This version of the form is not currently in use and is provided for reference only. Download this version of

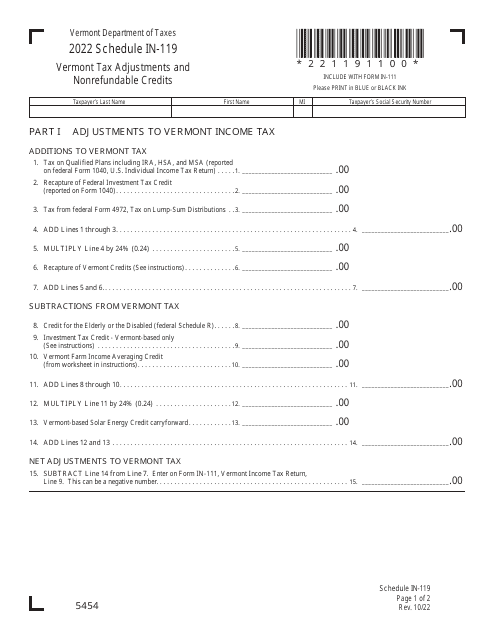

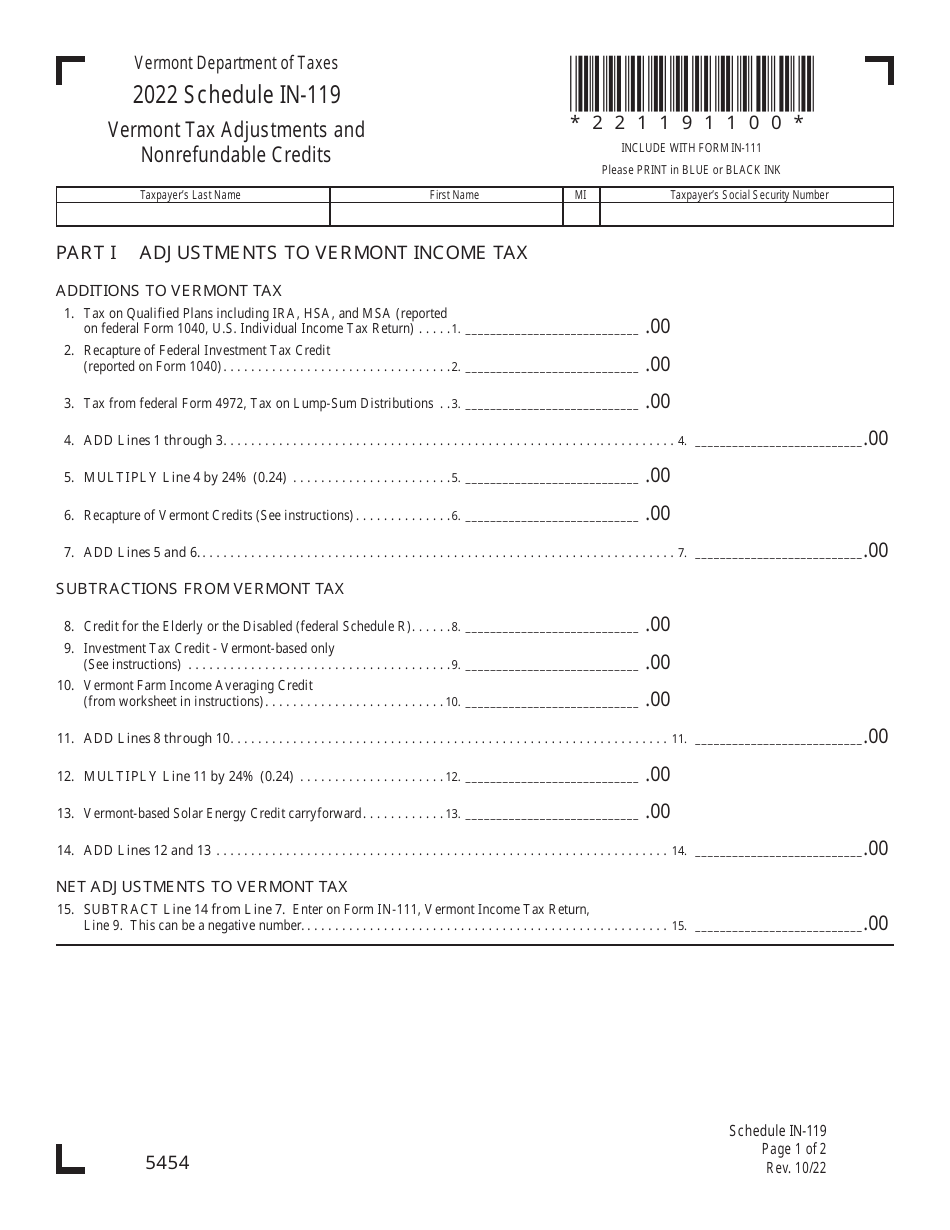

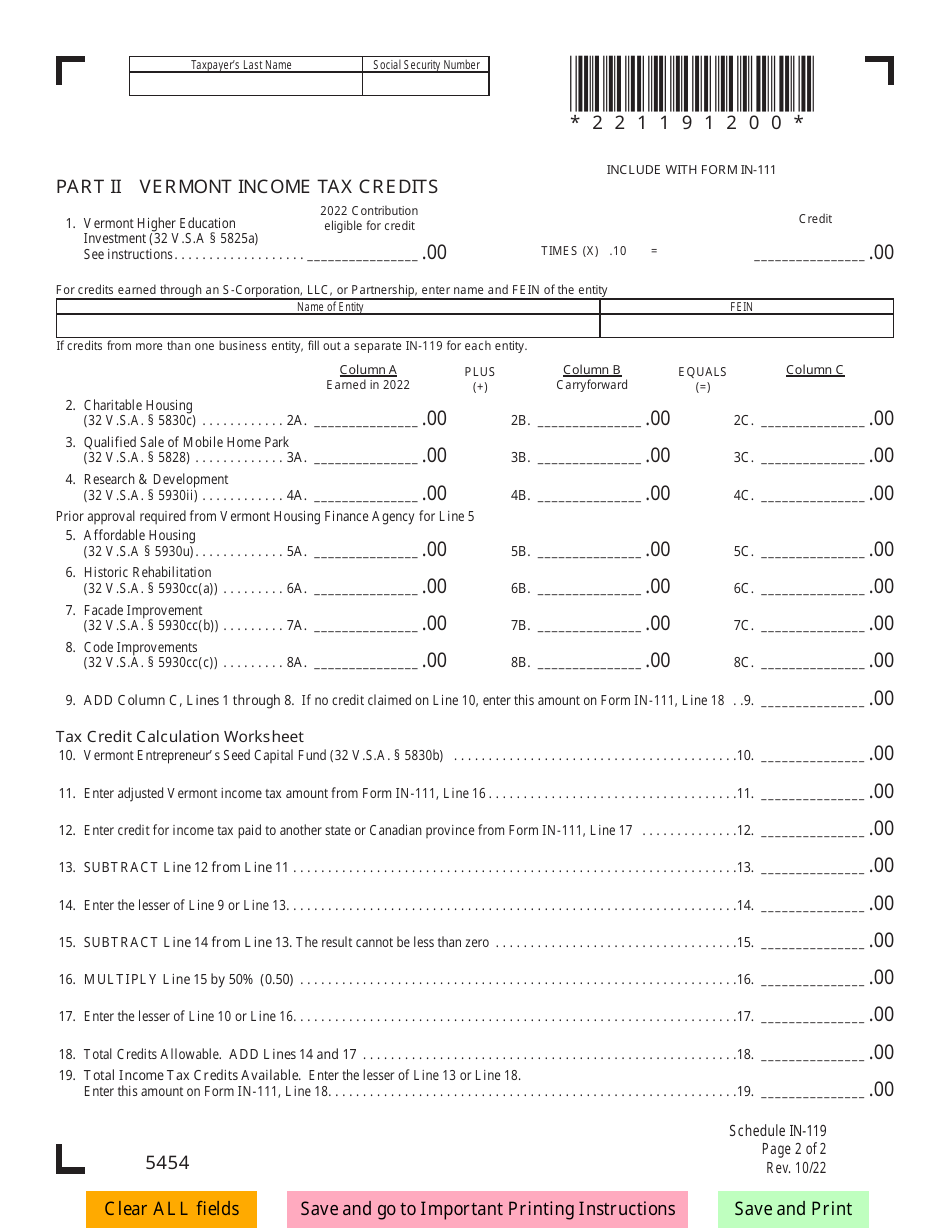

Schedule IN-119

for the current year.

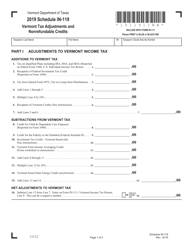

Schedule IN-119 Vermont Tax Adjustments and Nonrefundable Credits - Vermont

What Is Schedule IN-119?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule IN-119?

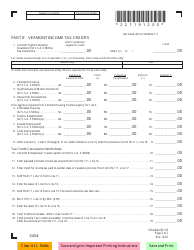

A: Schedule IN-119 is a form used in Vermont to calculate tax adjustments and nonrefundable credits.

Q: What are tax adjustments?

A: Tax adjustments are changes made to your income or deductions that may affect your tax liability.

Q: What are nonrefundable credits?

A: Nonrefundable credits are credits that can reduce your tax liability, but cannot result in a refund if they exceed your tax owed.

Q: When do I need to use Schedule IN-119?

A: You need to use Schedule IN-119 if you have specific tax adjustments or nonrefundable credits that you need to report.

Q: How do I fill out Schedule IN-119?

A: You will need to follow the instructions provided with the form and report the necessary information for tax adjustments and nonrefundable credits.

Q: Do I need to file Schedule IN-119 with my tax return?

A: Yes, if you have tax adjustments or nonrefundable credits to report, you must include Schedule IN-119 with your Vermont tax return.

Q: What happens if I don't file Schedule IN-119?

A: If you have tax adjustments or nonrefundable credits that you do not report on Schedule IN-119, it may result in errors on your tax return and potential penalties.

Form Details:

- Released on October 1, 2022;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule IN-119 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.