This version of the form is not currently in use and is provided for reference only. Download this version of

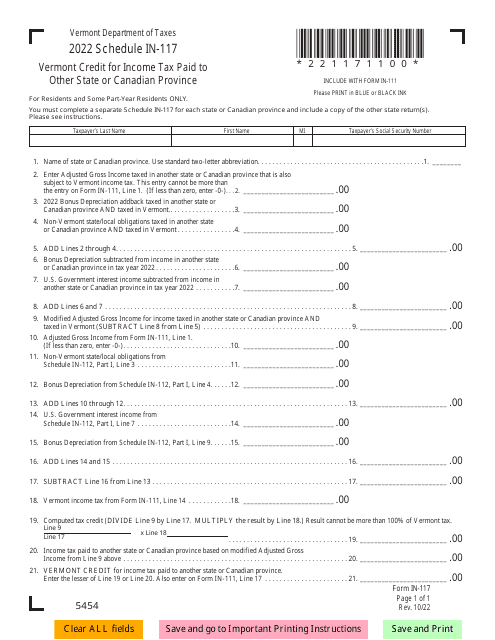

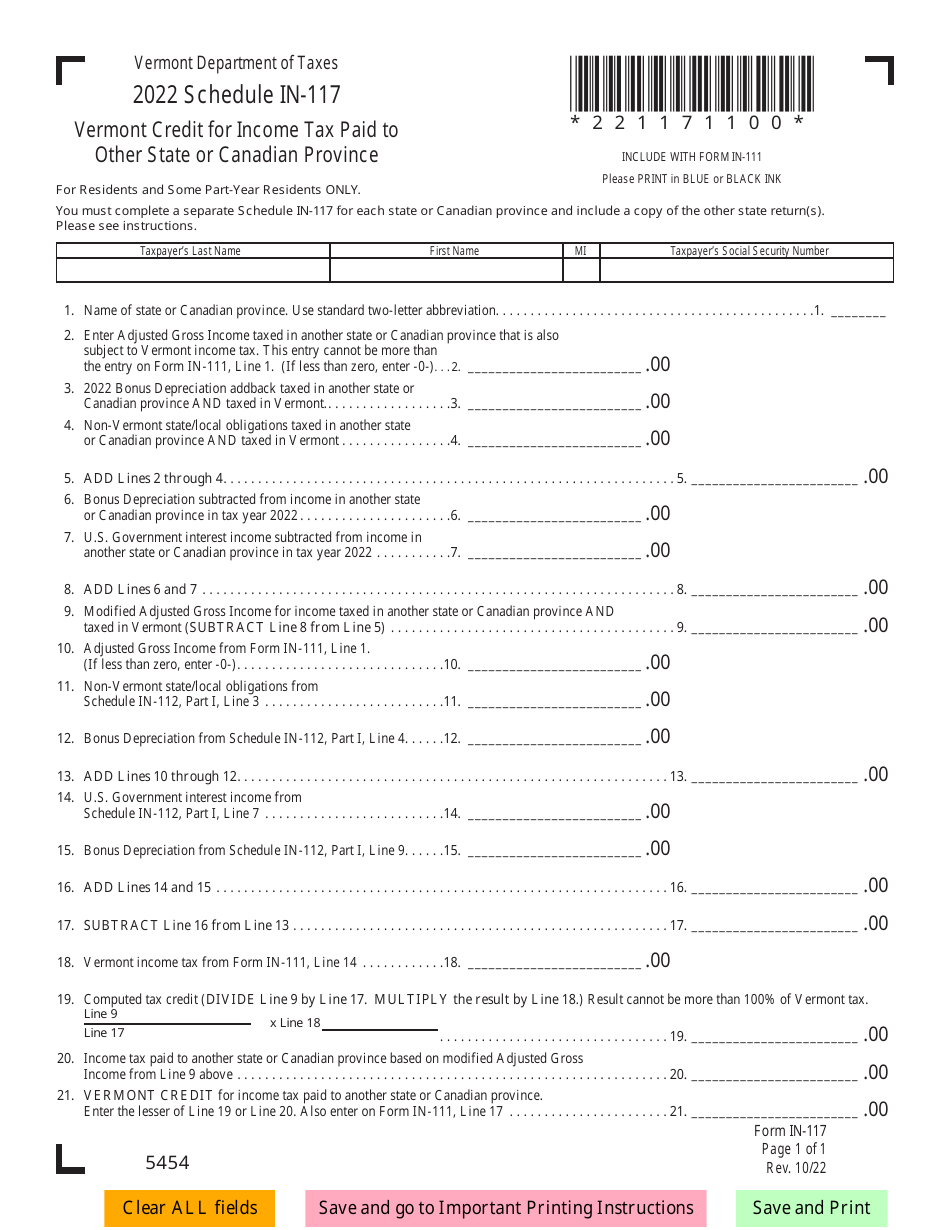

Schedule IN-117

for the current year.

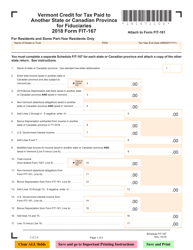

Schedule IN-117 Vermont Credit for Income Tax Paid to Other State or Canadian Province - Vermont

What Is Schedule IN-117?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is IN-117?

A: IN-117 is the form used in Vermont to claim a credit for income tax paid to another state or Canadian province.

Q: What is the purpose of IN-117?

A: The purpose of IN-117 is to prevent double taxation when a Vermont resident earns income in another state or Canadian province and pays taxes there.

Q: Who is eligible to use form IN-117?

A: Vermont residents who have earned income in another state or Canadian province and paid taxes there are eligible to use form IN-117.

Q: How does form IN-117 work?

A: Form IN-117 allows taxpayers to claim a credit for the amount of income tax paid to another state or Canadian province, reducing their tax liability in Vermont.

Q: What documents are needed to complete form IN-117?

A: Taxpayers will need to have their tax return from the other state or Canadian province, as well as any supporting documents that show the amount of tax paid.

Q: When is the deadline to file form IN-117?

A: Form IN-117 should be filed along with the Vermont income tax return by the regular tax filing deadline, which is usually April 15th.

Q: Can form IN-117 be filed electronically?

A: Yes, form IN-117 can be filed electronically if you are e-filing your Vermont income tax return.

Q: Can form IN-117 be amended?

A: Yes, if you need to make changes to your original form IN-117, you can file an amended version using form IN-117X.

Q: What happens if I don't file form IN-117?

A: If you fail to file form IN-117 and claim the credit for income tax paid to another state or Canadian province, you may end up being taxed on that income by Vermont as well.

Form Details:

- Released on October 1, 2022;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule IN-117 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.