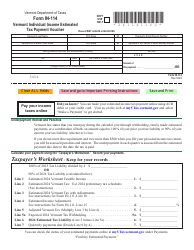

This version of the form is not currently in use and is provided for reference only. Download this version of

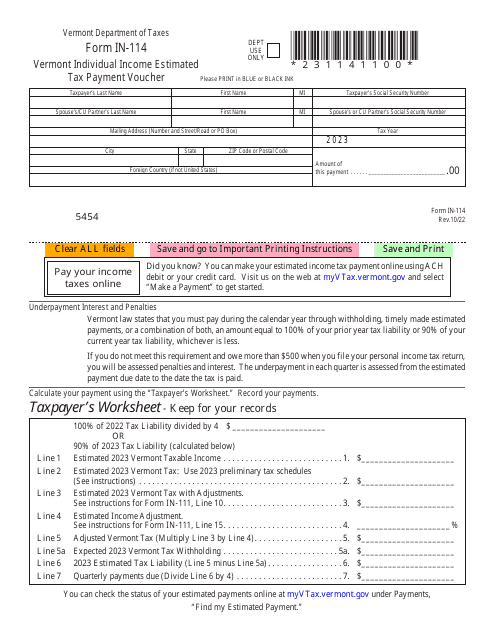

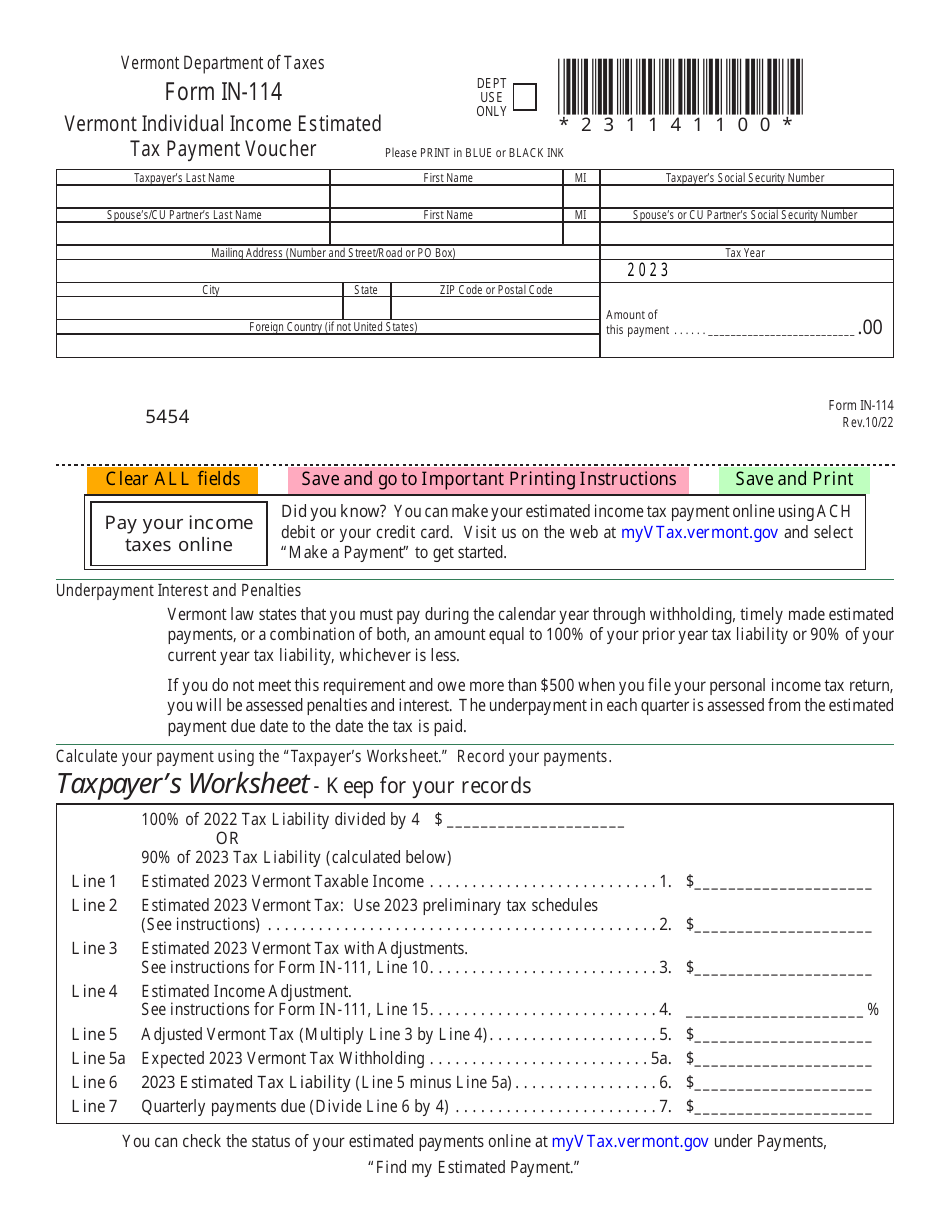

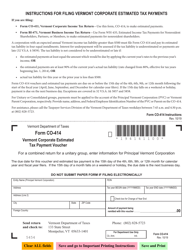

Form IN-114

for the current year.

Form IN-114 Vermont Individual Income Estimated Tax Payment Voucher - Vermont

What Is Form IN-114?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. Check the official instructions before completing and submitting the form.

FAQ

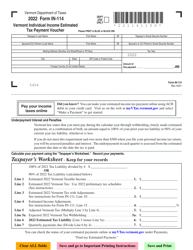

Q: What is form IN-114?

A: Form IN-114 is the Vermont Individual Income Estimated Tax Payment Voucher.

Q: Who needs to use form IN-114?

A: Any individual in Vermont who needs to make estimated tax payments for their personal income.

Q: What is the purpose of form IN-114?

A: Form IN-114 is used to calculate and submit estimated tax payments to the state of Vermont.

Q: When is form IN-114 due?

A: The due date for form IN-114 varies each year, but generally falls on April 15th for most taxpayers.

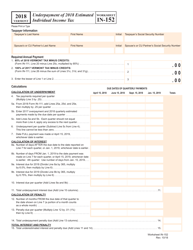

Q: What happens if I don't submit form IN-114?

A: If you fail to submit form IN-114 or make estimated tax payments, you may owe penalties and interest on the unpaid amount.

Q: Are there any exceptions to paying estimated taxes?

A: Yes, there are exceptions for individuals whose tax liability is less than $500, or for certain farmers and fishermen.

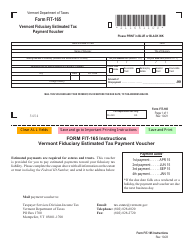

Q: Can I file form IN-114 electronically?

A: No, form IN-114 must be filed by mail along with your payment.

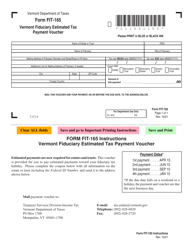

Form Details:

- Released on October 1, 2022;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IN-114 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.