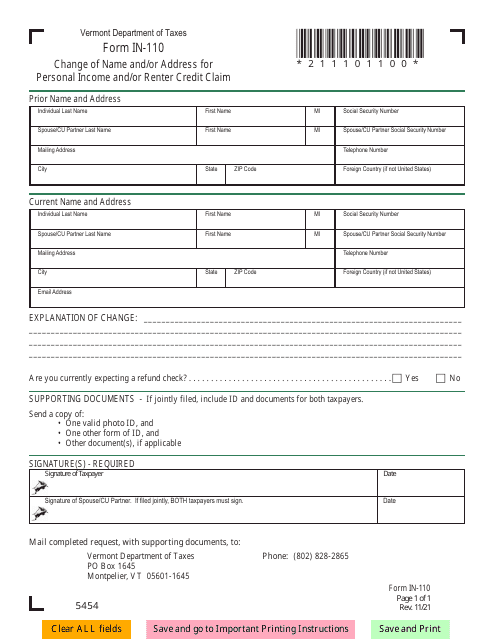

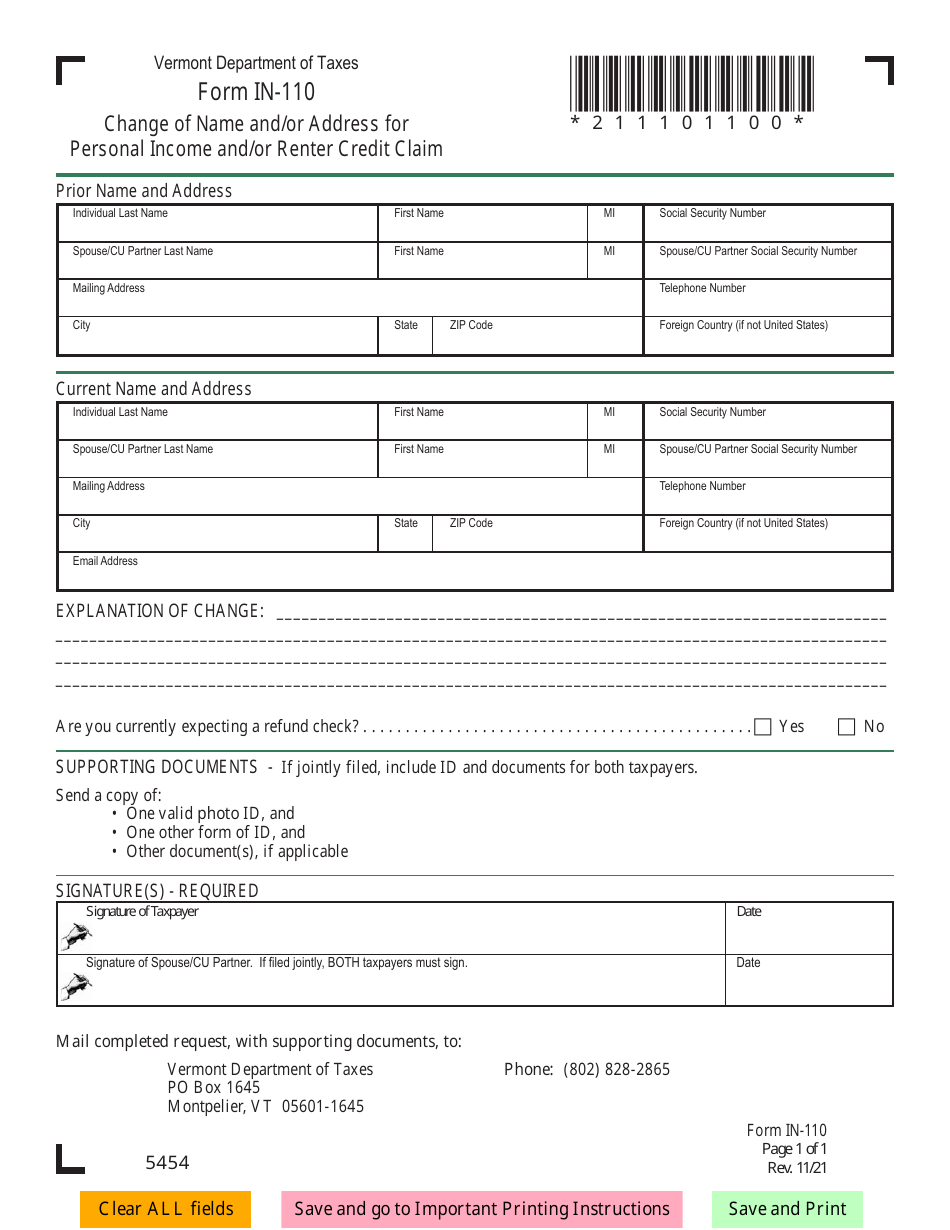

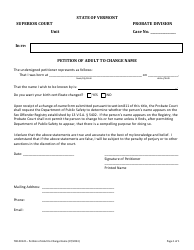

Form IN-110 Change of Name and / or Address for Personal Income and / or Renter Credit Claim - Vermont

What Is Form IN-110?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

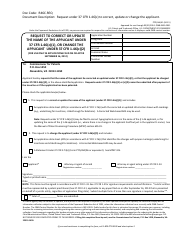

Q: What is form IN-110?

A: Form IN-110 is a document used for changing your name and/or address for personal income and/or renter credit claim in the state of Vermont.

Q: What can I use form IN-110 for?

A: You can use form IN-110 to change your name and/or address for personal income and/or renter credit claim in Vermont.

Q: What is a personal income credit claim?

A: A personal income credit claim is a claim for a credit on your Vermont income tax return.

Q: What is a renter credit claim?

A: A renter credit claim is a claim for a credit on your Vermont renter rebate.

Q: Who can use form IN-110?

A: Anyone who needs to change their name and/or address for their personal income and/or renter credit claim in Vermont can use form IN-110.

Q: Is there a filing fee for form IN-110?

A: No, there is no filing fee for form IN-110.

Q: What information do I need to provide on form IN-110?

A: You will need to provide your current name and/or address, your new name and/or address, your Social Security number, and other relevant information requested on the form.

Q: When should I file form IN-110?

A: You should file form IN-110 as soon as possible after your name and/or address change.

Q: What happens after I file form IN-110?

A: After you file form IN-110, the Vermont Department of Taxes will update their records with your new name and/or address.

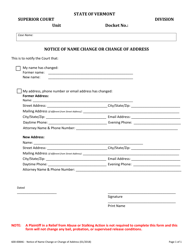

Q: Do I need to notify anyone else of my name and/or address change?

A: Yes, you may need to notify other government agencies, businesses, and organizations of your name and/or address change separately.

Form Details:

- Released on November 1, 2021;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IN-110 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.