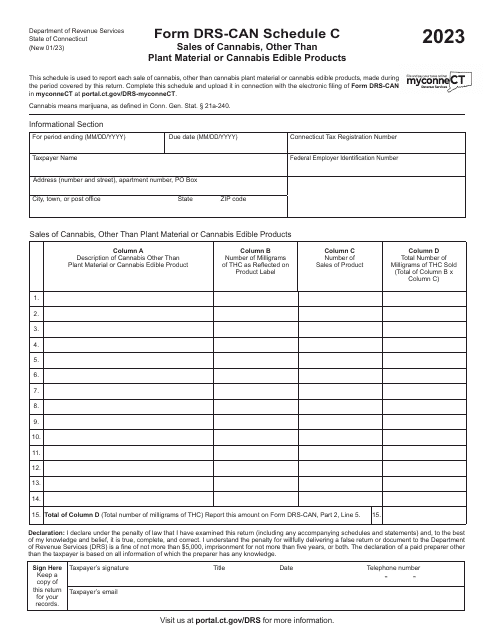

Form DRS-CAN Schedule C Sales of Cannabis, Other Than Plant Material or Cannabis Edible Products - Connecticut

What Is Form DRS-CAN Schedule C?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DRS-CAN Schedule C?

A: Form DRS-CAN Schedule C is a document used to report sales of cannabis, other than plant material or cannabis edible products, in Connecticut.

Q: Who needs to file Form DRS-CAN Schedule C?

A: Anyone who sells cannabis, other than plant material or cannabis edible products, in Connecticut needs to file Form DRS-CAN Schedule C.

Q: What type of sales should be reported on Form DRS-CAN Schedule C?

A: Form DRS-CAN Schedule C should be used to report sales of cannabis products, excluding plant material or cannabis edible products.

Q: Do I need to file Form DRS-CAN Schedule C if I only sell plant material or cannabis edible products?

A: No, Form DRS-CAN Schedule C is specifically for reporting sales of cannabis products other than plant material or cannabis edible products. If you only sell plant material or cannabis edible products, you do not need to file this form.

Q: When is the deadline for filing Form DRS-CAN Schedule C?

A: The deadline for filing Form DRS-CAN Schedule C is typically the same as the state's general sales tax filing and payment deadline, which is the last day of the month following the end of the reporting period.

Q: Are there any penalties for not filing Form DRS-CAN Schedule C?

A: Yes, failure to file Form DRS-CAN Schedule C or filing it late may result in penalties and interest charges.

Q: Is there a fee for filing Form DRS-CAN Schedule C?

A: No, there is no fee for filing Form DRS-CAN Schedule C.

Q: Can I file Form DRS-CAN Schedule C even if I don't have any sales to report?

A: If you do not have any sales to report, you may still need to file a zero sales report depending on the requirements of the Connecticut Department of Revenue Services (DRS).

Form Details:

- Released on January 1, 2023;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DRS-CAN Schedule C by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.