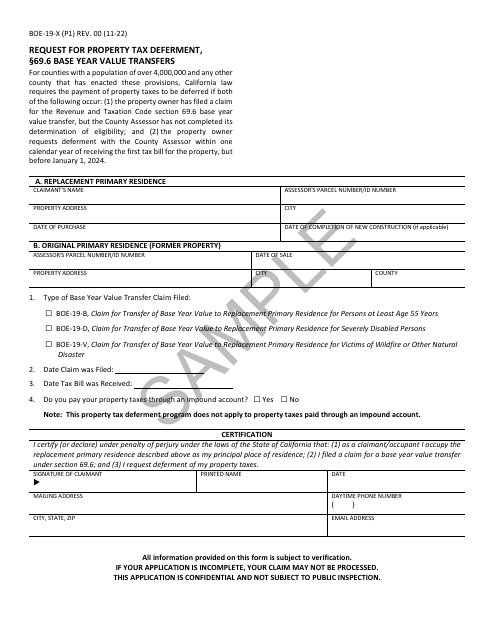

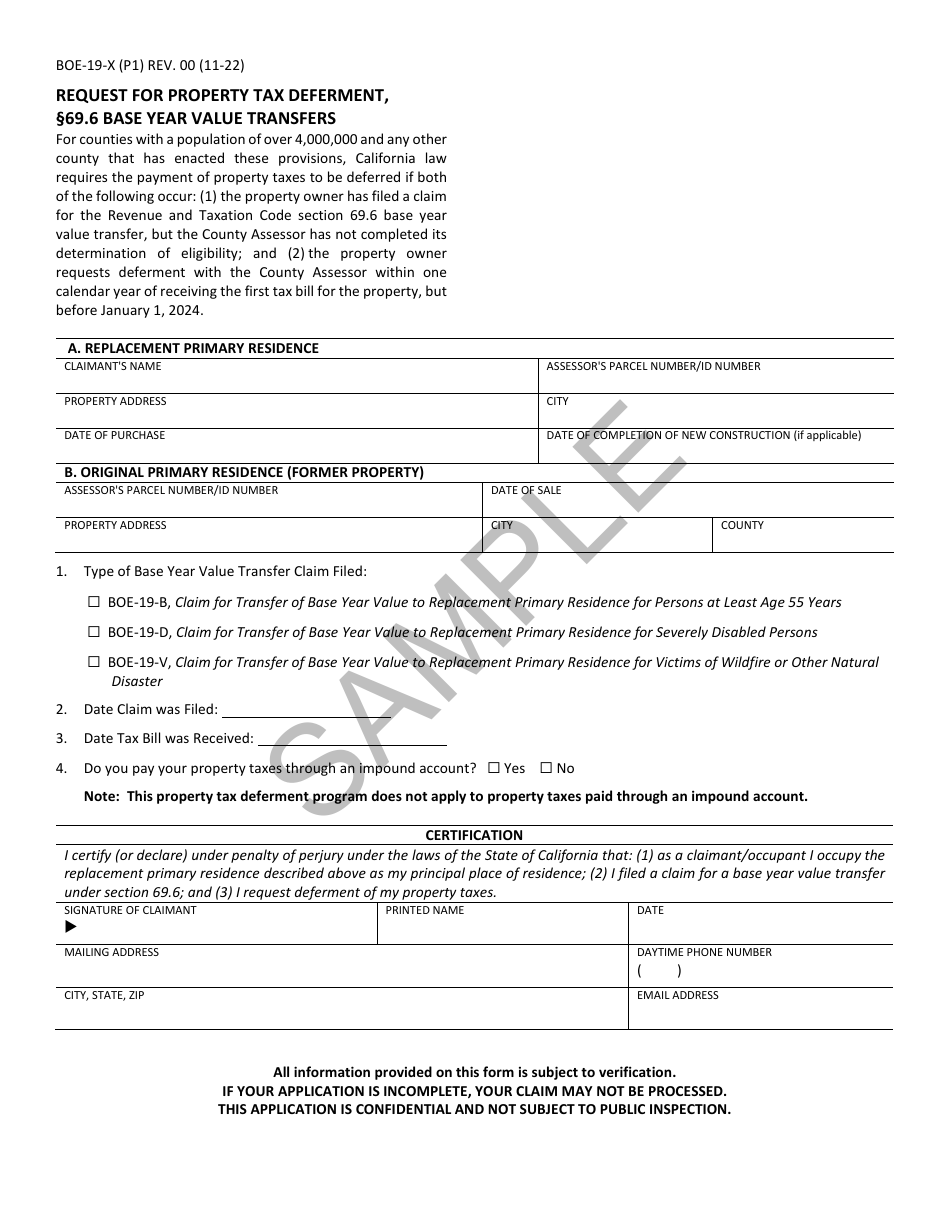

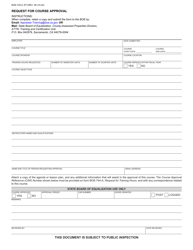

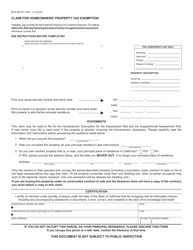

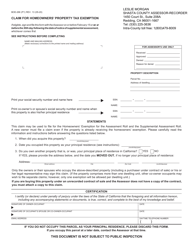

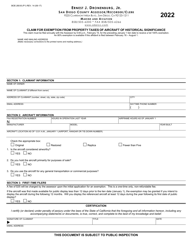

Form BOE-19-X Request for Property Tax Deferment, 69.6 Base Year Value Transfers - Sample - California

What Is Form BOE-19-X?

This is a legal form that was released by the California State Board of Equalization - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

