This version of the form is not currently in use and is provided for reference only. Download this version of

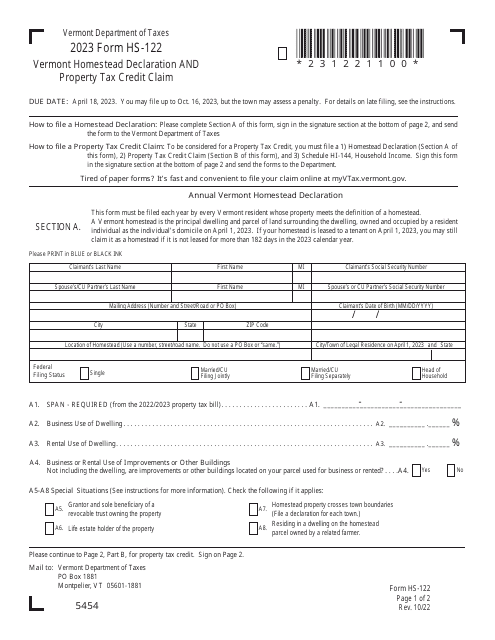

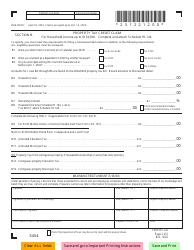

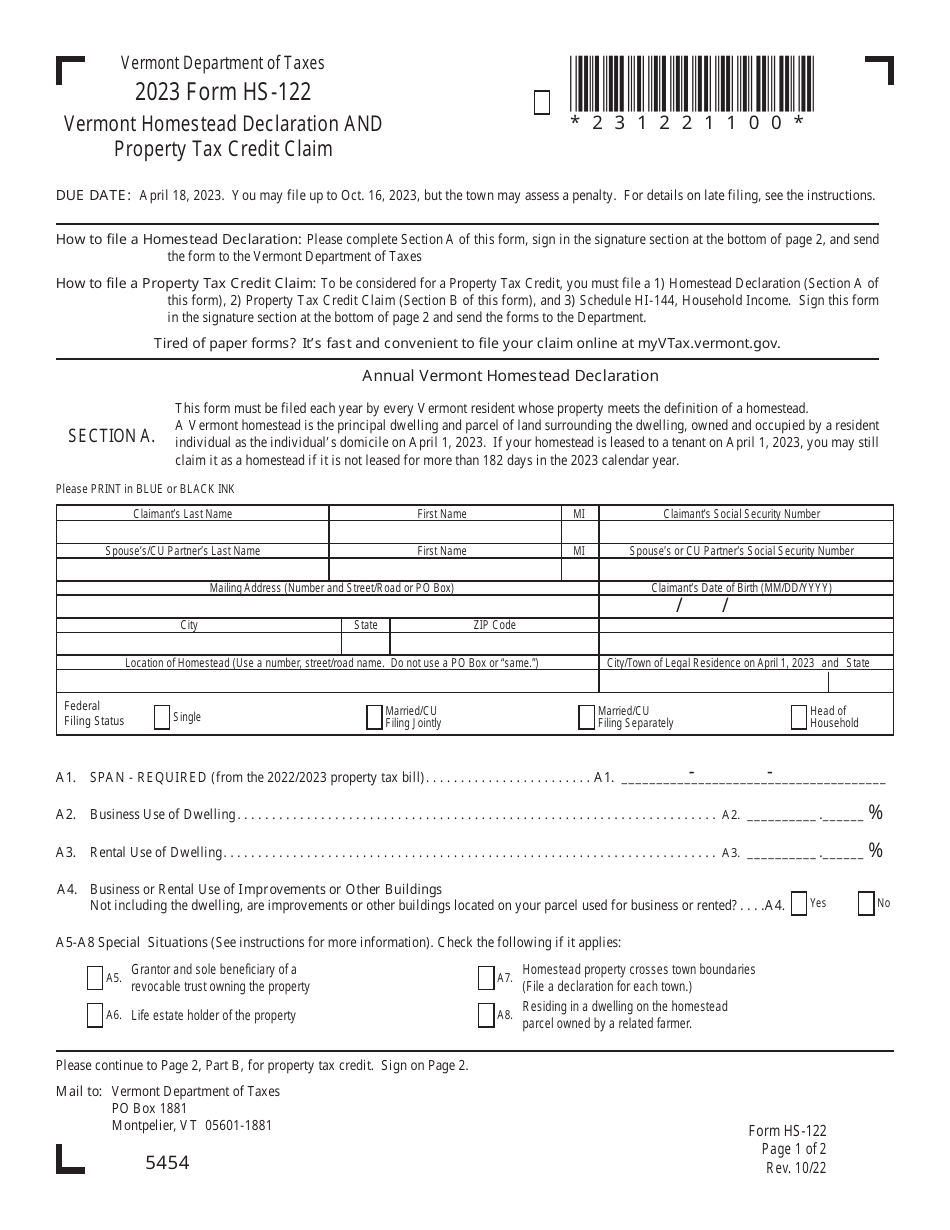

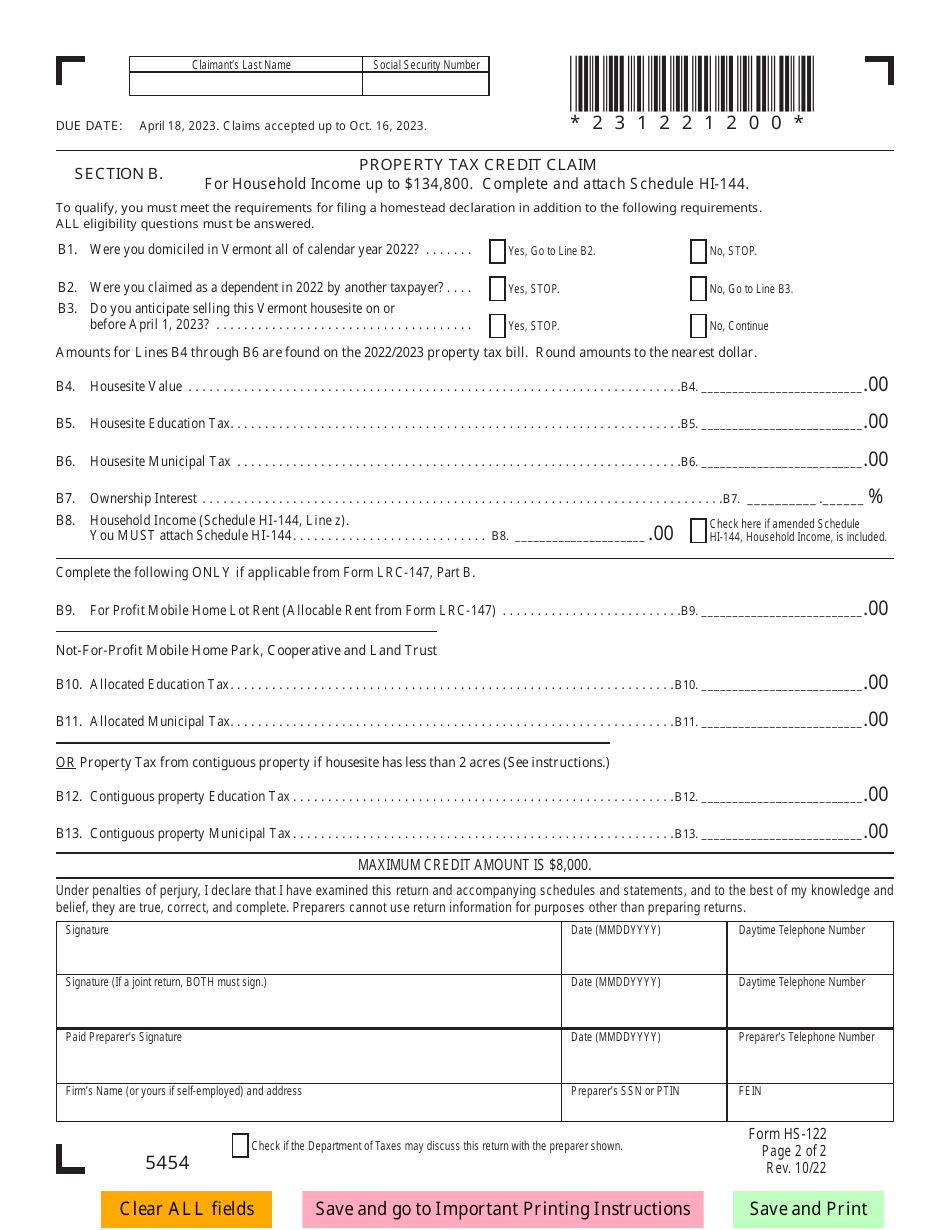

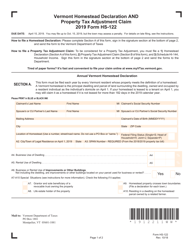

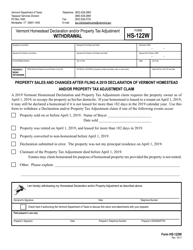

Form HS-122

for the current year.

