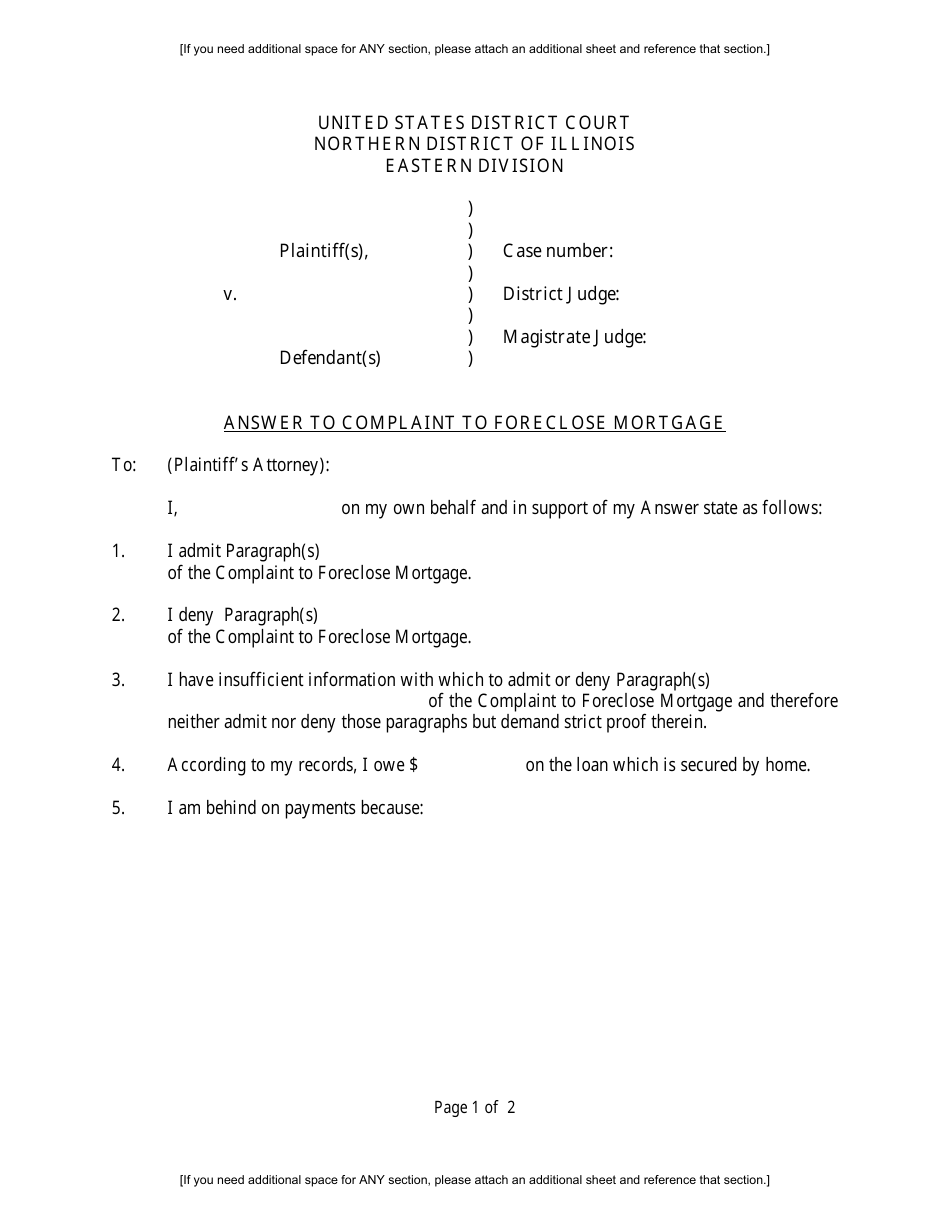

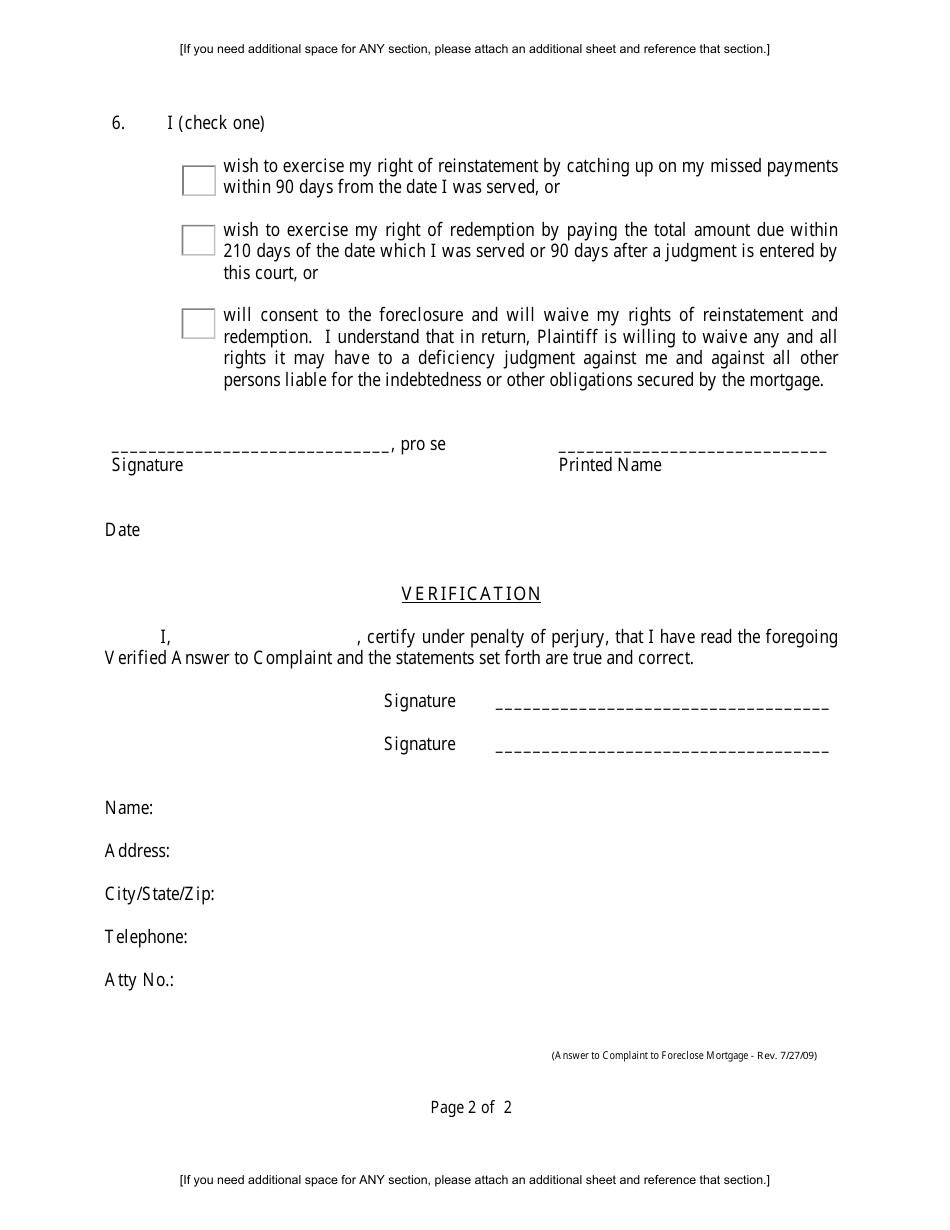

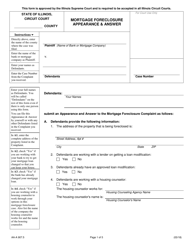

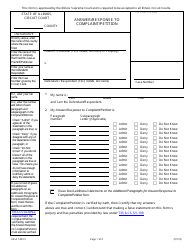

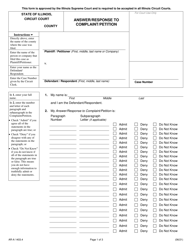

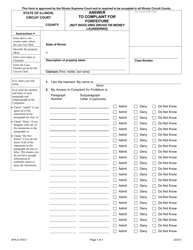

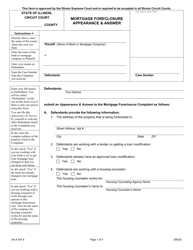

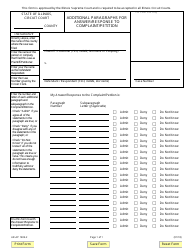

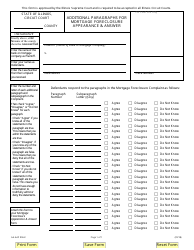

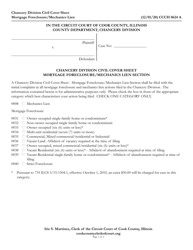

Answer to Complaint to Foreclose Mortgage - Illinois

Answer to Complaint to Foreclose Mortgage is a legal document that was released by the United States District Court for the Northern District of Illinois - a government authority operating within Illinois.

FAQ

Q: What is a complaint to foreclose a mortgage?

A: A complaint to foreclose a mortgage is a legal document filed by a lender to initiate a foreclosure lawsuit against a borrower who has defaulted on their mortgage payments.

Q: Who can file a complaint to foreclose a mortgage?

A: Only the lender or the holder of the mortgage can file a complaint to foreclose a mortgage.

Q: What happens after a complaint to foreclose a mortgage is filed?

A: After the complaint is filed, the court will review the documents and process the foreclosure lawsuit. The borrower will be notified and given an opportunity to respond to the complaint.

Q: What should I do if I receive a complaint to foreclose a mortgage?

A: If you receive a complaint to foreclose a mortgage, it is important to seek professional legal advice immediately. This will help you understand your rights and options in responding to the lawsuit.

Q: What are the possible outcomes of a foreclosure lawsuit?

