This version of the form is not currently in use and is provided for reference only. Download this version of

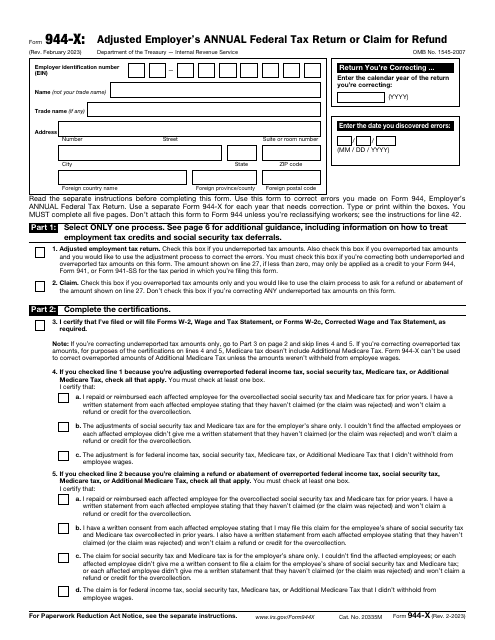

IRS Form 944-X

for the current year.

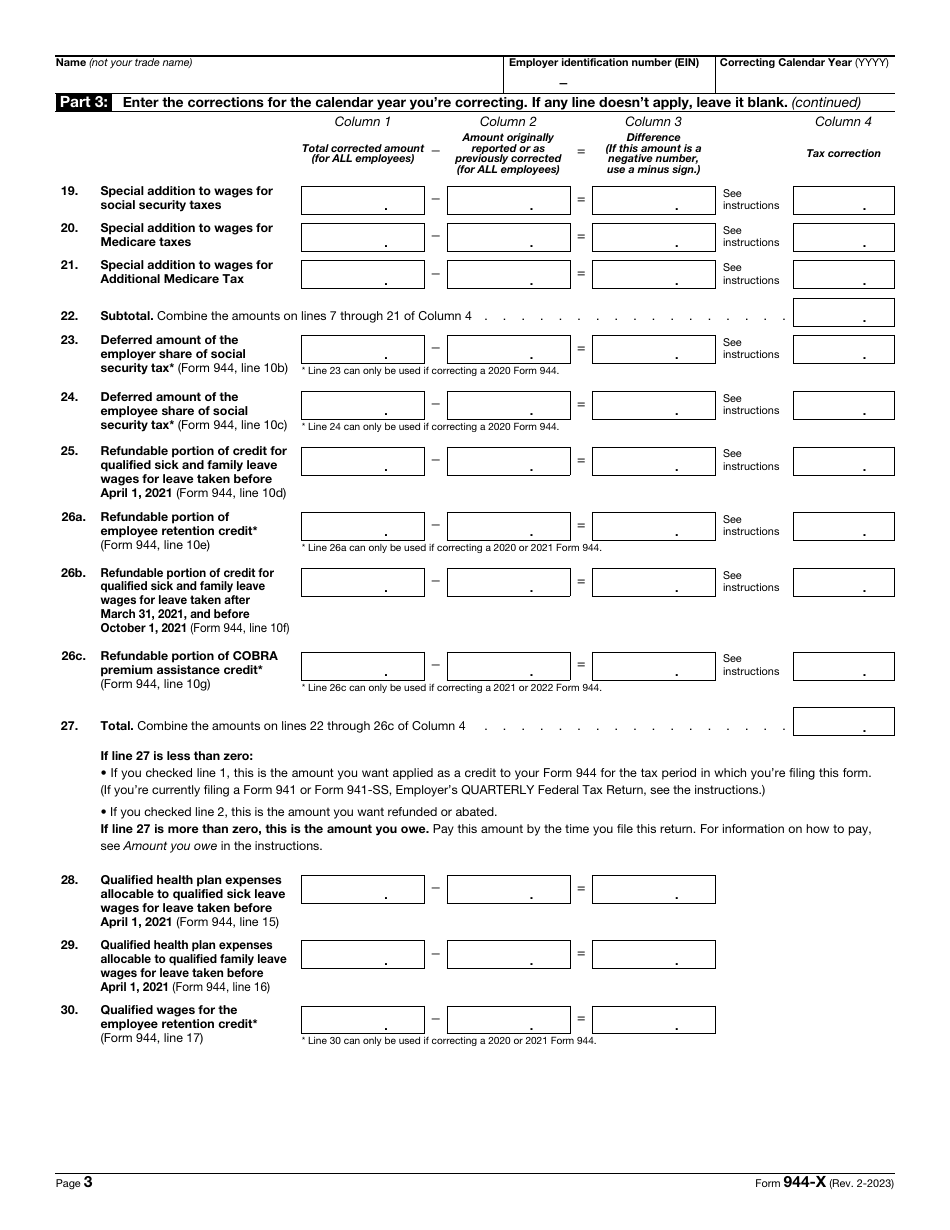

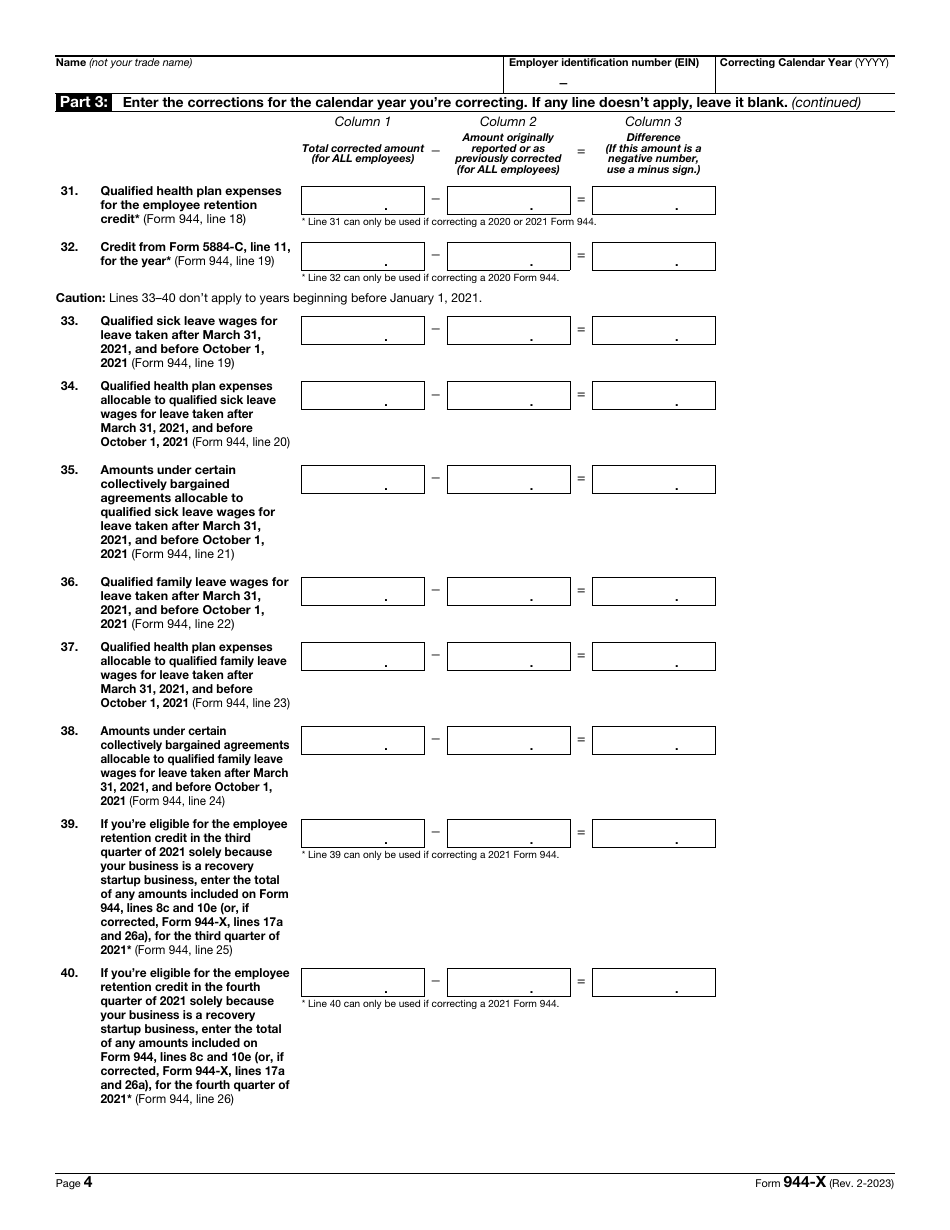

