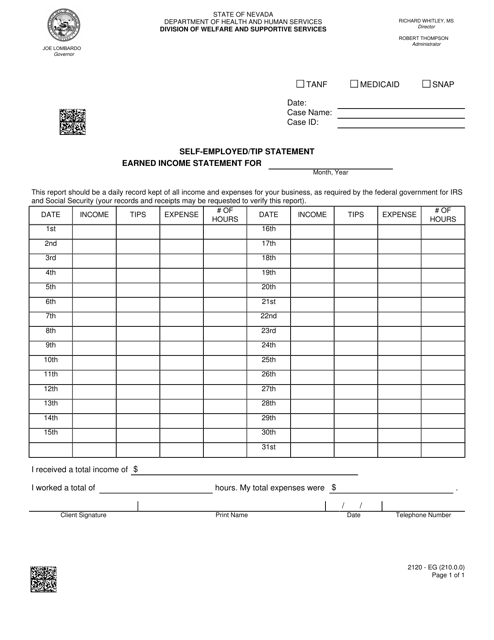

Form 2120-EG Self-employed / Tip Statement - Nevada

What Is Form 2120-EG?

This is a legal form that was released by the Nevada Department of Health and Human Services - Division of Welfare and Supportive Services - a government authority operating within Nevada. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 2120-EG?

A: Form 2120-EG is a Self-employed/Tip Statement form specific to Nevada.

Q: Who needs to fill out Form 2120-EG?

A: Self-employed individuals and those who receive tips in Nevada should fill out this form.

Q: What is the purpose of Form 2120-EG?

A: The purpose of Form 2120-EG is to report self-employment income and tips in Nevada.

Q: When is Form 2120-EG due?

A: Form 2120-EG is due by the last day of January following the end of the tax year.

Q: Is Form 2120-EG only for self-employed individuals?

A: No, Form 2120-EG is also for individuals who receive tips, in addition to self-employed individuals.

Q: What information is required on Form 2120-EG?

A: Form 2120-EG requires information about your self-employment income and tips received.

Q: Are there any penalties for not filing Form 2120-EG?

A: Yes, failure to file Form 2120-EG may result in penalties and interest charges.

Q: Can I file Form 2120-EG electronically?

A: Currently, you cannot file Form 2120-EG electronically; it must be filed by mail or in-person.

Form Details:

- The latest edition provided by the Nevada Department of Health and Human Services - Division of Welfare and Supportive Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 2120-EG by clicking the link below or browse more documents and templates provided by the Nevada Department of Health and Human Services - Division of Welfare and Supportive Services.