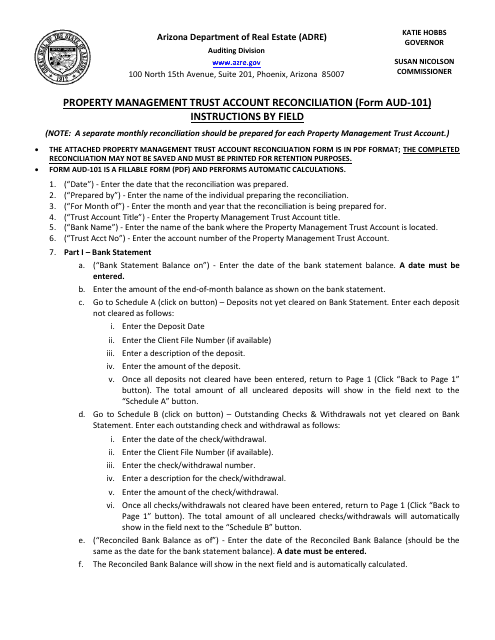

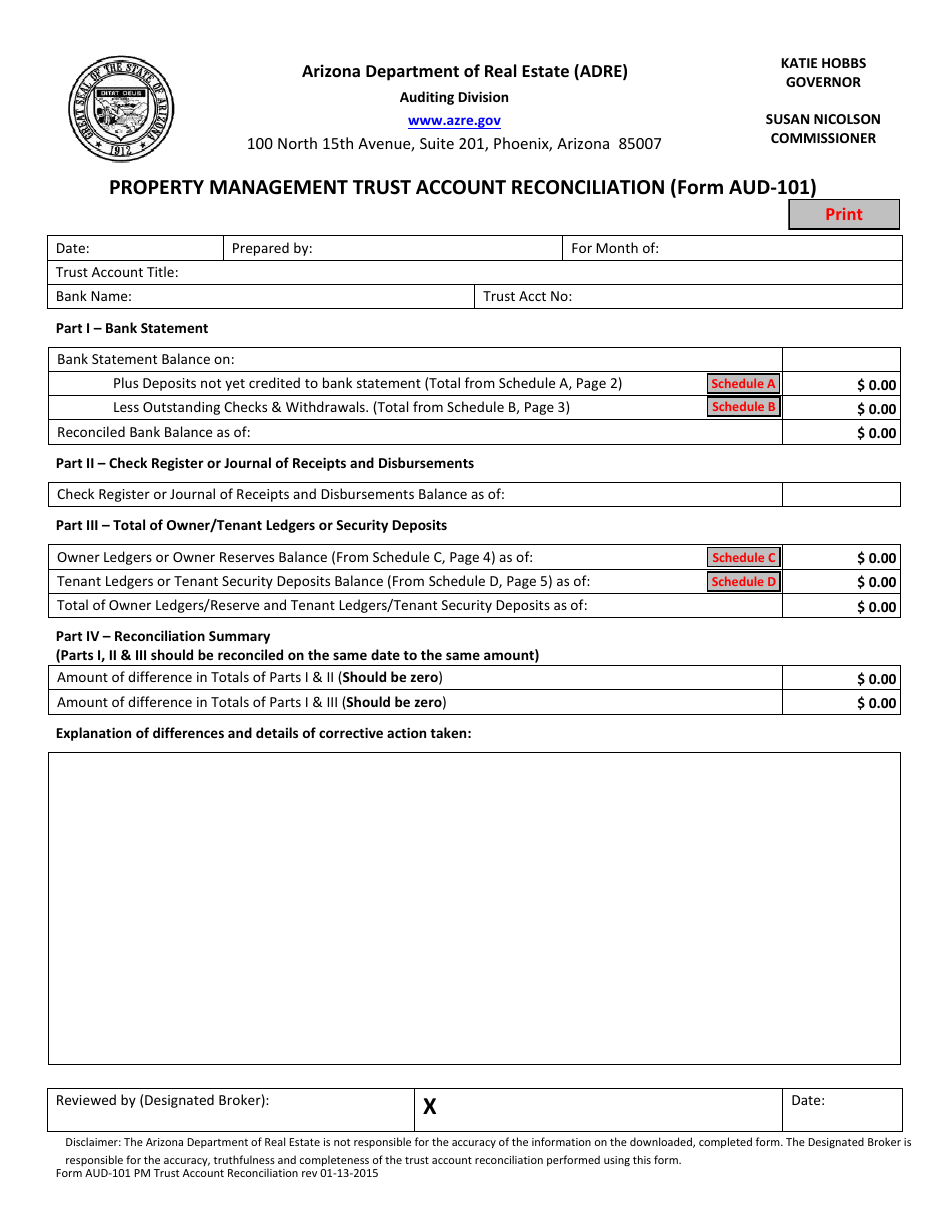

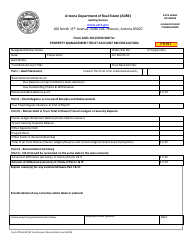

Form AUD-101 Property Management Trust Account Reconciliation - Arizona

What Is Form AUD-101?

