This version of the form is not currently in use and is provided for reference only. Download this version of

Schedule IN-153

for the current year.

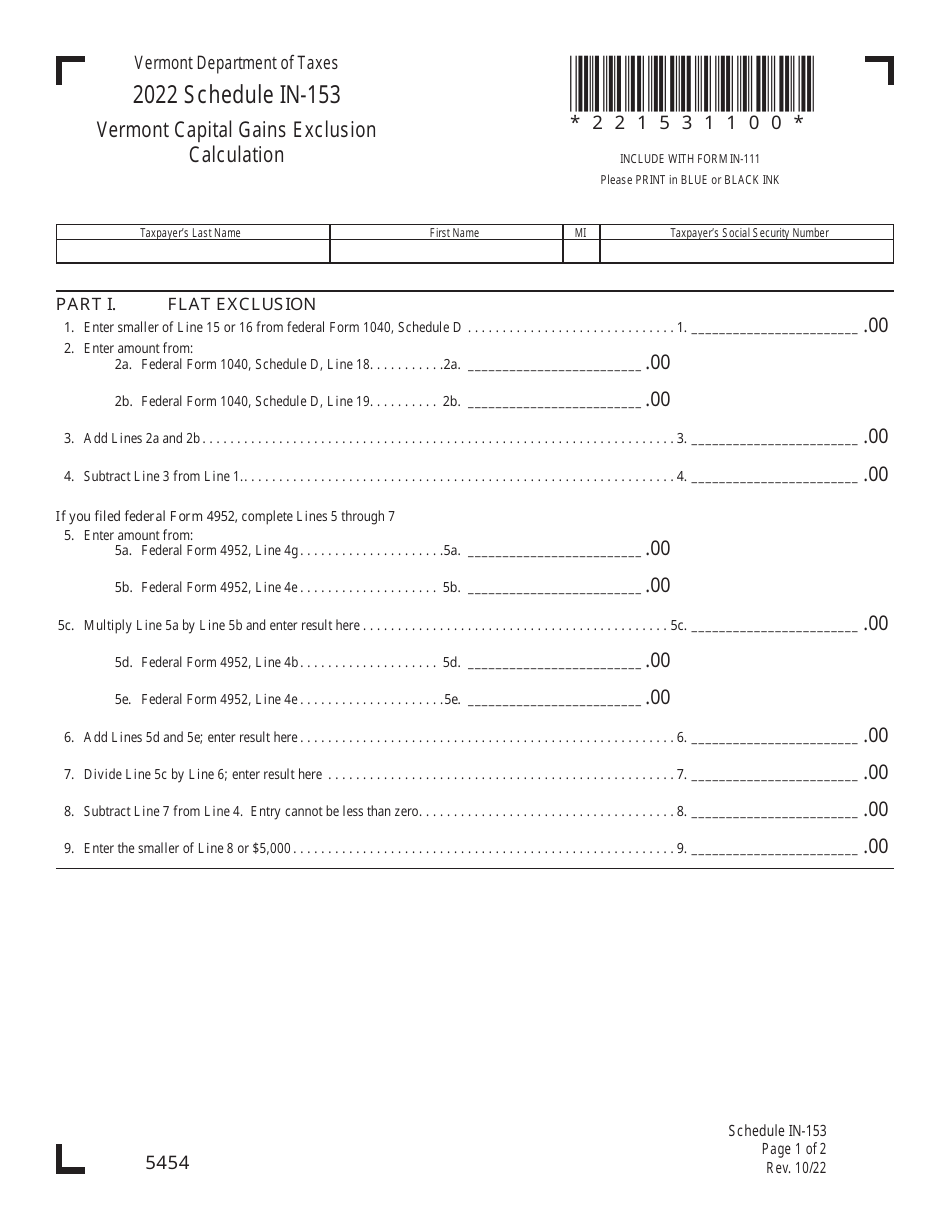

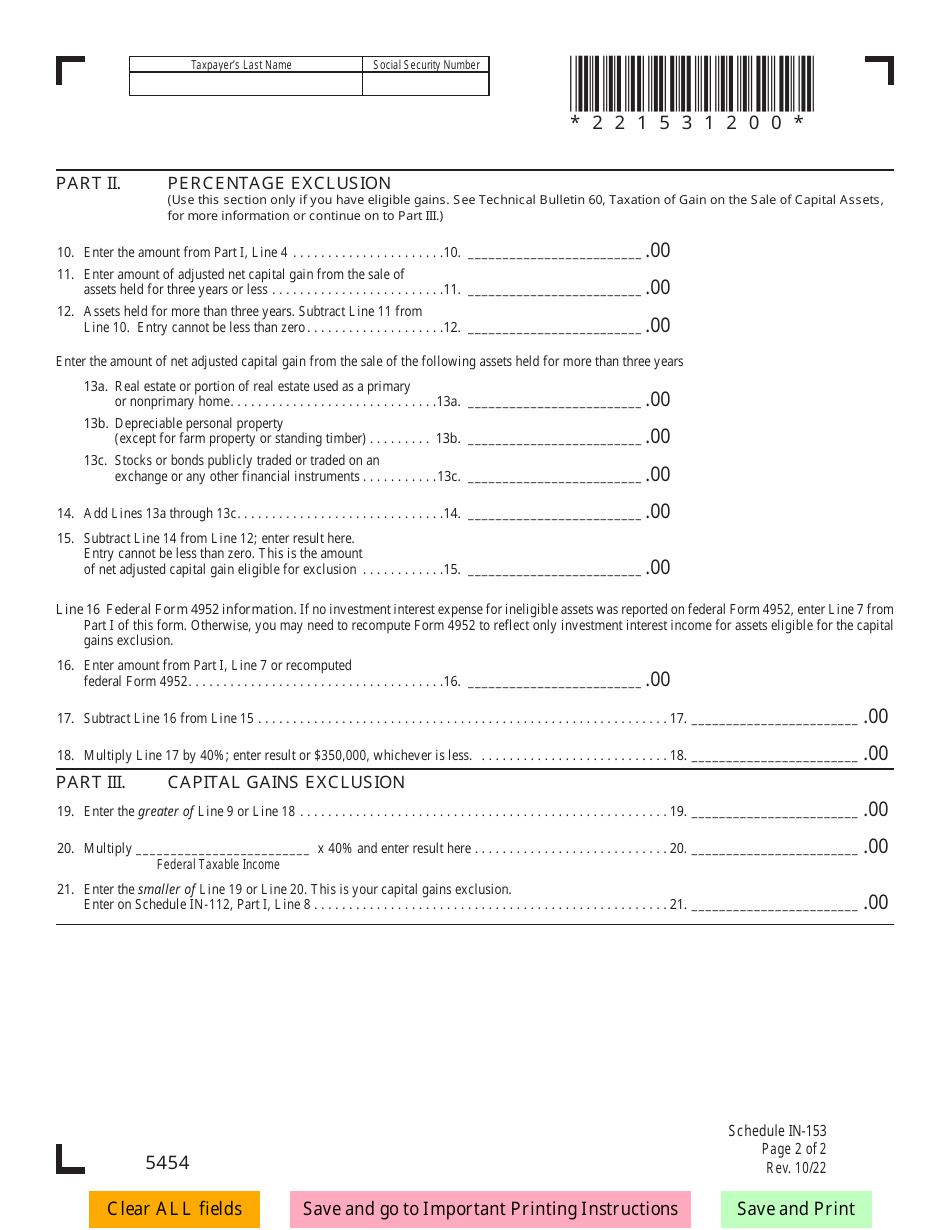

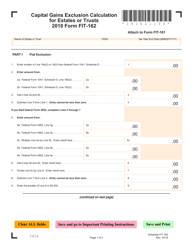

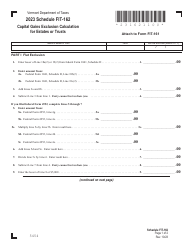

Schedule IN-153 Vermont Capital Gains Exclusion Calculation - Vermont

What Is Schedule IN-153?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule IN-153?

A: Schedule IN-153 is a tax form used in Vermont to calculate the state's capital gains exclusion.

Q: What is the Vermont capital gains exclusion?

A: The Vermont capital gains exclusion is a tax benefit that allows residents of Vermont to exclude a portion of their capital gains from their taxable income.

Q: What is the purpose of Schedule IN-153?

A: Schedule IN-153 is used to calculate the amount of capital gains that can be excluded from a taxpayer's income.

Q: How do I qualify for the Vermont capital gains exclusion?

A: To qualify for the Vermont capital gains exclusion, you must meet certain criteria such as being a Vermont resident and meeting the holding period requirements for the asset.

Q: What are the holding period requirements for the Vermont capital gains exclusion?

A: The holding period requirements for the Vermont capital gains exclusion vary depending on the type of asset. Generally, the asset must have been held for more than two years.

Q: When is the deadline for filing Schedule IN-153?

A: The deadline for filing Schedule IN-153 is the same as the deadline for filing your Vermont tax return, which is typically April 15th.

Q: Is the Vermont capital gains exclusion available to non-residents?

A: No, the Vermont capital gains exclusion is only available to residents of Vermont.

Q: What is the benefit of the Vermont capital gains exclusion?

A: The benefit of the Vermont capital gains exclusion is that it can lower your taxable income, resulting in a lower tax liability.

Q: Are there any limits to the Vermont capital gains exclusion?

A: Yes, there are limits to the Vermont capital gains exclusion. The maximum exclusion amount varies depending on the taxpayer's filing status and income level.

Form Details:

- Released on October 1, 2022;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule IN-153 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.