This version of the form is not currently in use and is provided for reference only. Download this version of

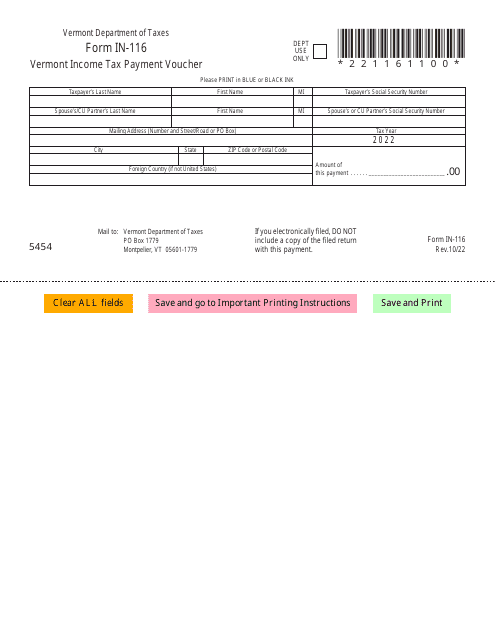

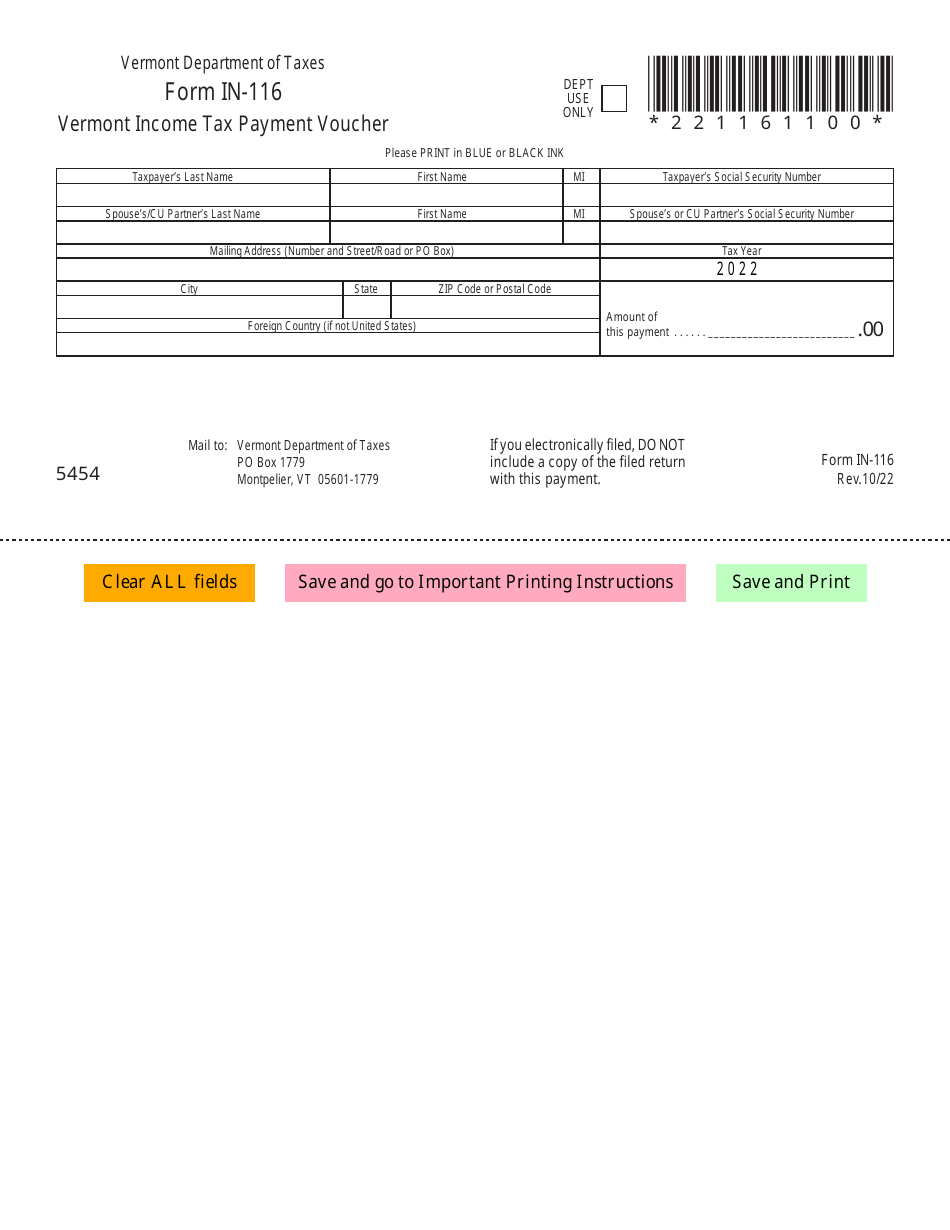

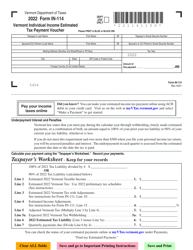

Form IN-116

for the current year.

Form IN-116 Vermont Income Tax Payment Voucher - Vermont

What Is Form IN-116?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IN-116?

A: Form IN-116 is the Vermont Income Tax Payment Voucher.

Q: What is the purpose of Form IN-116?

A: The purpose of Form IN-116 is to provide a voucher for taxpayers to submit their income tax payments to the state of Vermont.

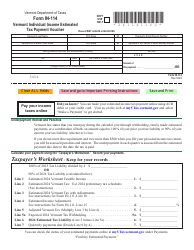

Q: Do I need to file Form IN-116 if I am filing my taxes electronically?

A: No, if you are filing your taxes electronically, you do not need to file Form IN-116. The payment can be made electronically.

Q: When is Form IN-116 due?

A: Form IN-116 is due on or before the same date as your income tax return.

Q: Can I make a payment without using Form IN-116?

A: Yes, you can make a payment without using Form IN-116. However, using the form ensures that your payment is properly applied to your tax account.

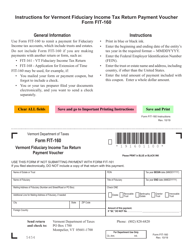

Form Details:

- Released on October 1, 2022;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IN-116 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.