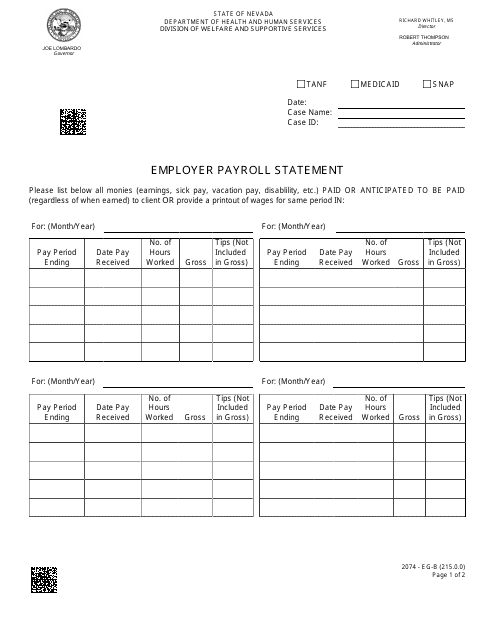

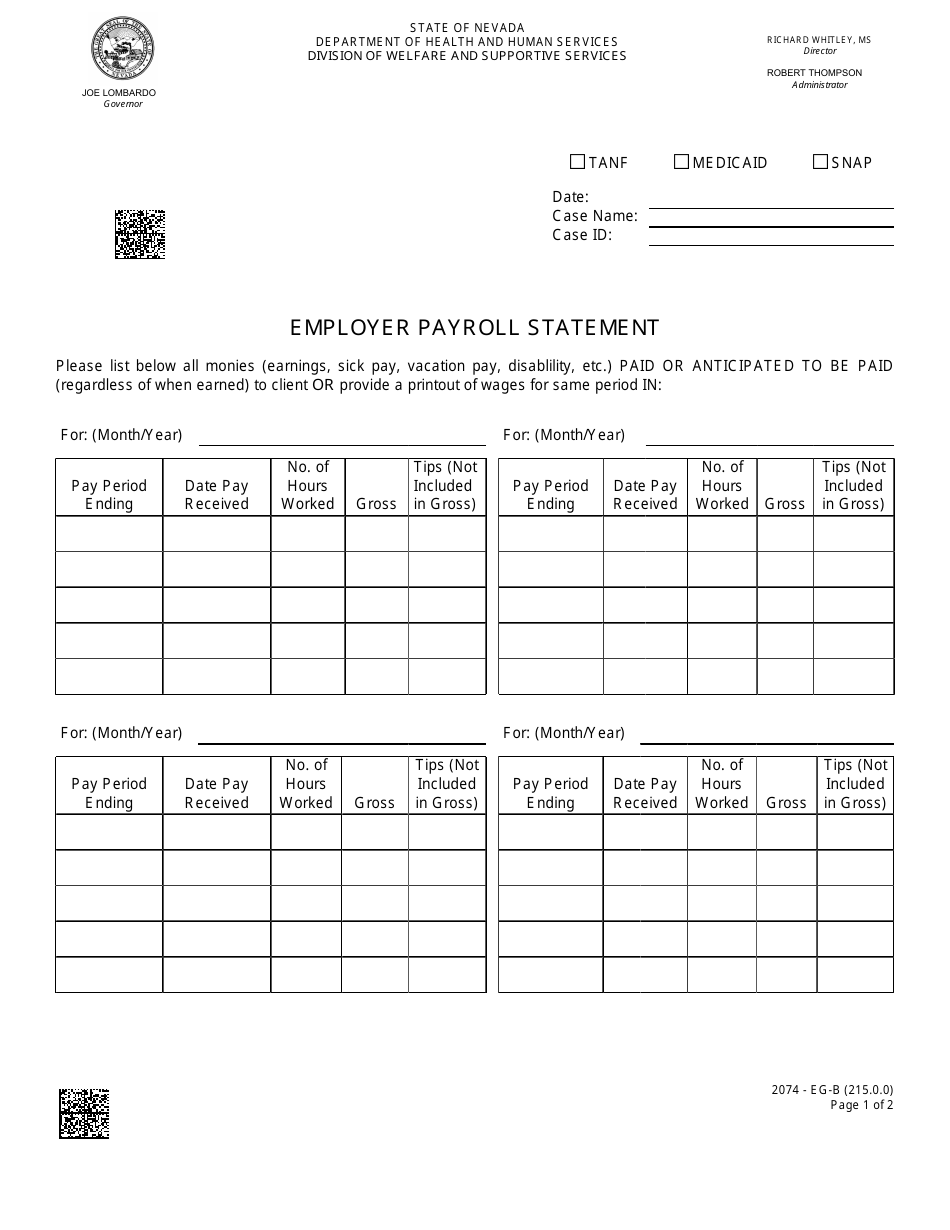

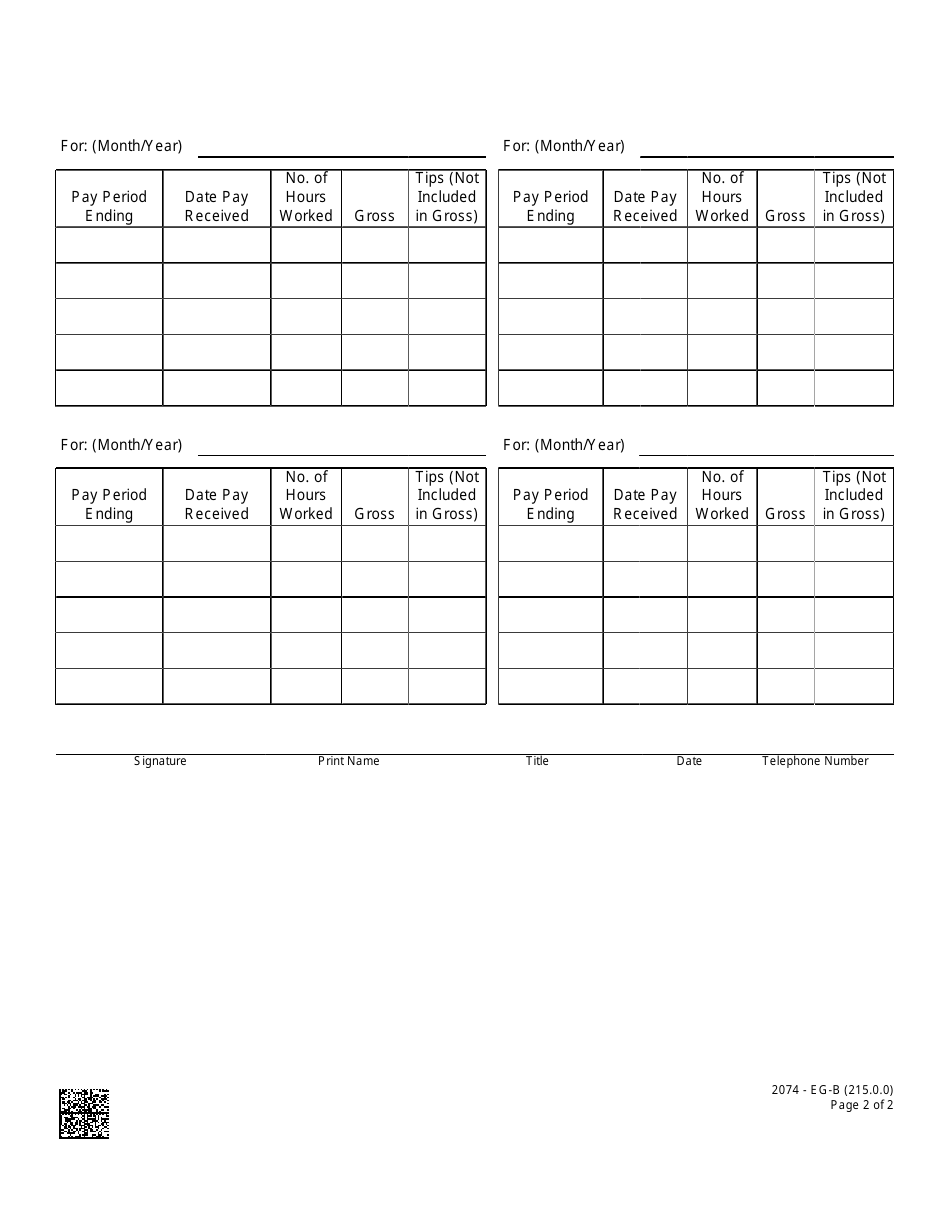

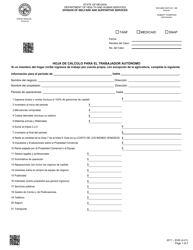

Form 2074-EG-B Employer Payroll Statement - Nevada

What Is Form 2074-EG-B?

This is a legal form that was released by the Nevada Department of Health and Human Services - a government authority operating within Nevada. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 2074-EG-B Employer Payroll Statement?

A: Form 2074-EG-B Employer Payroll Statement is a form used by employers in Nevada to report their payroll information.

Q: Who needs to file Form 2074-EG-B?

A: Employers in Nevada who have employees must file Form 2074-EG-B to report their payroll information.

Q: What information is required on Form 2074-EG-B?

A: Form 2074-EG-B requires employers to provide information about their company, employees, wages, and deductions.

Q: When is Form 2074-EG-B due?

A: Form 2074-EG-B is due quarterly, with the deadline falling on the last day of the month following the end of each quarter.

Q: Are there any penalties for not filing Form 2074-EG-B?

A: Yes, failure to file or late filing of Form 2074-EG-B may result in penalties and interest charges.

Q: Is Form 2074-EG-B only required for certain industries?

A: No, Form 2074-EG-B is required for all employers in Nevada with employees, regardless of the industry they operate in.

Form Details:

- The latest edition provided by the Nevada Department of Health and Human Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 2074-EG-B by clicking the link below or browse more documents and templates provided by the Nevada Department of Health and Human Services.