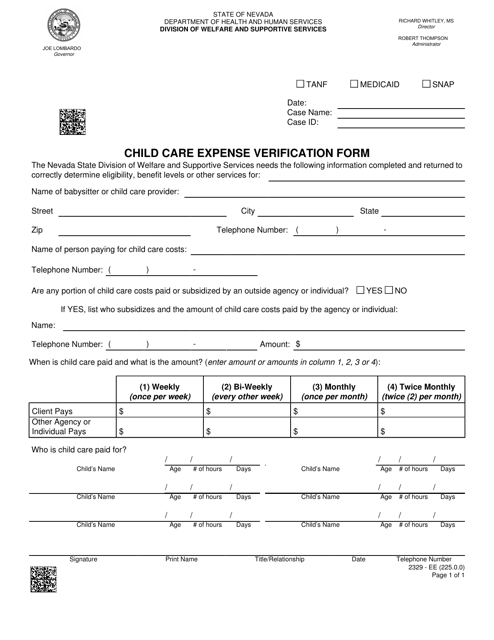

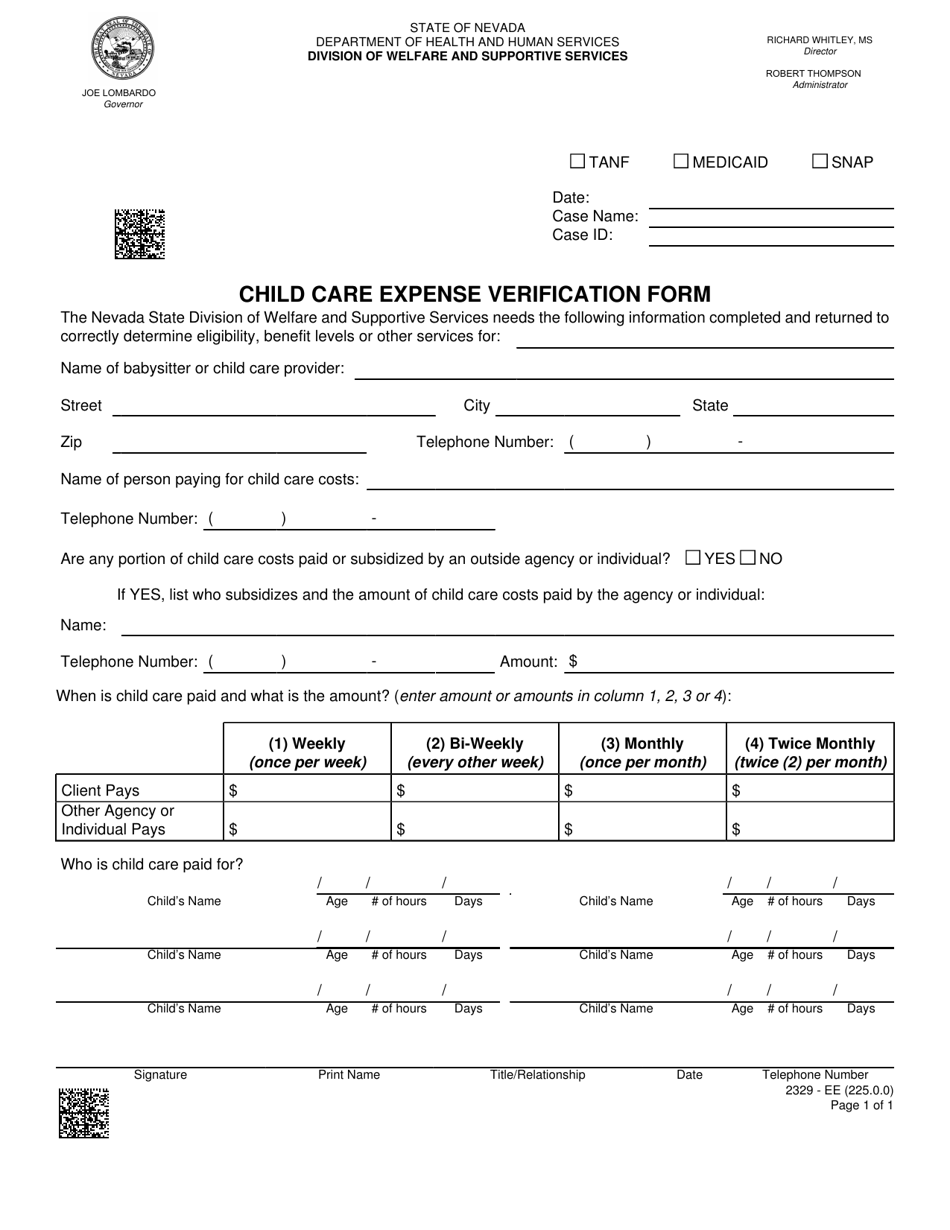

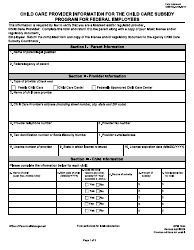

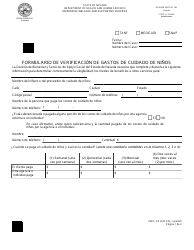

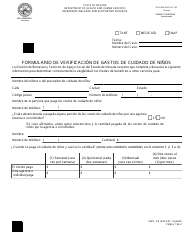

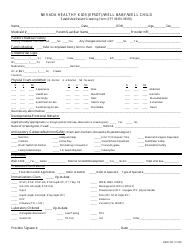

Form 2329-EE Child Care Expense Verification Form - Nevada

What Is Form 2329-EE?

This is a legal form that was released by the Nevada Department of Health and Human Services - Division of Welfare and Supportive Services - a government authority operating within Nevada. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 2329-EE?

A: Form 2329-EE is the Child Care Expense Verification Form used in Nevada.

Q: What is the purpose of Form 2329-EE?

A: Form 2329-EE is used to verify child care expenses for tax purposes.

Q: Who needs to fill out Form 2329-EE?

A: Parents or guardians who have incurred child care expenses in Nevada may need to fill out Form 2329-EE.

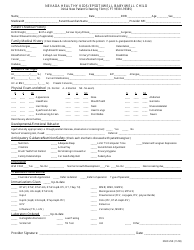

Q: What information is required on Form 2329-EE?

A: Form 2329-EE requires information such as the taxpayer's name, social security number, and details about the child care expenses.

Q: When should Form 2329-EE be submitted?

A: Form 2329-EE should be submitted with your annual tax return.

Q: Is Form 2329-EE specific to Nevada residents only?

A: Yes, Form 2329-EE is specific to Nevada residents and is used to verify child care expenses incurred in the state.

Q: Are there any fees associated with filing Form 2329-EE?

A: There are no fees associated with filing Form 2329-EE. It is simply a form used to report child care expenses.

Form Details:

- The latest edition provided by the Nevada Department of Health and Human Services - Division of Welfare and Supportive Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 2329-EE by clicking the link below or browse more documents and templates provided by the Nevada Department of Health and Human Services - Division of Welfare and Supportive Services.