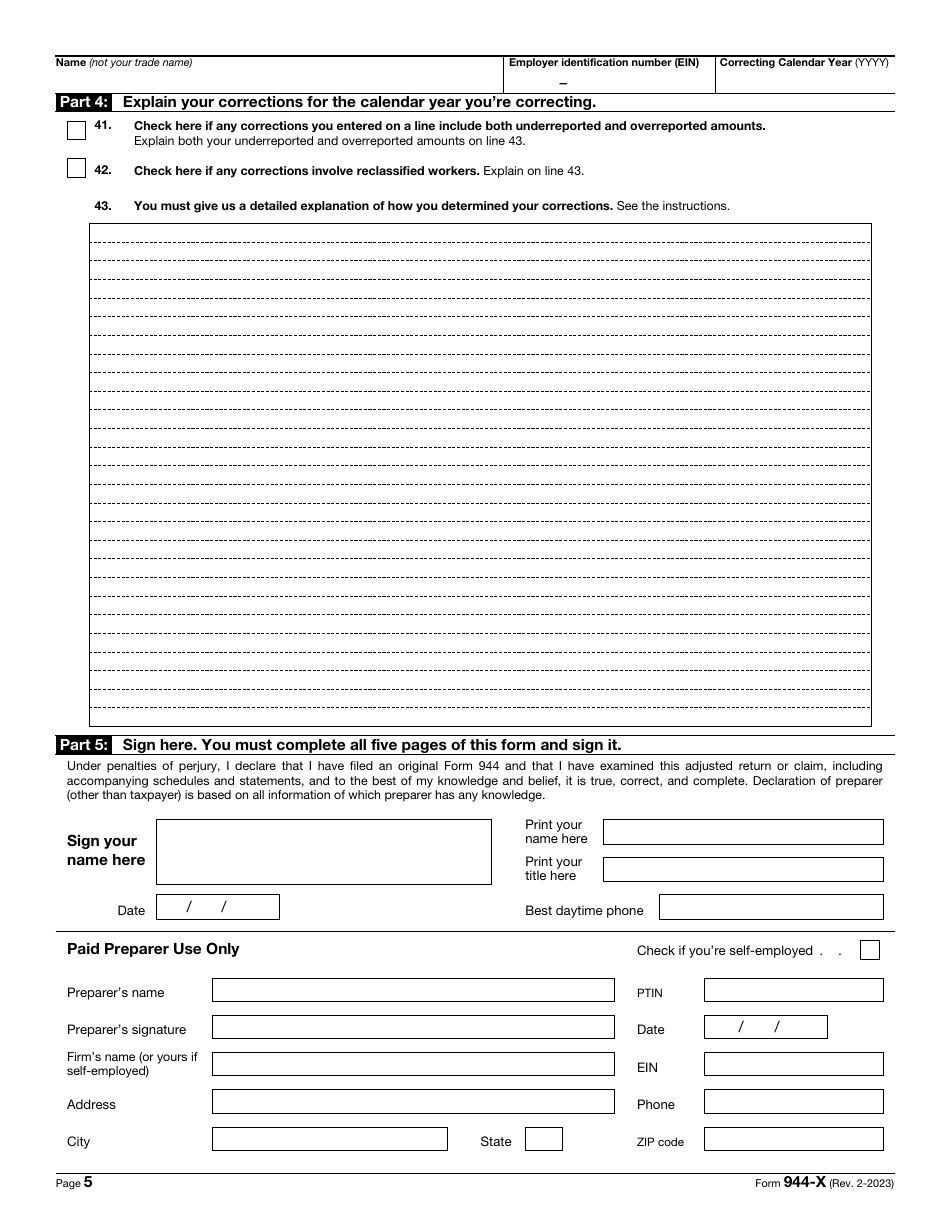

IRS Form 944-X Adjusted Employer's Annual Federal Tax Return or Claim for Refund

What Is IRS Form 944-X?

