This version of the form is not currently in use and is provided for reference only. Download this version of

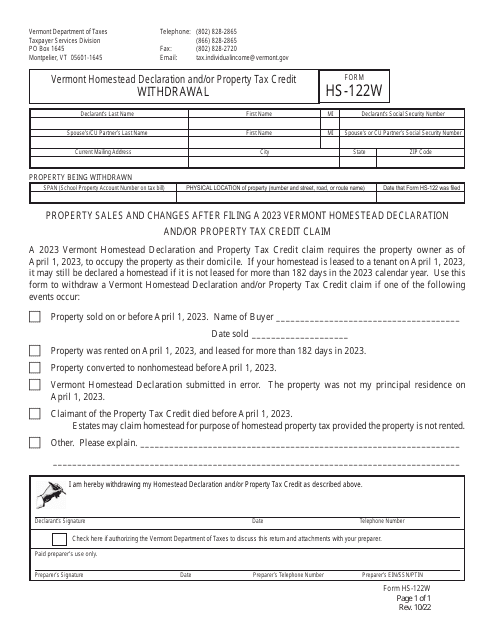

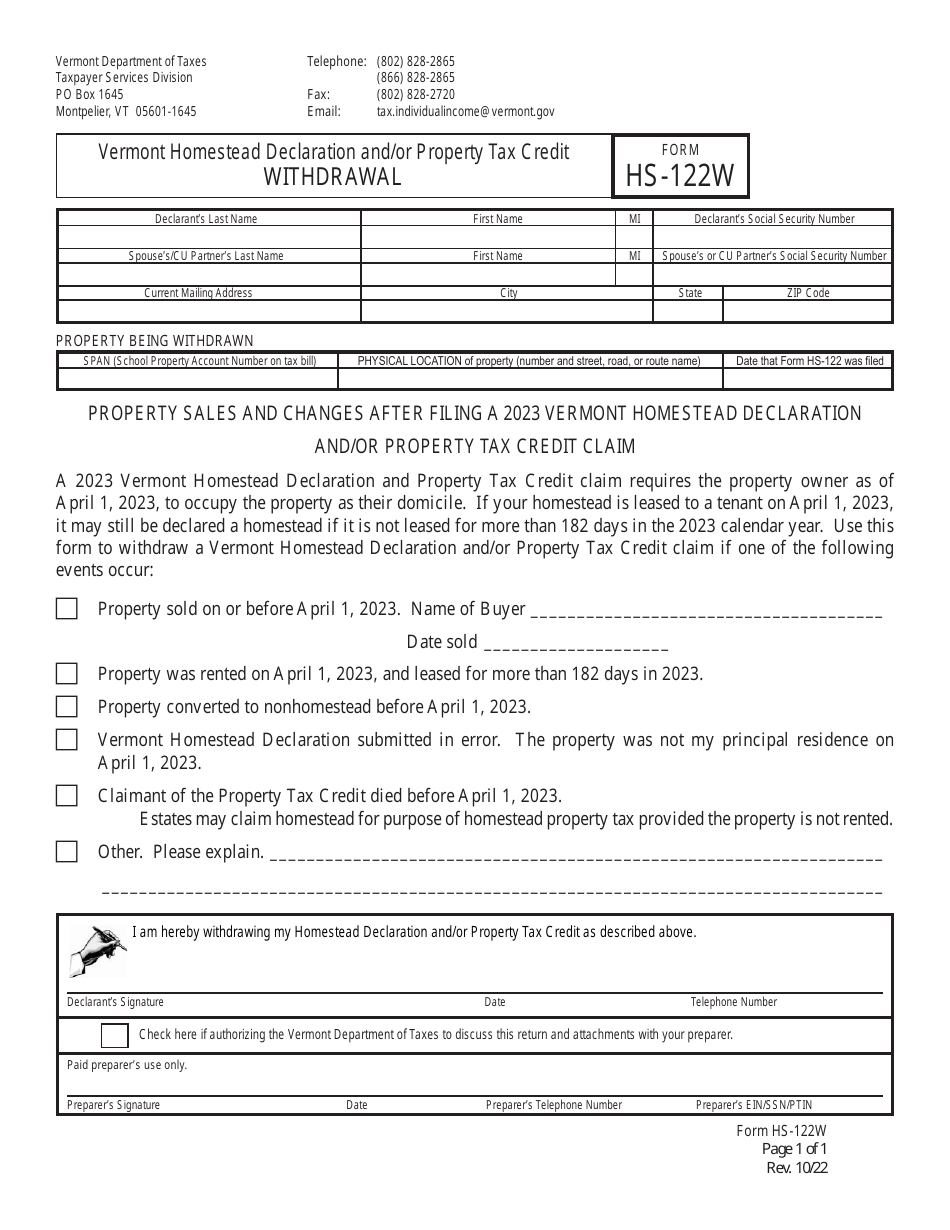

Form HS-122W

for the current year.

Form HS-122W Vermont Homestead Declaration and / or Property Tax Credit Withdrawal - Vermont

What Is Form HS-122W?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form HS-122W?

A: Form HS-122W is the Vermont Homestead Declaration and/or Property Tax Credit Withdrawal form.

Q: What is the purpose of Form HS-122W?

A: Form HS-122W is used to withdraw a previously filed Homestead Declaration or Property Tax Credit Claim.

Q: Who needs to file Form HS-122W?

A: Form HS-122W should be filed by Vermont residents who want to withdraw their Homestead Declaration or Property Tax Credit Claim.

Q: When should Form HS-122W be filed?

A: Form HS-122W should be filed when there is a change in a taxpayer's eligibility for the Homestead Declaration or Property Tax Credit.

Q: Is there a deadline to file Form HS-122W?

A: Yes, Form HS-122W must be filed by April 15th of the year following the tax year for which the withdrawal is requested.

Q: Are there any fees for filing Form HS-122W?

A: No, there are no fees for filing Form HS-122W.

Q: What supporting documents are required with Form HS-122W?

A: Supporting documents may include a copy of your federal tax return, mortgage interest statements, and insurance premium statements, among others.

Q: Who can I contact for more information about Form HS-122W?

A: For more information about Form HS-122W, you can contact the Vermont Department of Taxes.

Form Details:

- Released on October 1, 2022;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form HS-122W by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.