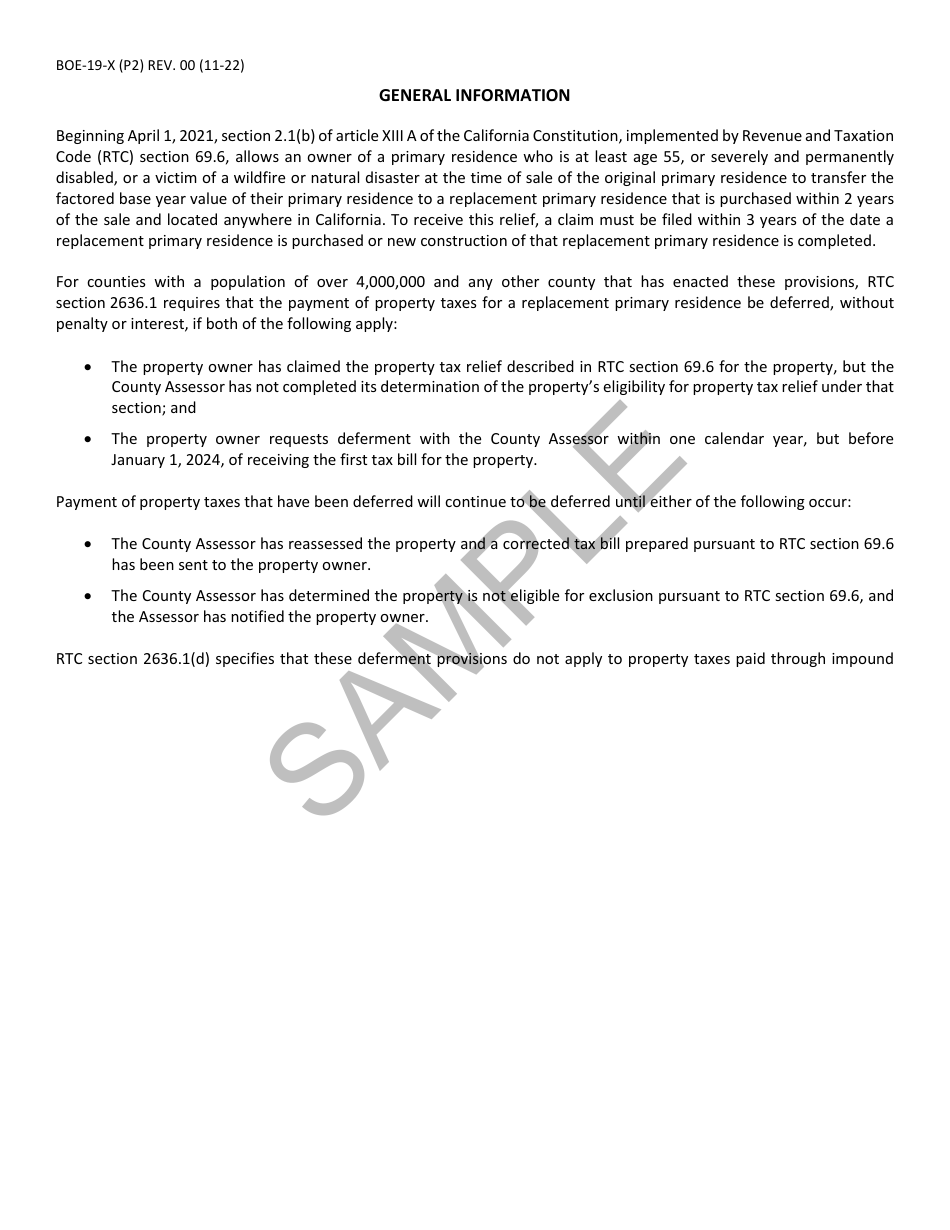

Q: What is BOE-19-X?

A: BOE-19-X is a form used to request property tax deferment in California.

Q: What is property tax deferment?

A: Property tax deferment is a program that allows eligible homeowners to postpone payment of their property taxes.

Q: What is 69.6 Base Year Value Transfers?

A: 69.6 Base Year Value Transfers is a provision in California tax law that allows qualified homeowners aged 55 or older to transfer the base year value of their existing home to a replacement property.

Q: Who can use BOE-19-X?

A: BOE-19-X can be used by homeowners who meet the eligibility criteria for property tax deferment.

Q: How does property tax deferment work?

A: Property tax deferment allows homeowners to postpone payment of their property taxes. The deferred amount becomes a lien on the property and must be paid when certain conditions are met, such as a change in ownership or when the homeowner no longer meets the eligibility requirements.

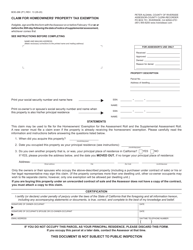

Q: How can I qualify for property tax deferment?

A: To qualify for property tax deferment, you must be a homeowner in California, meet certain age or disability requirements, occupy the property as your primary residence, have a total household income below specified limits, and have at least 40% equity in your home.

Q: What are the benefits of property tax deferment?

A: The benefits of property tax deferment include the ability to postpone payment of your property taxes, which can provide financial relief for eligible homeowners.

Q: Are there any risks or drawbacks to property tax deferment?