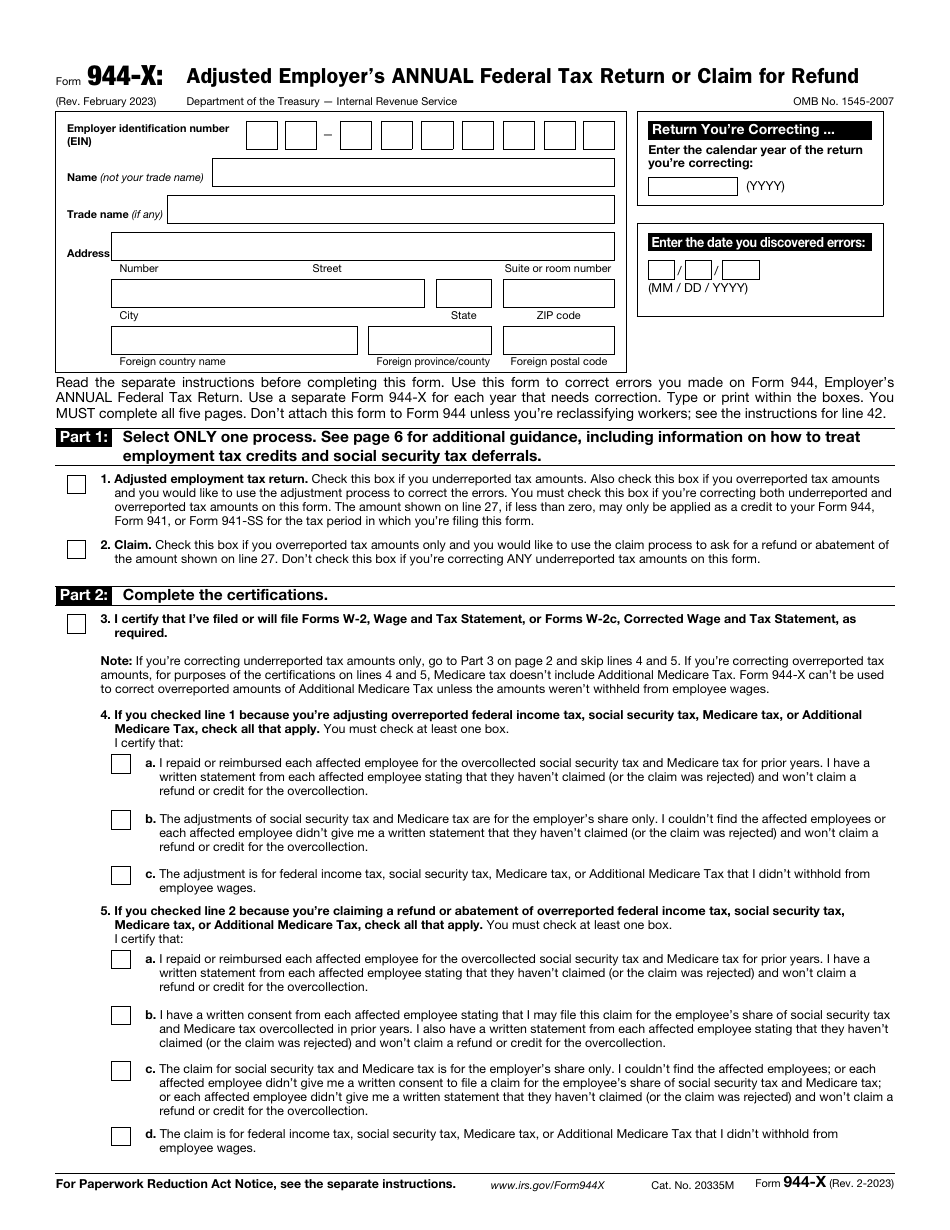

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on February 1, 2023. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 944-X?

A: IRS Form 944-X is the Adjusted Employer's Annual Federal Tax Return or Claim for Refund.

Q: Who should use IRS Form 944-X?

A: Employers who need to correct errors on their Employer's Annual Federal Tax Return (Form 944) should use IRS Form 944-X.

Q: What is the purpose of IRS Form 944-X?

A: The purpose of IRS Form 944-X is to report and correct errors on a previously filed Employer's Annual Federal Tax Return (Form 944).