This is a legal form that was released by the Arizona Department of Real Estate - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

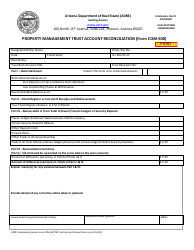

Q: What is Form AUD-101?

A: Form AUD-101 is a document used for property management trust account reconciliation in Arizona.

Q: Who uses Form AUD-101?

A: Property managers in Arizona use Form AUD-101 for trust account reconciliation.

Q: What is the purpose of Form AUD-101?

A: The purpose of Form AUD-101 is to ensure that property management trust accounts are properly reconciled and accurately reflect the current balances.

Q: When should Form AUD-101 be filed?

A: Form AUD-101 should be filed quarterly, within 30 days after the end of each calendar quarter.

Q: Are there any penalties for not filing Form AUD-101?

A: Yes, failure to file Form AUD-101 or filing it late may result in penalties and disciplinary action by the ADRE.

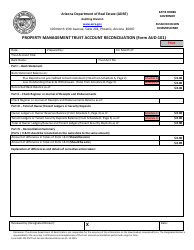

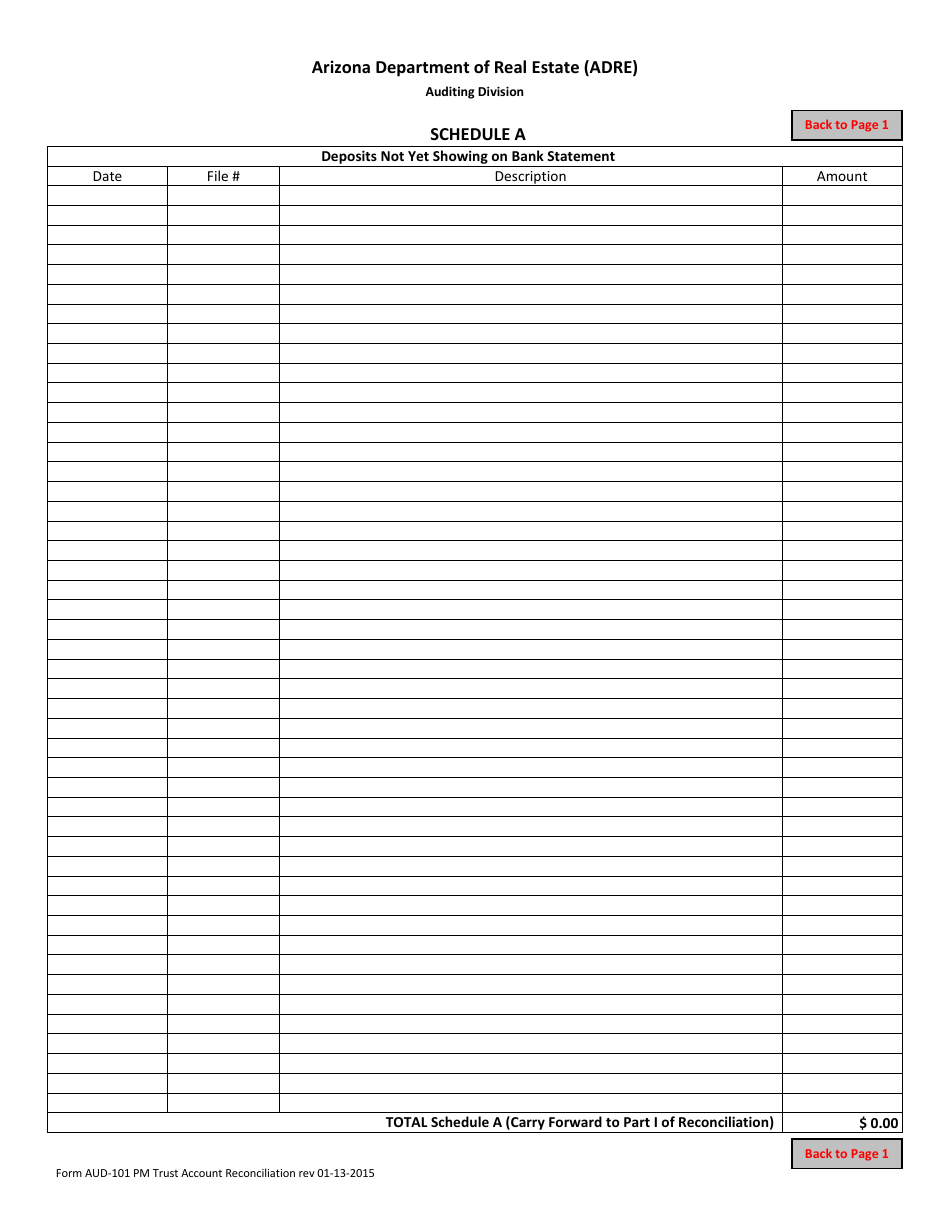

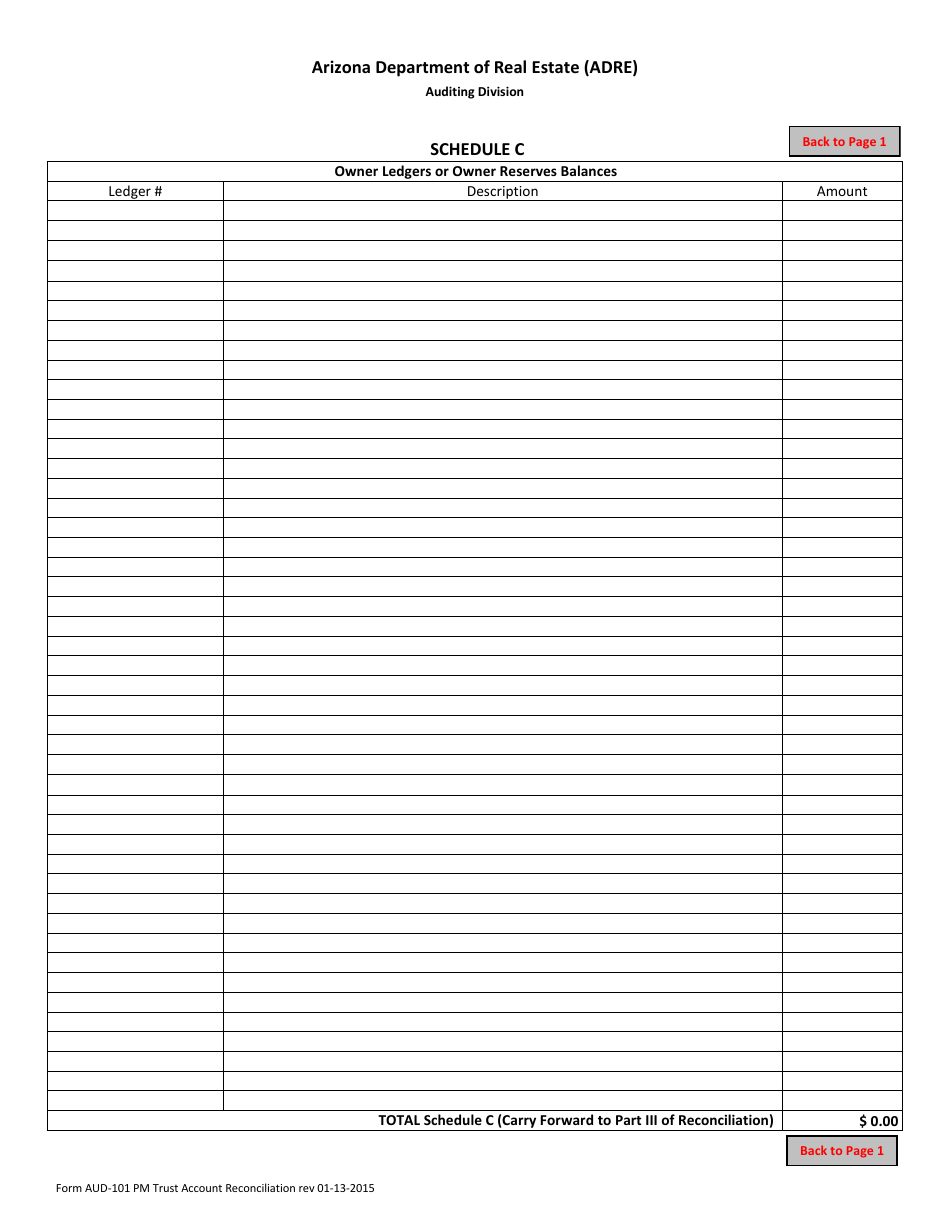

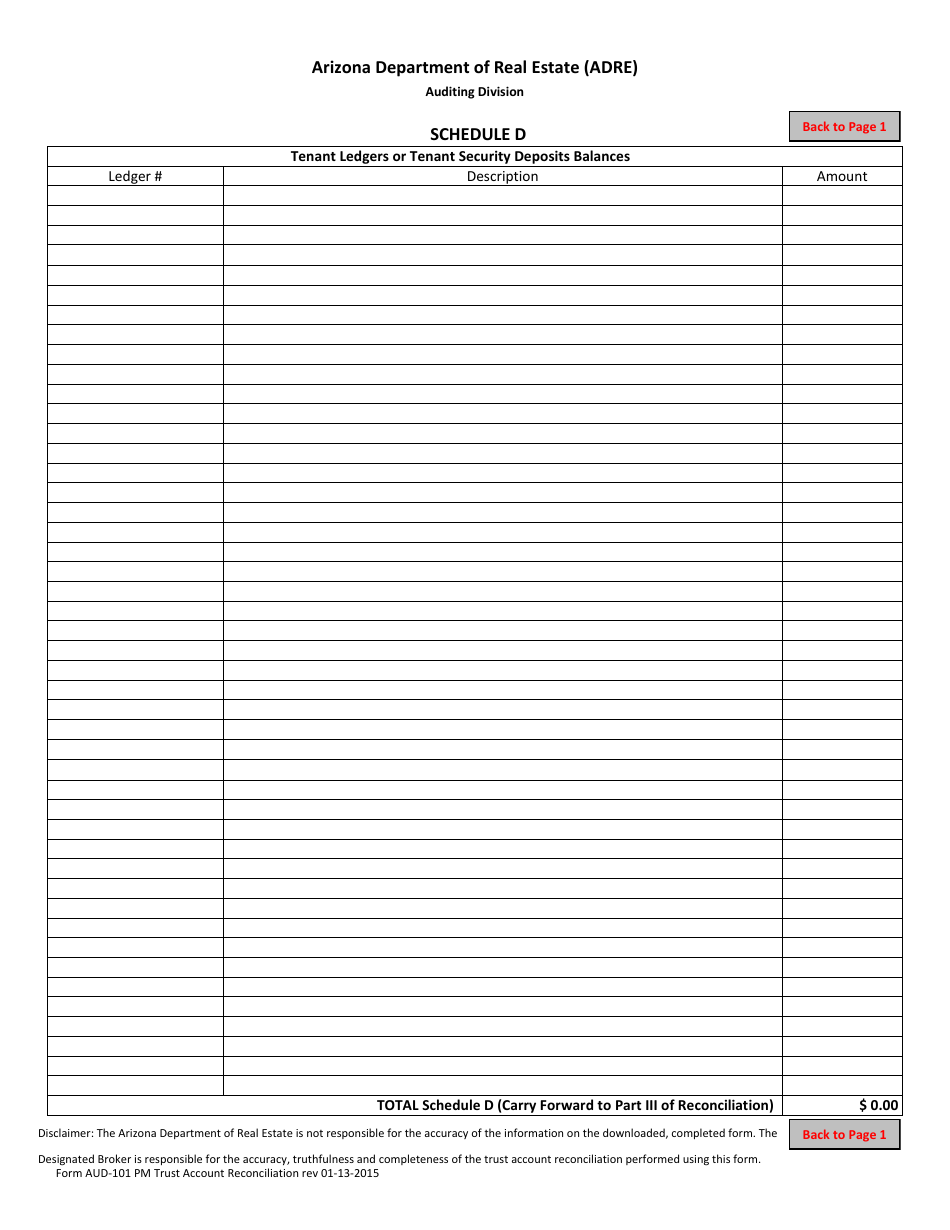

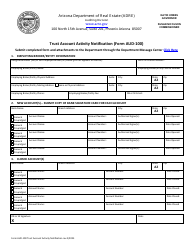

Q: What information is required on Form AUD-101?

A: Form AUD-101 requires information on the property manager, the trust account, deposits, disbursements, and reconciled balances.

Q: Is Form AUD-101 specific to Arizona?

A: Yes, Form AUD-101 is specific to property management trust account reconciliation in Arizona.

Form Details:

- Released on January 13, 2015;

- The latest edition provided by the Arizona Department of Real Estate;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AUD-101 by clicking the link below or browse more documents and templates provided by the Arizona Department of Real Estate.