A: Yes, there are risks and drawbacks to property tax deferment. The deferred taxes accumulate interest and become a lien on the property, which must be paid when certain conditions are met. Additionally, there may be restrictions on the use and transfer of the property while the deferment is in effect.

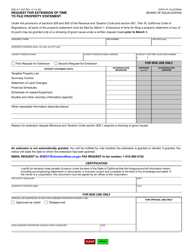

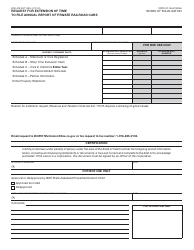

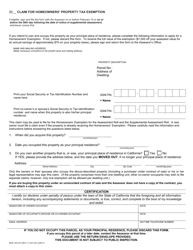

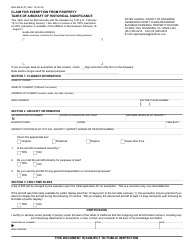

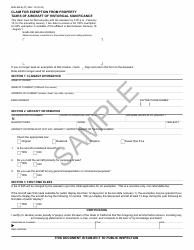

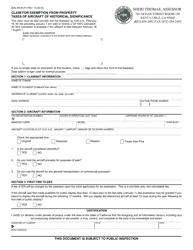

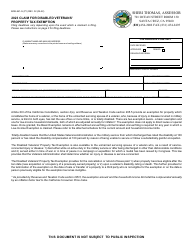

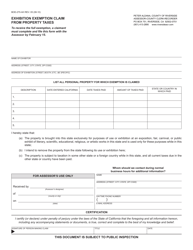

Q: How do I fill out the BOE-19-X form?

A: The BOE-19-X form includes sections for personal information, property information, and income information. You will need to provide accurate and complete information in each section, and follow the instructions provided with the form.

Q: What supporting documents are required for the BOE-19-X form?

A: The supporting documents required for the BOE-19-X form may include proof of age or disability, proof of income, and documentation related to the property being claimed for deferment. The specific requirements may vary, so it is important to follow the instructions provided with the form.

Form Details:

- Released on November 1, 2022;

- The latest edition provided by the California State Board of Equalization;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form BOE-19-X by clicking the link below or browse more documents and templates provided by the California State Board of Equalization.