A: The possible outcomes of a foreclosure lawsuit can vary, but generally include: the borrower successfully defending against the foreclosure, reaching a settlement with the lender, or the court ordering the foreclosure and the property being sold to satisfy the debt.

Q: Can I stop the foreclosure process after a complaint is filed?

A: It may be possible to stop the foreclosure process after a complaint is filed by negotiating with the lender, entering into a repayment plan, or seeking assistance from government programs and resources designed to help homeowners facing foreclosure.

Q: How long does the foreclosure process take in Illinois?

A: The length of the foreclosure process in Illinois can vary depending on various factors, but it typically takes several months to over a year to complete.

Q: Are there any alternatives to foreclosure in Illinois?

A: Yes, there are alternatives to foreclosure in Illinois such as loan modifications, short sales, deed in lieu of foreclosure, and bankruptcy. These options may allow the borrower to avoid the negative consequences of foreclosure.

Q: Can I challenge the foreclosure in court?

A: Yes, borrowers have the right to challenge a foreclosure in court by filing a legal response to the complaint, presenting a valid defense, or raising any applicable legal issues.

Q: What happens if I lose the foreclosure case?

A: If you lose the foreclosure case, the court may order the property to be sold at a public auction or sale, and the proceeds will be used to satisfy the outstanding mortgage debt. You may also be responsible for any remaining deficiency balance.

Form Details:

- Released on July 27, 2009;

- The latest edition currently provided by the United States District Court for the Northern District of Illinois;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the United States District Court for the Northern District of Illinois.