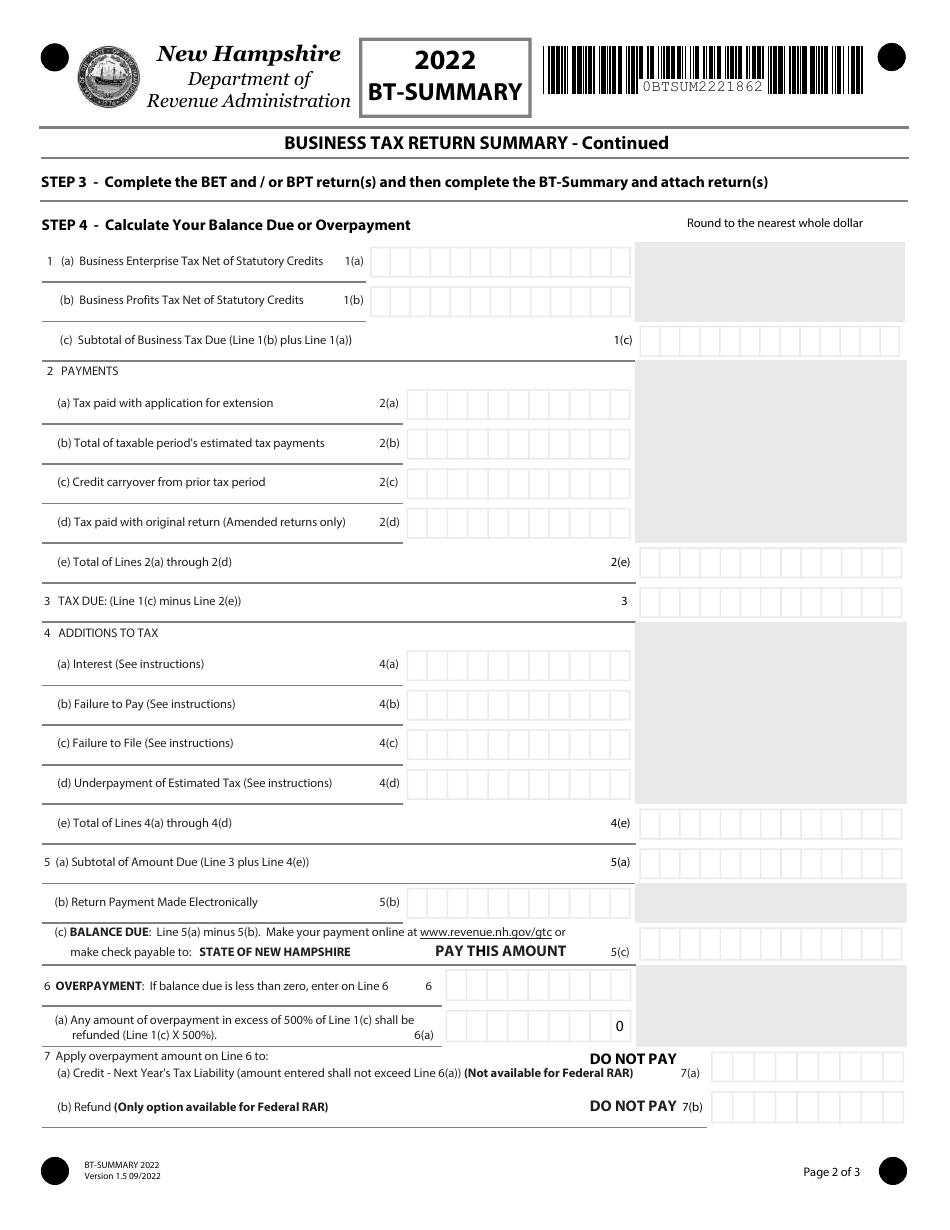

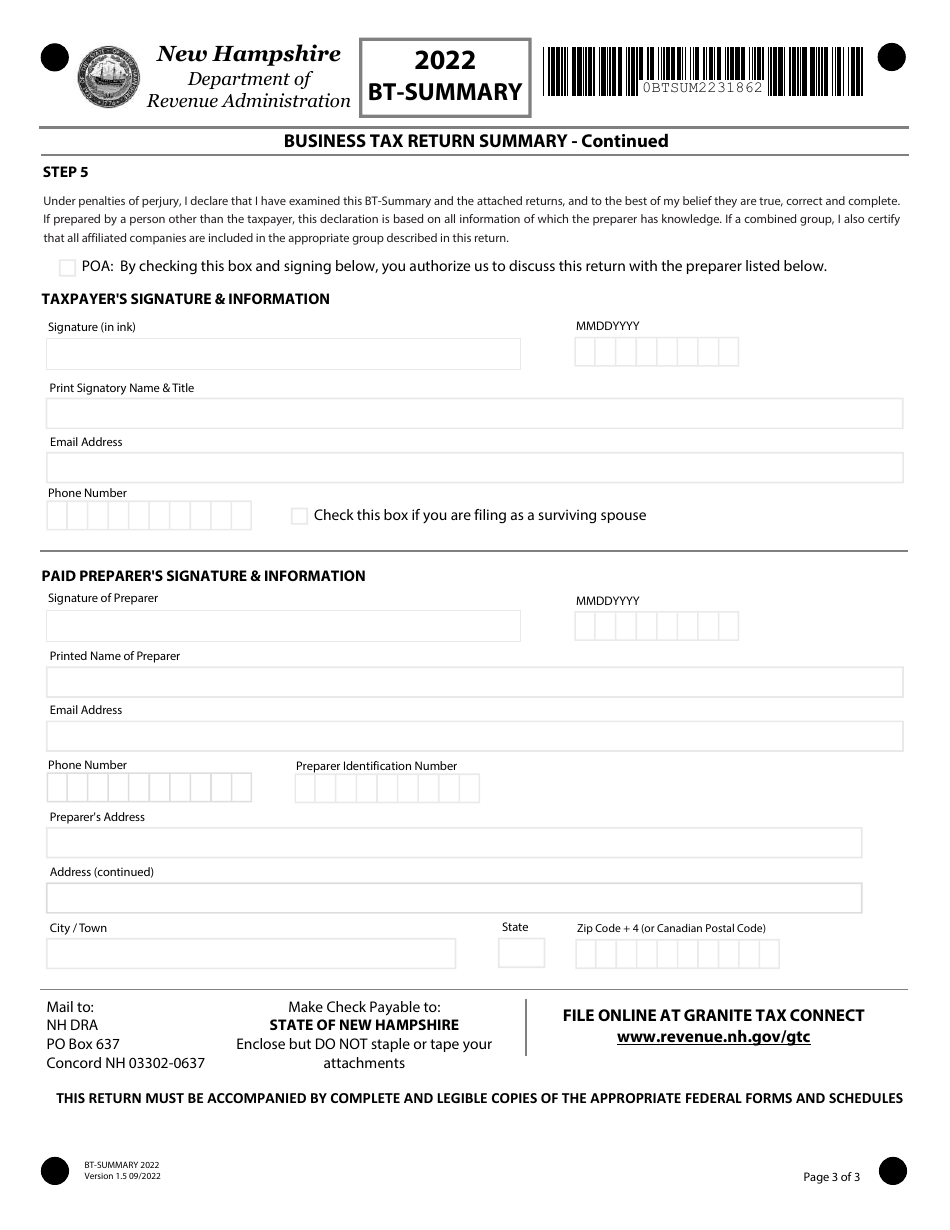

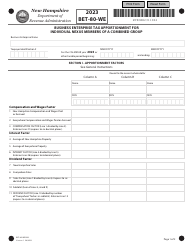

Form BT-SUMMARY

for the current year.

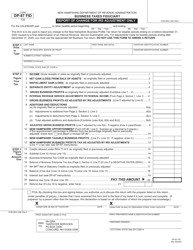

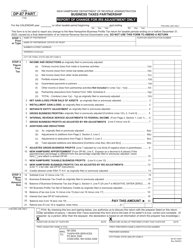

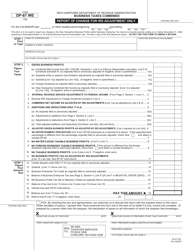

Form BT-SUMMARY Business Tax Return Summary - New Hampshire

What Is Form BT-SUMMARY?

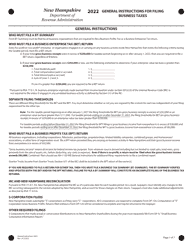

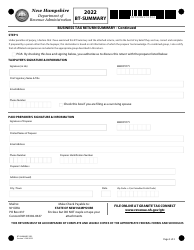

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. Check the official instructions before completing and submitting the form.

FAQ

Q: What is BT-SUMMARY?

A: BT-SUMMARY is a business tax return summary form used in New Hampshire.

Q: Who needs to file BT-SUMMARY?

A: Businesses that are required to file a tax return in New Hampshire need to file BT-SUMMARY.

Q: What is the purpose of filing BT-SUMMARY?

A: The purpose of filing BT-SUMMARY is to provide a summary of the business tax return to the state of New Hampshire.

Q: Is BT-SUMMARY the only form I need to file?

A: No, BT-SUMMARY is a summary form and you may need to file additional forms depending on your business activities and tax obligations.

Q: When is the deadline for filing BT-SUMMARY?

A: The deadline for filing BT-SUMMARY is generally the same as the deadline for filing your business tax return in New Hampshire, which is typically on or before April 15th.

Q: What happens if I don't file BT-SUMMARY?

A: Failure to file BT-SUMMARY may result in penalties and interest charges imposed by the state of New Hampshire.

Q: Is there a fee for filing BT-SUMMARY?

A: There is no fee for filing BT-SUMMARY in New Hampshire.

Form Details:

- Released on September 1, 2022;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BT-SUMMARY by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.