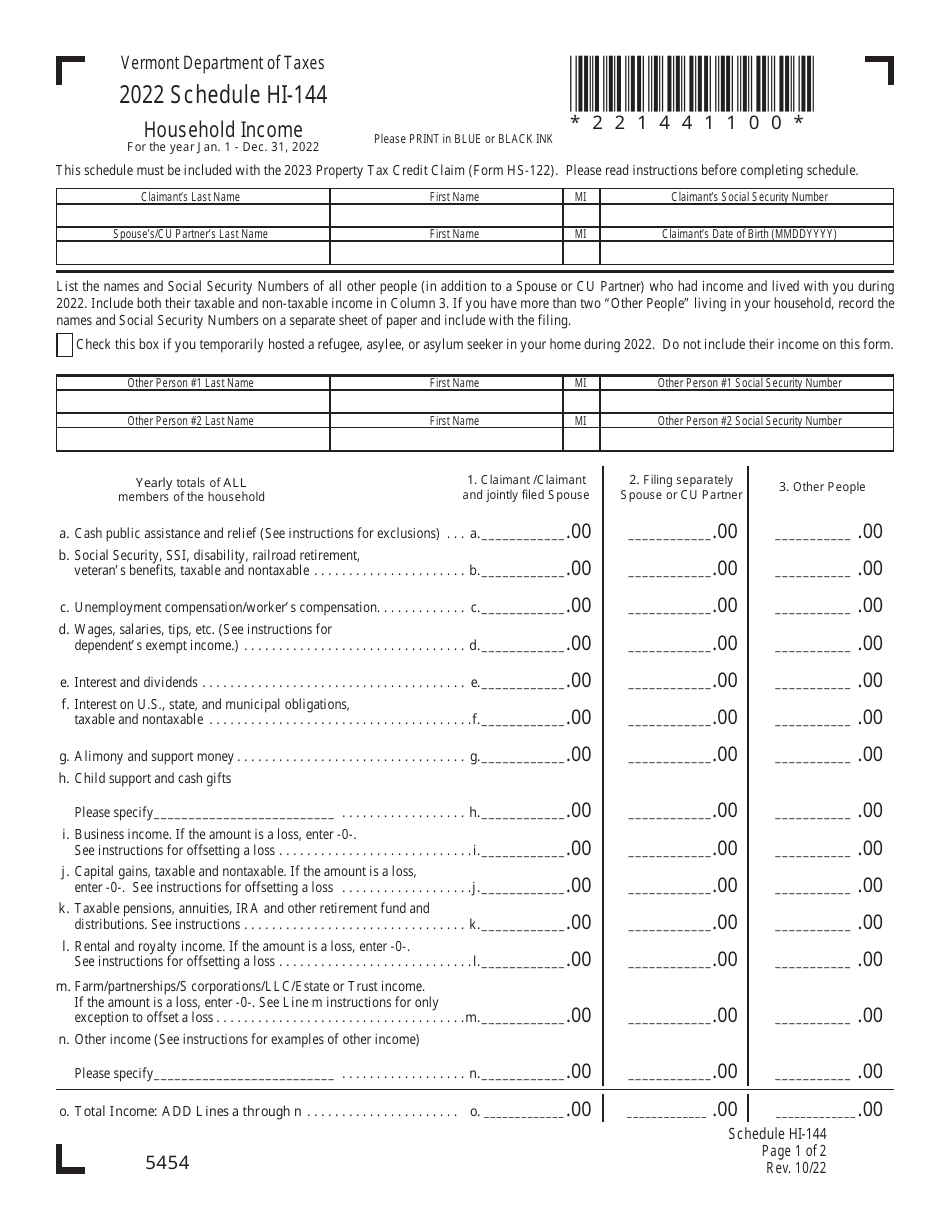

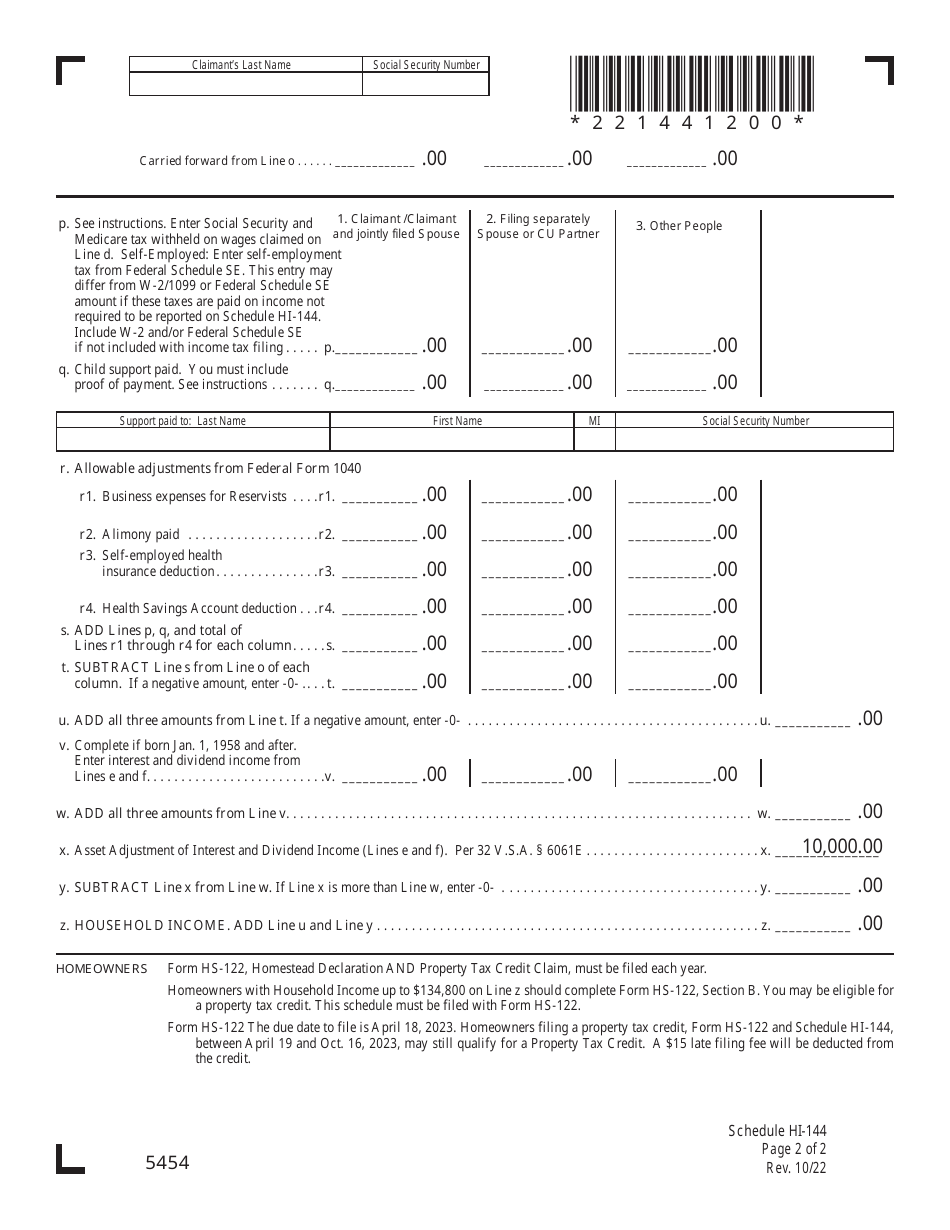

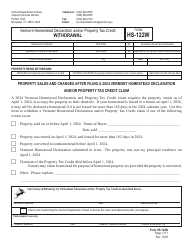

Form HS-122 Vermont Homestead Declaration and Property Tax Credit Claim - Vermont

What Is Form HS-122?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form HS-122?

A: Form HS-122 is the Vermont Homestead Declaration and Property Tax Credit Claim form.

Q: What is the purpose of Form HS-122?

A: The purpose of Form HS-122 is to declare a property as a homestead and claim a property tax credit in Vermont.

Q: Who needs to fill out Form HS-122?

A: Any resident of Vermont who owns a property and wants to claim a property tax credit needs to fill out Form HS-122.

Q: When should Form HS-122 be filed?

A: Form HS-122 should be filed by April 15th of each year.

Q: What information is required on Form HS-122?

A: Form HS-122 requires information such as the property address, ownership details, and income information.

Q: Can I claim the property tax credit if I don't declare my property as a homestead?

A: No, in order to claim the property tax credit, you must first declare your property as a homestead on Form HS-122.

Q: Is there a fee to file Form HS-122?

A: No, there is no fee to file Form HS-122.

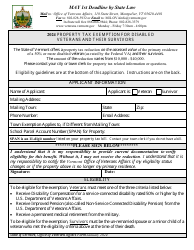

Q: Are there any eligibility requirements to claim the property tax credit?

A: Yes, there are income and residency requirements to be eligible for the property tax credit. Please refer to the instructions on Form HS-122 for more details.

Q: What should I do if I have questions or need assistance with Form HS-122?

A: If you have questions or need assistance with Form HS-122, you can contact the Vermont Department of Taxes for guidance.

Form Details:

- Released on October 1, 2022;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form HS-122 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.