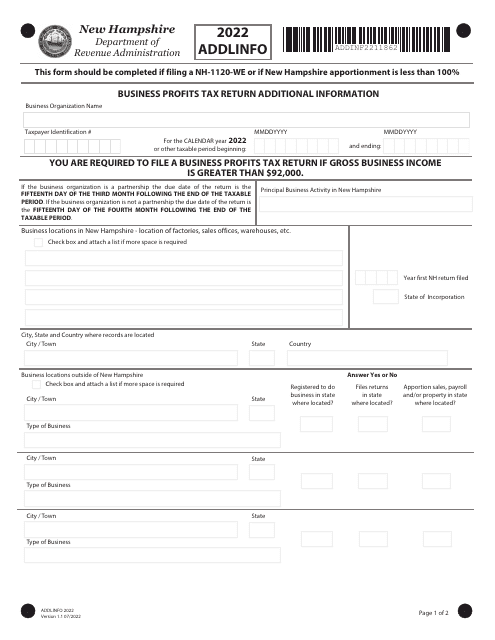

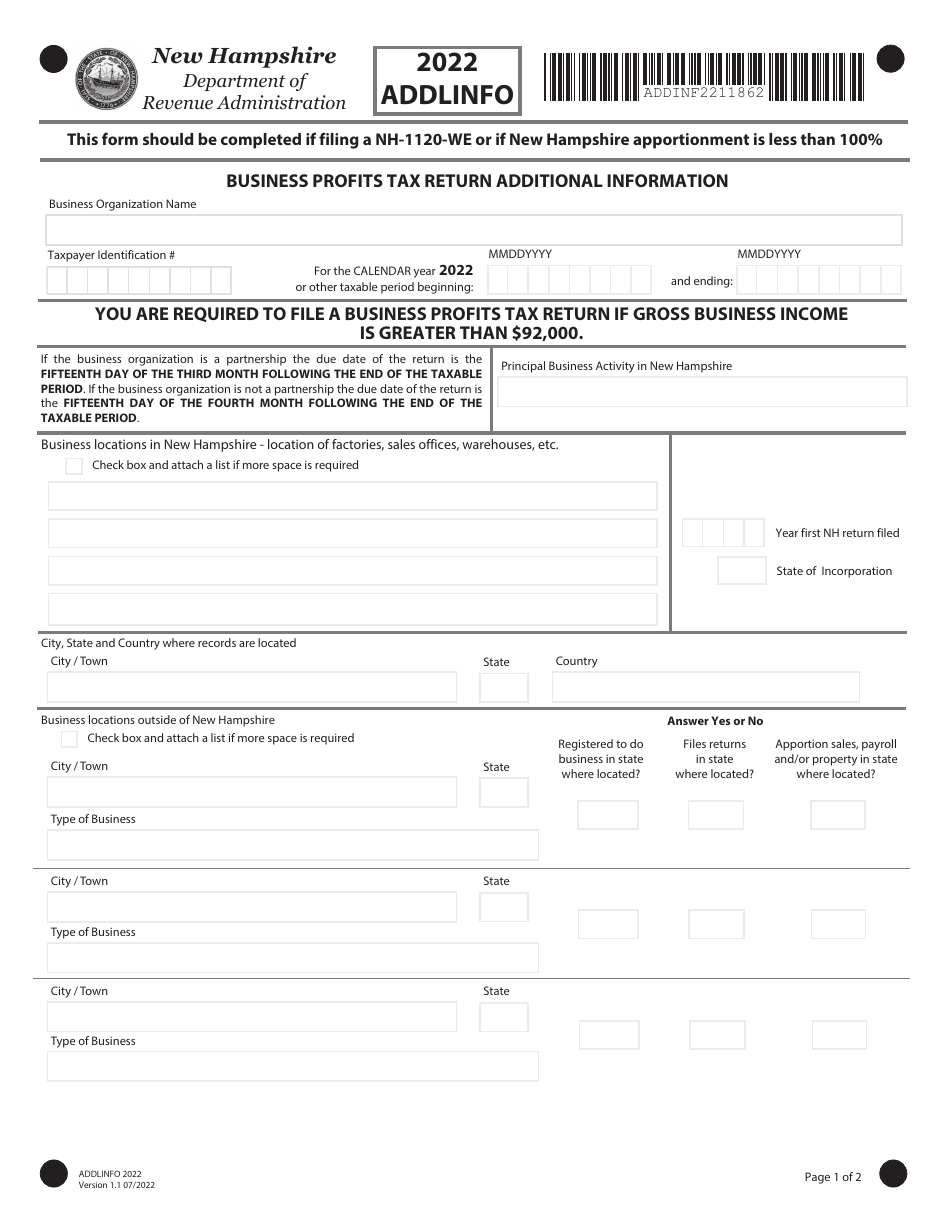

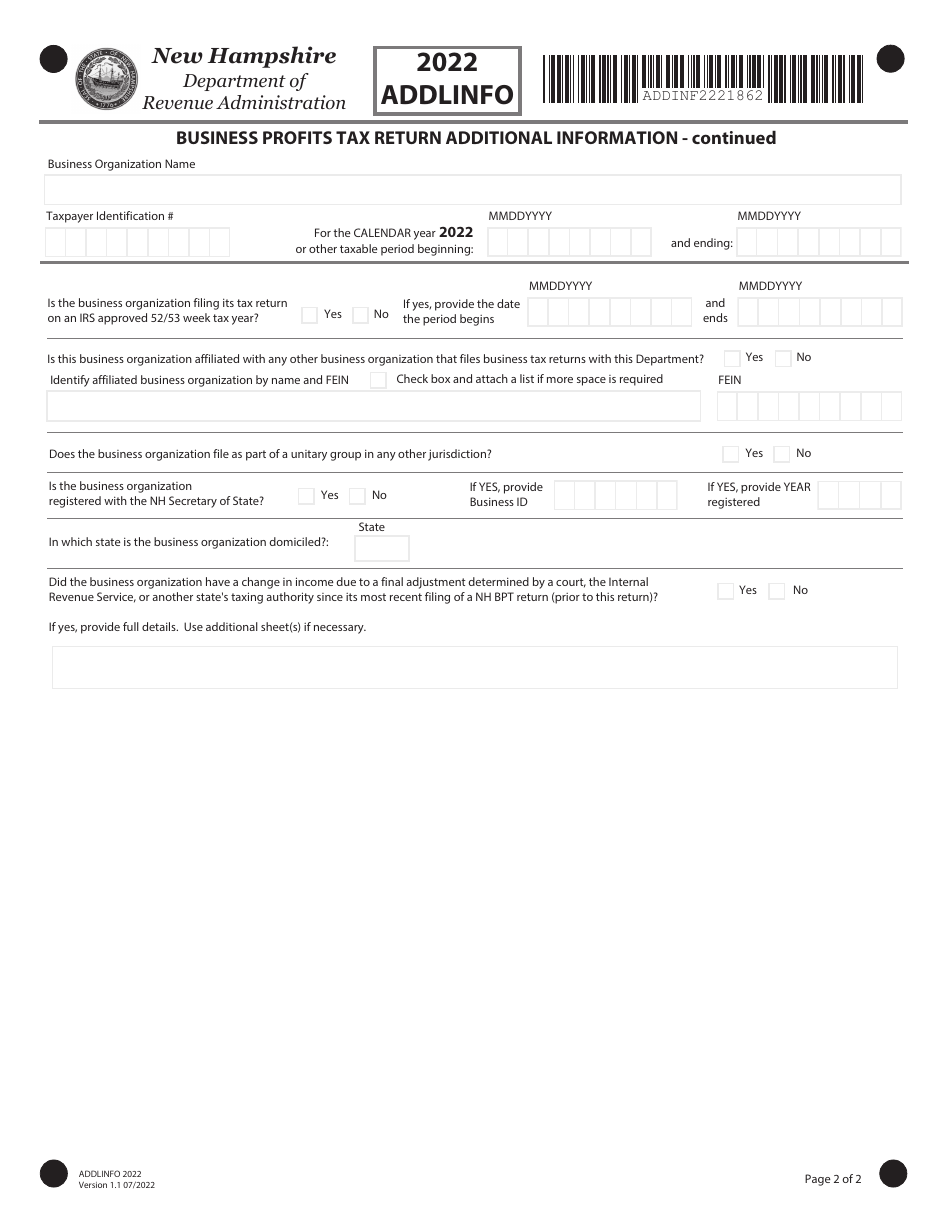

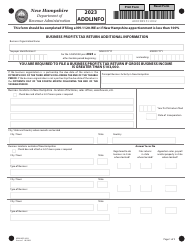

Form ADDL INFO Business Profits Tax Return Additional Information - New Hampshire

What Is Form ADDL INFO?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Business Profits Tax Return?

A: The Business Profits Tax Return is a tax form that businesses in New Hampshire must file to report their taxable profits.

Q: Why do businesses need to provide additional information for the Business Profits Tax Return?

A: Businesses may need to provide additional information to ensure accurate reporting of their profits and to comply with state tax laws.

Q: What kind of additional information is required for the Business Profits Tax Return?

A: The specific additional information required may vary, but it could include details about the business's income, expenses, deductions, and other financial information.

Q: Is there a deadline for submitting the additional information for the Business Profits Tax Return?

A: Yes, businesses must submit the additional information by the same deadline as the Business Profits Tax Return, which is typically April 15th for most businesses.

Q: What happens if a business fails to provide the additional information for the Business Profits Tax Return?

A: Failure to provide the required additional information may result in penalties or delays in processing the Business Profits Tax Return and may subject the business to further scrutiny by the tax authorities.

Form Details:

- Released on July 1, 2022;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ADDL INFO by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.