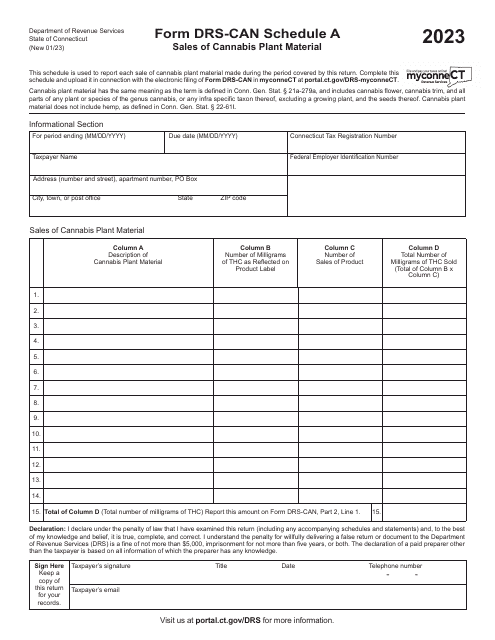

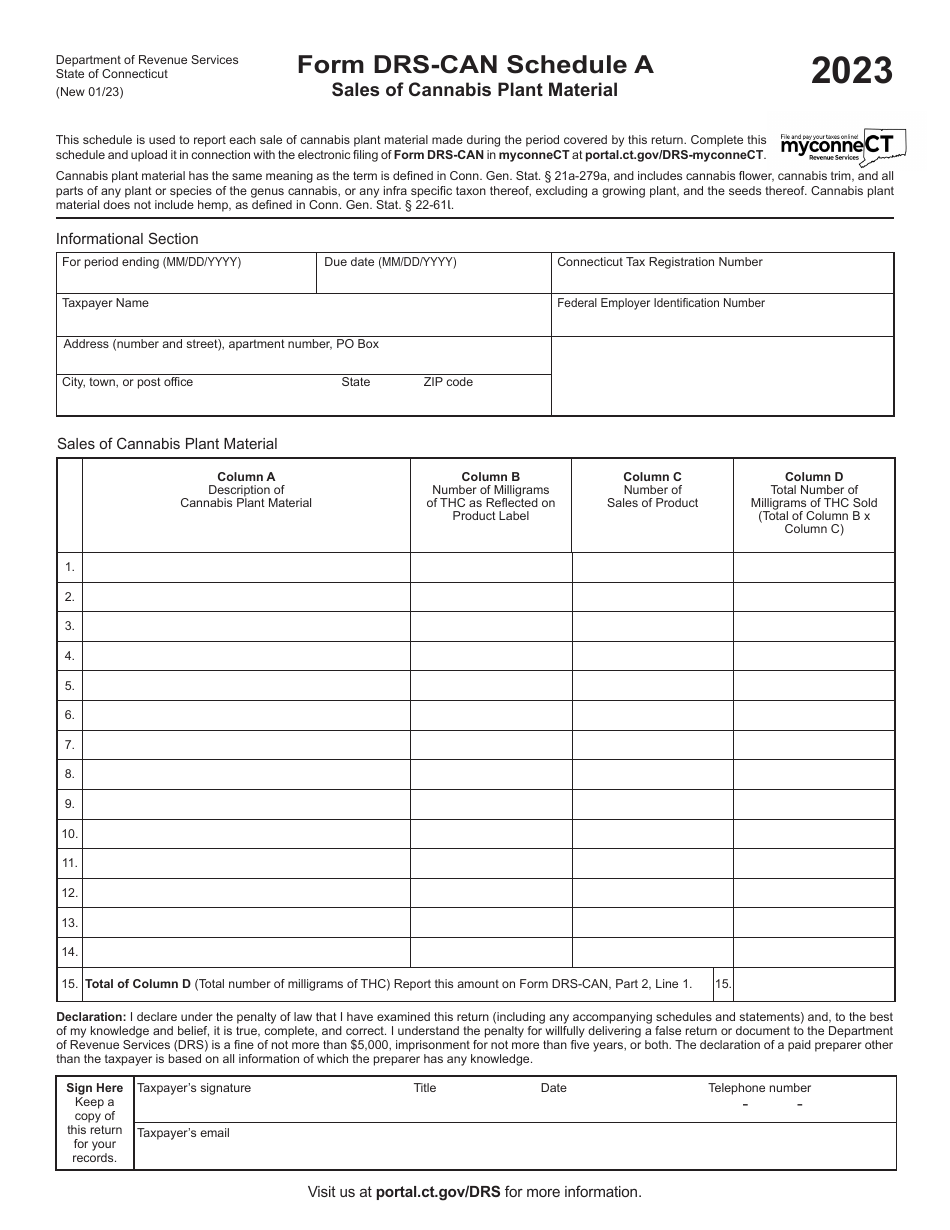

Form DRS-CAN Schedule A Sales of Cannabis Plant Material - Connecticut

What Is Form DRS-CAN Schedule A?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DRS-CAN Schedule A?

A: Form DRS-CAN Schedule A is a form used for reporting sales of cannabis plant material in Connecticut.

Q: Who needs to fill out Form DRS-CAN Schedule A?

A: Anyone who engages in the sale of cannabis plant material in Connecticut needs to fill out Form DRS-CAN Schedule A.

Q: What information is required on Form DRS-CAN Schedule A?

A: Form DRS-CAN Schedule A requires information such as the seller's name and address, the buyer's name and address, and the date and amount of the sale.

Q: How often do I need to file Form DRS-CAN Schedule A?

A: Form DRS-CAN Schedule A must be filed on a quarterly basis.

Q: Are there any penalties for not filing Form DRS-CAN Schedule A?

A: Yes, failure to file Form DRS-CAN Schedule A can result in penalties imposed by the Connecticut Department of Revenue Services.

Form Details:

- Released on January 1, 2023;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DRS-CAN Schedule A by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.