This version of the form is not currently in use and is provided for reference only. Download this version of

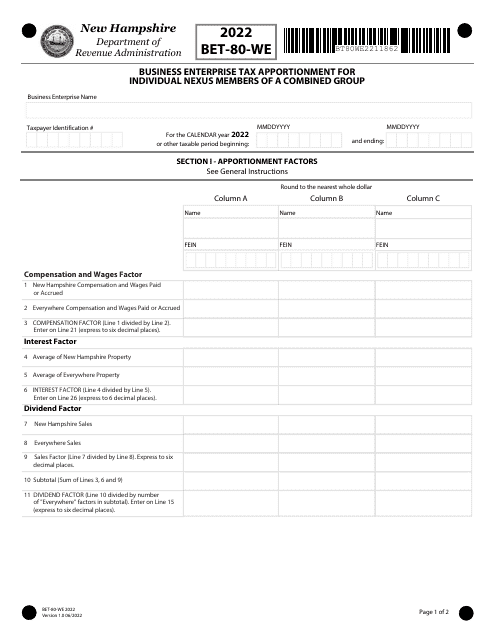

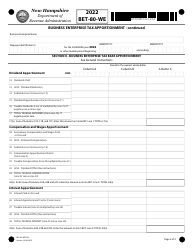

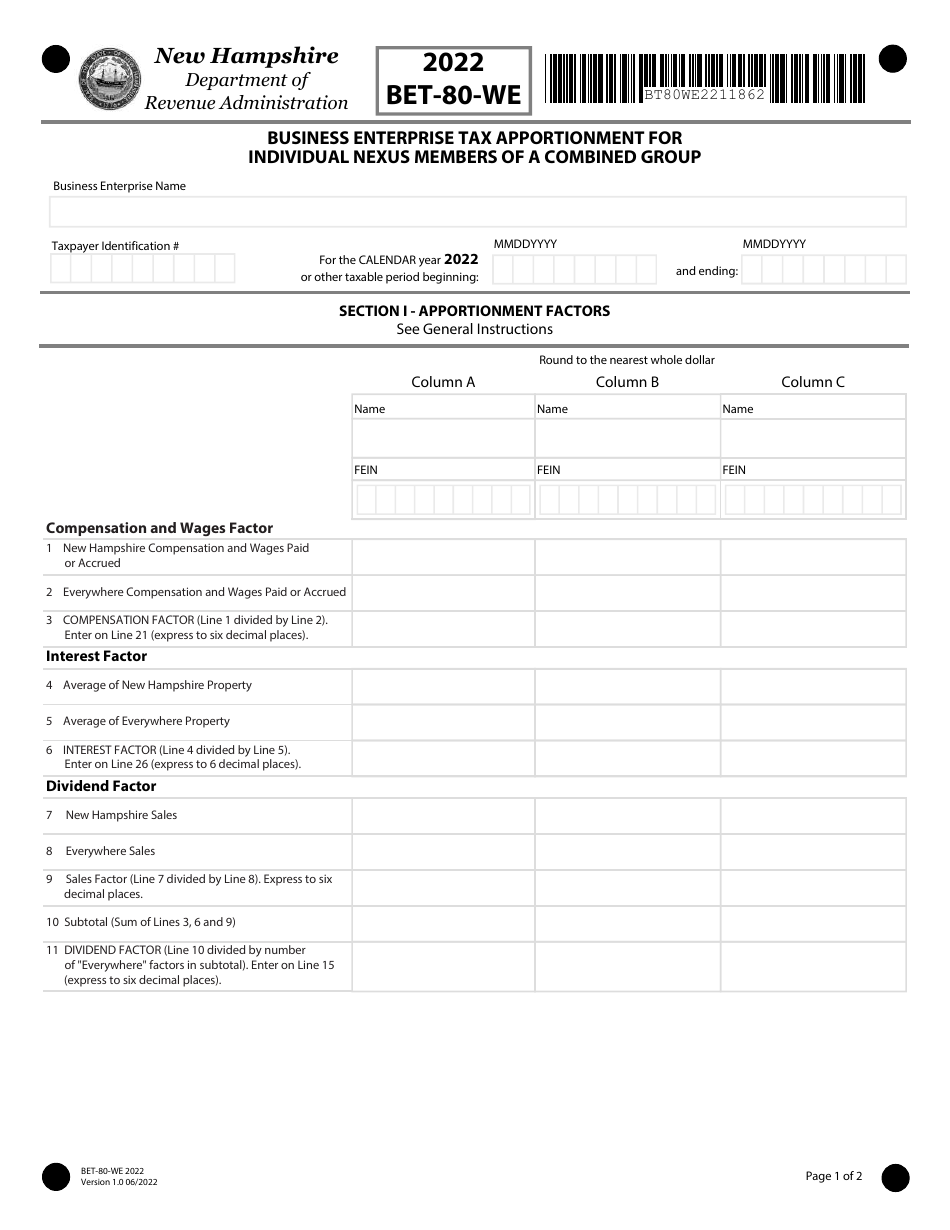

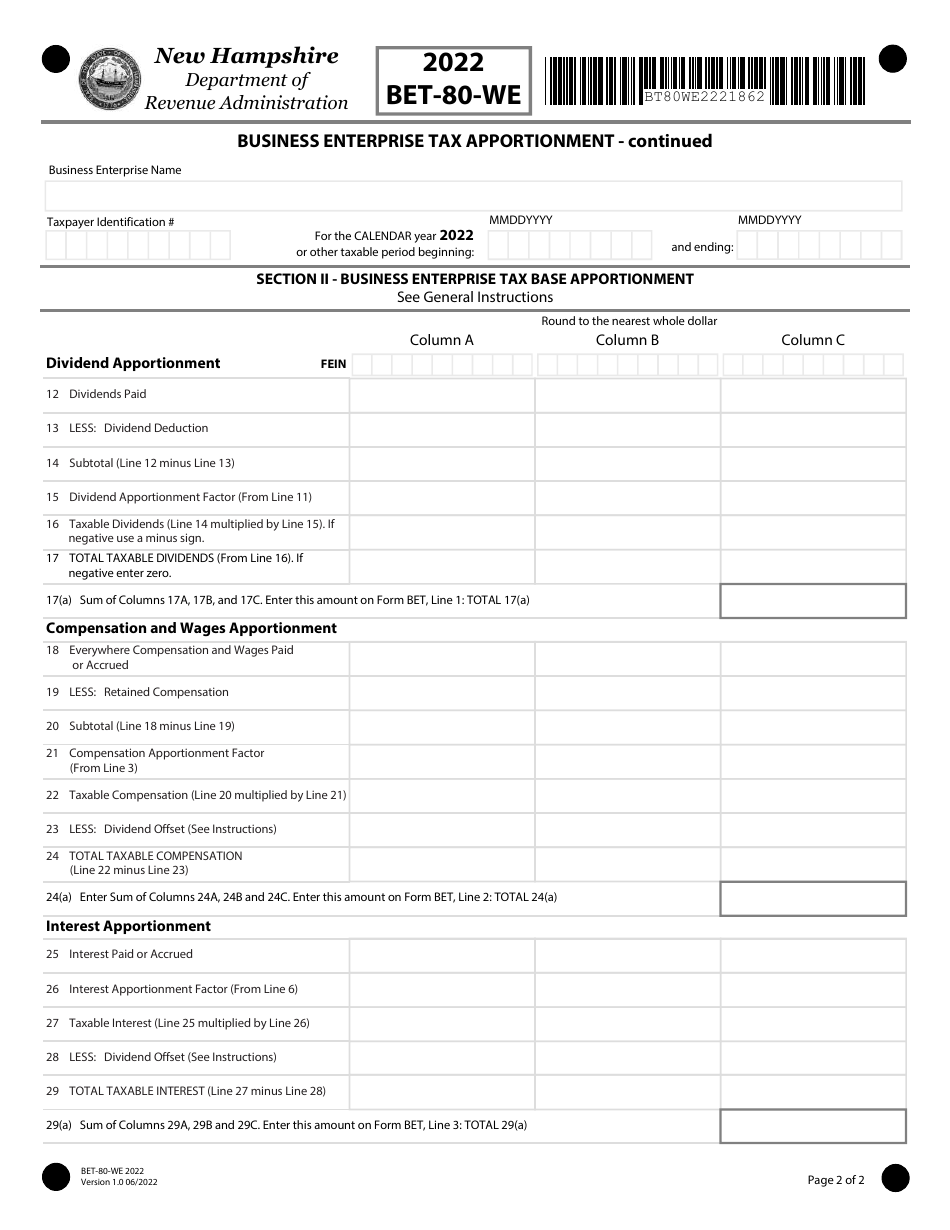

Form BET-80-WE

for the current year.

Form BET-80-WE Business Enterprise Tax Apportionment for Individual Nexus Members of a Combined Group - New Hampshire

What Is Form BET-80-WE?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. Check the official instructions before completing and submitting the form.

FAQ

Q: What is BET-80-WE?

A: BET-80-WE is a form used for business enterprise tax apportionment for individual nexus members of a combined group in New Hampshire.

Q: What is the purpose of BET-80-WE?

A: The purpose of BET-80-WE is to determine the portion of business enterprise tax that should be apportioned to individual nexus members of a combined group.

Q: Who needs to file BET-80-WE?

A: Individual nexus members of a combined group in New Hampshire who are subject to business enterprise tax need to file BET-80-WE.

Q: When is BET-80-WE due?

A: BET-80-WE is due on the same day as the business enterprise tax return, which is typically April 15th.

Form Details:

- Released on June 1, 2022;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BET-80-WE by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.