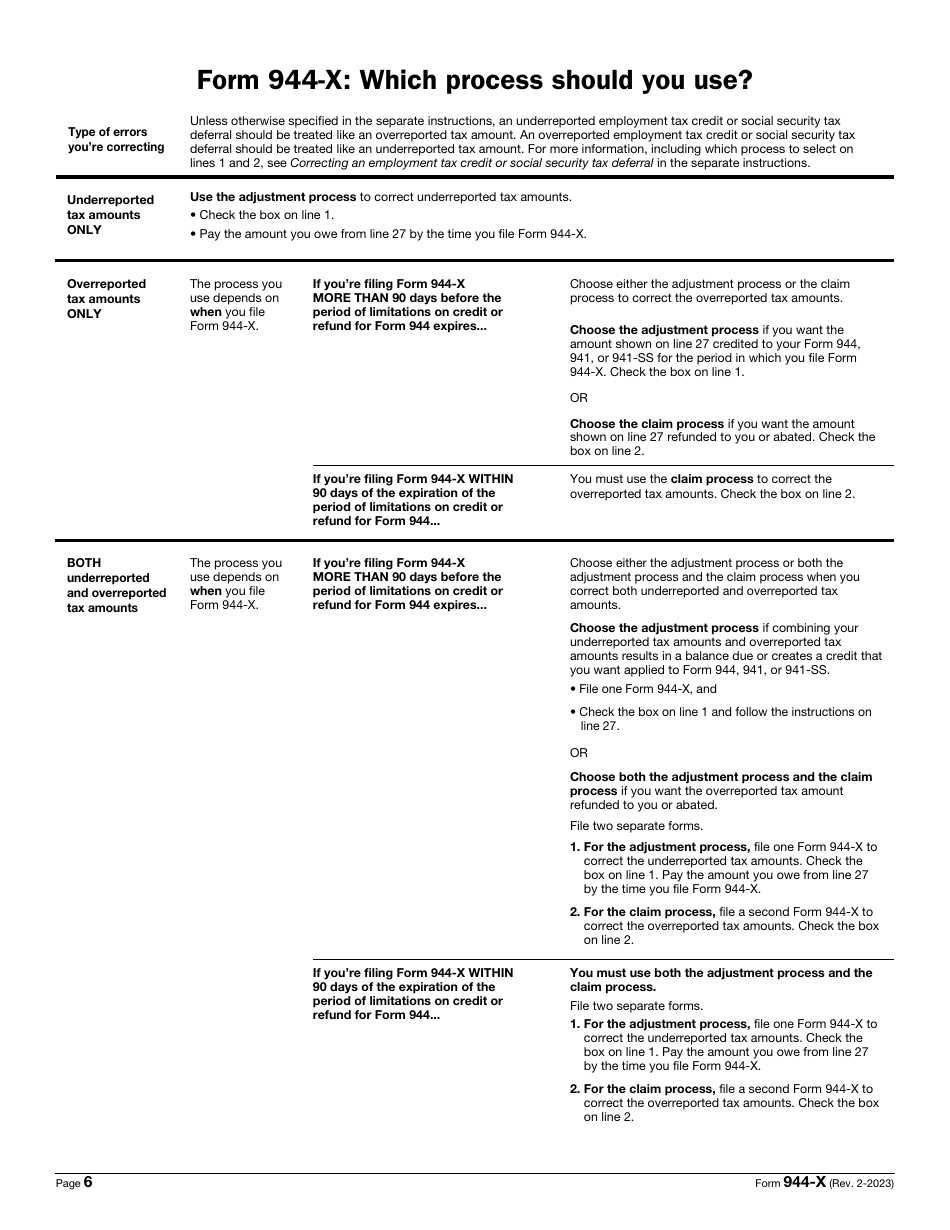

Q: Can I use IRS Form 944-X to claim a refund?

A: Yes, IRS Form 944-X can be used to claim a refund if you overpaid your employment taxes or are eligible for certain tax credits.

Q: What types of errors can be corrected using IRS Form 944-X?

