This version of the form is not currently in use and is provided for reference only. Download this version of

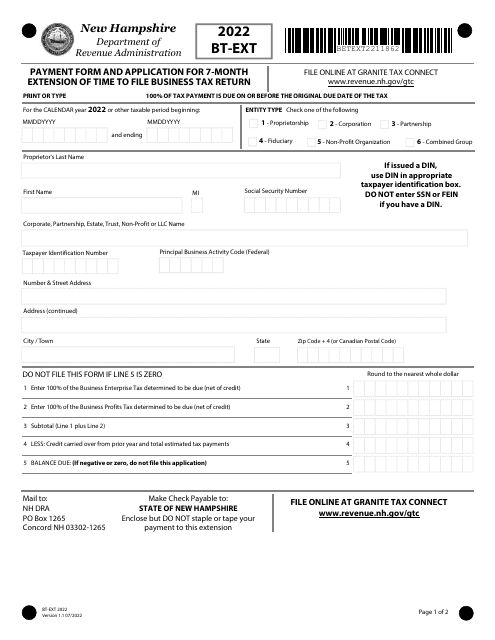

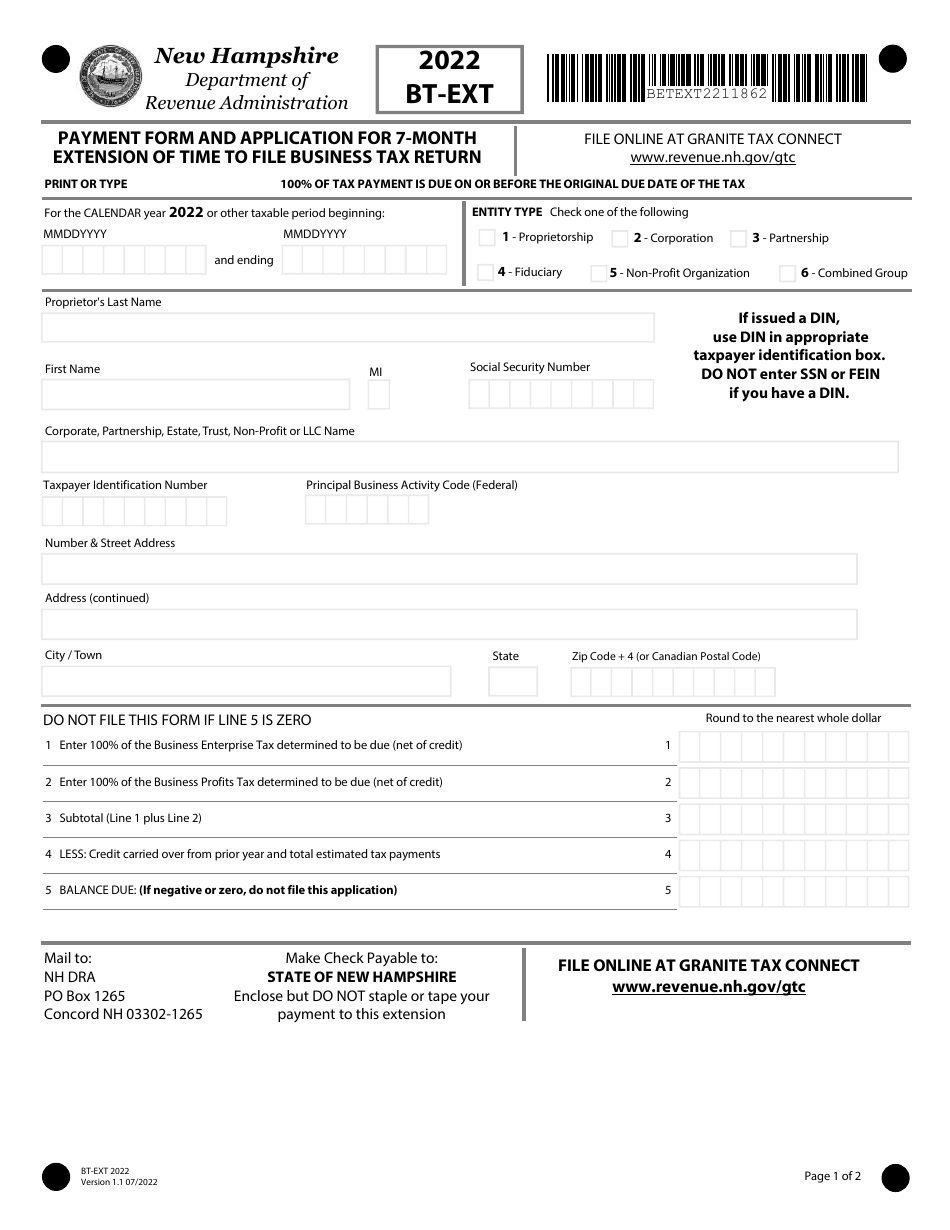

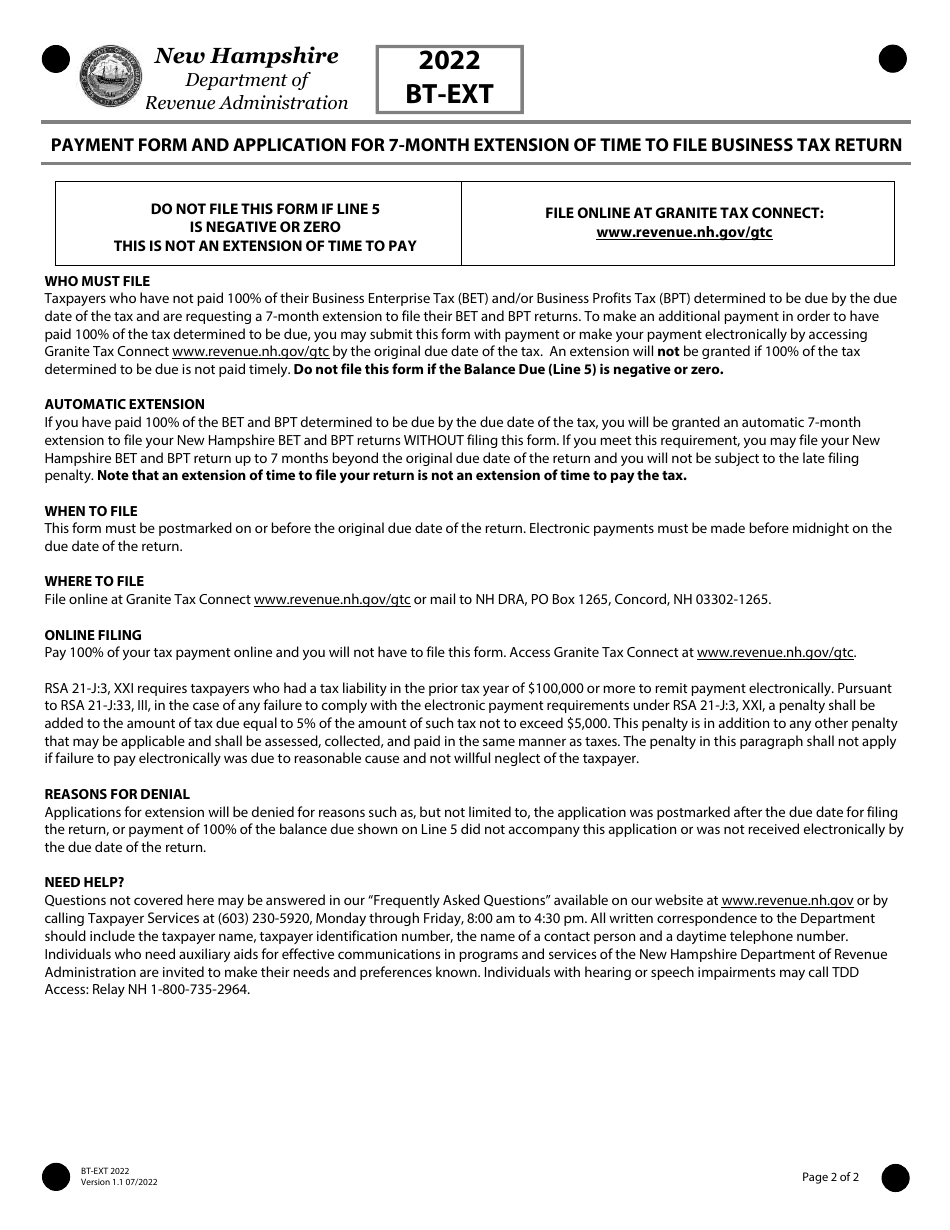

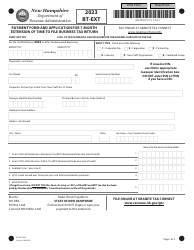

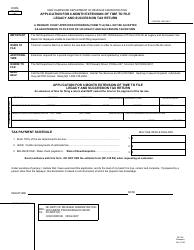

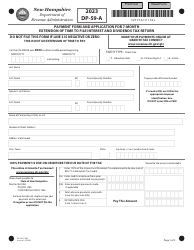

Form BT-EXT

for the current year.

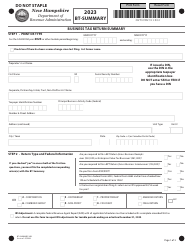

Form BT-EXT Payment Form and Application for 7-month Extension of Time to File Business Tax Return - New Hampshire

What Is Form BT-EXT?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form BT-EXT?

A: Form BT-EXT is a payment form and application for a 7-month extension of time to file a business tax return in New Hampshire.

Q: Who is required to use Form BT-EXT?

A: Businesses in New Hampshire that need additional time to file their tax return must use Form BT-EXT.

Q: What is the purpose of Form BT-EXT?

A: The purpose of Form BT-EXT is to request an extension of time to file a business tax return and make any necessary payment.

Q: How long is the extension period?

A: The extension period granted by Form BT-EXT is 7 months.

Q: Is there a fee for requesting an extension with Form BT-EXT?

A: No, there is no fee for requesting an extension using Form BT-EXT.

Form Details:

- Released on July 1, 2022;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BT-EXT by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.