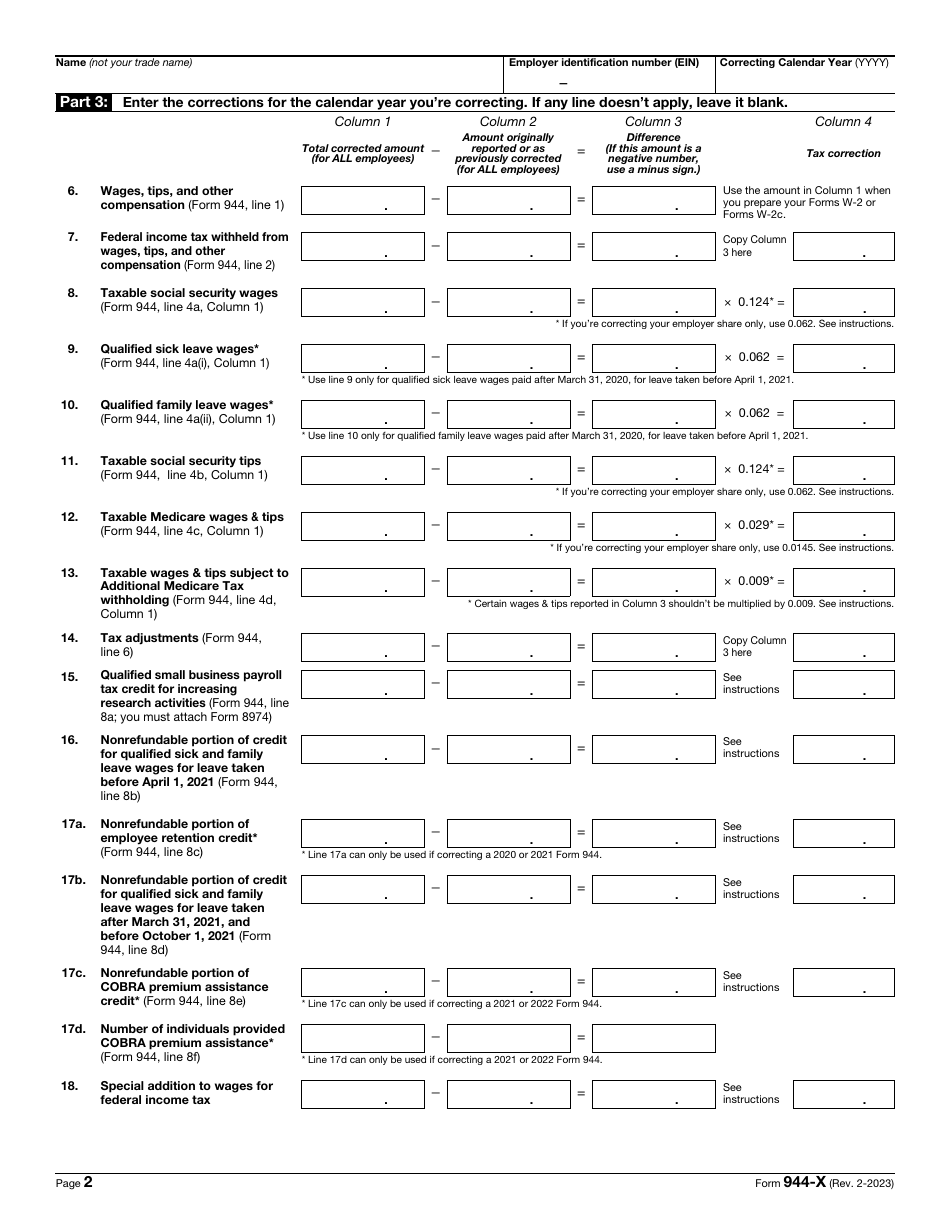

A: IRS Form 944-X can be used to correct errors in reporting wages, tips, and other compensation; tax liability; and tax deposits, among other things.

Q: Are there any deadlines for filing IRS Form 944-X?

A: Yes, you must file IRS Form 944-X within 3 years from the date you filed your original Form 944 or within 2 years from the date you paid the tax, whichever is later.

Q: Do I need to attach any supporting documents with IRS Form 944-X?

A: Depending on the changes being made, you may need to attach certain supporting documents, such as corrected wage and tax statements, to IRS Form 944-X.

Form Details:

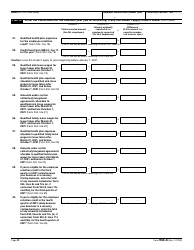

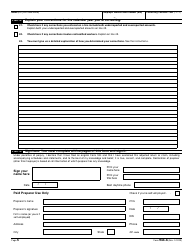

- A 6-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 944-X through the link below or browse more documents in our library of IRS Forms.